The magic of long-term investing: Mutual funds that have given 4x return in their 15-year SIPs

Most of the schemes in the list have been allocated majorly to mid and smallcap stocks

1/11

On March 1, a Moneycontrol personal finance story had explained, in charts, why chasing recent toppers is futile. But that (selecting the right fund for you) is just one part of investing. The more important part is to stay disciplined. Just like you need to thoroughly cook a dish for it to taste good, you all need to give your mutual funds time to perform. The power of compounding works in favour of long term investing. Here is the list of equity diversified funds that returned more than 4x of their invested amount made via systematic investment plans (SIP) over the last 15 years. Most of the schemes in the list have been allocated majorly to mid and smallcap stocks. Note that past performance is not indicative of future results. Source: ACEMF.

2/11

Part of midcap category earlier, Canara Robeco Emerging Equities Fund was moved to large & midcap category post the recategorisation classification in mid-2018. Higher allocation to mid and small cap stocks helped the fund to delivered higher returns in the long run. An SIP in the fund with Rs 10,000 per month over the last 15 years would have generated a total corpus of Rs. 92 lakh. Return as measured by Extended Internal Rate of Return (XIRR) from the 15-year SIP in the fund works out to 19.6 percent.

3/11

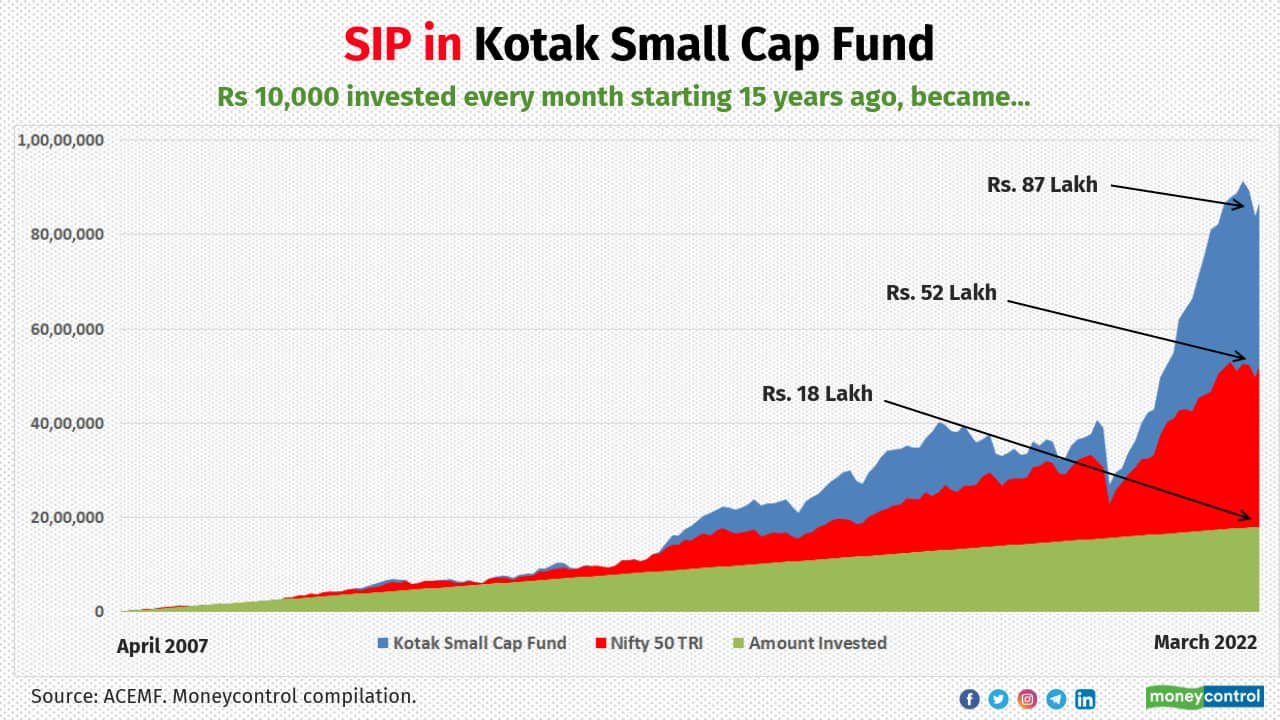

Formerly known as Kotak Mid-Cap, Kotak Small Cap has done exceedingly well within the smallcap category on SIPs contributed for the last 15 years. It delivered an XIRR of 19 percent during the period.

