BUSINESS

Trump’s 25% tariff: Use market dips for lump-sum buys, diversify globally, say experts

Trump tariffs on India: Investment experts' advice: avoid panic; remain diversified; and maintain 5–10 percent exposure to overseas stocks, regardless of such developments.

BUSINESS

The party’s on, but the playlist has changed: Quantum MF’s Chirag Mehta on Indian equities

The CIO of Quantum Mutual Fund talked about the key monitorable for the markets, sectors with long-term structural bets, and themes he’s avoiding now.

BUSINESS

Foreign Affairs: Overseas stocks that Indian mutual funds are embracing and rejecting

Indian fund managers invest in international stocks primarily to diversify portfolios beyond domestic opportunities, access global industry leaders, and tap into innovation-driven themes.

BUSINESS

Buying property abroad? What Indians need to know about the rules, risks and restrictions

Resident Indians, under the Reserve Bank of India’s Liberalised Remittance Scheme, can remit up to $250,000 per year to buy residential or commercial property abroad.

BUSINESS

A bet on urban India: How municipal bonds are slowly gaining traction

Municipalities are allowed to issue bonds to raise money to fund public infrastructure, such as roads, water supply and sewerage.

BUSINESS

Prateek Agrawal shares Motilal Oswal Mutual Fund's play on long-term growth themes

The MD and CEO of Motilal Oswal AMC believes index earnings typically move in line with nominal GDP and one needs to identify spaces with a structurally higher growth trajectory to seek differentiated outcomes

BUSINESS

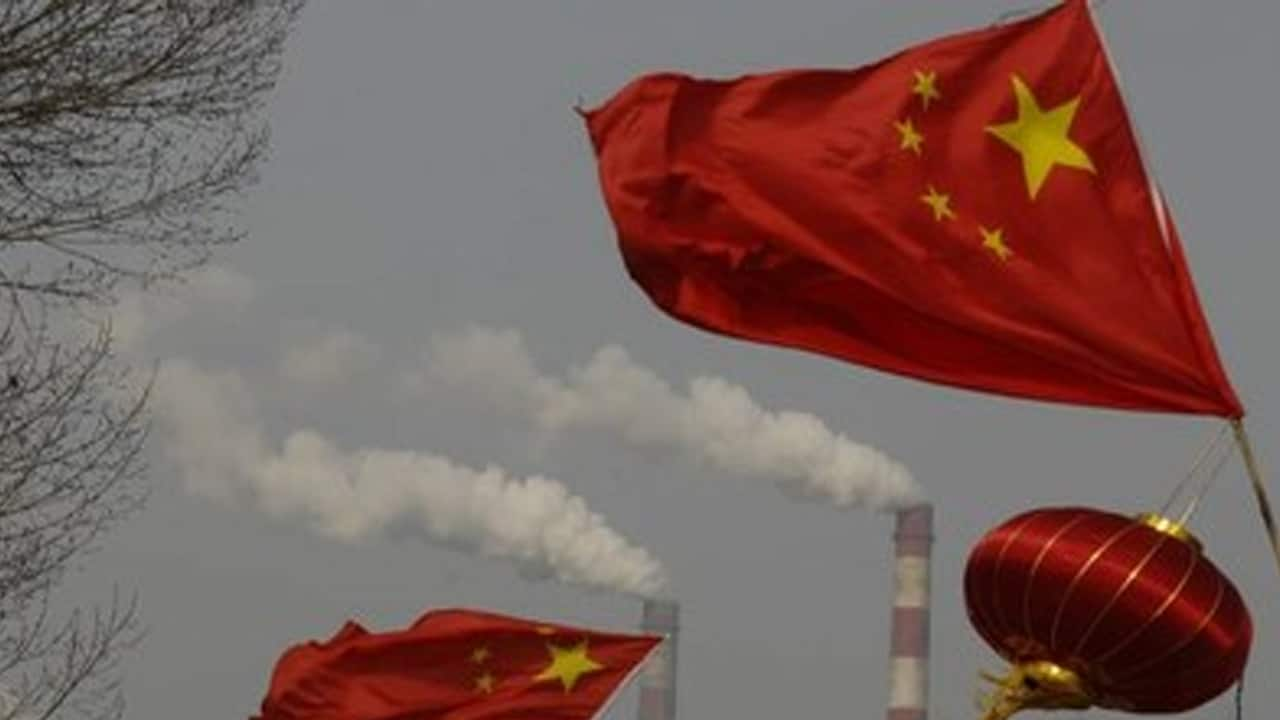

China funds give up to 53% returns in a year: Should you look to invest?

