Woodside Energy Group Ltd., Australia’s top liquefied natural gas exporter, expects consumption of the fuel to rise 50% over the next decade, pushing the supplier to consider further expansions.

“We’re seeing signs of that demand growth in emerging Asia,” Chief Executive Officer Meg O’Neill said Tuesday in an interview. “There’ll be points in time where we’ll see a fair amount of new supply arriving, but the demand growth is really likely to absorb that over the course of the coming years.”

The outlook is one of the most bullish in the industry, as energy companies and environmentalists debate the role of gas in the world’s transition to cleaner fuels. Shell Plc, a major LNG supplier, earlier this month pared back its forecast for consumption to an increase of more than 50% by 2040.

Woodside has long said that more gas will be needed to complement the expansion of intermittent renewable energy sources, and has flagged it is open to further expansions of its LNG business. Talks with smaller Australian rival Santos Ltd. on a potential tie-up collapsed earlier this month in a deal that would’ve created one of the biggest LNG producers in the Asia-Pacific region.

“We see a bright future for LNG, so Santos was an opportunity to bring together two LNG powerhouses to make an even bigger and more significant force in the industry,” O’Neill said in a separate interview on Bloomberg Television. “We weren’t able to get the deal over the line, and that’s fine because we have got great assets in the portfolio.”

The producer is advancing the $12 billion Scarborough LNG project in Australia, has other development options including Browse, Sunrise and Calypso, and continues to review possible acquisitions, she said.

“The M&A team is out looking at a variety of opportunities — but we are going to be disciplined,” said O’Neill. “We are going to make sure it fits our strategy, fits our capabilities and delivers value.”

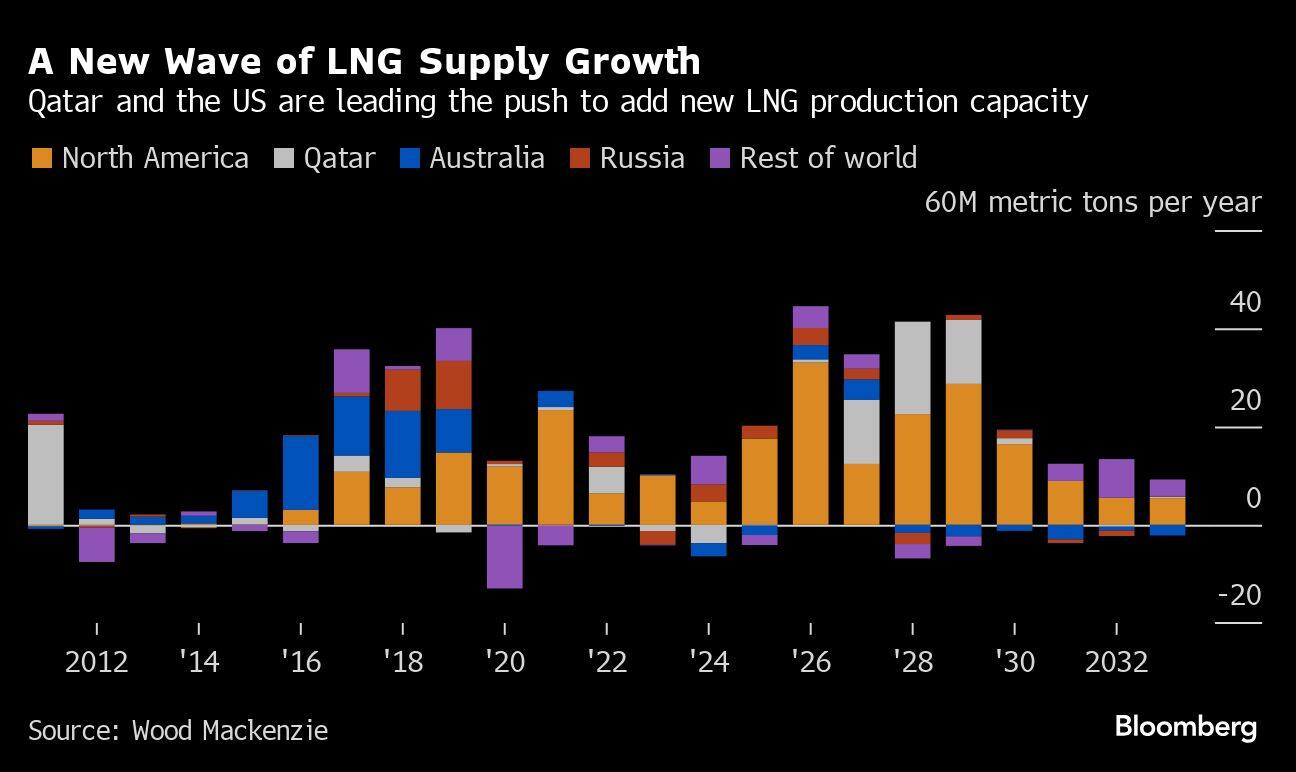

Qatar, which vies with the US and Australia as the biggest LNG shipper, is also bullish on demand, and announced plans Sunday for a 13% increase in annual capacity on top of a previously announced expansion.

A decision by the White House to impose a temporary halt on new LNG export licenses while it studies the impact of higher shipments on issues like climate change and national security is raising uncertainty about the US as a supplier, O’Neill said.

“It sends another worrying sign around the fiscal and regulatory stability in places that used to be places where you could count on investing,” O’Neill said. “When the rules change at the drop of a hat, without consultation, that’s a concerning signal for the market.”

Woodside earlier reported underlying profit fell 37% in 2023 on a year earlier as prices retreated and it booked $1.5 billion of impairments.

Read More: Woodside Profit Slides on Lower Prices as Output Hits Record

Asian LNG spot prices are at the lowest level since 2021 due in part to mild weather and high inventories in Europe and Asia. With no major liquefaction facility expected to start this year, supply and demand will be “pretty finely balanced” for 2024 and prices could be boosted by the situation in the Middle East or growth in China, O’Neill said.

Even though more production will start in 2025, demand will also return from buyers who were on the sidelines after the 2022 energy crisis due to high prices, such as Bangladesh and India, she said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.