Any well-balanced portfolio enables several outcomes - it helps you create wealth, manage risk and access funding during emergencies. Investors continuously strive to understand the secret behind achieving all three goals.

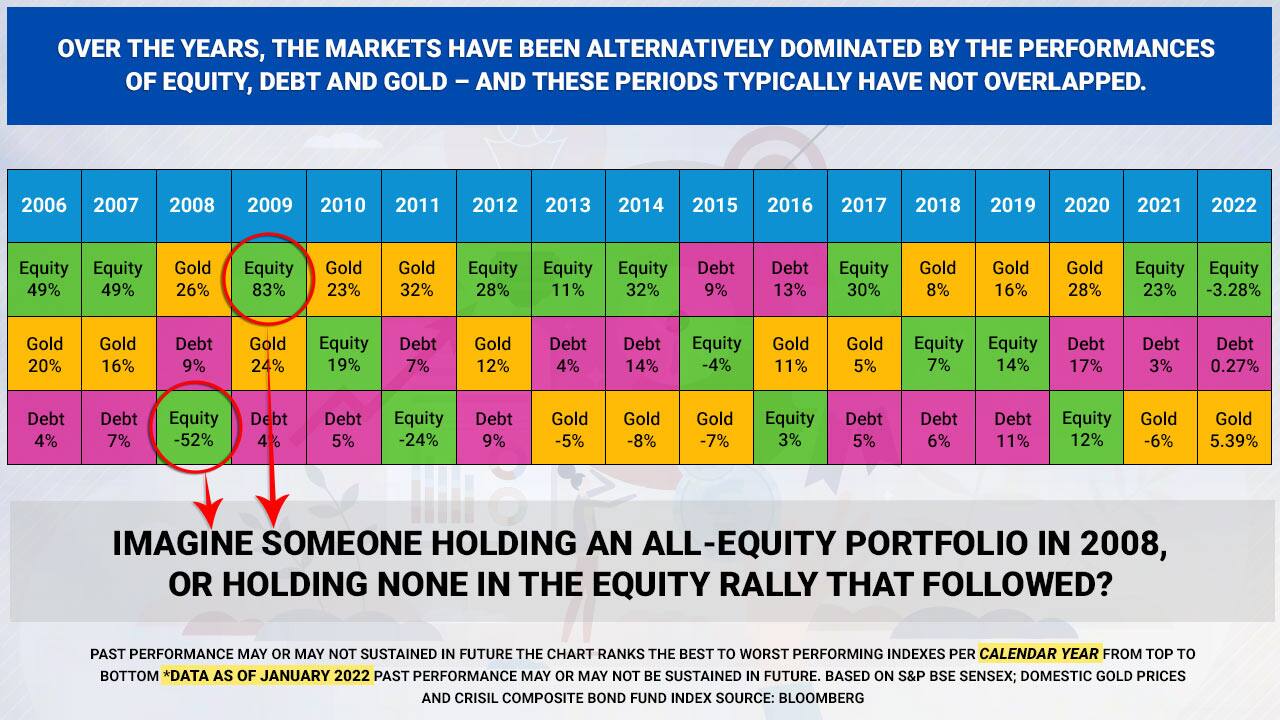

To achieve the right balance, you need a combination of equity, debt and gold in your investment portfolio. This helps to reap risk-adjusted returns as, generally, these asset classes are seen to be negatively correlated to each other.

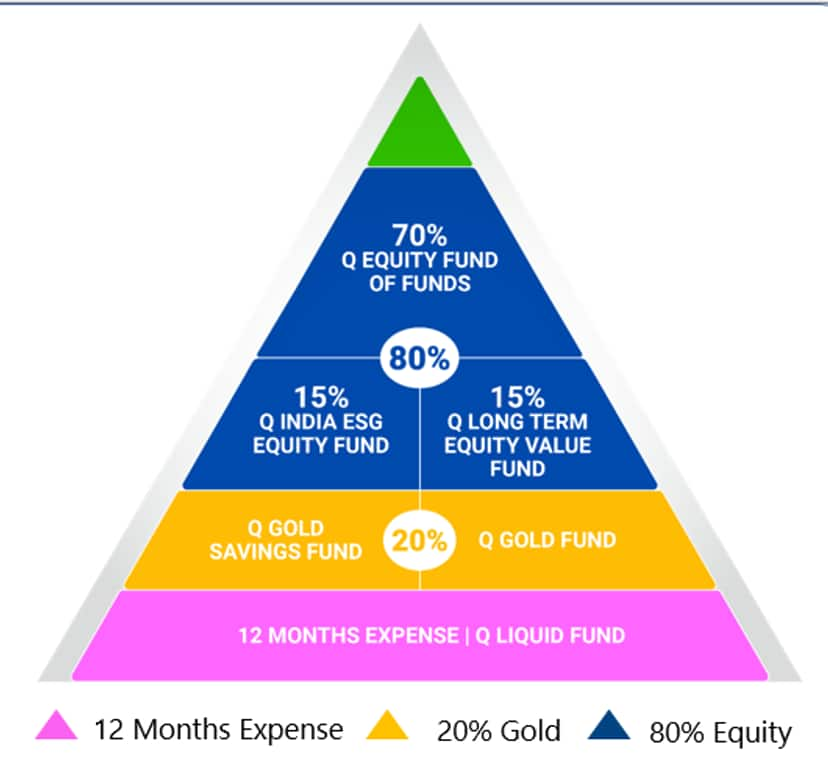

Well, one approach to ensure that your portfolio is adequately diversified is the 12-20-80 route. The 12-20-80 Rule This is a unique, readymade asset allocation plan that strategically not just diversifies your investments, thereby helping mitigate risk; it also allows you to generate wealth for the long-term without worrying about any uncertainty. This guideline enables you to achieve long-term and short-term goals while staying safe on rainy days. Goals can include:

