The recent cut in excise duty on petrol and diesel by Rs 2 comes as a much sought-after relief for consumers. Sky-rocketing petrol prices were pinching the pockets of consumers and resulted in much furor over the last fortnight. However, the relief to the consumers comes at the expense of government finances that are already struggling. The only true positive outcome of the move is that oil sector, both upstream and downstream has been spared thereby sending a strong message that there is no going back on the reforms agenda.

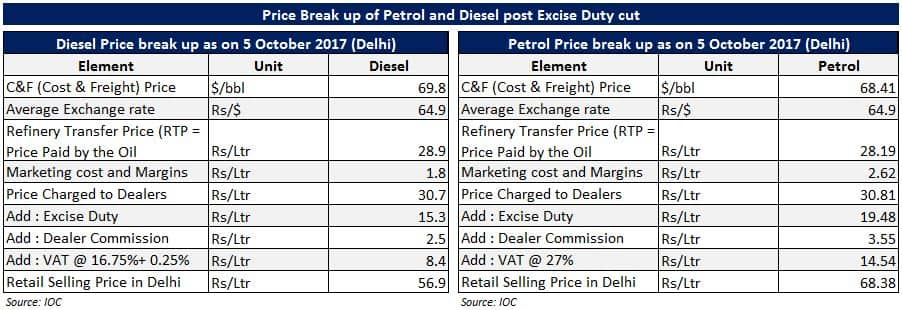

The excise cut has brought in a more than Rs 2 net reduction in oil prices due to the consequent cut in net VAT charged on overall excise duty. After the duty cut the central government has now urged state government to follow suit and cut VAT on fuels by 5 percent. Eighteen states in the country are ruled by BJP-led governments and as per latest updates these states will be initiating the VAT cut in the coming days. This would further reduce oil prices and please the customers.

Excise duty on petrol and diesel is expected to contribute around Rs 2,61,300 crore to the exchequer in FY18. This is almost 16.3 percent of total receipts and 1.6 percent of estimated FY18 GDP. The reduction in the excise duty by Rs 2, would lead to around Rs 26,000 crore reduced collections annually. Given that the announcement has come in the middle on the year, it would reduce the FY18 receipts by a whopping Rs 13,000 crore, which is approximately 0.8 percent of our total budgeted receipts for FY18 and around 2.4 percent of the total estimated fiscal deficit.

This reduction in the revenue receipts of the government risks fiscal slippages since the fiscal deficit has already touched 96 percent of the full year’s target in the first five months of the fiscal. With slowdown of tax collections, lower dividend from RBI and lower than targeted disinvestment (only 35 percent achieved after including upcoming GIC stake sale), the reduction in excise receipts from petroleum products could impact interest rates on account of fears of larger fiscal slippage. There is also a genuine risk of some cut-down in government expenditure unless disinvestment receipts springs a positive surprise.

Impact on InflationExpenditure on petrol and diesel has 6.84 percent weight in the CPI (consumer price index) basket. The recent reduction in petrol and diesel prices could potentially reduce the CPI inflation by around 20-21 basis points directly and the indirect impact might be higher. This augurs well for the headline inflation numbers that is faced with myriad headwinds including an inhospitable base.

What it means for oil marketing companiesThe cut comes as a huge temporary relief for the oil marketing companies whose margins were under a strict scanner due to public outrage (even though they have been more or less steady over the past two years). It comes as a breather that there was no tinkering with the policies especially when the oil ministry had given vague indications of asking OMCs and refiners to absorb the impact of global oil price hikes.

The cut in excise duty coupled with a proposition of further reduction through the VAT route provides a much sought after relief for the customers and calms the amplifying criticism against the government. It also stands to relieve pressure from the margins of the oil marketing companies in the short term. However, the widened fiscal gap cannot be wished away. The fire of criticism has been doused so far with a small price on the exchequer, it remains to be seen how government handles the situation should crude rally higher from the current level.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!