4/11

Formerly called Escorts Growth, Quant Active Fund has been managed with higher allocation to mid and smallcap stocks. The 15 year SIP, Quant Active Cap Fund delivered a XIRR of 18 percent.

5/11

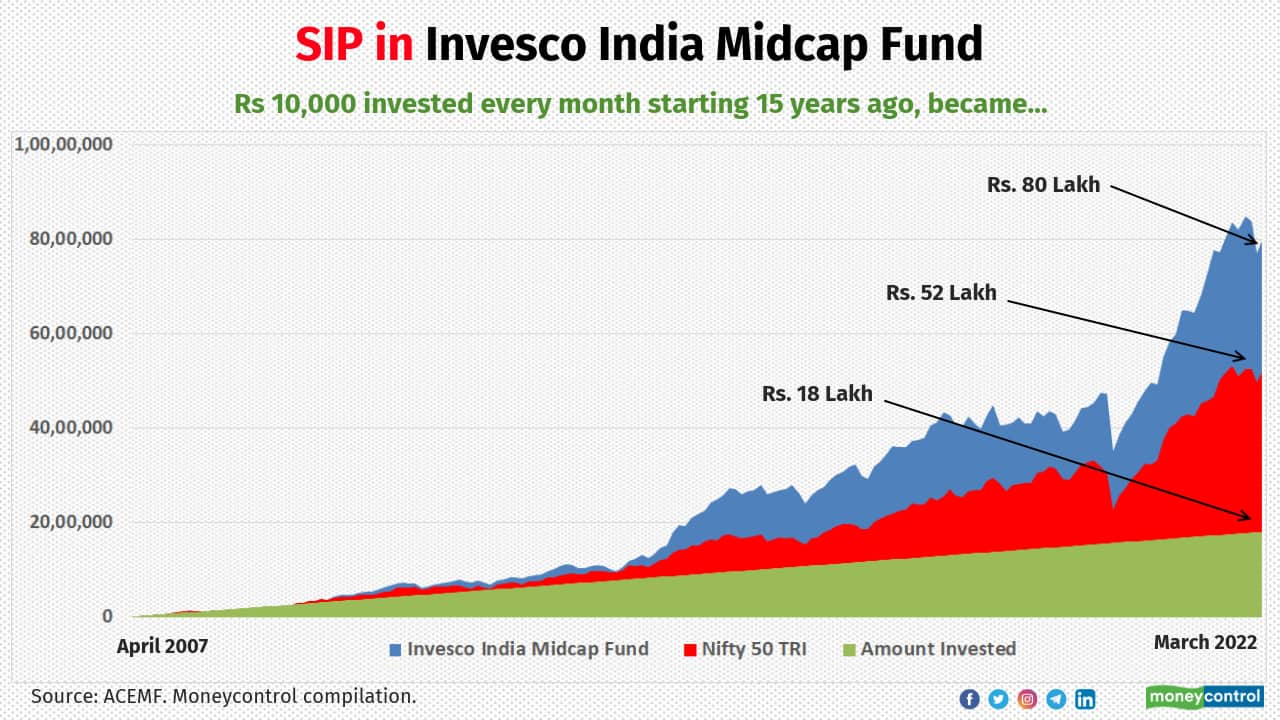

For the 15 year SIP, Invesco India Midcap Fund delivered a XIRR of 18 percent. It generated a total corpus of Rs. 79 lakh.

