One quick thing: Bengaluru airport likely to tap KPMG for AI to boost passenger experience

In today’s newsletter:

- Oyo IPO hits SoftBank wall

- Adobe CEO's vision for India’s AI future

- ShareChat shifts gears for IPO

P.S.: Introducing the Tech3 Podcast, your daily dose of tech and startup insights. Monday to Friday! Check it out on Spotify or Apple Podcasts

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 stories

Top 3 stories

Oyo IPO hits SoftBank wall

Third time’s supposed to be the charm... but not if your biggest backer isn’t on board.

Driving the news

Oyo has postponed its long-anticipated public market debut, again.

- This marks the third time since 2021 that Oyo’s IPO dreams have been deferred, and this time, even its biggest backer is saying “not yet”

Oyo's largest shareholder, SoftBank, with over a 40% stake, has reportedly pushed back against the October listing.

- The Japanese conglomerate wants Oyo to improve its earnings profile before going public, according to a Bloomberg report

Oyo's board is unlikely to greenlight a listing without SoftBank's backing or a promise not to sell shares during the IPO.

- Oyo is now eyeing a potential listing in March 2026, targeting a valuation of over $7 billion, the report added

Oyo is currently valued at around $3 billion, a significant reduction from $10 billion during its peak around 2021.

Markets turn cold

The delay comes amid shaky investor sentiment globally. The Nasdaq 100 is down about 6% in 2025 after strong gains in 2023 and 2024.

- Meanwhile, back home, the BSE Sensex dipped 0.9% in Q1 following a 7.3% drop in Q4FY2024

To make matters worse, SoftBank’s other Indian bets, including Ola Electric, Brainbees, and Unicommerce, have all seen post-IPO stock slumps.

Loan dilemma

Founder Ritesh Agarwal has been pushing for a speedy IPO to meet the terms of a $2.2 billion loan he restructured in 2022 to increase his stake in Oyo.

- The loan, guaranteed personally by SoftBank founder Masayoshi Son, requires a repayment instalment by December

SoftBank may agree to help extend that deadline in exchange for a delayed IPO, the report added

