Six tax-free bonds that bring safety and returns

Tax-free bonds appeal more to those in higher tax brackets because interest income is not taxable

1/8

Interest rates on bank fixed deposits have fallen to multi-decade lows, thanks to RBI’s liquidity measures. For those who wish to get a decent regular income, tax-free bonds are a good option. Tax-free bonds appeal more to those in higher tax brackets because interest income is tax free. Tax-free bonds are almost nil risk free instruments as they are issued by the government backed entities. Higher liquidity and YTM are the two criteria you have to look at while buying tax-free bonds from the secondary markets. Here is the list of the top six tax-free bonds with higher YTM and reasonable liquidity. Please note investments exceeding ₹10 lakh face value in certain tax-free bonds will result in reduction in the annual coupon rate by 25-30 bps. This will reduce the YTM too. The YTM mentioned below are for the investment made upto ₹10 lakh face value in these bonds

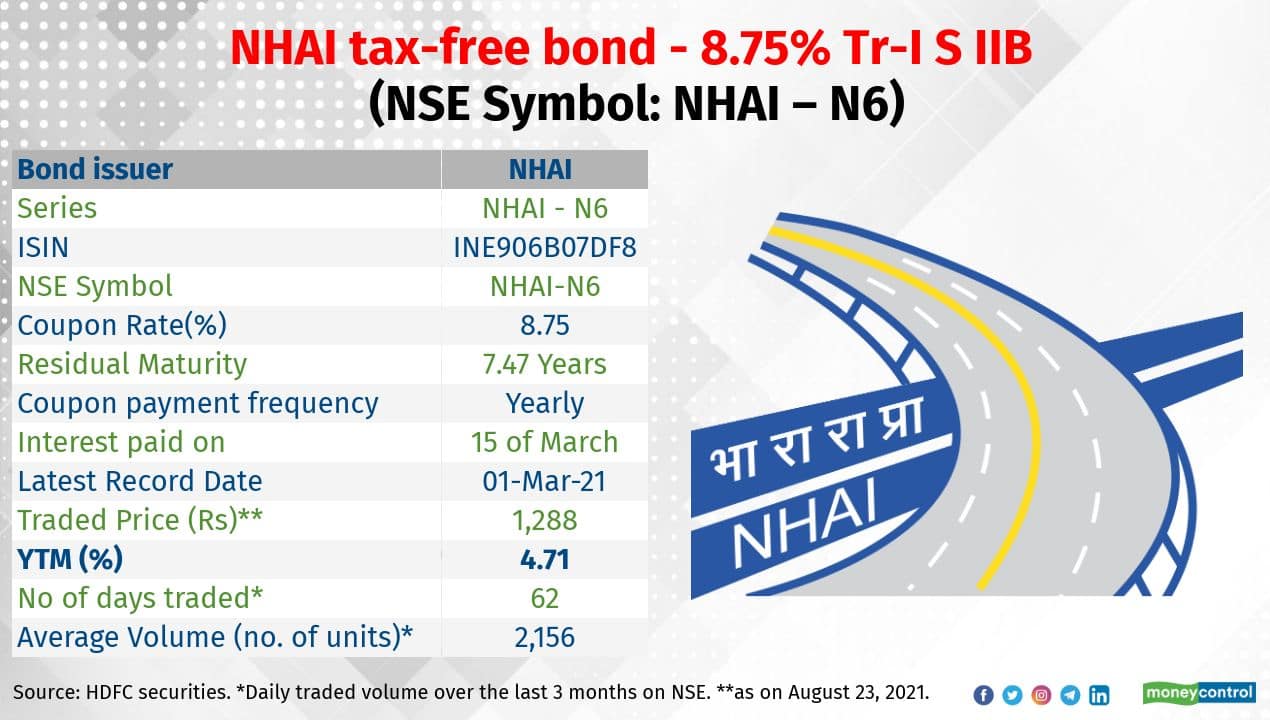

2/8

NHAI has strong financial flexibility because of continuous support from Government of India (GoI) for its projects. Rating agencies Crisil, CARE and Brickwork have assigned the highest rating of AAA.

