For Tata Steel, its European operations are turning out to be the joker in the pack. It is demonstrating highly unpredictable outcome which has led to a positive impact on its overall financial performance.

Consider this: Europe accounts for almost 50 percent of the overall group's steel production but contributed only 25 percent to group’s profitability (EBITDA) in FY17.

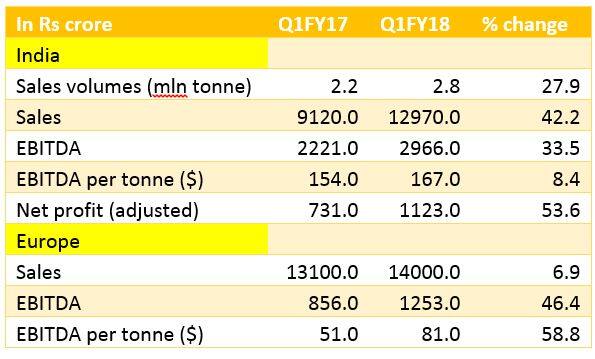

While European operations were going through a restructuring process, the market had very little expectations. As against hopes of EBIDTA at USD 50/tonne, Europe has delivered EBITDA of USD 81/ tonne in the quarter ended June 2017.

The strong recovery demonstrated by the European business also led to some good overall performance. On a consolidated basis, the company reported a three-fold jump in net profits to Rs 1550 crore on a sales turnover of Rs 30,973 crore that rose 19 percent in Q1FY18.

If Europe continues to deliver, considering there is still huge levers in terms of improving profitability, it is going to have significant impact on overall earnings.

For instance, the Indian operations on an annual sales turnover of 10.97 million tonnes generated close to Rs 12,000 crore EBITDA, which was thrice the amount of EBITDA (Rs 4400 crore) generated by European operations on a similar sales volume or 10.7 million tonnes in FY17.

Europe: pushing efficiency to the hiltThe next pertinent question is how much of the current performance of European operations is sustainable. There are three key developments, namely, volume, realisation and cost that are working in favour of its European operations.

In Q1FY18, Europe saw 27 percent increase in shipments to 2.8 million tonne, which is expected to remain strong, backed by better demand and improving economic prospects in the region. The European economy is expected to grow by 2.2 percent in the year 2017.

Secondly, European operations saw strong growth in realisation to Rs 58,663 per tonne in Q1FY18, up by 22.2 percent. Realisations were driven by a better product mix (value added products) and attractive pricing environment, which is expected to continue.

While speaking to analysts during the conference call, the management indicated that manufacturing and steel PMIs were trending higher in Europe. During the quarter ended June 2017, the European steel demand grew at 3.1 percent along with an increase in steel prices.

The third important pillar that is helping the European operations is effective management of cost, which is expected to stay low. The management has spoken about maintaining profitability of current European operations (EBITDA per tonne at USD 81 in Q1FY18 as against USD 51 per tonne in Q1FY17) post the restructuring of the business led by exiting from the loss-making facilities completely and restructuring pension and other liabilities.

On an yearly basis, in FY18, even at USD 80 per tonne, Europe on a sales volume of about 10 million tonne will be making close to Rs 5,200 crore EBITDA as against Rs 4400 crore in FY17.

Domestic business: driving volume growthWhile the European business is delivering higher profitability, the domestic business continues to benefit from volume growth led by the Kalinganagar project. During the quarter, Tata Steel India reported close to 28 percent growth in volumes to 2.75 million tonnes. Higher volumes combined with better prices led to higher realisations, which during the quarter, moved up to Rs 47,166 per tonne as against Rs 42,421 per tonne in the corresponding quarter last year.

OutlookThanks to the expansion at Kalinganagar project, Indian operations will be clocking sales volumes of close to 12.5 million tonnes in the current financial year as against 10.97 million tonnes last year.

Higher volumes at the Indian operation and improving profitability of its European business will lead to a turnaround year for Tata Steel in FY18. This will be supported by a healthy price and demand scenario in both international and domestic markets.

However, most of these positives are already factored in. Even if we optimistically estimate 10-12 percent profit growth over earlier expectations of a profit of Rs 5000 crore, the stock is priced dearly. It now trades at 10 times its FY18 consensus estimated earnings, leaving very little upside in the near-term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!