A year ago, Crompton Greaves (now known as CG Power and Industrial) was struggling with a slowdown in the industrial and power segment and a related debt burden. The situation was exactly opposite in the case of its consumer electricals business which was churning out cash and earning good margins, making a decent return on equity.

The company demerged the two businesses when its shares were trading at around Rs 80. Existing shareholders of the parent company were given one share for one existing share. Today, the combined value of the two shares is Rs 300, which is close to 400 percent return in little over a year.

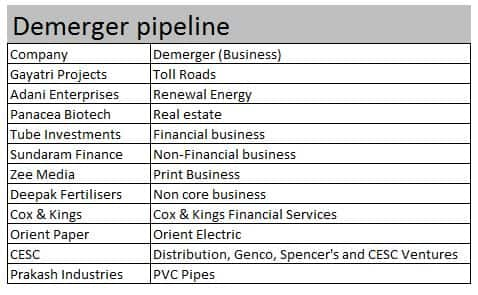

Over the past year we have seen companies demerging their business divisions, and a few more are queueing up to do so (see table). This urge to demerge is driven by the fact that the companies feel their stocks are mispriced despite a broad market rally. In the search for shareholder returns, it is an alternative to the long search for organic growth, or to financial engineering, and it seems to be working well.

One big difference is perception. Once the two businesses are separated, the one which is more lucrative and earns good returns gets the sort of value that may have eluded it before the demerger. Before the demerger, Crompton’s power business made a profit of Rs 135 crore profit or about 3.3 percent of the capital employed. The consumer business earned a profit of Rs 401 crore on Rs 3200 crore capital employed in the business making close to 30 percent return on capital. Before the demerger, the combined entity was trading at one time its book value. Today, consumer business is compared with the companies like Havells, and trades at 9 times its book value.

Game of valuationGetting a better value for the demerged entity is often a prime objective, but what is interesting to note is that the demerger provides a greater focus, divides risks and provide the ability to scale and raise growth capital independently.

Demergers are also often looked at as a solution to a problem like dealing with high debt. The case in point is Sintex Industries. Till FY16, the company was sitting on a debt of Rs 6,400 crore with interest coverage ratio of less than 3 times. On top of that, there was a huge pressure of FCCB conversion and promoters’ holdings being pledged. Its textile business was casting a shadow on its lucrative plastic businesses. The textile business was sitting on huge debt and suffering because of lack of scale. Textile was making a 3 percent return on capital as against 16 percent in the case of plastics business. Before the demerger, the combined entity was trading at around Rs 80 a share or about 6 times its earnings compared to listed peers such as Nilkamal and Supreme Industries, which were trading at 25 times their earnings.

Today, the plastic business alone trades at 95 a share or 14 times its earnings. The valuation of both the demerged entity is close to Rs 122, which is about 50 percent higher than the value ascribed before the demerger. The trick lies in separating the risks and getting higher valuations for the lucrative business.

A company will typically prefer to demerge a business which is doing well but not getting enough value being part of the overall holding company. Orient Paper Industries is demerging consumer electronics business, whose brand ambassador is cricketer MS Dhoni. In FY17, the paper business reported Rs 9 crore segment profit or 1.6 percent of the asset (Rs 562 crore) deployed in the business. Consumer electronics business earned a segment profit of Rs 82 crore or 15 percent of the assets employed. Even at 15 times earnings, this business could be worth Rs 1,300 crore as against the current market capitalisation of the combined entity of Rs 2,123 crore. On account of news of the demerger, some rerating has already happened with the stock more than doubling in the last one year. Often the news of demerger spreads well before the event and that is precisely a reason that investors have to be early to spot these opportunities.

“The biggest challenge is estimating the timeline. From the date of the announcement, it may take 12-24 months before the actual event takes place. The best ways is to look for the opportunity just about 3-4 months before the date of the demerger,” said Aruna Giri, Founder and CEO, Trust Line Holdings.

He adds: “There are two ways to look for value. One needs to look at the sum-of-the-parts valuation of each of the businesses that are going to be demerged. Second, what is the holding discount that the market is giving? Like in the case of Orient Paper, when the cement business was separately listed it created huge value because the market was not giving any meaningful value to the cement business before the demerger…investors were fearing it to be part of the loss-making paper business.”

Sector fancyOne common thread among most of the demerger stories is that they often come at a time when sentiment about a particular sector or business is high thus allowing companies to list at maximum valuations for the demerged entity. For instance, Fortis Healthcare demerged its diagnostic business SRL at a time when Dr Lal PathLabs and Thyrocare listed at exceptionally high valuations. The current trend is in favour of financials with companies like Reliance Capital raising funds through the listing of mutual fund business held under Reliance Nippon Life Asset Management Company.

Tube Investments—part of the Cholamandalam Group—will shortly demerge and list its general insurance business Cholamandalam MS General Insurance business. The move to demerge the insurance business is timely, as investors are willing to pay more for the business. The recently listed insurance players ICICI Prudential, ICICI Lombard and SBI Life are currently trading on an average of 50 times their FY17 earnings. If we apply the same yardstick the TI's investment in general insurance business will be worth Rs 350 per share as against current value of Rs 210 per share ascribed by the market. CESC is demerging its businesses including the retail business held under the company Spencer's having 124 stores. The retail arm which is turning around its financial could unlock more value particularly in the light of strong rerating of retail sector companies like DMart, Shoppers Stop and Future Retail. Apart from the listing, demerger will remove complexity in the business.

"CESC’s proposed demerger plan will lead to substantial value unlocking. The move would bring with it benefits like isolation of cash flows of the power vertical from other businesses (one of the investors’ key concerns) and the opportunity to invest in a pure-play power distribution business, with steady cash flows and growth. The demerger also signifies management’s confidence in a sustainable turnaround in Spencer’s operations. Post the demerger, several assets (stake in Noida Power, renewables, and others) would get their fair value which was not the case in the conglomerate structure," said Atul Karwa, who is tracking the company at HDFC Securities.

While valuing conglomerates, the market prefers to value these investments at book value or discount to the fair value because of the conservative valuations approach. This is precisely a reason that demerged entities once listed separately manage to get the higher value.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.