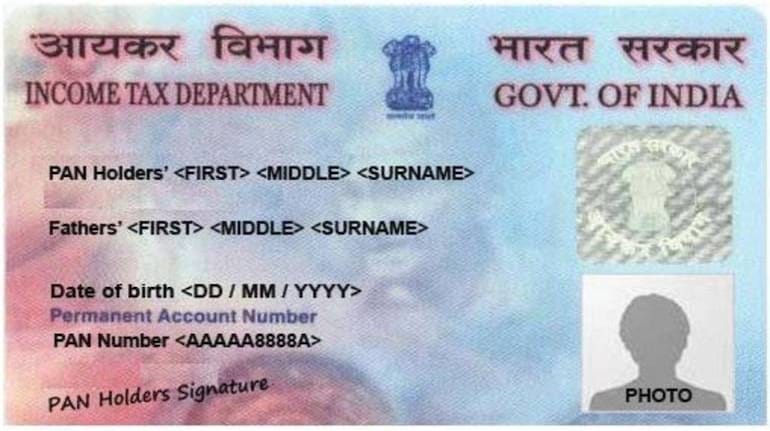

The Finance Ministry has extended the deadline for linking Aadhaar Card to PAN cards to June 30, earlier this year in March. The Ministry also informed that not linking the two documents by June 1 would render the PAN card invalid.

The government has also added a clause that those PAN card holders who have not linked the PAN and Aadhaar card by the initial deadline of March 31, 2022, will have to now pay a penalty of Rs 1,000.

If you are not sure whether you have linked your PAN and Aadhaar, you can visit this step-by-step guide on how to do so.

Here's a step by step guide on how to link your PAN with your Aadhaar by paying the Rs 1000 penalty

Step one : Go to the official website of the Income Tax Department of India here: https://www.incometaxindiaefiling.gov.in

Step two: Click on the 'Link Aadhaar' option which is available under the 'Quick Links' menu section on the homepage.

Also Read: PAN-Aadhaar linking deadline extended till June 30Step three: A new page will open where you need to enter your PAN, Aadhaar number, and your name as mentioned on your Aadhaar card.

Step four: Enter the Captcha code displayed on the page and click on the 'Link Aadhaar' button.

There are certain people and categories who do not have to mandatorily link their PAN to Aadhaar. As per a 2017 notification issued by the Central Board of Direct Taxes (CBDT), the mandatory linking of Aadhaar with PAN does not apply to four categories, which are residents of the states of Assam and Meghalaya and the union territory of Jammu and Kashmir, Non-Resident Indians (NRIs), people above the age of 80 years or more at any time during the previous year and individuals who are not citizens of India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.