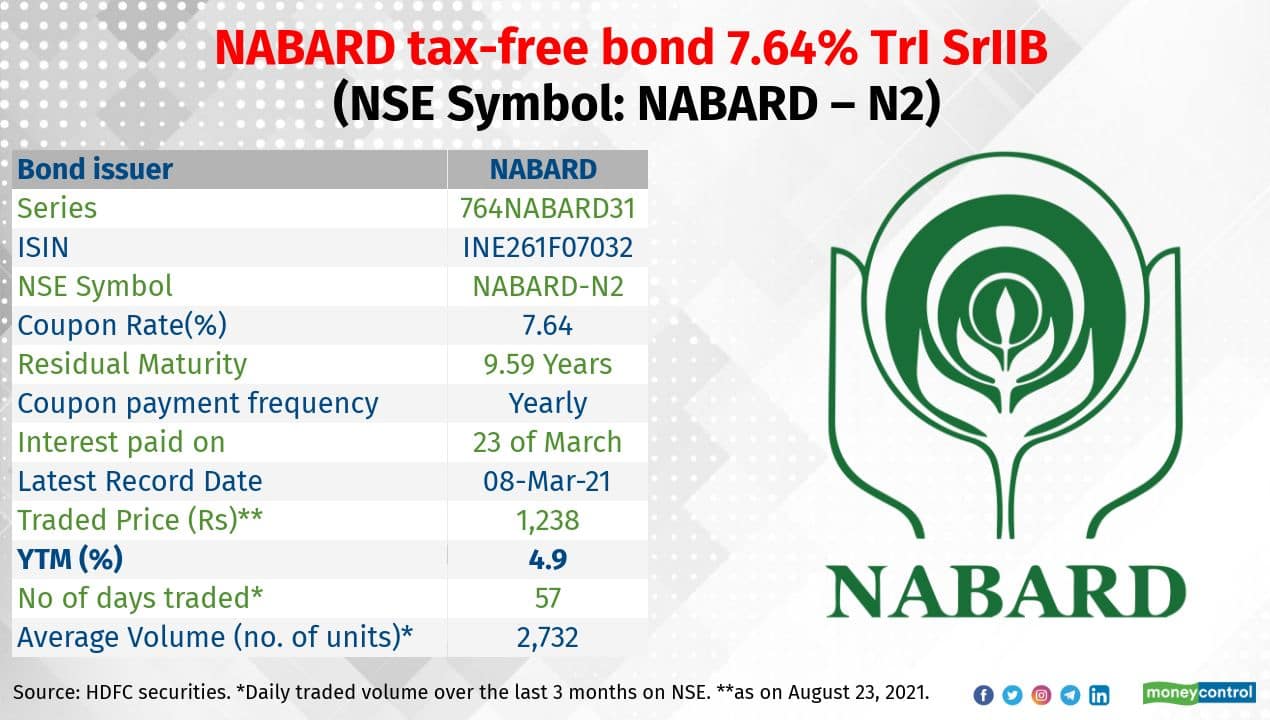

3/8

NABARD has strong linkages with the GoI and is an apex policy institution and nodal agency for agriculture and rural development in India. NABARD’s net non-performing loan ratio was 0.15 percent in 9MFY21. India Ratings has assigned AAA to the tax-free bonds issued by the entity.

