The Techade, a term coined by industry body Nasscom at the start of 2020 to describe a decade shaped by cloud, data, and artificial intelligence-led transformation, is now at its halfway mark. Five years in, the Indian IT services industry is discovering that AI’s most immediate impact lies less in topline acceleration and more in productivity gains, leaner delivery models, and structurally changed cost bases.

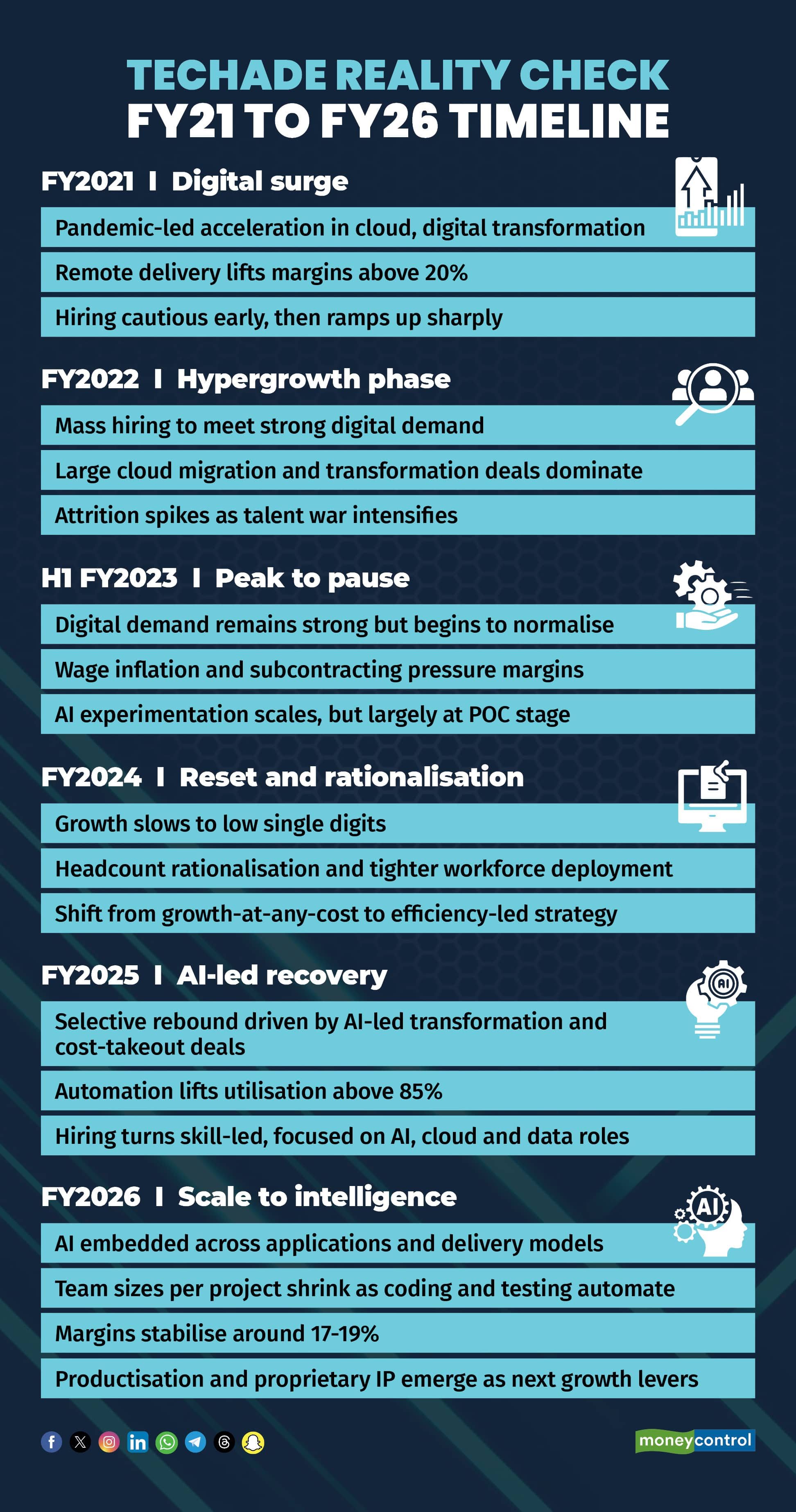

Data from a five-year industry review by Quess Corp shows the sector has completed a full cycle between FY2021 and FY2026, moving from hypergrowth to slowdown and into a selective recovery driven by AI-led transformation and cost takeout deals.