6/11

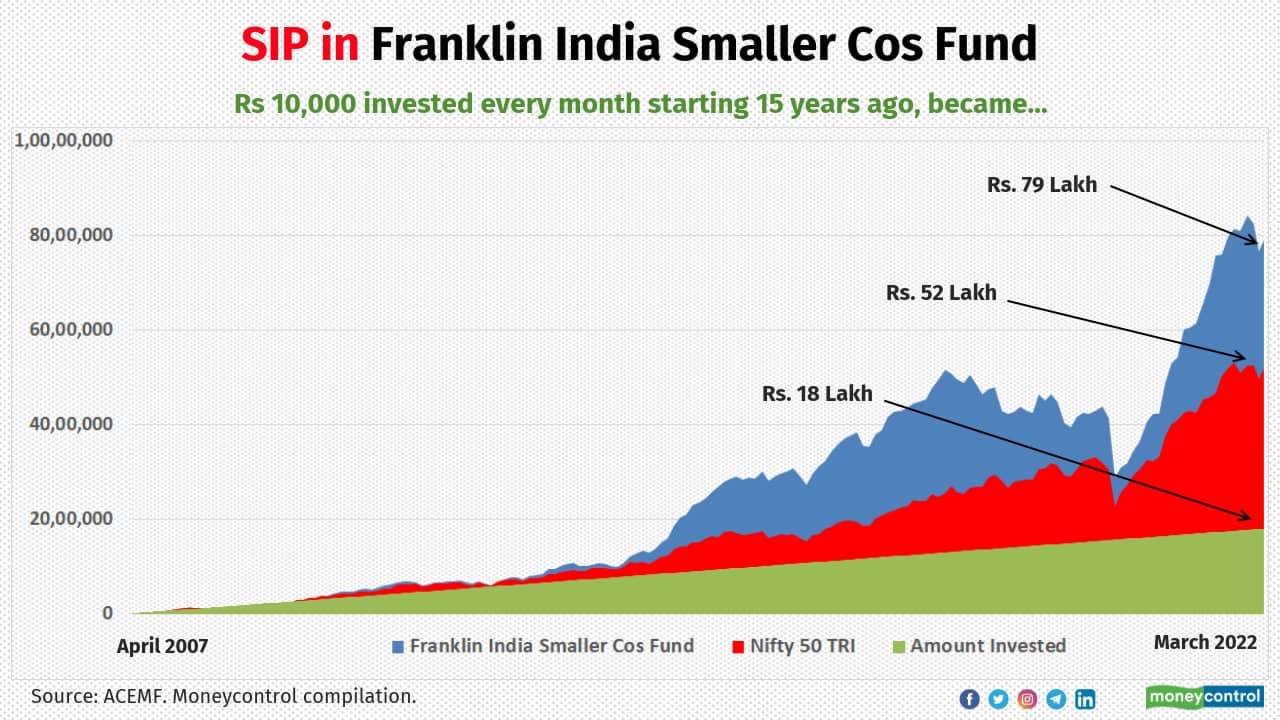

Franklin India Smaller Cos Fund has delivered a XIRR of 18 percent for the SIP contributed for the tenure of last 15 years. It generated a total corpus of Rs. 79 lakh, which is more than quadrupled the invested amount of Rs 18 lakh.

