11 stocks to watch out for as lock-in period expires in November

During the lock-in period, promoters and investors cannot liquidate the pre-IPO securities held by them

1/12

A large supply of shares, including those of new-age tech companies, is expected to hit Dalal Street as several pre-IPO lock-ins will end in November. The Securities and Exchange Board of India (Sebi) has set the lock-in period at six months for investors who purchase the shares of the company in a pre-IPO issue. Earlier, it was one year. Since the new rule came into effect from April 1, 2022, we will see a mix of both six-month and 12-month lock-in expiries in November. “We have seen in the past that when lock-in ends, there’s an oversupply, which brings stock prices under pressure. Hence, there is great anticipation that these stocks will also see a correction,” said Aditya Kondawar, Partner and Vice-President, Complete Circle Capital. With the help of Mehul Bumtaria, a close watcher of the IPO markets, we have compiled this list for you. Note: Current Market Price on closing basis as on October 31, 2022

2/12

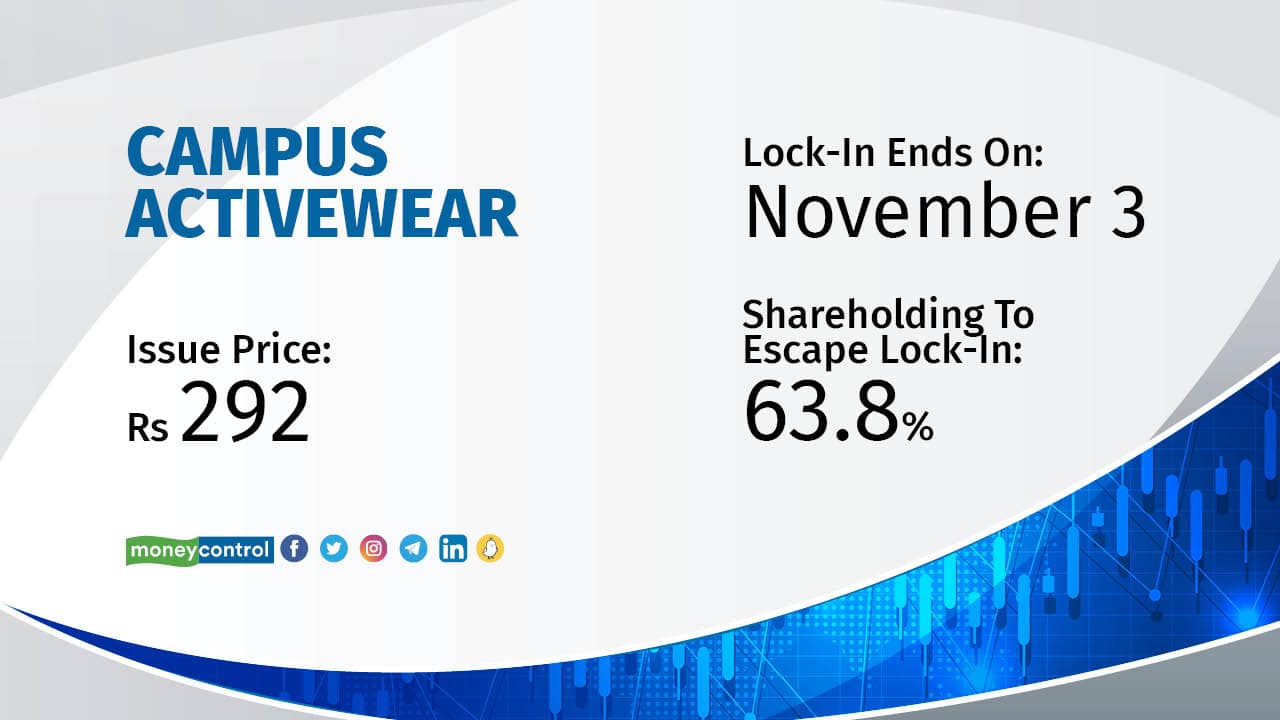

Campus Activewear | CMP: Rs 579.80 | Issue Price: Rs 292 | Lock-In Ends On: November 3 | Shareholding To Escape Lock-In: 63.8 percent | Prominent Pre-IPO Investors: TPG Growth (7.62 percent) and QRG Enterprises (1.87 percent). Promoters Hari Krishan Agarwal and Nikhil Aggarwal will be eligible to sell 54 percent stake.

