Six favourite bets for FIIs and mutual funds in FY22: Do you own any of these?

Six stocks from the BSE universe were favourites of foreign investors and mutual funds as they increased their stakes consistently in these stocks in each of the four quarters of the fiscal year 2022, a Moneycontrol study of investing trends by big institutional investors showed

1/7

Six stocks from the BSE universe were favourites of foreign investors and mutual funds as they increased their stakes consistently in these stocks in each of the four quarters of the fiscal year 2022, a Moneycontrol study of investing trends by big institutional investors showed. We only considered the companies with a market-cap of over Rs 1,000 crore. (Data Source: ACE Equity). According to Moneycontrol SWOT analysis, all these six stocks have more strengths points than weaknesses. Take a look.

2/7

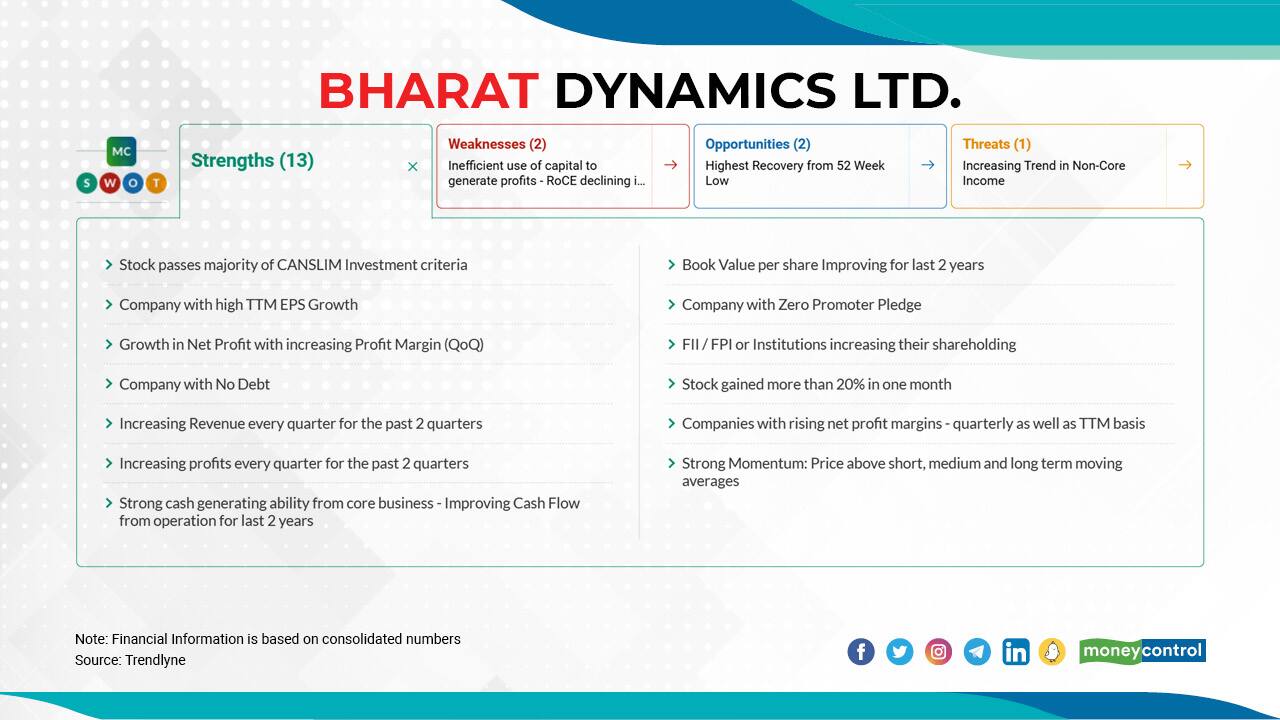

Bharat Dynamics Ltd | In FY22, FIIs increased their holding in the stock to 0.41 percent in the June 2021 quarter; 1.43 percent in September 2021 quarter; 1.73 percent in the December 2021 quarter; and 2.11 percent in the March 2022 quarter. During the same periods, MFs increased their holding in the stock to 6.89 percent, 7.43 percent, 8.04 percent, and 9 percent, respectively.

3/7

Hindustan Aeronautics Ltd | In FY22, FIIs increased their holding in the stock to 0.98 percent in the June 2021 quarter; 2.29 percent in September 2021 quarter; 3.15 percent in the December 2021 quarter; and 4.37 percent in the March 2022 quarter. During the same periods, MFs increased their holding in the stock to 4.71 percent, 4.95 percent, 6.05 percent, and 7.83 percent, respectively.

4/7

Ion Exchange (India) Ltd | In FY22, FIIs increased their holding in the stock to 1.49 percent in the June 2021 quarter; 1.63 percent in September 2021 quarter; 2.54 percent in the December 2021 quarter; and 2.66 percent in the March 2022 quarter. During the same periods, MFs increased their holding in the stock to 5.25 percent, 5.44 percent, 6.69 percent, and 6.85 percent, respectively.

5/7

Poly Medicure Ltd | In FY22, FIIs increased their holding in the stock to 12.82 percent in the June 2021 quarter; 13.68 percent in September 2021 quarter; 14.13 percent in the December 2021 quarter; and 15.07 percent in the March 2022 quarter. During the same periods, MFs increased their holding in the stock to 1.96 percent, 2.39 percent, 2.58 percent, and 2.87 percent, respectively.

6/7

Rites Ltd | In FY22, FIIs increased their holding in the stock to 1.01 percent in the June 2021 quarter; 1.11 percent in September 2021 quarter; 1.30 percent in the December 2021 quarter; and 1.45 percent in the March 2022 quarter. During the same periods, MFs increased their holding in the stock to 5.77 percent, 6.53 percent, 6.60 percent, and 6.89 percent, respectively.

7/7

Suven Pharmaceuticals Ltd | In FY22, FIIs increased their holding in the stock to 7.93 percent in the June 2021 quarter; 8.03 percent in September 2021 quarter; 8.25 percent in the December 2021 quarter; and 8.56 percent in the March 2022 quarter. During the same periods, MFs increased their holding in the stock to 4.47 percent, 4.94 percent, 5.24 percent, and 5.91 percent, respectively.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!