7/11

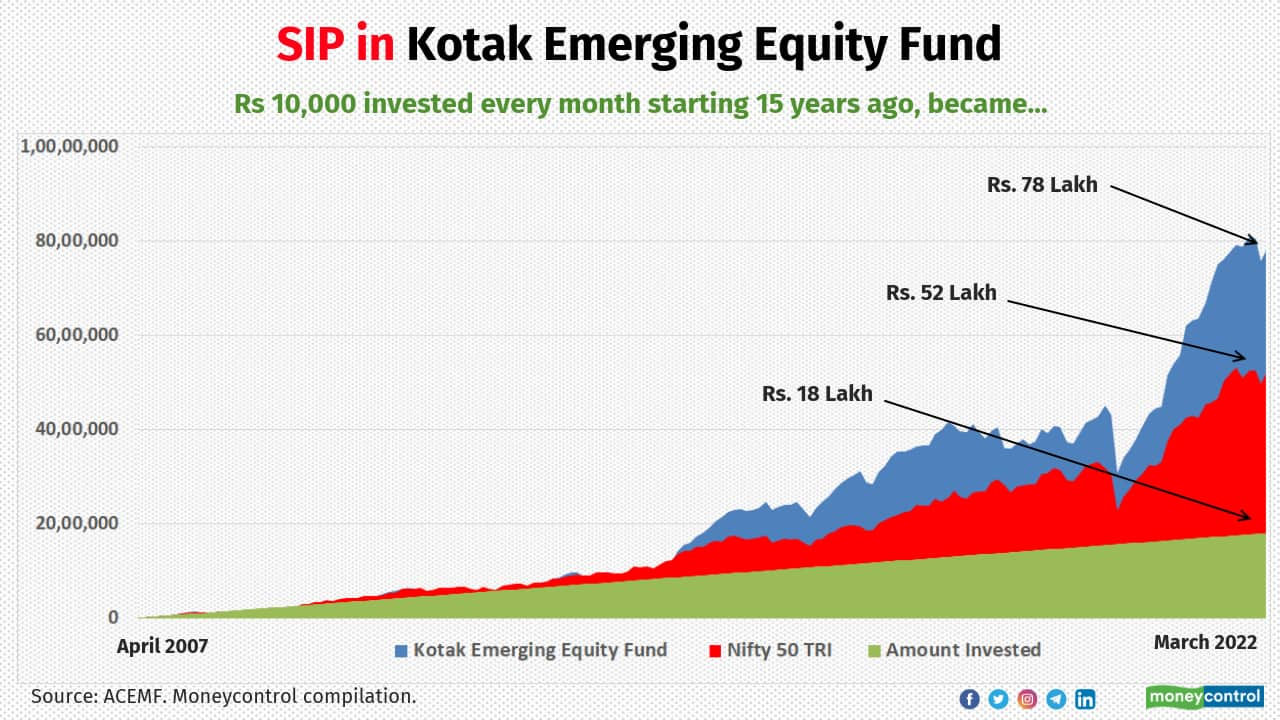

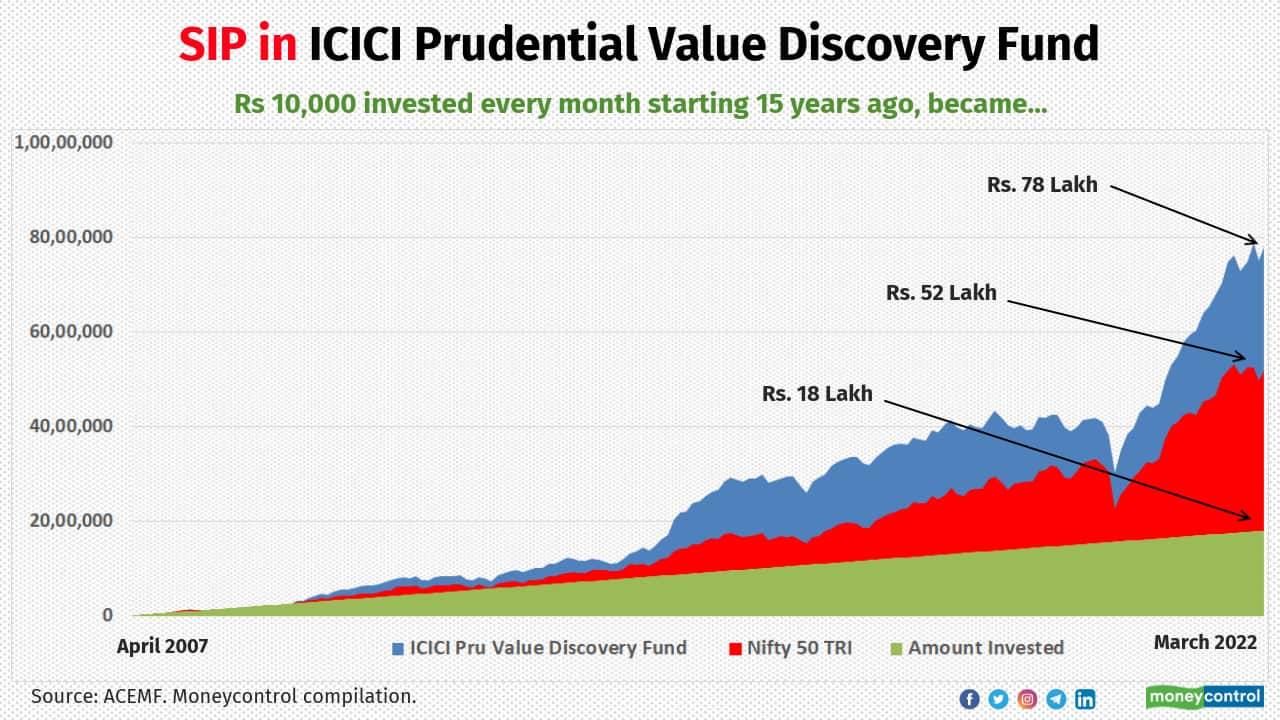

Kotak Emerging Equity Fund has delivered a XIRR of 18 percent for the SIP contributed for the tenure of last 15 years. It generated a total corpus of Rs. 78 lakh.

8/11

ICICI Pru Value Discovery Fund is the only scheme among the top 10 performers in terms of 15- year SIP return