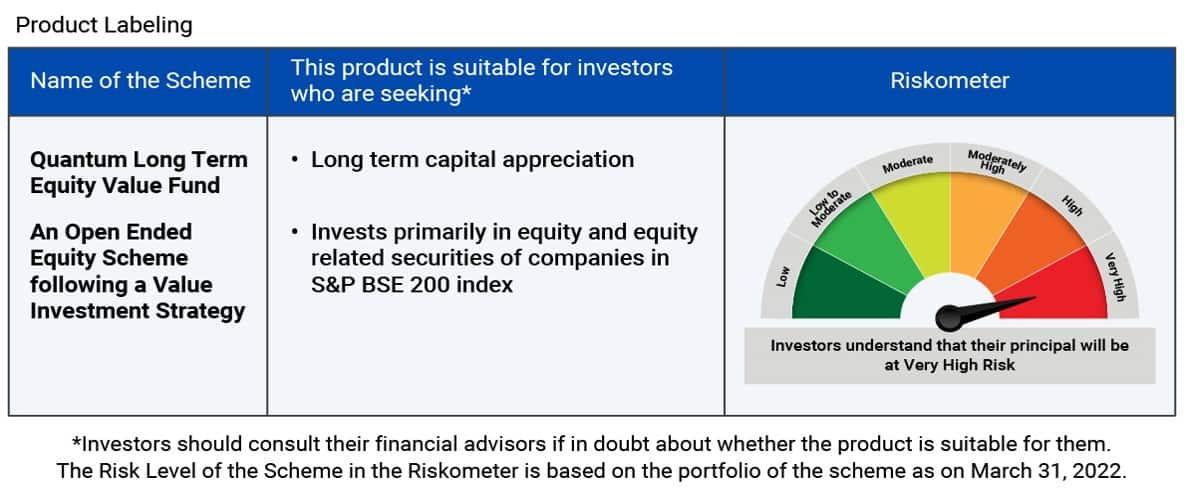

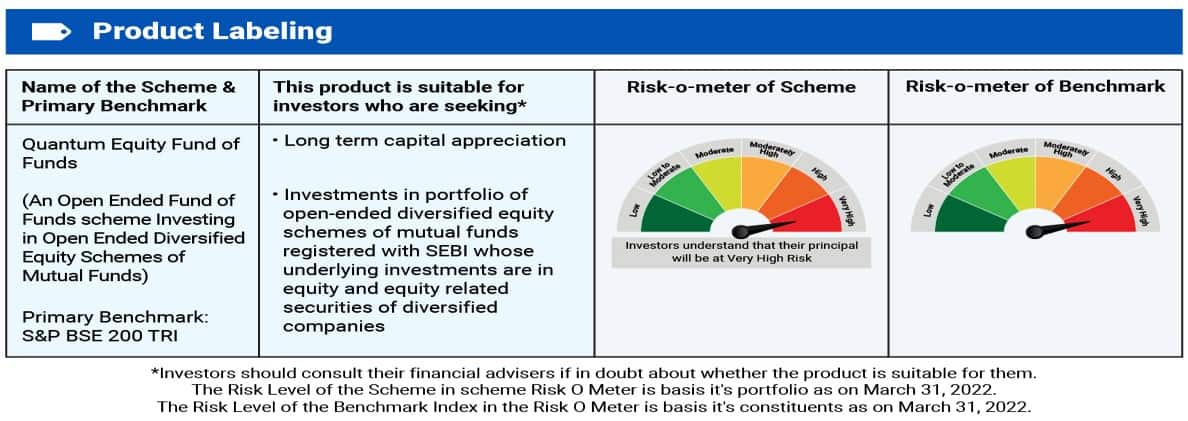

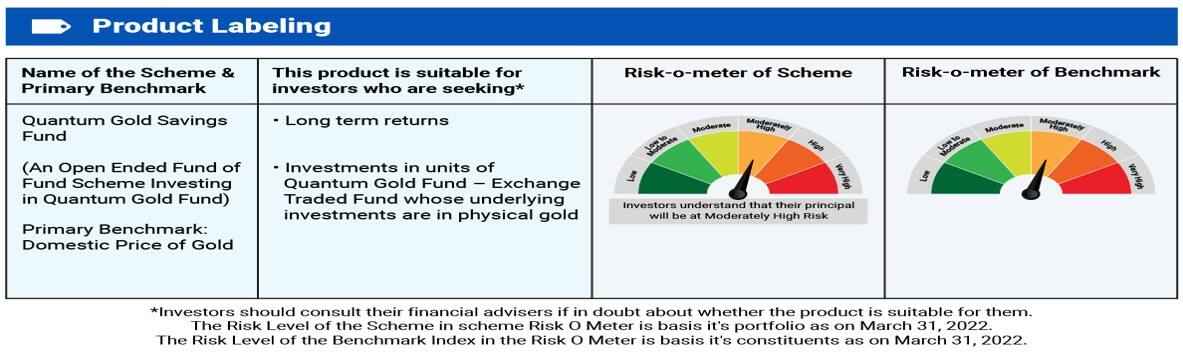

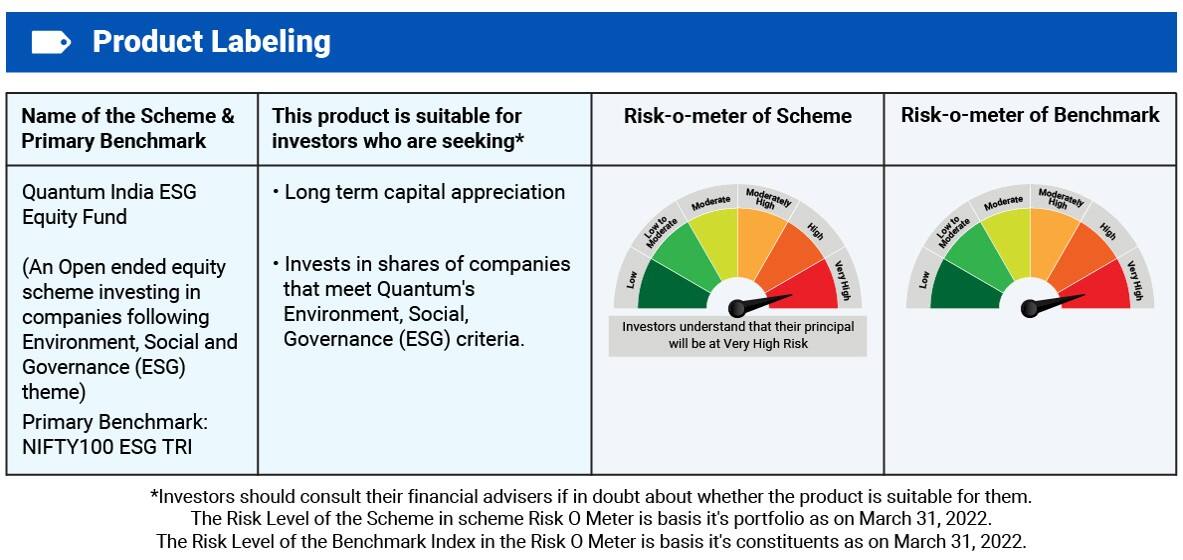

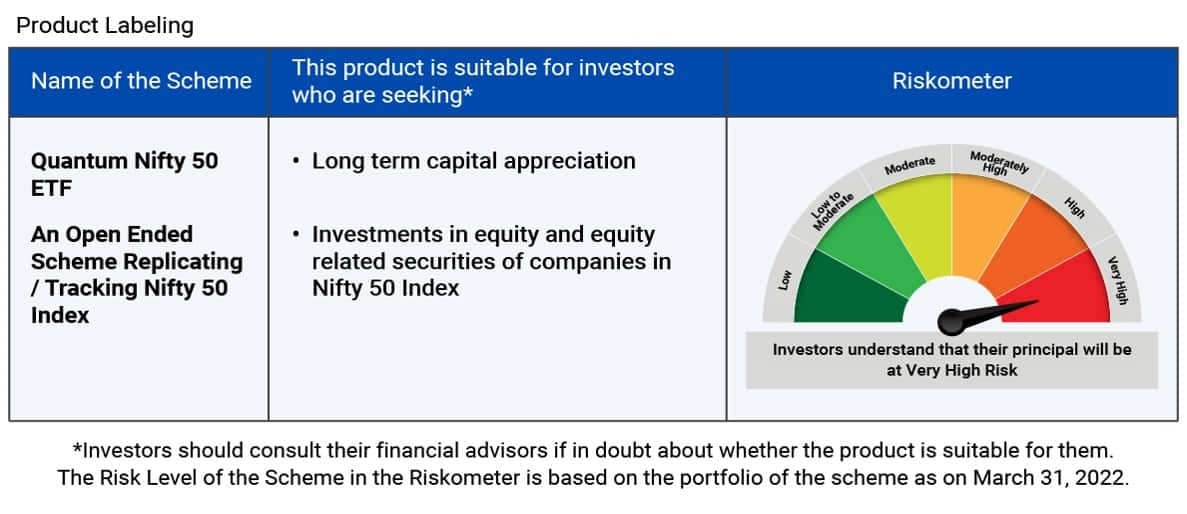

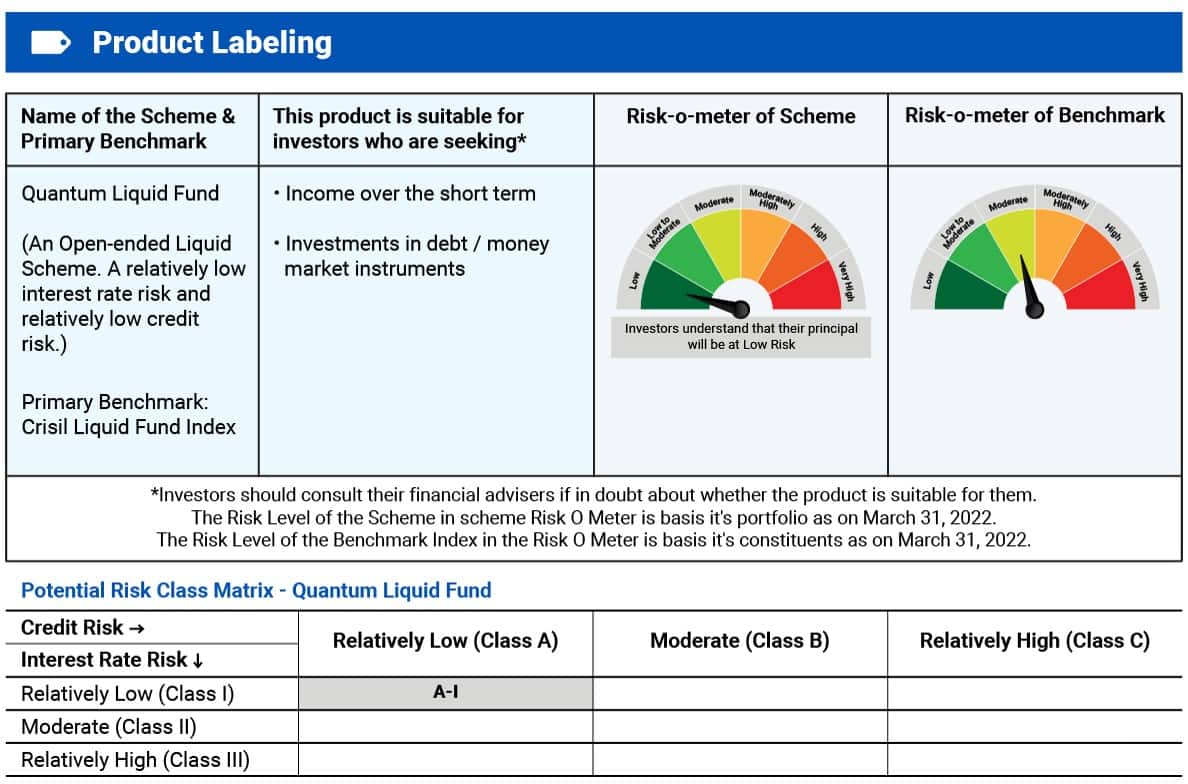

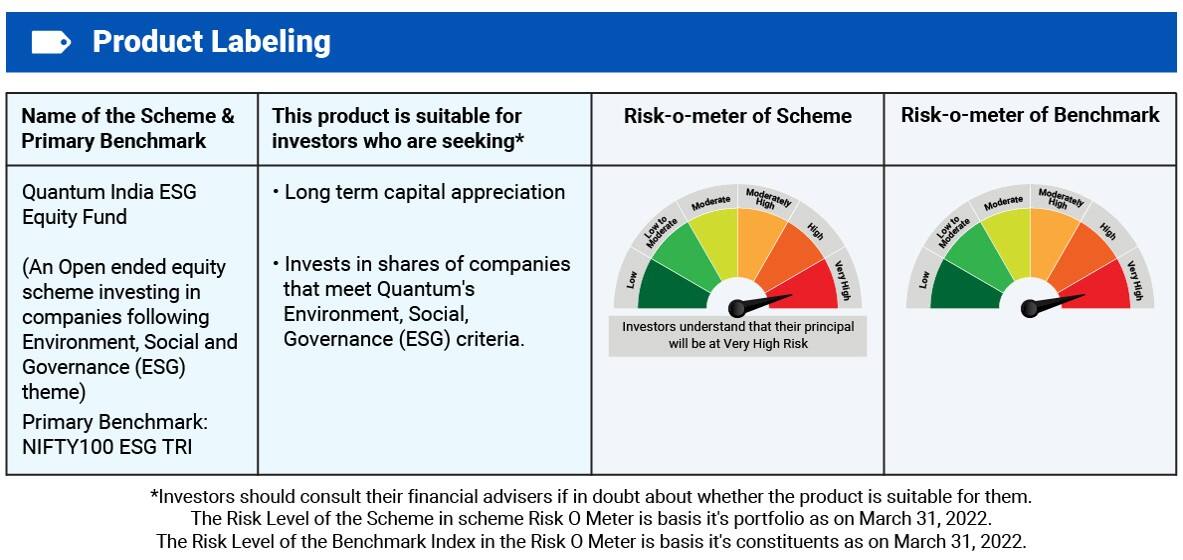

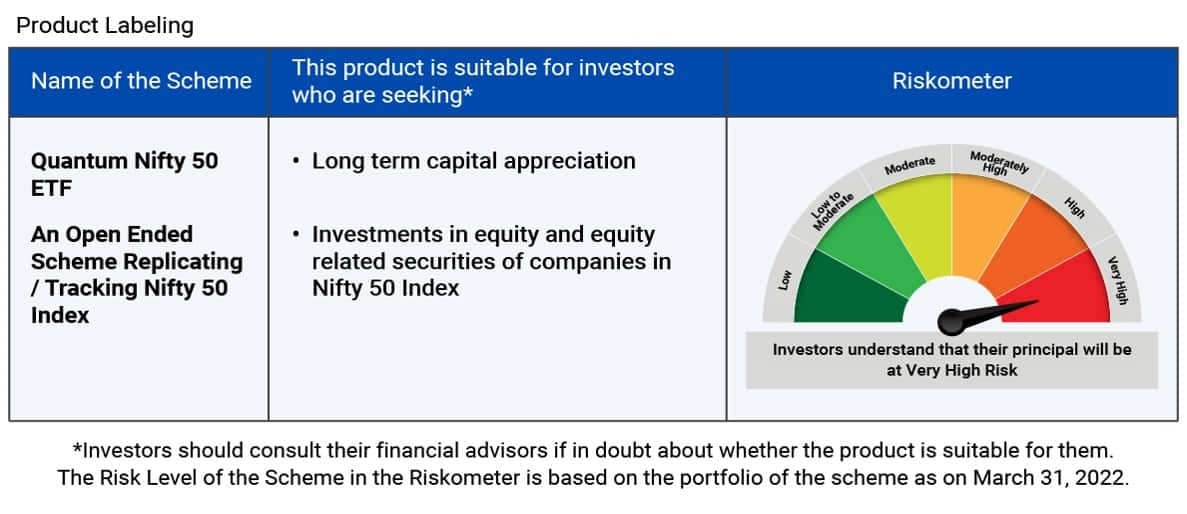

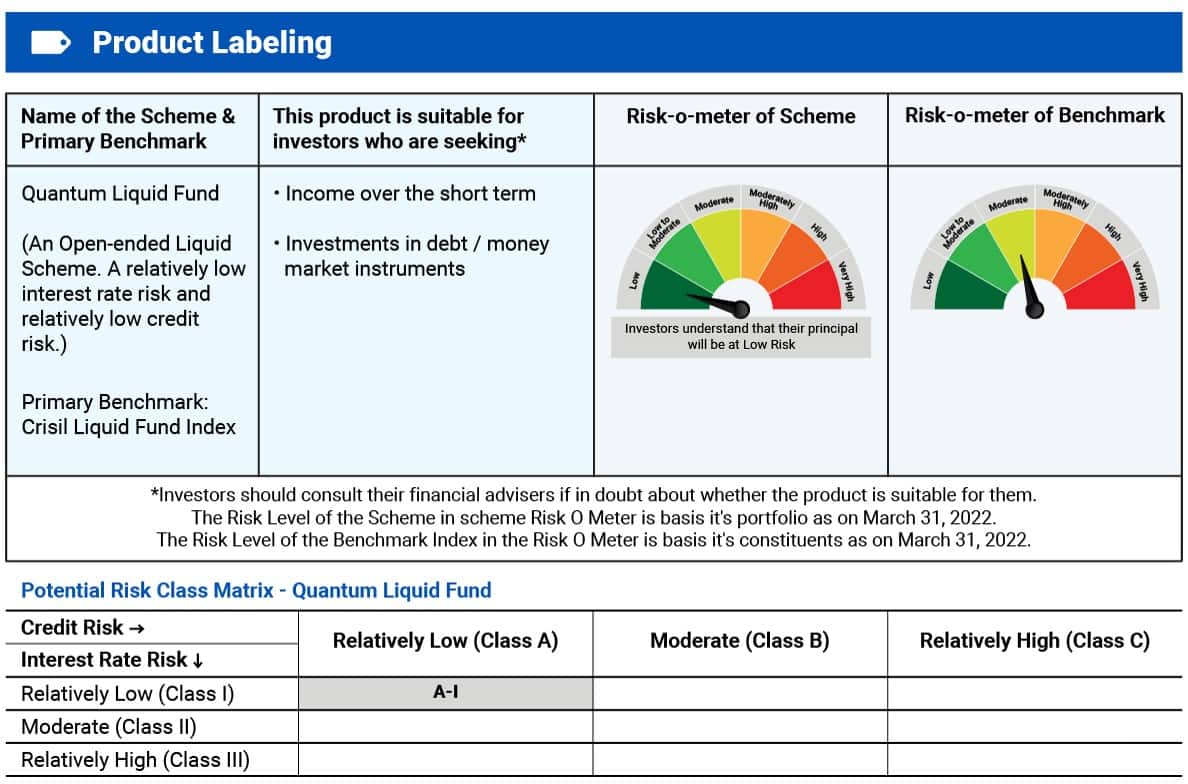

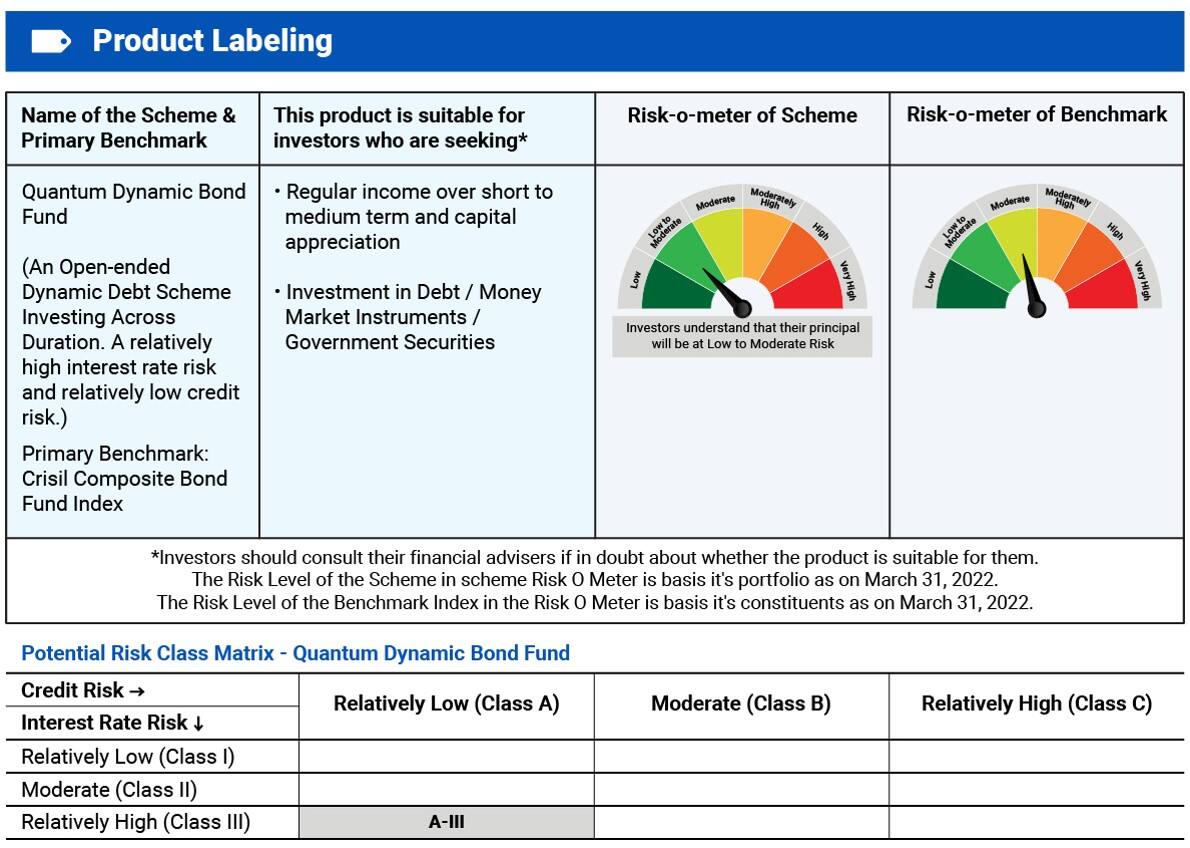

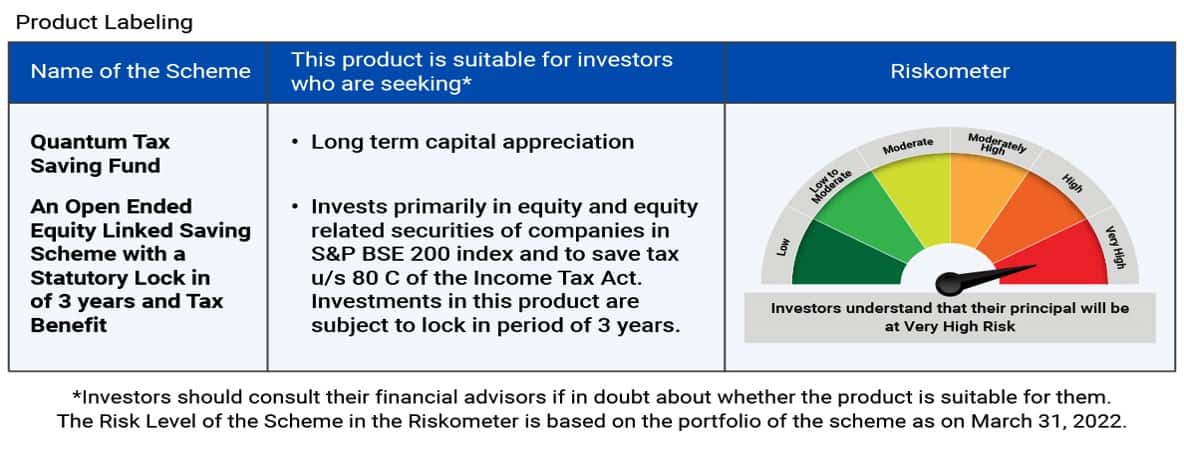

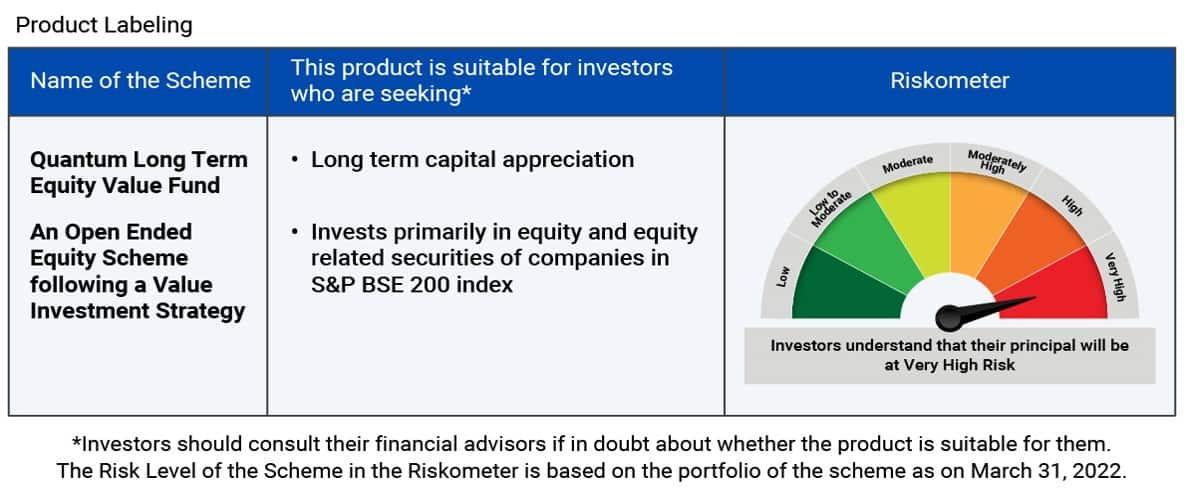

Well, one approach to ensure that your portfolio is adequately diversified is the 12-20-80 route. The 12-20-80 Rule This is a unique, readymade asset allocation plan that strategically not just diversifies your investments, thereby helping mitigate risk; it also allows you to generate wealth for the long-term without worrying about any uncertainty. This guideline enables you to achieve long-term and short-term goals while staying safe on rainy days. Goals can include:  12% - Build your emergency fund We live in unprecedented times and will