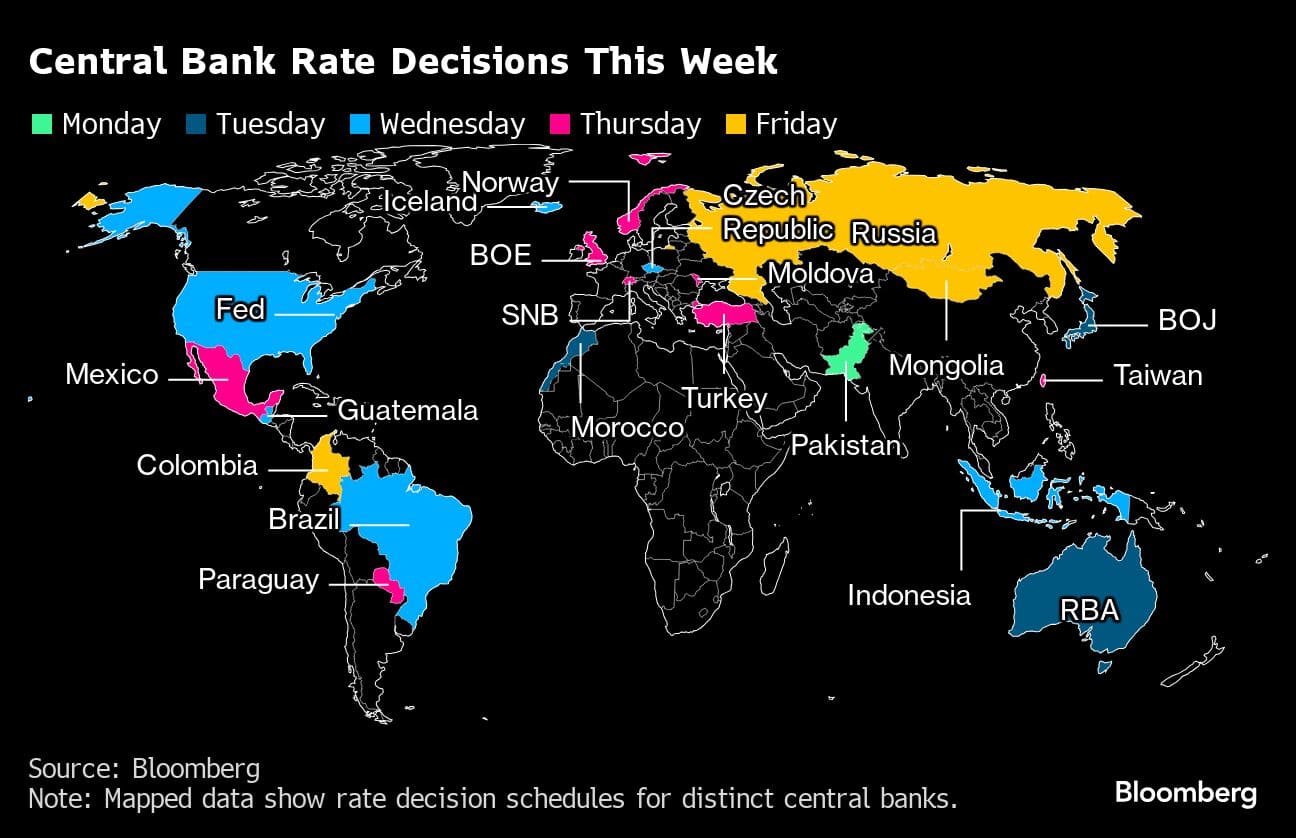

Investors may glean more on the Federal Reserve’s resolve to ease and how close Japan is to finally exiting negative interest rates as central banks set policy for almost half the global economy.

The coming week features the world’s biggest agglomeration of decisions for 2024 to date, including judgments on the cost of borrowing for six of the 10 most-traded currencies. The collective outcome may underscore how monetary officials’ perception of inflation risks is diverging noticeably.

That would reflect how a global consumer-price shock in the wake of the pandemic, further exacerbated by Russia’s war in Ukraine, has transitioned asymmetrically, with some economies facing stronger domestic price pressures than others.

In turn, the world now features a patchwork of different policy dynamics, in contrast to the largely synchronized response that central banks previously engineered.

Most consequential will be the Fed’s decision on Wednesday, which may reveal whether still-robust economic data are giving Washington officials cause to dial back intentions to cut rates — or whether their outlook for three reductions this year remains on track.

