BUSINESS

Tarsons Products: Industry indicators point to recovery

Upcoming capacities, plans to unveil new products, and an inorganic strategy to push exports should drive earnings growth in the near to medium term

BUSINESS

What’s the importance of US Biosecure Act for India?

The legislation will curb the dominance of Chinese players in the US biotech industry, throwing up opportunities for Indian companies

BUSINESS

Ami Organics: Well placed to meet growth guidance despite global challenges

Successful inspection by the regulatory agency of Japan adds to the company’s credential in the advanced intermediates space

BUSINESS

Concord Biotech: Strong grip on fermentation APIs stays

Though valuations are at a premium, the company has strong earnings prospects ahead

BUSINESS

Jackson Hole Symposium: The interest rate cycle's direction is clear

Stock portfolio churn could be tricky as Fed takes cues from high-frequency indicators and starts cutting rates for better risk-reward balance

BUSINESS

Balaji Amines: What is the future of this import substitution play?

The medium-term growth driver is a series of projects, which are getting commissioned in the near term. Also, the company has a significant surplus capacity that can gain traction from a gradual global recovery.

BUSINESS

Galaxy Surfactants: Growth led by advanced economies

The domestic market is cautiously growing after a strong FY24 and the economy is improving. Logistics pose a key challenge for the company

BUSINESS

Aarti Industries: Greedy when others are fearful?

As the volume growth guidance is intact and new capacities and newer chemical value chains are expected to get unlocked in the next two years, investors should consider the opportunity the market is offering

BUSINESS

PCBL: Will growth accelerate with the new acquisition?

The newly acquired business of water treatment chemicals is doing well. While the company has additional diversification plans on specialty chemicals, a sharp jump in leverage can hold it back in the near term.

BUSINESS

Zydus Lifesciences: Time to book profit?

Transitional opportunity due to Revlimid helped this quarter, though remaining quarters may not witness a similar contribution. Hence, margins are likely to moderate.

BUSINESS

Syngene: Strong play on ‘China Switches’ in the CRAMS space

The shift in global supply chains in the post-pandemic world –described as China Switches by the company – has led to the setting up of pilot projects across a broad range of services.

BUSINESS

Divi’s Lab: Growth visibility for custom synthesis

While pricing erosion remains a challenge for generic APIs, new opportunities for generic molecules would unfold in FY26. Medium-term growth would be on account of seven molecules that are going off-patent

BUSINESS

Sun Pharma: Softness in specialty segment can weigh on valuation

While the company enjoys nearly 50 percent share in high-margin segments, near-term earnings growth trajectory doesn’t appear exciting

BUSINESS

Fed July meet: Setting the stage for a 'dial back'

US Federal Reserve chief Jerome Powell has signalled the beginning of rate cuts in September

BUSINESS

Navin Fluorine: Lacklustre Q1FY25; growth capex on track

In the next 18 months, the company is planning to commission various capacities across segments which will provide a base for multi-year growth.

BUSINESS

Sumitomo Chemical India: Does the stock present an opportunity after the strong run-up?

The company has a strong product pipeline but there are a few concerns to be monitored

BUSINESS

IPO: Should investors bet on the largest pharma contract manufacturer of India?

Successful execution of CDMO expansion and profitability of the API business need to be watched

BUSINESS

SRF: Banking on the ramp-up of recently commissioned assets

The company’s margin improvement in the near term is contingent on its performance in the chemicals segment.

BUSINESS

This pharma stock gets the Budget tonic

The scrapping of customs duty will make cancer drugs of AstraZeneca affordable

BUSINESS

Sanstar IPO: Does this maize-based ingredients play make a worthy investment?

Near-term growth depends on upcoming expansion plan

BUSINESS

Himadri Speciality: Play on new energy transition

While there is still room for margin expansion for the legacy business, the stock is now more a play on the global energy transition which includes electric vehicles (EVs) and new-age battery systems

BUSINESS

Balaji Amines: Has the stock bottomed out?

The company has a significant surplus capacity, which can gain traction from the China-plus-one theme and a gradual global recovery. This should help in operating leverage over the years

BUSINESS

Indian equities: Will FII inflows get stronger with US rate cuts looking imminent?

US retail inflation is likely to cool down faster than expected as labour market is back in balance and excess savings have been exhausted

BUSINESS

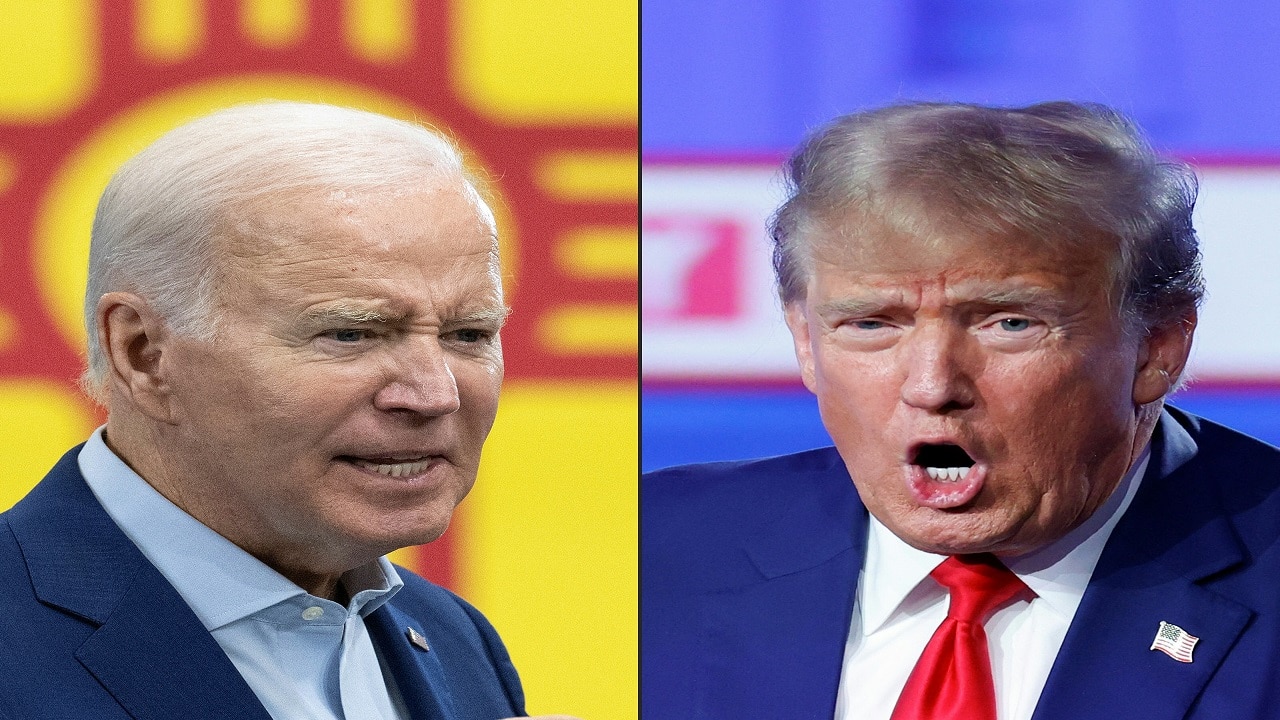

US elections: What is in store for geopolitics and markets?

Equity markets have broadly performed well under both regimes historically