Find out more

Picture credit: DALL-E

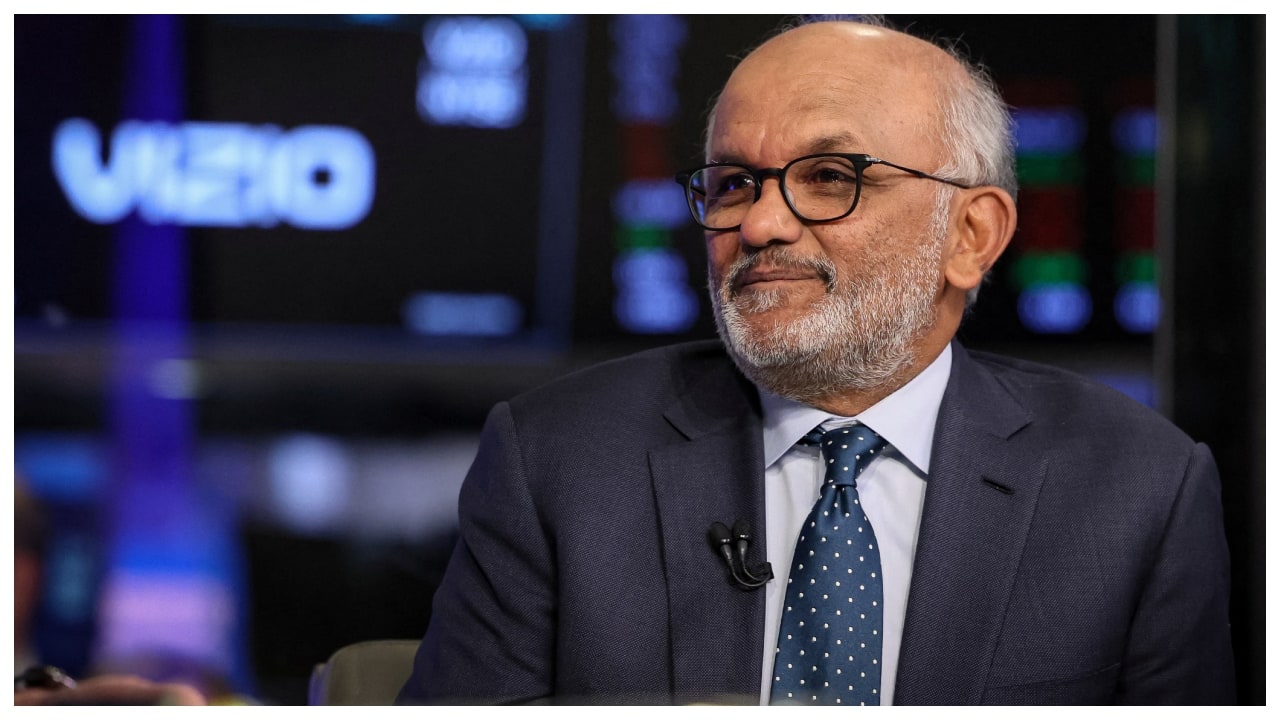

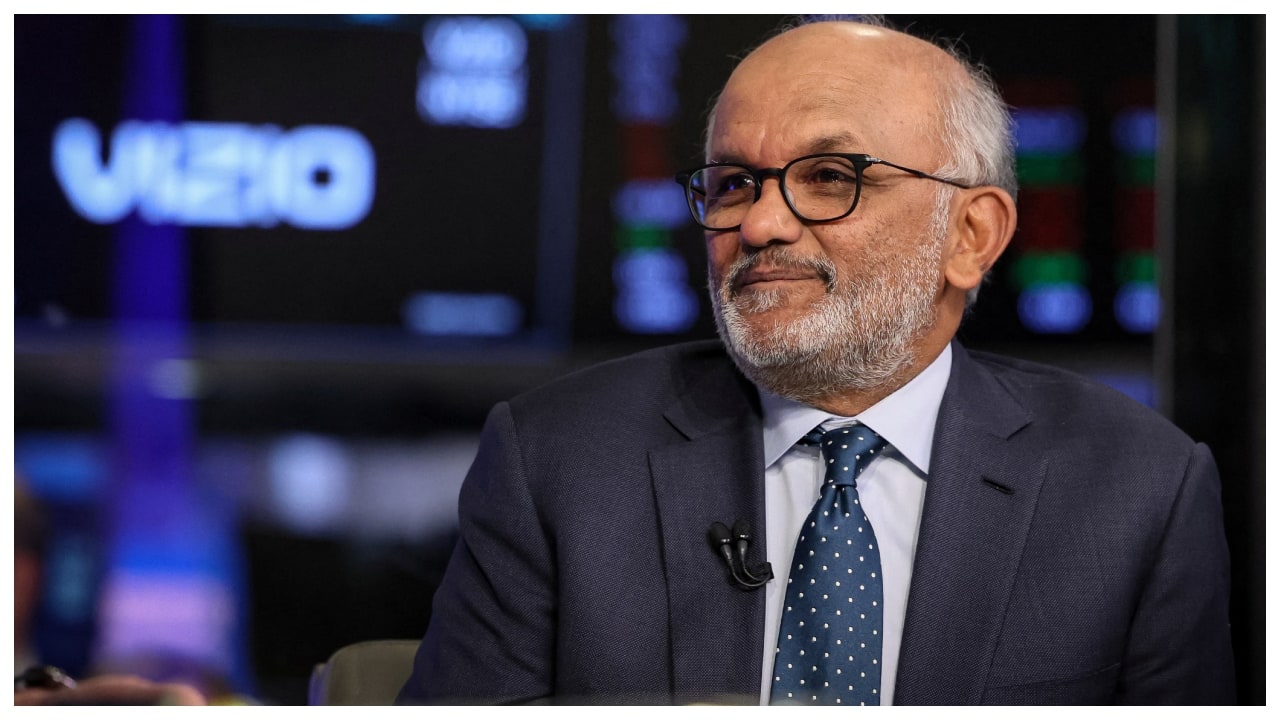

Adobe CEO's vision for India’s AI future

Adobe CEO Shantanu Narayen believes that India, now a major force in artificial intelligence (AI), is well-positioned to take the lead in shaping ethical AI on the global stage

In an interview with us, Narayen said that it was "really encouraging to hear the Prime Minister talk about the importance of responsibility."

"At the end of the day, when you think about what creativity is, creative intellectual property is soft goods, which can be pirated," he told us.

Hence, protecting your style and the uniqueness of what you do is an important part in this era of AI, he said.

The big opportunity

The growing demand for personalised customer experiences is fueling a surge in content creation across industries.

- This is opening a massive opportunity for India, where imagination, creation, and production can take place, Narayen said

Interfaces are the real deal

Narayen also told us that the real value for customers is in the interfaces, not in the data or the models.

- He pointed out to GenAI features across its products, such as Photoshop, Premiere Pro, and Acrobat

Go deeper

ShareChat shifts gears for IPO

After a rollercoaster ride, Mohalla Tech, the parent company of social media apps ShareChat and Moj, is plotting a comeback, this time with profitability in sight.

Tell me more

The vernacular social media platform, which surged in popularity after TikTok was banned in India, is preparing for an IPO within the next two years, said CEO Ankush Sachdeva.

- After peaking in 2022, the company struggled with user retention, high cash burn, layoffs, and top-level exits

Sachdeva’s co-founders, Bhanu Pratap Singh (former CTO) and Farid Ahsan (former COO), also exited the startup in 2023.

Sachdeva describes the shift as a journey from “high cash burn” to “slowly chipping away costs while scaling revenue.”

Revamp in works

The company is currently experimenting with new monetisation streams, and what better way to do that than by adding a bit of AI magic.

- ShareChat and Moj will soon offer a one-minute video format to drive more ad revenue, Sachdeva said

Mohalla Tech also turned cash-flow positive in February 2024 and is now on track to double its revenue over the next three years.

Go deeper