The Bank of Japan’s announcement on Tuesday is also pivotal. The prospect that it’s moving toward finally raising borrowing costs and effectively calling an end to a generation-long period of feeble price growth points to how tectonic plates are shifting in another key member of the global financial system.

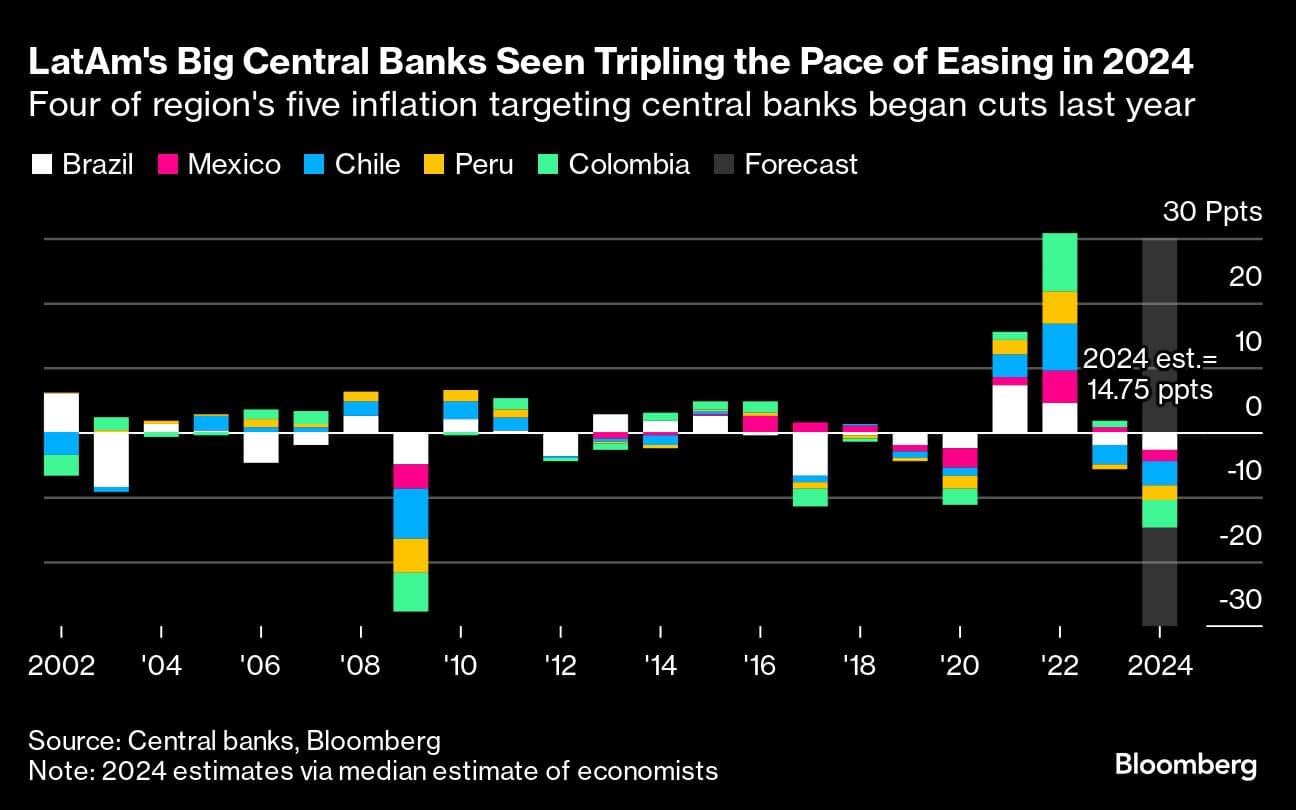

In Europe, meanwhile, central banks from the UK to Switzerland might inch toward reducing borrowing costs, while all four with decisions in Latin America in the coming week are poised to either begin or extend easing cycles.

Pakistan will be Monday’s main rate event. With a team of International Monetary Fund officials visiting this weekend for talks over the troubled economy’s loan program, most forecasters in a Bloomberg survey reckon the central bank will keep its rate unchanged at 22%.

A minority does anticipate a cut, though, with predictions of its size ranging from a quarter point to a full percentage point.

TuesdayThe BOJ’s decision will be among the most closely watched in decades, as officials decide whether to end the world’s last negative rate now, or wait until April.