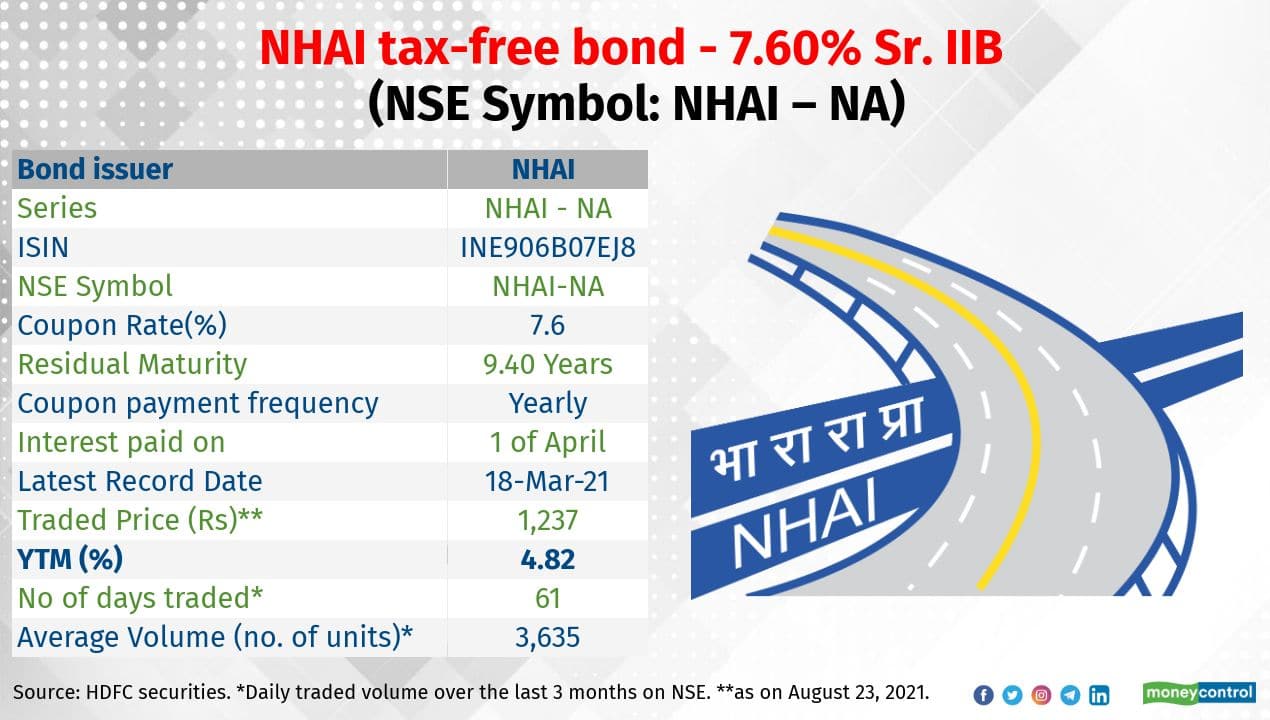

4/8

NHAI has strong financial flexibility because of continuous support from GoI for its projects. Rating agencies Crisil, CARE and Brickwork have assigned the highest rating of AAA.

