The Federal Reserve will likely avoid signaling an imminent rate cut this week, staying focused on stubborn inflation while keeping one eye on a slowly rising jobless rate.

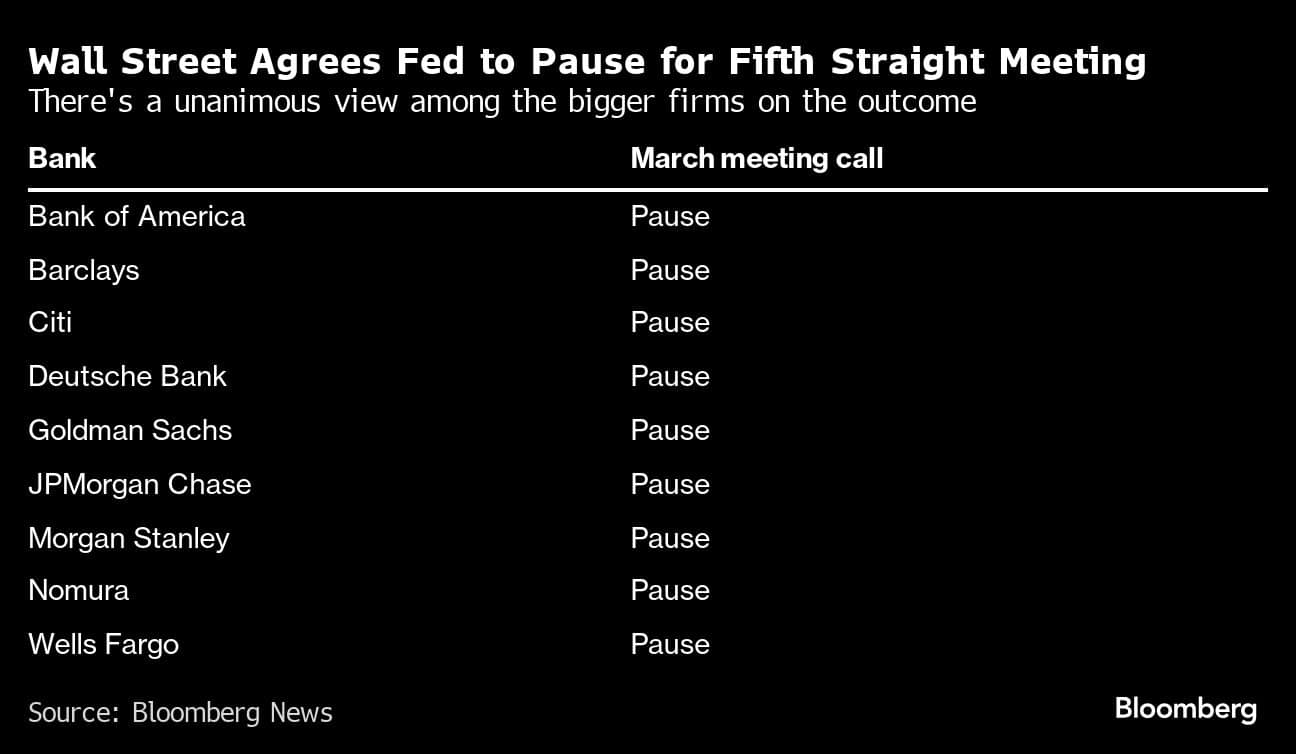

The Federal Open Market Committee is poised to keep rates in a range of 5.25% to 5.5% at its two-day policy meeting, a two-decade high first reached in July. The rate decision and economic forecasts will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later.

Fed officials are reluctant to lower borrowing costs until they’re certain inflation is closing in on 2%, the rate they see as appropriate for a healthy economy. But a recent rise in the unemployment rate to a two-year high means they’ll need to balance their attention on both prices and the labor market.

Rate Forecasts

Wall Street will be focused on Fed officials’ forecasts for interest rates — the so-called dot plot — which will show how much the committee expects to cut interest rates in 2024 and 2025.

Most economists surveyed by Bloomberg News expect policymakers to pencil in three cuts for 2024 with the first move in June, in line with markets’ current pricing, though more than a third expect two or fewer. Minneapolis Fed President Neel Kashkari, for one, has said he was considering reducing his outlook for 2024 cuts from two to one.

“It would only take two participants to move their dots to move the median to 50 basis points of cuts for this year,” said Veronica Clark, an economist at Citigroup Inc. “We are thinking the Fed is OK with where they are now. But it is definitely the risk.”

What Bloomberg Economics Says...

“We think the dot plot will show the median FOMC participant still expects 75 basis points of rate cuts this year. Given Powell’s past sensitivity to signs of slowing activity - which is still the case in recent weeks despite hot inflation prints - he could surprise on the dovish side at the news conference.”