The meeting comes days after the nation’s largest umbrella group for unions announced that annual pay negotiations resulted in the biggest increases in more than 30 years, sending a signal to authorities that their long-sought-after virtuous cycle of strong wages fueling demand-led inflation may be emerging.

The raises outpaced inflation in a positive sign for households that have seen real wages fall every month for almost two years. Economists are divided on whether the central bank will move Tuesday or not.

“We think it will judge that it’s too early to tighten,” Taro Kimura, senior Japan economist at Bloomberg Economics, said in a report. “To be sure, there is a significant risk to our call.”

The same day, the Reserve Bank of Australia will probably hold its cash rate at 4.35% after weaker-than-expected inflation in January. Investors will focus on whether the institution keeps its hawkish tone or hints at a pivot a few months out.

And later in Morocco, with inflation having slowed to 2.3% in January, the central bank may opt to keep its rate steady at the 3% level it reached a year ago.

WednesdayA trio of decisions in Europe and Asia might pique investors’ interest before the day’s main events. Firstly, Indonesia’s central bank is seen keeping rates on hold.

Over in Europe, Iceland may begin easing with a quarter-point cut from 9.25% — the highest level in Western Europe — according to lender Islandsbanki hf. Slowing inflation and a long-term pay deal may provide officials with reassurance against a potential wage-price spiral.

The Czech central bank is poised to act more aggressively, with most economists anticipating a half-point reduction and one predicting a bigger move.