“The revenue mix from AI, cloud, and advanced digital services has risen sharply, from about 25% five years ago to nearly 60% today. Traditional work has not disappeared, instead, it is being re-engineered with AI to improve productivity, automation, and outcomes,” Kapil Joshi, CEO of IT Staffing at Quess Corp, told Moneycontrol.

What has changed structurally is not demand for technology, but how that demand translates into staffing, margins, and growth.

From scale to intelligence

The most visible shift over the Techade’s first half is the movement away from scale-led growth toward intelligence-led delivery. AI is no longer being deployed as a standalone automation layer but embedded directly into applications, workflows, and decision systems.

Describing this transition, Joshi said applications are moving beyond static reporting toward analytics and decision support. “Earlier, most applications were logic-based, we called it RPA. But now there is AI in every application,” he said, framing the broader industry shift.

This embedding of AI has altered delivery economics more quickly than it has reshaped the revenue mix.

In fact, the world’s largest IT company, Accenture, recently announced that it would discontinue the practice of calling out separate Gen AI revenue because of increasing complexity in determining the actual number.

Also, read: Doing more with less: AI rewrites the operating model of Indian IT

Productivity rises, team sizes shrink

The clearest impact of AI adoption is on productivity. Automation across coding, testing, and maintenance is reducing the number of engineers required per project, breaking the traditional linear link between headcount and output.

Data from the five-year industry review shows this shift clearly. After aggressive mass hiring in FY22 and FY23 to meet post-pandemic digital demand, firms moved into rationalisation in FY24.

That was followed by selective, skill-led hiring in FY25 and the first half of FY26, with utilisation rebounding to over 85 percent through automation and predictive staffing.

Also, read: India’s top IT firms lean towards IP-led growth as Gen AI shrinks the pyramid

Joshi summed up the delivery-side change, saying the projects that earlier required large front-end and back-end teams are now being delivered by significantly smaller groups as “a lot of coding and testing is automated.”

Teaneck-headquartered IT giant Cognizant has quantified this change, saying that about 30 percent of its code is now written by Gen AI.

Also, read: Cognizant calls time on the IT era, bets future on AI built delivery

The outcome is not job elimination, but slower incremental hiring and higher output per employee.

Cognizant’s Chief AI Officer Babak Hodjat, in a recent interaction with Moneycontrol, said productivity gains from AI are most visible when applied end-to-end across delivery processes, rather than as isolated tools, reinforcing the industry-wide shift toward leaner execution models.

Also, read: AI-led RFP automation has boosted win rates at Cognizant, says Babak Hodjat

Margins stabilise, not surge

AI-driven productivity gains are feeding into cost structures, but not translating into a significant margin expansion. Industry margins, which crossed 20 percent during the remote-delivery phase of FY2021 and FY2022, compressed to 15 to 18 percent in FY2023 due to wage inflation and subcontracting.

From FY2024 to FY2026, margins stabilised in the 17 to 19 percent range.

The data shows why: efficiency gains from automation and offshore leverage are being partially retained by service providers and partially passed on to clients in the form of cost optimisation. This sharing of benefits has helped defend margins in a low-growth environment.

“Some part improves margins and some part is passed on to the client,” Joshi said, capturing the cost-sharing dynamic in one line.

Also, read: From 4 weeks to 5 days: How Infosys’ AI agents are boosting enterprise operations

Free cash flow has remained resilient through the cycle, consistently exceeding net income, underscoring improved operating discipline even as revenue growth moderated.

Demand shifts to outcomes

On the demand side, enterprises are also changing how they buy technology services. Rather than large, labour-heavy contracts, clients are prioritising outcome-led transformation, efficiency gains, and platform modernisation.

In a recent interaction, Genpact’s GCC head Dinesh Jain told Moneycontrol that cost arbitrage benefits tend to peak early in a transformation journey, after which productivity and data readiness become the main levers of value.

Also, read: GCCs increasingly rely on BPM partners for transformation, says Genpact

This shift is pushing buyers toward fewer but larger deals, longer conversion timelines, and sharper scrutiny of returns.

The net effect is slower hiring, tighter cost structures, and a stronger focus on delivery quality over volume.

Productisation becomes the next lever

Looking ahead, differentiation in IT services is increasingly shifting toward productised offerings and proprietary intellectual property. Services firms are moving to package repeatable solutions rather than rely solely on bespoke project work.

Also, read: India’s top IT firms lean towards IP-led growth as Gen AI shrinks the pyramid

Five years into the Techade, the contours of the next cycle are clearer: AI is lifting productivity, capping headcount growth, and reshaping cost structures, but it is also enforcing discipline on revenue expectations.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.