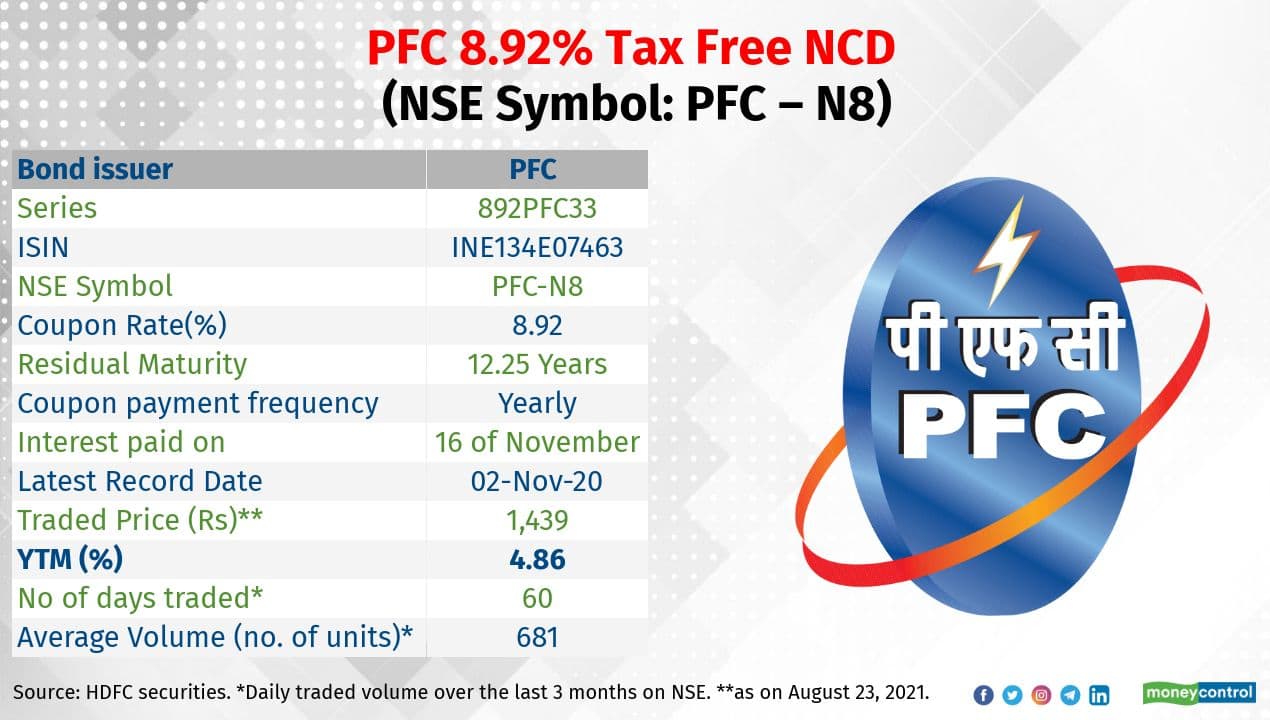

5/8

PFC was established in 1986 by GoI as an institution dedicated to funding and developing the power sector in India. PFC's net NPAs were 3.3 percent as on September 30, 2020. CRISIL has reaffirmed its AAA ratings on the debt instruments issued by PFC.

6/8

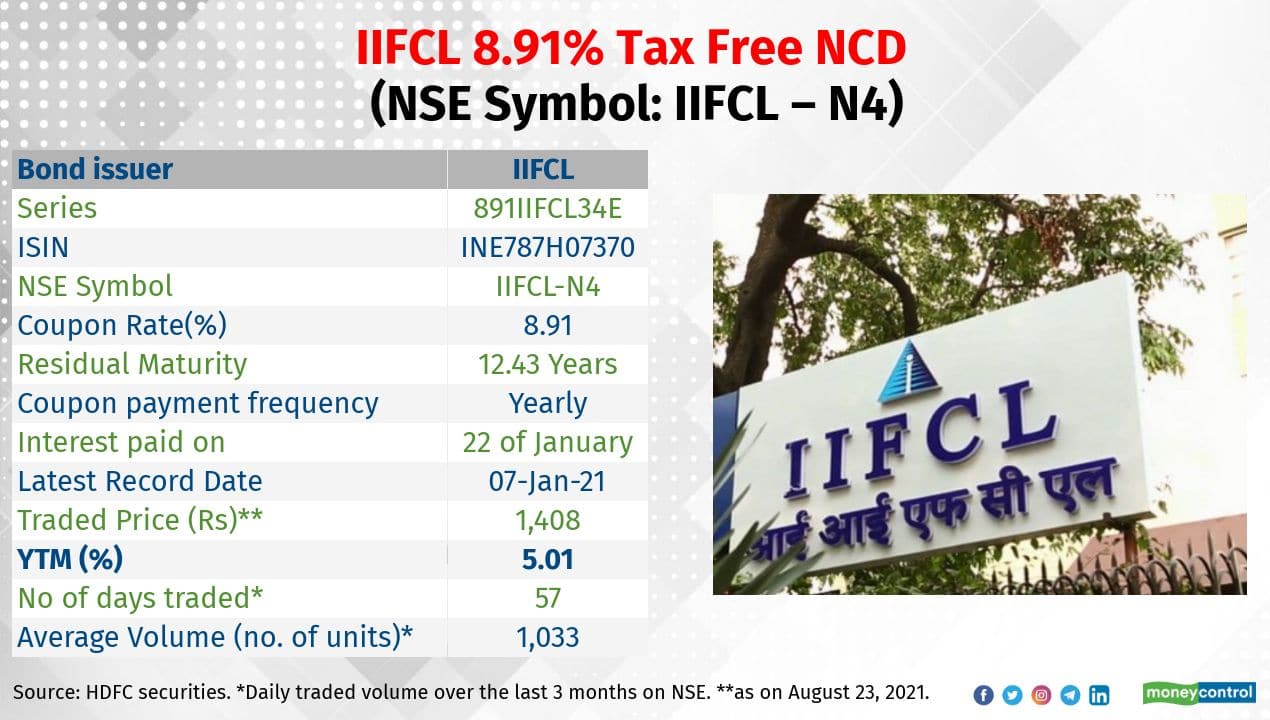

As a 100 percent GoI-owned non-deposit accepting and non-banking financial company, IIFCL is a critical vehicle for the GoI to bridge the funding gap in the infrastructure space by providing low-cost funding. In 1HFY21, IIFCL’s net non-performing assets (NPAs) was 8.16 percent. India Ratings has affirmed IIFCL at AAA rating.