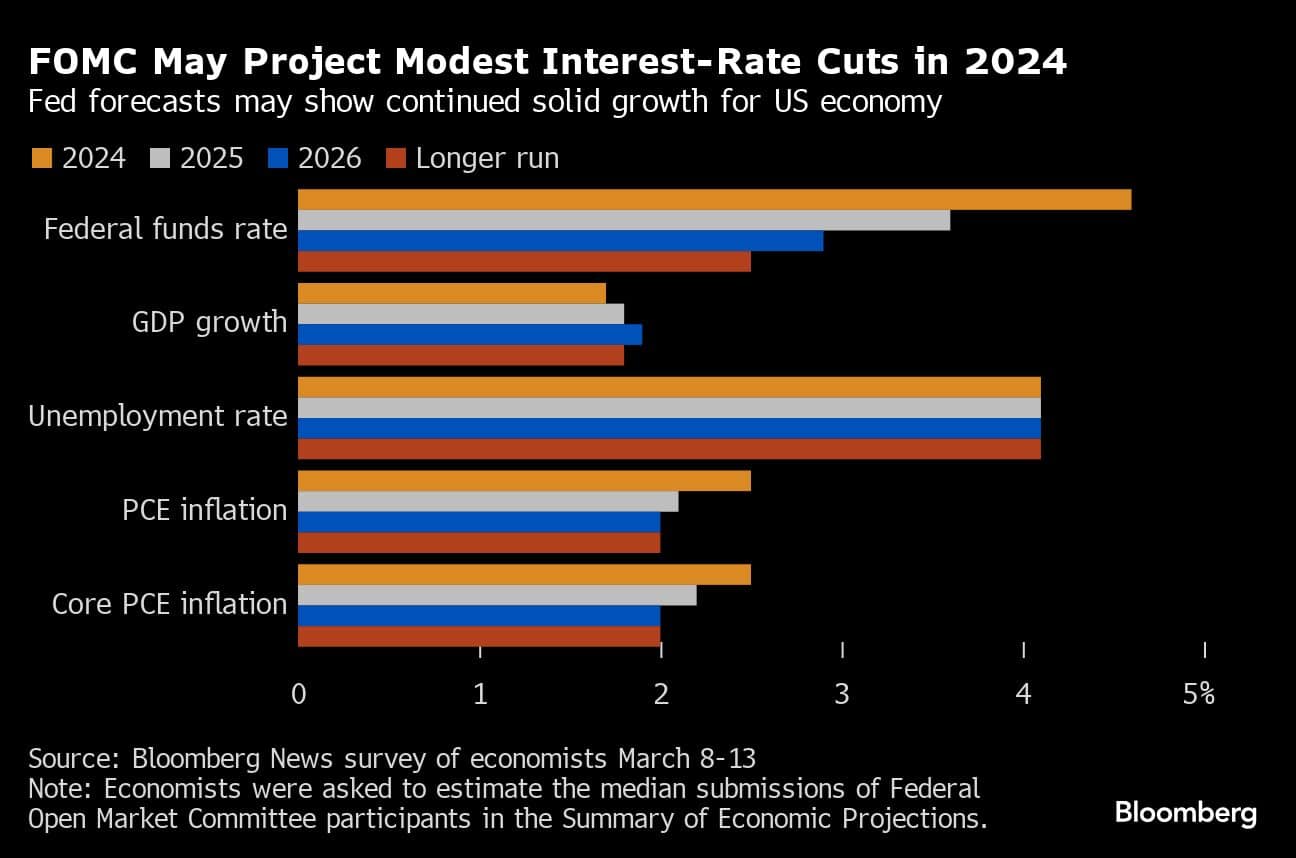

Attention then shifts across the Atlantic, where the Fed is widely expected to hold rates steady for a fifth consecutive meeting, and to continue to project three quarter-point rate cuts in 2024, even as inflation has proven stickier than expected the past two months.

After raising their benchmark federal funds rate more than five percentage points starting in March 2022, the Federal Open Market Committee has held borrowing costs at a two-decade high since July.

Against the backdrop of strong job growth and a jump in prices in January and February, officials have repeatedly emphasized they’re in no rush to ease.

Most economists surveyed by Bloomberg News expect the policymakers to pencil in three cuts for 2024, with the first move coming in June, in line with markets’ current pricing, though more than a third expect a hawkish surprise of fewer reductions.

Chair Jerome Powell told Congress this month that the central bank is getting close to the confidence it needs to start lowering rates, saying they were “not far” from that when considering the strength of inflation.

