BUSINESS

SEBI issues guidelines for usage of brand or trade name by advisors, analysts

SEBI observed that few investment advisers and research analysts use the brand name, trade name or logo more prominently while marketing their services rather than their name as registered with the regulator.

BUSINESS

SEBI brings in advertisement code for investment advisers, research analysts

These compliances are part of SEBI’s new advertisement code to further strengthen the conduct of IAs and RAs, while issuing any advertisement.

BUSINESS

Gold and silver ETFs suffer LTCG blow but still glitter

Gold ETFs offer far better liquidity, convenience, safety and efficiency over the physical gold markets; silver ETFs also provide better liquidity and price efficiency than traditional options.

MCMINIS

Does investing in ESG funds make sense?

Better disclosures key to a meaningful approach.

BUSINESS

SEBI eases time limit for disclosure of NAVs of overseas funds

Mutual funds are mandated to disclose the NAVs of all schemes within a given outer time limit.

BUSINESS

SEBI evaluating Total Expense Ratio process, to release detailed guidelines

In December 2022, the market regulator announced that it has initiated an internal study to re-look at the expenses that fund houses charge unitholders.

BUSINESS

Hybrid mutual funds rev up to be the next big wave. But, do they suit everyone?

Hybrid schemes, with total AUM of Rs 4.87 trillion, are the second-lowest open-ended mutual fund category after Solution Oriented Schemes. Compared to this, Growth/Equity Oriented Schemes command an AUM of Rs 15.01 trillion

BUSINESS

Sebi gives mutual fund holders till Sept 30 to furnish their nominations

Sebi in June 2022 had mandated nominations or opting out of nominations for all the existing individual unitholders.

MCMINIS

What is indexation benefit in MFs?

Debt funds' indexation benefit is only till March 31.

BUSINESS

Debt taxation impact: Edelweiss, Mirae, Franklin MFs open overseas funds for lump sum subscription

Investors should look at their asset allocation, and if there’s a need to buy more international funds, only then should they invest. Taxation shouldn’t be the only reason to invest, experts say

BUSINESS

Not just debt funds, gold and international funds to also lose from the Finance Bill tweak

Balanced advantage funds stand to gain as experts predict that conservative investors might shift to them to get the equity tax advantage

MCMINIS

What’s behind crypto market’s mini revival?

The surge is largely in major cryptocurrencies.

BUSINESS

Quant MF’s Balanced Advantage Fund comes with a twist. Will it work?

The Quant Dynamic Asset Allocation Fund will dynamically switch between equities and debt. The one difference this scheme has from existing balanced advantage funds is that it doesn’t insist on a minimum 65% equity exposure at any time. The NFO opened on March 23 and will close on April 6

BUSINESS

Banking mutual funds turn sour; what’s the outlook for them amid the global turmoil?

While optimists had hoped that global dislocations would not impact Indian banks, data shows otherwise. At -9.13% banking MFs delivered worst returns among all fund categories since the start of the year.

BUSINESS

How to pay taxes on crypto gains if you are an NRI

Taxation on crypto gains is based on the principle of the residence of the person and the source of income. Worldwide income of Indian residents is taxable in India. However, NRIs are subject to source-based taxation. Read on to find out what that means.

BUSINESS

Crypto tax: Searching for ways to lower burden leads to more confusion

Given the lack of clarity over certain aspects of crypto taxation, investors would be better off taking a chartered accountant or tax portal’s help in filing their taxes for this year.