3/12

Rainbow Children’s Medicare | CMP: Rs 690 | Issue Price: Rs 542 | Lock-In Ends On: November 5 | Shareholding To Escape Lock-In: 22.7 percent | Prominent Pre-IPO Investor: British International Investment (9.29 percent).

4/12

Nykaa | CMP: Rs 1,180 | Issue Price: Rs 1,125 | Lock-In Ends On: November 9 | Shareholding To Escape Lock-In: 67 percent | Prominent Pre-IPO Investors: Harindarpal Singh Banga (6.4 percent), Steadview Capital Mauritius (3.5 percent), Narotam Sekhsaria (3.1 percent), Sunil Kant Munjal (3 percent), Mala Gaonkar (2.4 percent), TPG Growth IV (2.3 percent). Promoter Nayar family is also eligible to sell 32.4 percent stake.

5/12

Fino Payments Bank | CMP: Rs 202.95 | Issue Price: Rs 577 | Lock-In Ends On: November 10 | Shareholding To Escape Lock-In: 55 percent | Non-promoter locked in shares stand at zero. Promoter Fino Paytech, whose principal shareholders include ICICI Group, BPCL and Blackstone, will be eligible to sell 4.5 crore shares.

6/12

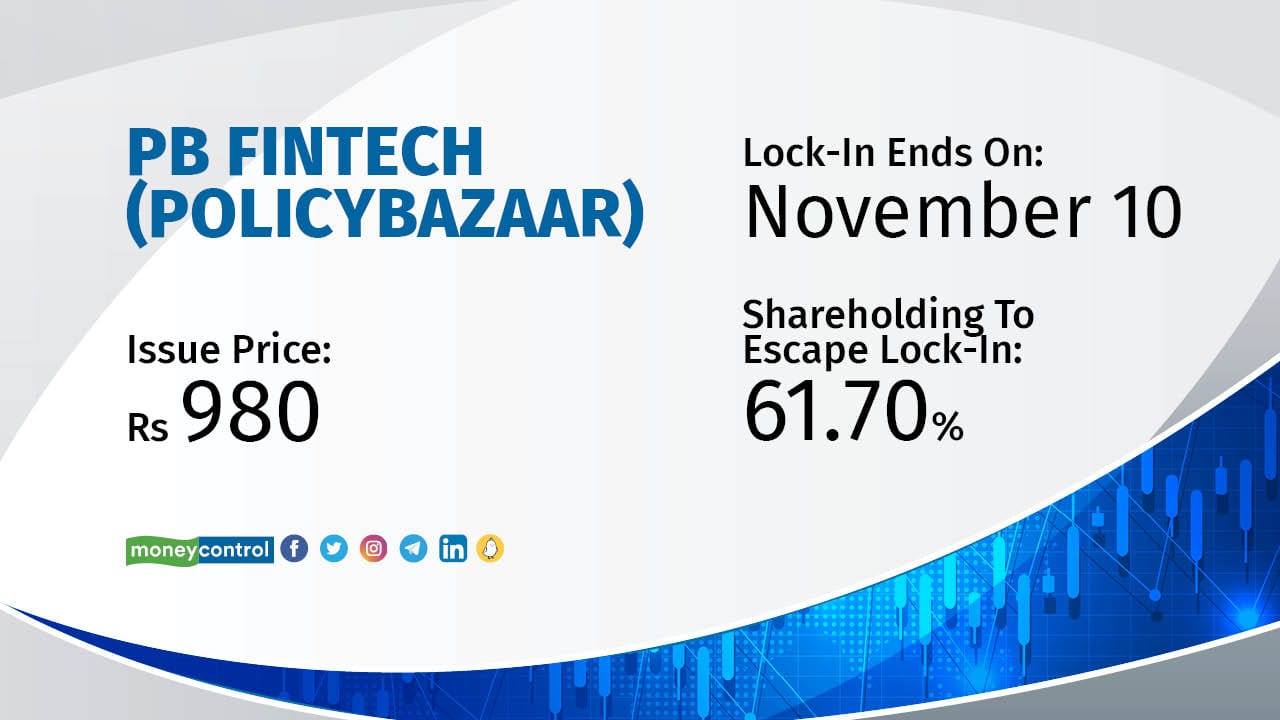

PB Fintech (Policybazaar) | CMP: Rs 383.50 | Issue Price: Rs 980 | Lock-In Ends On: November 10 | Shareholding To Escape Lock-In: 61.70 percent | Prominent Pre-IPO Investors: InfoEdge (19.45 percent), SoftBank (10.2 percent), Tencent (8.38 percent), Tiger Global (7.1 percent) and Falcon Q LP (2.58 percent). CEO Yashish Dahiya will also be eligible to offload 75 lakh shares.

7/12

One97 Communications (Paytm) | CMP: Rs 637.95 | Issue Price: Rs 2150 | Lock-In Ends On: November 14 | Shareholding To Escape Lock-In: 85.76 percent | Prominent Pre-IPO Investors: Antfin (25 percent), Softbank (18 percent), Elevation Capital and SAIF Funds (16 percent), Berkshire Hathaway (2 percent) and Alibaba (6 percent). Founder Vijay Shekhar Sharma will also be eligible to offload his 8.9 percent stake.