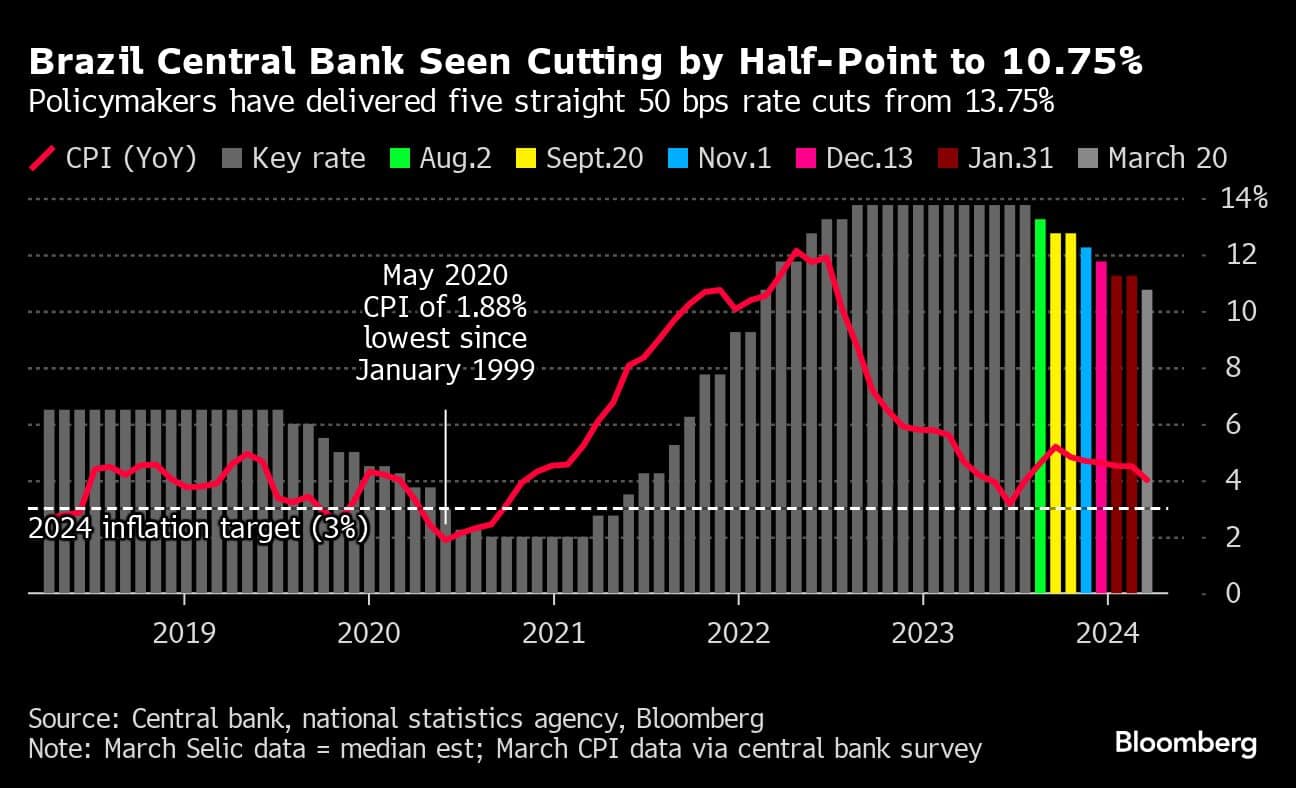

For later in the day, Brazil’s central bank has telegraphed that a sixth straight half-point cut is on tap, which would take the key rate down to 10.75%.

The institution’s board, led by President Roberto Campos Neto, may shorten the horizon on current guidance, which signals cuts of “the same magnitude in the next meetings” after three straight above-forecast inflation prints.

Economists see a year-end rate of 9%, but the policy path from there remains less clear as neither the central bank nor analysts see consumer prices back to target before 2027.

ThursdayThree decisions will reveal how parts of Western Europe have reached a crossroads in monetary policy.

Firstly, the Swiss National Bank is anticipated by most economists to stay on hold, though two respondents in Bloomberg’s survey predict that officials will cut rates, opting not to wait for bigger counterparts to start their own easing cycles.

Shortly after that, Norges Bank is also expected to keep borrowing costs on hold, with investors focusing on potential changes in its outlook for when reductions might start. Most economists still see the pivot to easing in Norway no earlier than in the third quarter, even as inflation has been cooling faster than anticipated.

Bank of England policymakers will have fresh inflation data on Wednesday and the latest purchasing manager surveys on Thursday to consider before their decision, which is seen likely to keep rates unchanged again.

With consumer-price growth slowing but likely to still come in well above the 2% target, the UK central bank is in no rush to move toward easing for now.

Observers are likely to focus on the vote count from officials on the Monetary Policy Committee, with another three-way split possible between those wanting no change and others favoring either a cut or a hike.

“Having dropped its tightening bias at its February meeting, we don’t think the MPC will be minded to alter its guidance,” Dan Hanson and Ana Andrade of Bloomberg Economics wrote in a report. “A bigger shift in tone is likely to come in May.”

Investors will also closely watch Turkey’s rate decision after February’s inflation numbers came in higher than expected. Several banks, including JPMorgan, say monetary officials will probably raise the key rate beyond its current level of 45%, though most doubt that will happen until after this month’s local elections.

The focus will again shift to Latin America later in the day. In Mexico, officials may finally pull the trigger on a long-awaited cut — likely a quarter point — and by doing so join major peers across the region in easing monetary policy.

Banco de Mexico, led by Governor Victoria Rodriguez, has kept borrowing costs at a record-high 11.25% since last March while consumer prices have embarked on a protracted and bumpy path downward.

In one of Latin America’s smaller economies, Banco Central del Paraguay will likely cut its key rate for an eighth time since August, from the current 6.25%, after inflation slowed to 2.9% last month.

FridayThe Bank of Russia’s first post-election rate decision is likely to keep borrowing costs unchanged for a second straight time, following last month’s hold at 16%. With inflation at 7.7% — well above its 4% target — the central bank has said it sees room to begin lowering borrowing costs only in the second half of the year.

Later on, Colombia’s central bank is all but certain to cut the current 12.75% rate for a third straight meeting — and may opt to go bigger after consecutive quarter-point reductions.

Policymakers led by Governor Leonardo Villar do have room for maneuver: inflation has slowed for 11 months and Colombia’s economy is operating well short of potential.

Economic DataThe coming week will also feature some key data releases:

China’s monthly batch of numbers may show growth in retail sales and industrial output slowed in the first two months of 2024, while property investment may have dropped 8% on year.

US statistics on the schedule include housing starts and PMI numbers.

Canada, Japan, South Africa and the UK will all release inflation data.

Euro-zone reports due include PMI surveys and consumer confidence.

Germany’s ZEW and Ifo indicators will provide a snapshot of the potential recovery of Europe’s biggest economy.

Singapore, Malaysia, New Zealand, Japan and South Korea publish trade data.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.