that has allocated significantly lower to the mid and smallcap stocks. Thanks to its prudent stock selection, the scheme has done notably well over the long run.

9/11

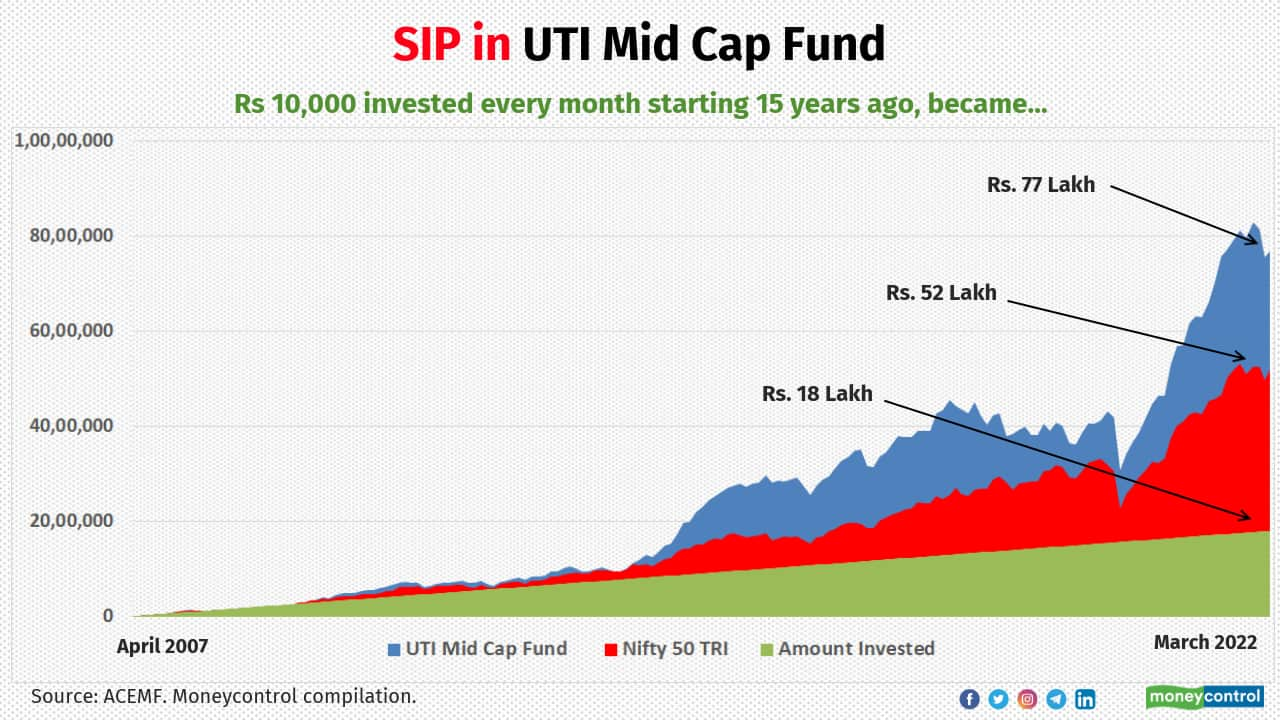

UTI Mid Cap Fund has delivered a XIRR of 17.5 percent for the SIP contributed for the tenure of last 15 years. It generated a total corpus of Rs. 77 lakh.