8/12

Sapphire Foods | CMP: Rs 1460 | Issue Price: Rs 1180 | Lock-In Ends On: November 15 | Shareholding To Escape Lock-In: 43.3 percent | Prominent Pre-IPO Investors: WWD Ruby (9.77 percent) and Fennel Private (2.77 percent). Promoter and promoter groups Sagista Realty Advisors, Sapphire Foods Mauritius and Arinjaya (Mauritius) can together offload 31 percent stake i.e. 1.9 crore shares.

9/12

Delhivery | CMP: Rs 344.85 | Issue Price: Rs 487 | Lock-In Ends On: November 19 | Shareholding To Escape Lock-In: 82.42 percent | Prominent Pre-IPO Investor: Softbank (18.5 percent), Nexus Partners (9.1 percent), CPPIB (6 percent), Tiger Global (5.2 percent), Steadview Capital (2.69 percent), Times Internet (3.9 percent) and Fedex (2.9 percent).

10/12

Tarsons Products | CMP: Rs 775.55 | Issue Price: Rs 662 | Lock-In Ends On: November 23 | Shareholding To Escape Lock-In: 51 percent | Prominent Pre-IPO Investor: Clear Vision Investment Holdings (23.42 percent). Promoters Sanjiv Sehgal and Rohan Sehgal can together offload 27.31 percent stake.

11/12

GoFashion | CMP: Rs 1400 | Issue Price: Rs 690 | Lock-In Ends On: November 25 | Shareholding To Escape Lock-In: 46.6 percent | Prominent Pre-IPO Investor: Sequoia Capital (13.88 percent). Promoter group Saraogi family trusts can sell 33 percent stake i.e. 1.7 crore shares.

12/12

Ethos Watches | CMP: Rs 977 | Issue Price: Rs 878 | Lock-In Ends On: November 25 | Shareholding To Escape Lock-In: 59 percent | Prominent Pre-IPO Investors: Abakkus Growth Fund (1.3 percent), Alchemy Capital (2.19 percent) and Markertich Consultancy (1.03 percent). Pulkit Seksharia (1.17 percent), Siddharth Iyer (2.11 percent) and Mukul Agrawal (3.96 percent) will also be eligible to sell their stakes.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!