experience multiple crises during our lifetime. These can include pandemics, market crashes, natural calamities, geopolitical tensions and job loss. We cannot change these circumstances, but having an emergency fund will help us navigate tough times confidently. An emergency fund comprises at least 12 months of living expenses, which can account for rent/ home loan EMI, utilities, groceries, travel and other fixed monthly expenses. A common question among investors is this - where can I store this emergency fund? As the name suggests, an emergency fund is to address any financial emergency, hence must be easy to liquidate. One option is to keep it in your savings bank account, while the other option is to park it in a liquid fund such as the Quantum Liquid Fund. The fund follows the SLR investment philosophy (Safety, Liquidity and Returns). Quantum Liquid Fund aims to keep your investment safe and liquid and try and achieve slightly higher returns than bank savings deposits. It realises that achieving all three – high safety, high liquidity and high returns is not easy and can have a detrimental effect on your emergency corpus. 20% – Manage risk with gold mutual funds Quantum recommends investing 20% of your portfolio in a timeless asset - gold - via gold funds. By investing in gold, your portfolio gets diversified to include an instrument that has the potential to withstand volatile markets and other unforeseen circumstances. However, investing in physical gold comes with certain constraints. For instance, there are charges, security threats and efforts to physically visit jewellery stores, etc. Secondly, liquidity can be an issue as buying and selling is not an immediate, done deal. On the other hand, investing in gold mutual funds comes with multiple advantages such as high liquidity, digitally-enabled investing and redemption, and the option of investing in smaller amounts via SIP. You can opt for the Quantum Gold Fund and Quantum Gold Saving Fund, backed by 24-karat physical gold. Every gold bar held by Quantum Gold Fund undergoes an independent purity test, it is 24 Karat