BUSINESS

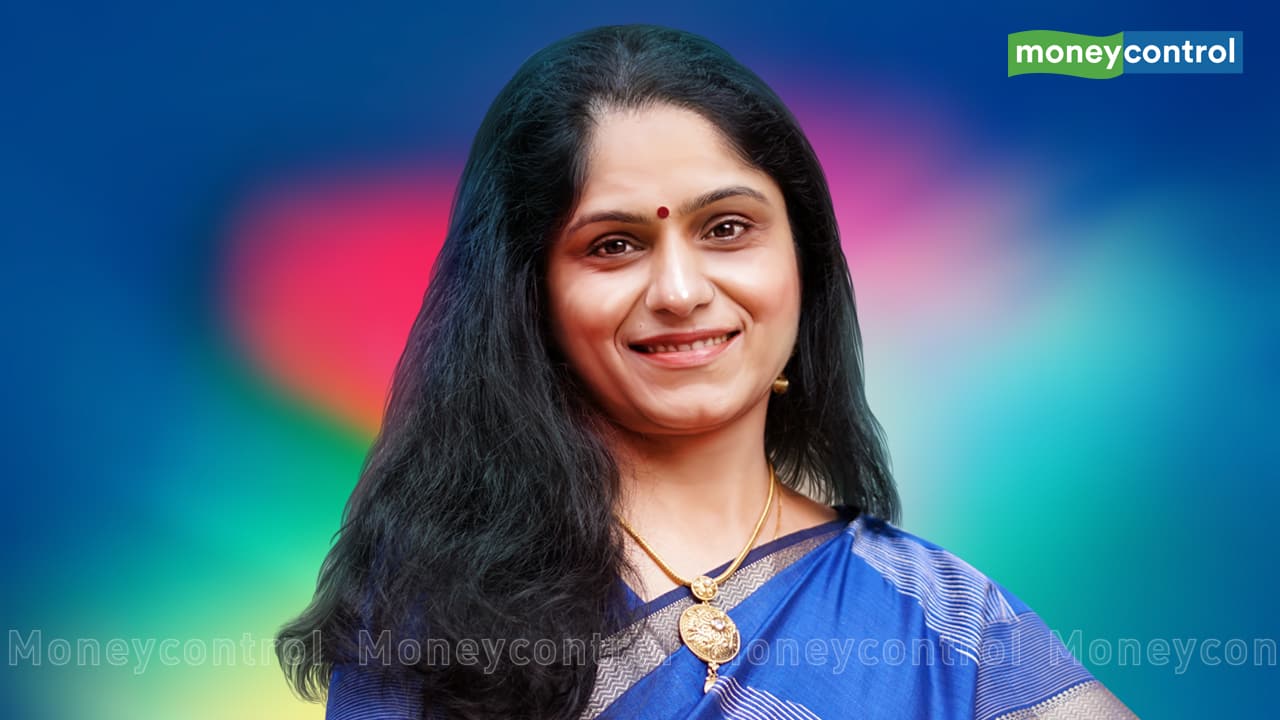

How Roopali Prabhu reads people and balance sheets for her equity research picks

Prabhu believes that constant learning is one key driving factor for her in life.

BUSINESS

Women's Day: How an article pulled Kiran Telang into the financial advisory industry

It was at the launch party of a new fund offer by a big mutual fund house that Telang realised that she didn’t want to just sell investment products. Financial planning felt more holistic to her, she says.

BUSINESS

Once a mis-selling victim, Priya Sunder now runs a successful financial advisory firm

Started in 2005, PeakAlpha today has over 5,000 clients and manages Rs 1,300 crore in assets, with 40 percent of the total client base being women. One of the key responsibilities of a financial advisor, says Sunder, is managing the emotions of a client as investment is a function of greed and fear.

BUSINESS

Indiabulls Housing’s NCD issue offering 10.15% opens; should you invest?

The NCD issue comes with a fair bit of credit risk as it is not rated AAA, which is the highest safety rating

BUSINESS

Outperformance of Indian markets will get stronger, says Richard Pattle of True Beacon

India has managed inflation better than other economies and is well placed to navigate worries on the price front, says the co-founder of the wealth management firm

BUSINESS

How fund managers in the alternative investment space look to create wealth

Broadly, they look beyond the obvious benchmarks, while sticking with the basics. They also keep an eye on emerging trends to spot future winners.

BUSINESS

Midcaps and smallcaps still little expensive, says Vikaas M Sachdeva of Sundaram Alternates

Investors, he says, would do well to identify high-quality companies and should not get carried away by short-term gyrations. Look at the high cash-flow and high ROC-generating companies, and stay the course. That is the way to write the India story, he says.

BUSINESS

Shankar Sharma on Adani, risks to India's growth and next big market trigger

Reducing fiscal deficit is a challenge going forward as paring can happen only in the discretionary part of the budget, which is capital expenditure. But when you cut capex, it will affect growth, says the founder of GQuant Investech