Over the past two years, China’s regulators have implemented policy measures to rejuvenate the struggling property sector, address the slowing economy, and tackle deflation. This shift in policy has triggered a notable surge in Chinese stock markets.

BUSINESS

Flexicap, largecap, value funds cut cash in May; midcap, smallcap schemes stay cautious

Indian funds deployed cash cautiously in May, as cash holdings as a percentage of assets in active equity schemes fell from 5.62% in April to 5.14% last month

BUSINESS

Investing in internet funds? Factors to track before taking the plunge

Investors should always look to spread their bets to cut the risk but some suggest that digital-focused funds may not entirely serve the purpose

BUSINESS

Active investing still beats passive strategies fairly often, says Arun Kumar of FundsIndia

Arun Kumar, VP and Head of Research at FundsIndia, says that as long as we are in a bull market, sectoral/thematic launches will continue.

BUSINESS

Gold is climbing again. Is it time to take some profits or stay invested?

Gold Price Today: Entering gold purely because it’s in the news can backfire, as prices may retreat if tensions ease or the Fed delays cuts. Also, avoid lump-sum investments at all-time highs.

BUSINESS

Silver ETF AUM doubles in a year, outpaces gold ETFs despite lower returns

Over the last one year, since June 2024, the assets of silver exchange-traded funds have grown by 126 percent, compared to an 82 percent rise in the assets of gold ETFs.

BUSINESS

Mutual fund's SIP inflow rises to a fresh high of Rs 26,688 crore in May

Mutual fund SIP assets rose to Rs 14.61 lakh crore against Rs 13.90 lakh crore in April. The SIP AUM was around 20.24% of the total AUM of the mutual fund industry as against 19.9% in April.

BUSINESS

Equity fund inflows fall 22% to hit one-year low of Rs 19,013 crore in May: AMFI data

However, the overall net assets under management of the mutual fund industry rose to Rs 72.20 lakh crore for the first time against Rs 69.99 lakh crore in April.

BUSINESS

RBI rate cut: Investors might have to look for bonds with higher yields

The RBI's 50 bps repo rate cut to 5.5 percent would typically boost bond prices due to the inverse relationship between bond prices and interest rates - when rates fall, bond prices rise

BUSINESS

Motilal Oswal MF to launch fund that covers 1,000 stocks; should you invest?

Motilal Oswal BSE 1000 Index Fund: By expanding to 1,000 stocks from the existing broadest funds, the BSE 1,000 index includes an additional 250 microcap companies, significantly increasing its sectoral and thematic reach

BUSINESS

These debt funds are defying gravity, but is the risk worth the return?

Data shows that the Sensex and Nifty have gained around 6 percent on a one-year basis, in which time some credit risk funds have zoomed more than 20 percent.

BUSINESS

Defence, gold and BFSI mutual funds shine in a stormy 2025

Out of around 1,650 mutual funds, across equity, debt, hybrid and precious metals, 1,162 or 70 percent schemes are showing positive returns on a YTD basis in 2025.

BUSINESS

US credit downgrade: What it means for Indian investors in US bonds

US bonds provide useful portfolio diversification given that the US Treasury has historically been the classic safe haven asset with deep liquid markets and strong institutional framework and US dollar as the default reserve currency.

BUSINESS

We have a cautious near-term outlook for domestic and global markets: Avinash Satwalekar, Franklin Templeton India

The president of Franklin Templeton India expects the markets to consolidate, given the lack of clarity on the global tariff front.

BUSINESS

Where to invest Rs 10 lakh in this market? Ihab Dalwai of ICICI Prudential AMC answers

Patience and discipline are often an investor’s best allies in the wealth creation journey, says this Senior Fund Manager.

BUSINESS

Should you invest in Canara Robeco Multi Asset Allocation Fund?

Multi-asset funds follow a dynamic investment strategy, adjusting their mix of assets depending on prevailing market conditions. They are well-suited for investors looking for a balanced approach.

BUSINESS

Investing in the American Dream: Why global millionaires are betting on the US Golden Visa

US Golden Visa: Under the EB-5 programme, individuals can obtain a Green Card by investing a minimum of $800,000 in a US business or project that creates at least 10 full-time jobs for American workers.

BUSINESS

SIPs gain ground: Monthly inflows hit fresh all-time high of Rs 26,632 crore in April

SIP inflows had surged 45.24 percent to Rs 2.9 lakh crore during the financial year FY25.