The Rs 7-lakh crore non-performing asset (NPA) problem has been the fly in the otherwise smooth ointment that is the Modi government’s economy scorecard. In its Financial Stability Report, the RBI has named stressed assets (12.3 percent of advances) as the prime reason why banks are risk-averse and credit-shy. In this context, Finance Minister Arun Jaitley’s comment of "a radical overhaul in NPA resolution" assumes importance. As one would expect, markets have given his views a cautious welcome, sending the Bank Nifty up 1 percent.

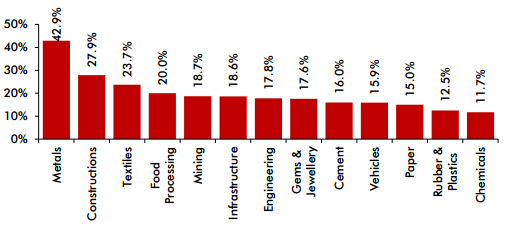

As per RBI’s Financial Stability Report, 22.3 percent of the credit given to the industry is either classified as NPA (non-performing assets) or restructured (industry accounts for 40 percent of total bank credit). The sector that tops the non-performing asset list are metals, construction, textiles, mining, infrastructure (including power) and engineering. In the first nine months of the current fiscal, a majority of NPAs were from these sectors.

Source: RBI

Before speculating on the modus operandi of a possible resolution, it is important to understand the evolution of the problem. Contrary to popular perception that NPAs have been created only by wilful defaulters, the problem had its origin from multiple sources, hence a one-size-fits-all solution might not be appropriate.

The genesis of the great NPA saga may be traced back to the "commodity super cycle" that resulted in false hopes of a never-ending surge in commodity prices, and a generous funding of capacities. The other fancied sector, infrastructure, witnessed issues with project completion on account of unavailability of resources, improper offtake (no power purchase agreement) and inability of promoters to bring in the requisite equity. For completed infrastructure projects, overall lacklustre demand posed challenges for servicing debt. The construction sector faced issues of bloated receivables and finally unviable business models and unscrupulous promoters also played their part.

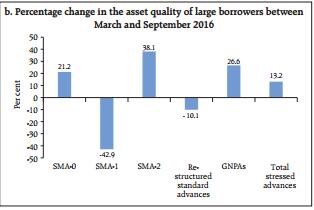

Given the genesis of the crisis, the focus is likely to be on the large accounts first. According to RBI, the asset quality of large borrowers deteriorated significantly. The share of special mention accounts (SMA)-2 increased across bank groups.

Source: RBI

While the exact nature of the resolution is still unclear, it has to be a marked departure from the existing mechanisms such as corporate debt restructuring (CDR), strategic debt restructuring (SDR) and scheme for sustainable structuring of stressed assets (S4A), which are all focused on protecting bank books from stress. The pace of resolution so far has been tardy as bankers have failed to work together, there have been disagreements on the haircut (the difference between the book value and selling price of the asset) and finally public sector bankers are wary of being questioned by Vigilance agencies over any decision they take.

A few weeks ago, the RBI Deputy Governor suggested creation of special structures like a private asset management company, which will handle the creation, selection and implementation of a feasible resolution plan for quick turnaround of stressed assets and the involvement of two credit rating agencies which will rate the company.

In case of companies which are far gone and are in need of a more long-term solution, the suggested mechanism was to create a national asset management company with a minority government stake, which would raise debt and manage the asset reconstruction companies (ARCs) and private equity firms that would actually turn around the underlying company.

However, the key question that remains unanswered is when the bad assets are housed under an ARC or a Bad Bank, the transfer price of the asset becomes critical. If the transfer happens at closer to the book value, the banks are spared of significant provisioning but it is not economically viable for the buyer. If the bank transfers with a deep haircut, then incremental provisioning requirement makes the proposition self-defeating. Government has so far been wary of pumping money into beleaguered PSBs (public sector banks) lest it is accused of wasting precious taxpayers’ money in bailing out unscrupulous promoters.

One option could be to raise long-term sovereign backed bonds by the Bad Bank or similar entity, and PSBs being issued bonds in lieu of the loans transferred thereby protecting their capital adequacy.

The other solution, which is rumoured to be doing the rounds, is to make large public sector units buy some of the assets wherever synergistic benefits are visible (like NTPC buying some power projects). However, for any such transaction to fructify, the correct pricing of the asset is important. The ability of banks to provide for the haircut also needs to be resolved.

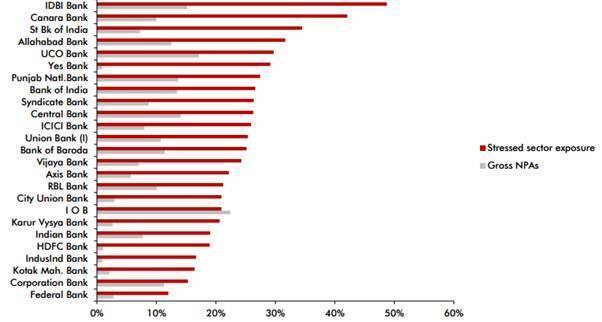

While markets may have to wait in the coming week to get a clarity on the exact mechanism, PSBs and a few private banks that are reeling under asset quality problems can party, hoping that a resolution is near.

Source: Ambit

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.