BUSINESS

PI Industries: Quality name wading through industry challenges

Q2 performance below Street expectations and a traction in CDMO is crucial for growth

BUSINESS

Tarsons Products: A ‘pick & shovel’ play in pharma research

The company is set to benefit from the surge in demand seen for plastic labware in the coming days, with US biotech firms decoupling from China being a key factor.

BUSINESS

Suraksha Diagnostics IPO: A play on eastern India healthcare demand

A successful replication of the business model outside the core area will be key to growth

BUSINESS

HUL: Value unlocking on the cards after ice cream business demerger

The high-growth, but low-margin category contributes only 3 percent to HUL’s turnover and needs significant investments.

BUSINESS

Galaxy Surfactants: International business prospects hedge domestic slowdown

Though there was a recovery in rural areas, domestic demand was muted in Q2FY25. US and Europe businesses helped top line growth

BUSINESS

Max Healthcare: Quick turnaround in acquired assets makes us positive on the stock

The company appears well-positioned to gain from sectoral tailwinds, with its focus on expanding presence in key markets, and being a preferred service provider for international patients

BUSINESS

KIMS: A play on hinterland healthcare demand in South India

While the capacity addition pipeline is decent, the growing focus on oncology and transplant centres will strengthen the company’s margin profile.

BUSINESS

Balaji Amines: Methyl amines capacity ramp-up to help in H2 FY25

The company appears to be future-ready with significant investments in higher-margin products without denting its balance sheet

BUSINESS

Fed vs. Trumponomics 2.0: Post rate cut, how should investors position themselves?

Initially, the US central bank will respond primarily to the non-farm payroll trajectory. But later on, any aggressive stance by Trump on global trade, the fiscal deficit and immigration can potentially rekindle inflation

BUSINESS

Sagility IPO: A play on US healthcare outsourcing market

Balance sheet healthy and there is room to raise more funds in future

BUSINESS

Ami Organics: Early CDMO ramp-up aces growth outlook

While the semi-conductor and battery chemical businesses are the new drivers of growth for the long term, it would take time. Near-term growth would be driven by the advanced intermediates business.

BUSINESS

Dabur: A bigger rural footprint, a wider product basket key growth levers

Urban demand has bottomed out and expected to pick up once food inflation stabilises

BUSINESS

Cipla: M&A positioning, new US regime are key wild cards

The management is primarily focusing on Indian assets which can bring synergy, followed by US assets. Cipla’s continued investment in US subsidiary InvaGen would de-risk the business model from a compliance point of view.

BUSINESS

Syngene: FY25 guidance intact as biotech funding revives

The macro tailwinds are strong as biotech firms are looking for a China alternative and the US Biotech Act can potentially decouple China’s biotech supply chain from the US biotech value chain

BUSINESS

Navin Fluorine: Strong order book visibility for CDMO, specialty segments

The capex projects for agro-specialty at Dahej, the additional R-32 capacity, and the anhydrous hydrofluoric acid plants should also contribute to FY26 earnings

BUSINESS

Himadri Speciality: Little comfort on valuation

In the near term, HSCL could continue to benefit from the demand-supply mismatch in Europe. HSCL’s long-term plan is to diversify into new-age businesses. This can have a long gestation period and face technological challenges

BUSINESS

Nestle India: Sluggish consumption amid elevated commodity prices

Coffee and cocoa were particularly costlier while prices of cereals and edible oils picked up due to an erratic monsoon

BUSINESS

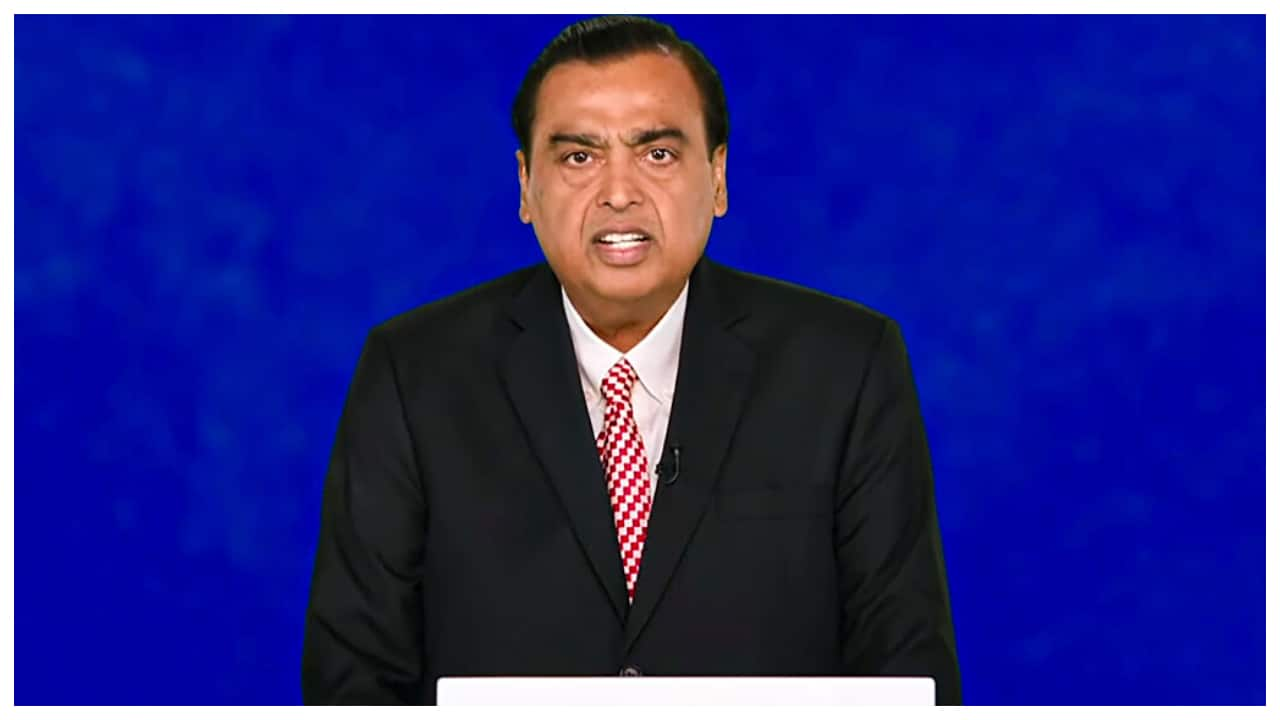

Reliance Industries Q2: Consumption-oriented segments telecom, retail drive growth

While a subdued global economic environment has affected its O2C business performance, improving prospects for consumption growth and progress in new energy business will drive the stock outlook

BUSINESS

Trump vs Harris: What it means for India and markets

A Republican win could be negative for EMs, while a Democrat victory is likely to be beneficial for countries like India

BUSINESS

How prudent is the investment case for HEG?

The graphite electrode player is likely to be a key beneficiary of the decarbonisation trend in the steel industry

BUSINESS

As the Middle East explodes, how should investors position themselves?

Valuation makes the Indian market vulnerable to a military escalation. The gap between Nifty earnings yield and the 10-year G-Sec yield is closer to the average during historical market peaks

BUSINESS

What should investors do with these carbon-black twins?

Long-term plans have a long gestation period and can face challenges

BUSINESS

Nocil: A casualty of China dumping

The current challenges due to dumping and moderate growth expectations are a dampener. Further, elevated valuation is likely to cap the upside in the near term

BUSINESS

Fed’s aggressive defence: What should investors do?

The US Fed’s rate cut cycle will reinforce the gush of liquidity to Indian markets, which, along with earnings growth, should continue to offset valuation concerns in the near term.