10/11

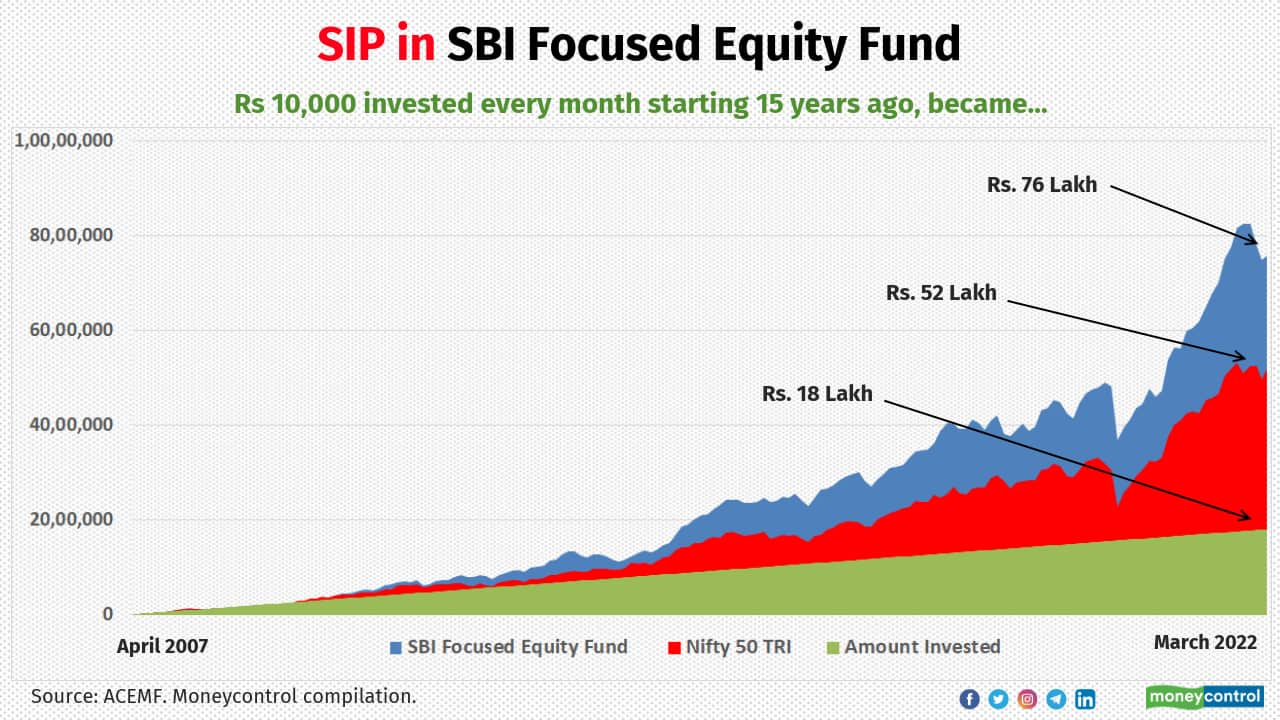

Earlier known as SBI Emerging Businesses and had a mandate to invest upto 30 stocks from mid and small cap universe, SBI Focused Equity Fund was classified as Focused Fund post implementation of SEBI recategorisation norms in 2018. Notable allocation to overseas equity too helped the scheme to deliver higher return.

11/11

Formerly called BNP Paribas Future Leaders Fund, Baroda BNP Paribas Mid Cap Fund delivered a XIRR of 17 percent for the 15 year SIP. It generated a total corpus of Rs. 73 lakh.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!