7/8

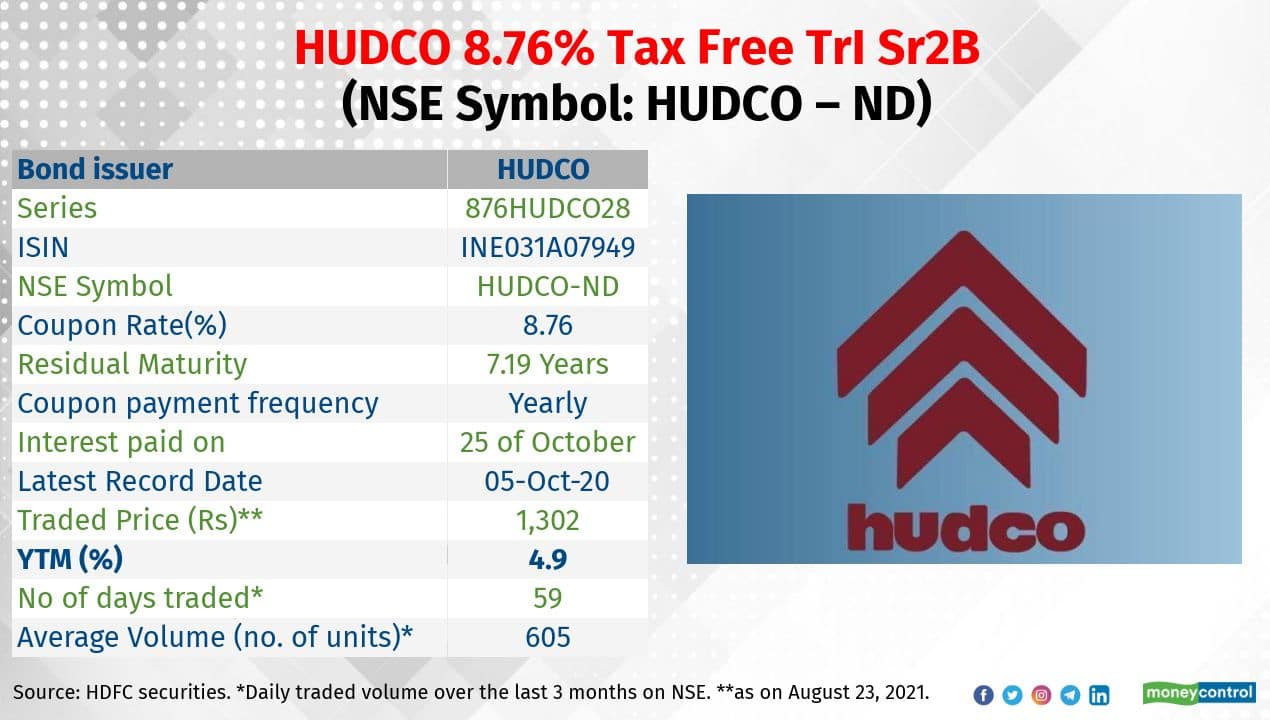

Housing and Urban Development Corporation (HUDCO), incorporated in 1970, is a listed Miniratna public sector enterprise under the Ministry of Housing and Urban Affairs, GoI. Its net non-performing asset (NPA) ratios remained stable at 0.5 percent in FY21. India Ratings and ICRA have assigned AAA to the tax-free bonds issued by the entity.

8/8

The interest paid by tax-free bonds are exempt from income tax. Keep in mind that selling tax-free bonds in the secondary market attracts capital gains tax. If you sell them within 12 months from the date of purchase, you will have to pay tax on the gains as per your slab. If you sell after 12 months, tax has to be paid on the gain at flat rate of 10 per cent. There is no indexation benefit available. Check with your tax consultant while making investment decision.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!