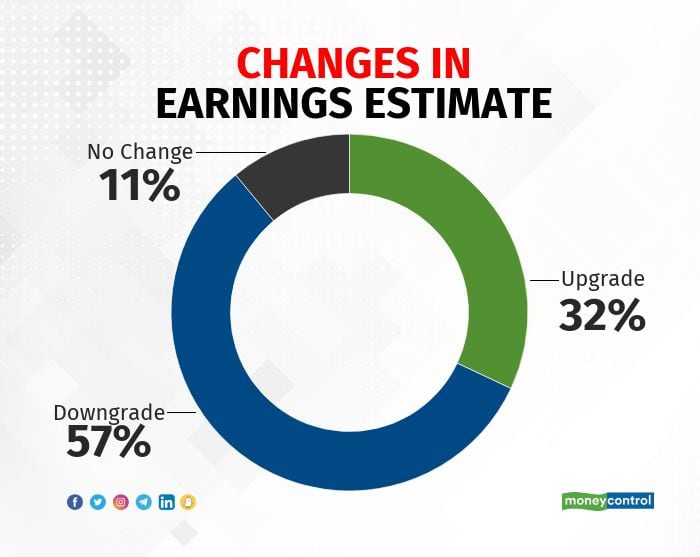

It’s halfway through the April-June quarter earnings season and Nifty50 stocks have seen more downgrades than upgrades, according to a Jefferies report, and the downhill pack is led by those with global linkages.

IT and metals led the earnings estimate downgrades, while banks and consumer companies saw earnings estimate upgrades.

"FY23 Nifty earnings estimates have moved down by 1.4 percent halfway through the results season. Globally driven, 9 (of 50) stocks accounted for 60 percent of the cuts. Domestic companies' estimates were more resilient at minus-0.7 percent. IT margins, cement saw earnings cuts,” said the report.

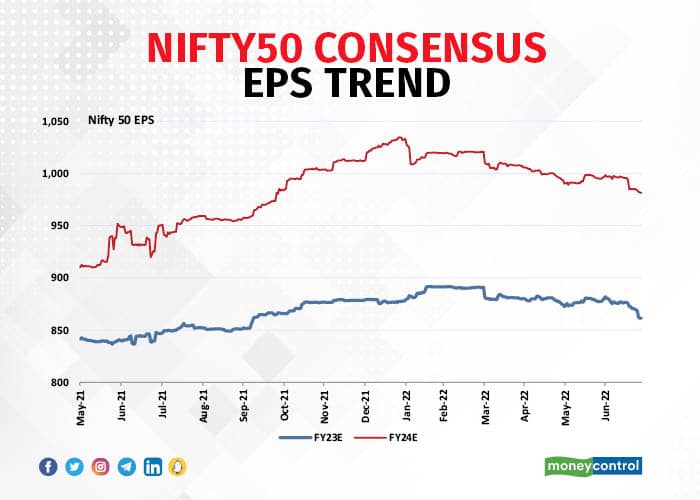

The Nifty consensus earnings for FY23/24 have seen earnings downgrade of 3.3 percent/1.4 percent since late March 2022 peak.

That said, the margin outlook has improved across the board. “Declining metal prices and flattish energy prices recently drove improved margin outlook for 2Q/2H. Companies across sectors like consumer (HUL), real estate (Lodha), automobile (Maruti, Tamo) and cement (Ultratech, ACC) were positive on margins near term,” an analyst said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!