— Anna Wong, chief US economist

Some economists, including those at Bloomberg Economics and JPMorgan Chase & Co., predict the FOMC may raise its outlook for the long-run federal funds rate, reflecting persistent price pressures or higher productivity. The committee has estimated that rate at 2.5%, and any increase would imply rates will stay higher for longer in the future.

FOMC Statement

The committee is almost certain to retain its guidance on interest rates, which says no reduction in rates will be appropriate until it has more confidence that inflation is moving sustainably toward its 2% target.

The description of the labor market will be a key clue to how the committee is weighing job trends. In January, the FOMC said unemployment was “low.” With the February jobless rate at 3.9%, one option would be to reword that to “the unemployment rate has edged higher, but remains low,” according to Bank of America economists.

No dissents are expected.

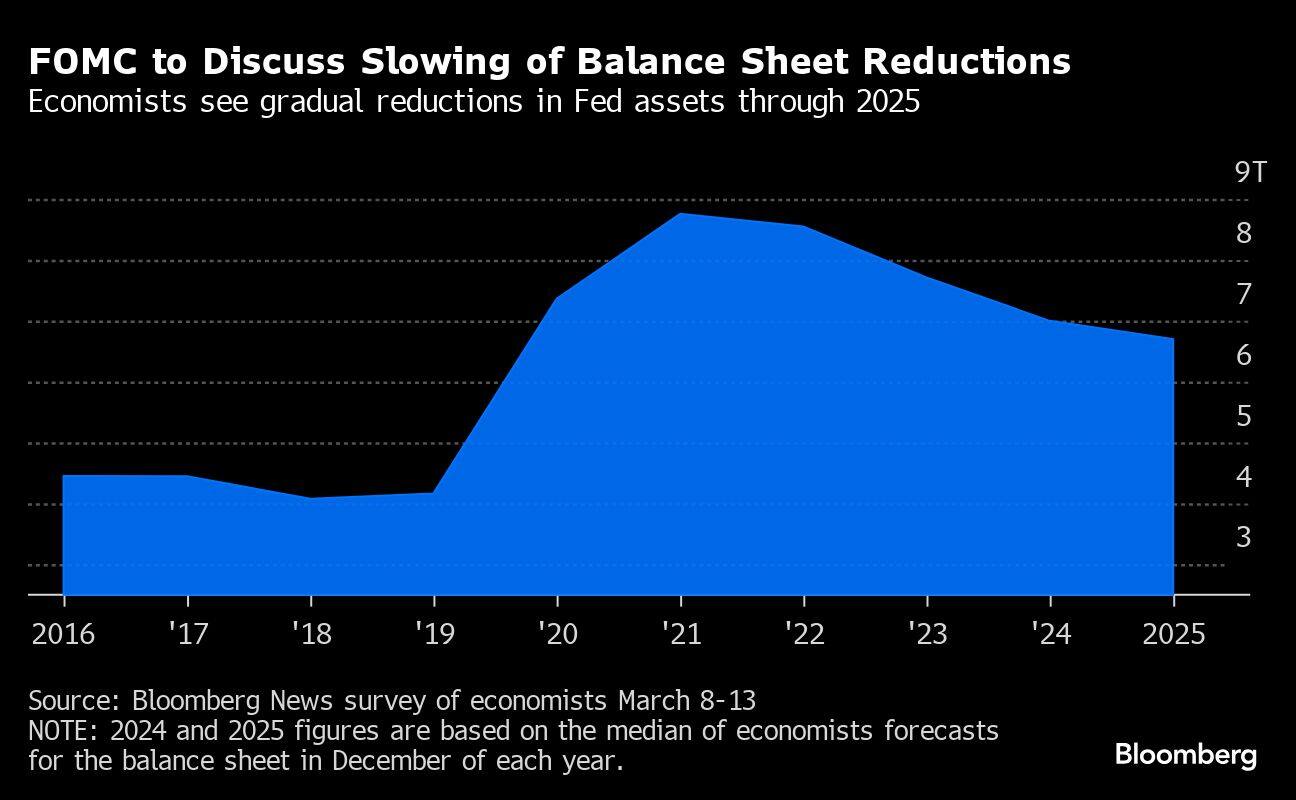

Balance Sheet

The committee is scheduled to hold a discussion on its $7.5 trillion balance sheet, which it’s been shrinking by allowing some securities to mature without replacing them, a process known as quantitative tightening. No decision on tapering the pace of tightening is expected at this meeting, but Powell might provide an update on the talks at the press conference.

A plurality of economists expect the Fed to announce a slower pace of tightening in June, with the actual tapering starting in June or July. They expect the asset portfolio to shrink to $6.7 trillion in December 2025.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.