gold from London Bullion Market Association (LBMA) approved refiners. Moreover, there are no making charges, thus reducing the asset's cost price while appreciating over time. Recently, Quantum announced a change in the face value of Quantum Gold Fund, making it more accessible for investors. The face value was changed from Rs 100/- to Rs 2/-. Accordingly, each unit approximately represented 1/100th of 1 gram of gold. 80% – Build wealth with your equity portfolio You must have a long-term horizon when building wealth, as it enables your funds to enjoy the benefits of compound interest. Investing in the stock market is one of the surest ways to accumulate wealth. However, investing in individual stocks come with significant risks, especially if you're not a savvy equity investor. One approach to prudently building wealth is to create a diversified equity portfolio with 80% of your investments. Of the 80% to be invested in an equity portfolio, investments can be further bifurcated as follows: • 15% in Quantum Long Term Equity Value Fund This fund has a 16-year track record built on the foundation of value investing. Over 90% of its investable amount is parked in a mix of large and mid-cap funds. The fund's strategy is to identify high-value companies, purchase them at attractive prices and benefit from long-term capital appreciation. The fund aims to deliver long-term risk-adjusted returns, thus beating inflation over a long-term horizon. • 15% in Quantum India ESG Equity Fund Responsible Investing (ESG) is becoming a preferred mode for investors worldwide. ESG refers to the practice of investing in companies with a triple bottom line focusing on people, the planet and profits. It was born from a desire for investments that align with specific social and sustainable goals and is considered the future of investing. Quantum India ESG Equity Fund (QESG) enables you to get a head start in ESG with a resilient portfolio that invests in Indian companies that score higher on the ESG spectrum. The QESG fund's holdings are based on Quantum's proprietary research on ESG. • 70% in Quantum Equity Fund of Fund The Quantum Equity Fund of Funds (QEFOF) is a unique opportunity that strategically invests in a mix of assets drawn from over 400 funds. At any given time, your investments are diversified across India’s finest five to ten equity schemes. The selection of these third-party equity funds is based on high-value insights resulting from Quantum's comprehensive qualitative and quantitative research. A core aspect of the research relies on one-on-one interactions with various fund managers to understand their calibre and vision for the fund. QEFOF ensures that you benefit from a combination of large-cap, mid-cap, flexi-cap and blue-chip strategies. The Takeaway Adopting such a comprehensive strategy enables you to grow your wealth steadily while adequately diversifying into the investment trifecta of debt, equity and gold. With testing times like the one we are currently going through, it is imperative for a thoughtful investor like you to embrace a simple, solid asset allocation strategy. Act now! Start now! Invest now!

