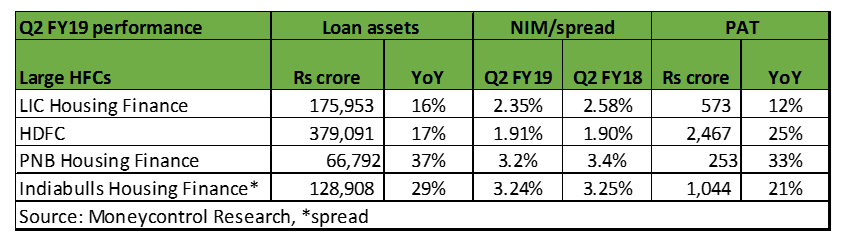

Most housing finance companies reported decent performance in Q2FY19. The performance was good across business parameters such as loan growth, spreads, asset quality and capitalisation. However, given the change in market environment since mid –September with heightened concerns around funding, Q2 performance cannot be extrapolated for rest of the year.

Housing finance companies are now experiencing a tumultuous time. Over the past 5-7 years, NBFCs including HFCs have rapidly gained market share in the overall housing credit pie. The total housing finance market of around Rs 16.7 lakh crore as at the end of March 2018 has grown at a five-year compounded annual growth rate (CAGR) of 18 percent with the pace of growth of HFCs and NBFCs being higher at a five-year CAGR of 20 percent. However, the tight liquidity situation is likely to change the housing credit landscape in coming months.

We analyse the current funding situation and its likely impact on growth, asset quality and profitability of HFCs.

We expect HFCs to continue to resort to bilateral DA transactions to raise liquidity in coming months in which both public and private sector banks likely to participate in a big way. However, yield in the securitisation market is likely to inch up as it stands changed from being a sellers’ market (NBFCs and HFCs) earlier to a buyers’ market (banks) now.

Growth to slowdownGiven the tight liquidity scenario, the focus of HFCs is either on conserving or raising liquidity. To raise liquidity through pre-payments, HFCs have increased rates on non-housing loan segment.

So the overall growth of HFCs is likely to moderate in H2FY19. Also, the share of home loans in the overall on-book portfolio would also decline due to the increased retail portfolio sales by various HFCs.

While the larger players like HDFC will continue to dominate the mortgage market, we see many small players ceding their market share in favour of banks.

Asset quality remains vulnerableWhile the overall asset quality for HFCs has held up well so far, a pressure is witnessed in some pockets of housing credit. For instance, asset quality for the newer HFCs in the affordable segment (likes of Aspire Home Finance and Mahindra Rural Housing Finance) has significantly weakened with gross non-performing assets (GNPAs) of 4.1 percent as compared to all HFCs at 1.1 percent as on March 31, 2018.

Further, the tightening liquidity and slowdown in growth could impact the asset quality in segments like construction finance and loan against portfolio (LAP).

Profitability to moderateThe overall profitability indicators for HFCs remained healthy until H1 FY19. However, going forward, a mix of factors could adversely impact the earnings of HFCs.

HFCs are now facing the heat of rising interest rates after having moderated till Q3FY18. Since a significant chunk of borrowing will be refinanced at higher rates, the overall cost of funds for HFCs is likely to go up in H2FY19. While most of the HFCs have increased their lending rates also by 20-30 basis points (bps), it is extremely difficult to pass on the entire rate increase to borrowers. Hence, we anticipate net interest margins (NIMs) of HFCs to decline in H2 FY19.

While we don’t envisage the current liquidity issues to transform into a credit crisis, there is a likelihood of increased credit cost especially in the non-housing portfolio if the growth slows down persists for longer.

A reduction in operating costs and upfront income booking on assignment transactions are likely to extend some support to the profitability. So, overall, we see significant downside pressures on the profitability of HFCs in the near term.

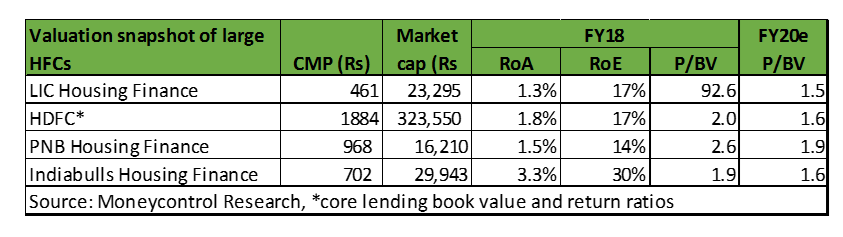

Outlook and viewStocks of HFCs have nosedived following the funding concern. As such valuation has turned reasonable.

However, future investment decision in HFCs is likely to be driven by how the liquidity situation pans out for the sector and not the valuation of the stock per se.

We are positive on the long-term growth prospects for HFCs. However, the current scenario calls for a selective approach.

The stock of Indiabulls Housing Finance is gyrating wildly on every incremental news around liquidity. Precisely for this reason, we suggest investors wait till the dust settles around the liquidity situation.

Though there is a lot of comfort emanating from its strong parentage and low valuations, LIC housing finance’s performance remains lacklustre.

In case of PNB Housing Finance, the impending stake sale by PNB remains the near-term impediment.

In today’s environment where access to funding has become a function of market confidence, we suggest investors stay with large players with strong parentage. Large-cap names like HDFC give us immense comfort and should form part of an investor’s core portfolio. With the housing credit market staring at multiple headwinds in the near-term, HDFC is the most worthy bet in the housing finance space.

Follow @nehadave01For more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!