Citigroup Inc. raised its growth forecast for China to 5% this year, as promising data helps build consensus around the nation’s ability to achieve its official government target.

Retail sales and industrial production may improve, the economists wrote Wednesday, adding that the nation’s export contraction could also narrow after official manufacturing surveys expanded for the first time in six months.

“The cyclical bottom is here, with all eyes on whether organic demand will pick up amid gathering policy momentum,” wrote economists led by Yu Xiangrong. The bank’s previous forecast was 4.7%, making it among the more bearish investment banks on China.

“Previously, we had downgraded our GDP forecast out of policy disappointment,” the economists said, adding that since the end of August “policy momentum exceeded expectations clearly” due to some property easing measures.

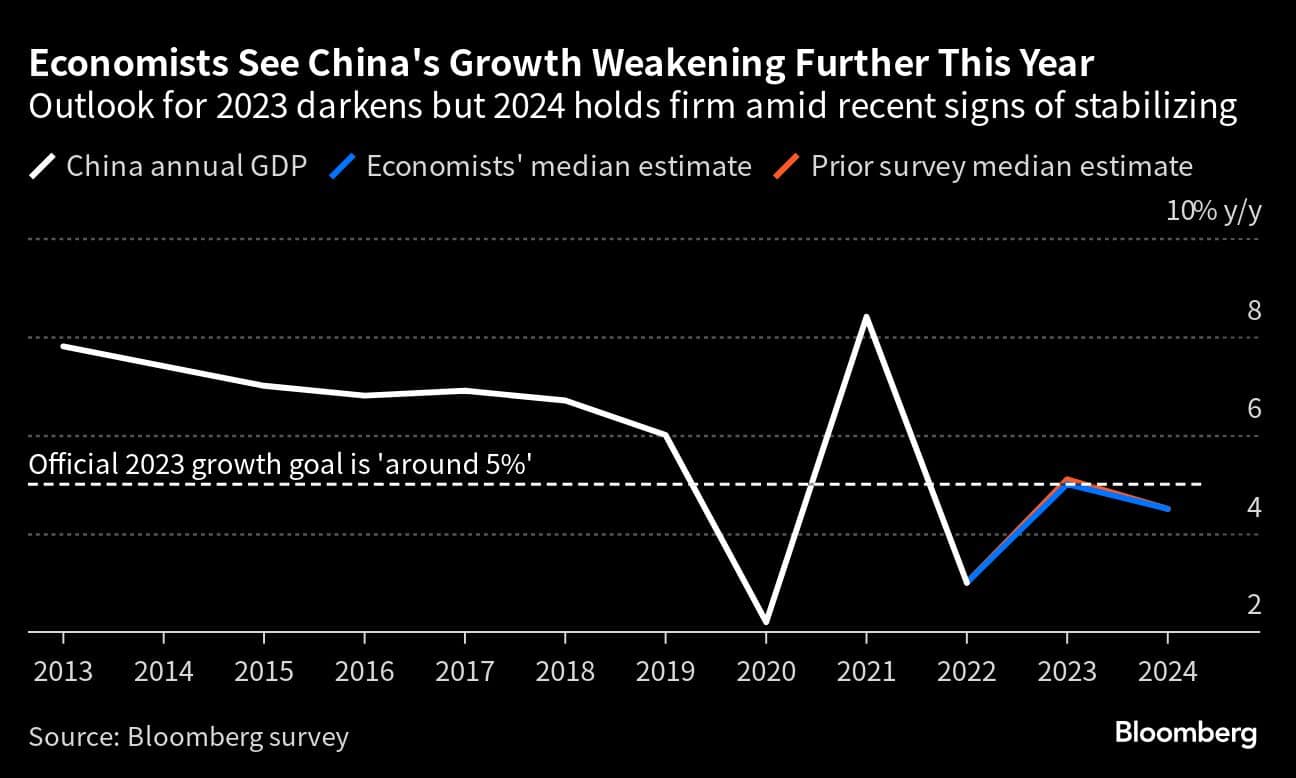

The most recent poll of economists by Bloomberg showed a median forecast for growth of 5% for the year — in line with the official goal. That is, however, in part because many firms have been downgrading their expectations for the economy as the property crisis drags on activity.

While recent data has indicated some sectors of China’s economy, such as factory activity, is stabilizing, the recovery remains precarious. Economists have pointed to concerns about domestic demand and job market pressures, along with ongoing troubles within the real estate market.

This week is a critical period for activity: Analysts are watching closely the combined mid-autumn and National Day holiday period — which began Sept. 29 and runs through Oct. 6 — for signs of increased consumer confidence.

Sales at China’s major retailers and restaurants rose 8.3% in the first three days of the holidays versus the same period in 2022 when several regions faced coronavirus restrictions, China Central Television reported, citing data from Ministry of Commerce.

There will be about 900 million domestic tourist trips made during this year’s holidays, China’s Ministry of Culture and Tourism has predicted. That would translate to an increase of about 5% in daily average domestic tourism revenues compared to the same period in 2019, according to economists at HSBC Holdings Plc.

“The services recovery is likely to be a key driver for sustained recovery momentum,” economists led by Erin Xin wrote in a note.

Some economists see a likelihood that the government will need to step up support, particularly for the property sector. The value of new home sales by China’s top 100 developers fell 29% on-year in September, according to China Real Estate Information Corp, improving only slightly from the previous month’s 34% drop.

The figures “might indicate a need to step up policy stimulus after a wave of support measures didn’t revive sentiment much,” Bloomberg Intelligence Analyst Kristy Hung wrote in a note.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!