12% - Build your emergency fund We live in unprecedented times and will experience multiple crises during our lifetime. These can include pandemics, market crashes, natural calamities, geopolitical tensions and job loss. We cannot change these circumstances, but having an emergency fund will help us navigate tough times confidently. An emergency fund comprises at least 12 months of living expenses, which can account for rent/ home loan EMI, utilities, groceries, travel and other fixed monthly expenses. A common question among investors is this - where can I store this emergency fund? As the name suggests, an emergency fund is to address any financial emergency, hence must be easy to liquidate. One option is to keep it in your savings bank account, while the other option is to park it in a liquid fund such as the Quantum Liquid Fund. The fund follows the SLR investment philosophy (Safety, Liquidity and Returns). Quantum Liquid Fund aims to keep your investment safe and liquid and try and achieve slightly higher returns than bank savings deposits. It realises that achieving all three – high safety, high liquidity and high returns is not easy and can have a detrimental effect on your emergency corpus. 20% – Manage risk with gold mutual funds Quantum recommends investing 20% of your portfolio in a timeless asset - gold - via gold funds. By investing in gold, your portfolio gets diversified to include an instrument that has the potential to withstand volatile markets and other unforeseen circumstances. However, investing in physical gold comes with certain constraints. For instance, there are charges, security threats and efforts to physically visit jewellery stores, etc. Secondly, liquidity can be an issue as buying and selling is not an immediate, done deal. On the other hand, investing in gold mutual funds comes with multiple advantages such as high liquidity, digitally-enabled investing and redemption, and the option of investing in smaller amounts via SIP. You can opt for the Quantum Gold Fund and Quantum Gold Saving Fund, backed by 24-karat physical gold. Every gold bar held by Quantum Gold Fund undergoes an independent purity test, it is 24 Karat gold from London Bullion Market Association (LBMA) approved refiners. Moreover, there are no making charges, thus reducing the asset's cost price while appreciating over time. Recently, Quantum announced a change in the face value of Quantum Gold Fund, making it more accessible for investors. The face value was changed from Rs 100/- to Rs 2/-. Accordingly, each unit approximately represented 1/100th of 1 gram of gold. 80% – Build wealth with your equity portfolio You must have a long-term horizon when building wealth, as it enables your funds to enjoy the benefits of compound interest. Investing in the stock market is one of the surest ways to accumulate wealth. However, investing in individual stocks come with significant risks, especially if you're not a savvy equity investor. One approach to prudently building wealth is to create a diversified equity portfolio with 80% of your investments. Of the 80% to be invested in an equity portfolio, investments can be further bifurcated as follows: • 15% in Quantum Long Term Equity Value Fund This fund has a 16-year track record built on the foundation of value investing. Over 90% of its investable amount is parked in a mix of large and mid-cap funds. The fund's strategy is to identify high-value companies, purchase them at attractive prices and benefit from long-term capital appreciation. The fund aims to deliver long-term risk-adjusted returns, thus beating inflation over a long-term horizon. • 15% in Quantum India ESG Equity Fund Responsible Investing (ESG) is becoming a preferred mode for investors worldwide. ESG refers to the practice of investing in companies with a triple bottom line focusing on people, the planet and profits. It was born from a desire for investments that align with specific social and sustainable goals and is considered the future of investing. Quantum India ESG Equity Fund (QESG) enables you to get a head start in ESG with a resilient portfolio that invests in Indian companies that score higher on the ESG spectrum. The QESG fund's holdings are based on Quantum's proprietary research on ESG. • 70% in Quantum Equity Fund of Fund The Quantum Equity Fund of Funds (QEFOF) is a unique opportunity that strategically invests in a mix of assets drawn from over 400 funds. At any given time, your investments are diversified across India’s finest five to ten equity schemes. The selection of these third-party equity funds is based on high-value insights resulting from Quantum's comprehensive qualitative and quantitative research. A core aspect of the research relies on one-on-one interactions with various fund managers to understand their calibre and vision for the fund. QEFOF ensures that you benefit from a combination of large-cap, mid-cap, flexi-cap and blue-chip strategies. The Takeaway Adopting such a comprehensive strategy enables you to grow your wealth steadily while adequately diversifying into the investment trifecta of debt, equity and gold. With testing times like the one we are currently going through, it is imperative for a thoughtful investor like you to embrace a simple, solid asset allocation strategy. Act now! Start now! Invest now!

Disclaimer – Terms of Use The data in this presentation are meant for general reading purpose only and are not meant to serve as a professional guide/investment advice for the readers. This presentation has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been suggested or offered based upon the information provided herein, due care has been taken to endeavor that the facts are accurate and reasonable as on date. Quantum AMC shall make modifications and alterations to the performance and related data from time to time as may be required as per SEBI Mutual Fund Regulations. Readers are advised to seek independent professional advice and arrive at an informed investment decision before making any investment. None of the Sponsors, the Investment Manager, the Trustee, their respective Directors, Employees, Affiliates or Representatives shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the data/information/opinions contained in this presentation. The Quantum AMC shall make modifications and alterations to the performance and related data from time to time as may be required.

Disclaimer – Terms of Use The data in this presentation are meant for general reading purpose only and are not meant to serve as a professional guide/investment advice for the readers. This presentation has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been suggested or offered based upon the information provided herein, due care has been taken to endeavor that the facts are accurate and reasonable as on date. Quantum AMC shall make modifications and alterations to the performance and related data from time to time as may be required as per SEBI Mutual Fund Regulations. Readers are advised to seek independent professional advice and arrive at an informed investment decision before making any investment. None of the Sponsors, the Investment Manager, the Trustee, their respective Directors, Employees, Affiliates or Representatives shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the data/information/opinions contained in this presentation. The Quantum AMC shall make modifications and alterations to the performance and related data from time to time as may be required. Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme. Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-). Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!