Shubham Agarwal

The Nifty consolidation continues as it gyrates between 17,800 and 16,850 with major hurdle pegged at 17,800.

There has been no major trigger as the Nifty shut shop with a marginal loss of 0.43 percent around 17,280. Private bank and oil sector contributed the most for this firm stand. The Nifty recorded short build-up on the OI (open interest) front in the week gone by.

The Bank Nifty, on the other hand, outperformed as it closed around 37,600 with a significant loss of 2.37 percent as it moved between 38,500 and 36,650 the last week. Overall, the Bank Nifty ended the week with a loss of around 900 points. The index also witnessed short build-up on the OI front during the week.

Further diving into the Nifty upcoming weekly expiry, PE writers are showing aggression by building more positions compared to CE writers.

The Nifty immediate resistance stands at 17,500 and vital resistance stands at the 18,000 levels where nearly 49 lakh and 70 lakh shares have been added. On the lower side, immediate and vital support level is at 17,000 where nearly 61 lakh shares has been added.

Looking at the Bank Nifty upcoming weekly expiry data, on the upper side, Bank Nifty immediate resistance at 38,000/38,500 where both strikes nearly added 14 lakh shares followed by vital resistance stands at 39,000 where nearly 16 lakh shares has been added whereas, on the downside immediate support level stand at 37,500 where nearly 14 lakh have been added.

India VIX still trading on the upper regime as it increased significantly by 18.5 percent. Spike in the India VIX has created a fear in the market. Further spikes in India VIX can lead to more fear.

Looking at the sentimental indicator, the Nifty OI PCR for the week has increased from 1.09 to 1.101. Bank Nifty OIPCR over the week increased from 0.831 to 0.849 compared to last Friday. Overall data indicates more of PE writers over CE writers in the Nifty.

Moving further to the weekly contribution of sectors to the Nifty. Most of the sectoral indices shows mixed contribution whereas PVTB contributed 85 points on the negative side, while on the other side OIL contributed approximately 40 points on the positive side. Most other sectors contributed marginally.

Let's look at the top gainer and loser stocks of the week in the F&O segment. Voltas topped by gaining over 4.8 percent, followed by Page Industries at 4.6 percent, Eicher Motors 3.9 percent. Whereas, Manappuram Finance has lost over 20.5 percent, Metropolis -14.4 percent and Astral 12.4 percent over the week.

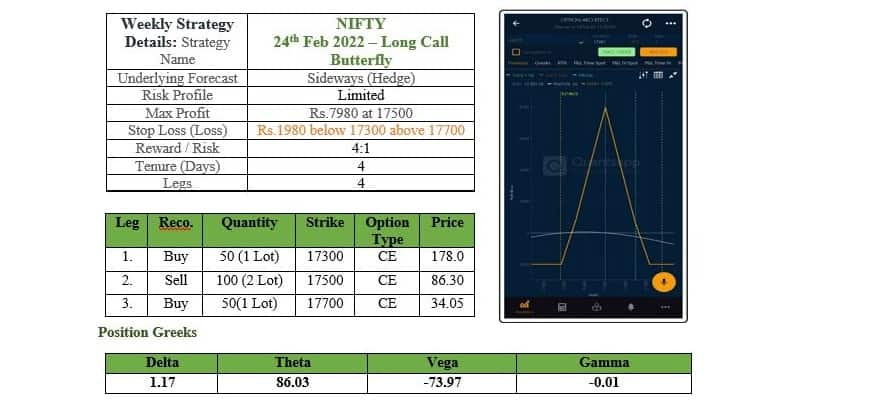

Considering the consolidation along, the upcoming week can be approached with a low-risk strategy like Long Call Butterfly in the Nifty.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.