Did you know that NPS schemes invest in midcaps too? Check out their favourites

Allocation to midcap stocks aside, tax benefits under Section 80C and Subsection 80CCD (1B) also make National Pension System attractive

1/9

The Pension Fund Regulatory and Development Authority (PFRDA) has been proactive in setting up National Pension System (NPS) as a rival to other well-regulated investment vehicles such as mutual funds. For one, it allowed NPS managers to invest in midcap stocks by widening the investment universe to top 200 stocks by market capitalisation in July 2021. Earlier, managers were restricted to around 100 large-cap stocks traded in the Futures & Options market, having a market cap of at least Rs 5,000 crore.

2/9

The next rung of 100 stocks are midcaps where the managers started adding positions since July 2021. While most NPS equity schemes have underperformed broader indices so far, such allocation to midcaps is likely to help them outpace their benchmarks going ahead. Below are the lists of midcap stocks held by seven NPS managers in their portfolio of Scheme-E under Tier-1 account. As per latest data, these schemes invested about Rs 1,592 crore in midcap stocks (about five percent of the total Tier-I equity assets under management). Portfolio data is as of July 31, 2022. Source: Websites of the NPS managers.

3/9

Aditya Birla Sun Life Pension Fund - Scheme E.

Corpus as of July 31, 2022: Rs 253 crore

Allocation to large-cap stocks: Rs 231 crore

Allocation to mid-cap stocks: Rs 12 crore

5-year return (CAGR): 12.4%

Corpus as of July 31, 2022: Rs 253 crore

Allocation to large-cap stocks: Rs 231 crore

Allocation to mid-cap stocks: Rs 12 crore

5-year return (CAGR): 12.4%

4/9

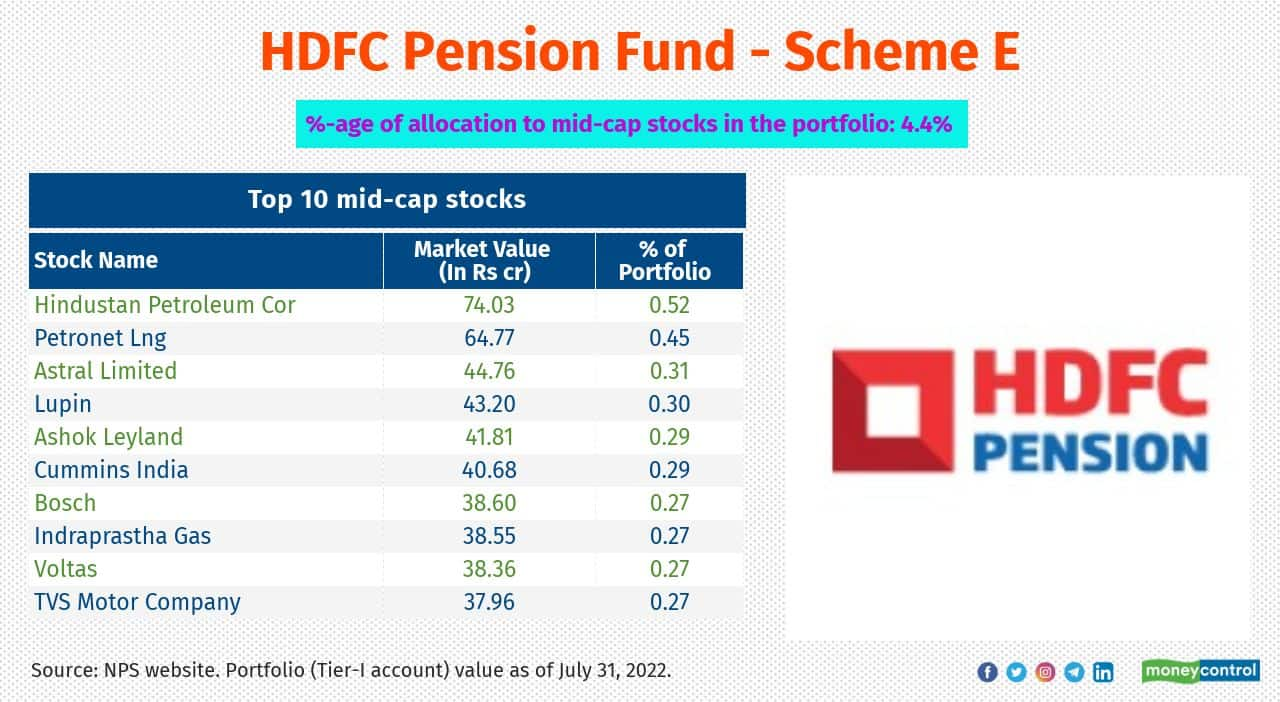

HDFC Pension Fund - Scheme E

Corpus as of July 31, 2022: Rs 14,257 crore

Allocation to large-cap stocks: Rs 13,010 crore

Allocation to mid-cap stocks: Rs 629 crore

5-year return (CAGR): 13.3%

Corpus as of July 31, 2022: Rs 14,257 crore

Allocation to large-cap stocks: Rs 13,010 crore

Allocation to mid-cap stocks: Rs 629 crore

5-year return (CAGR): 13.3%

5/9

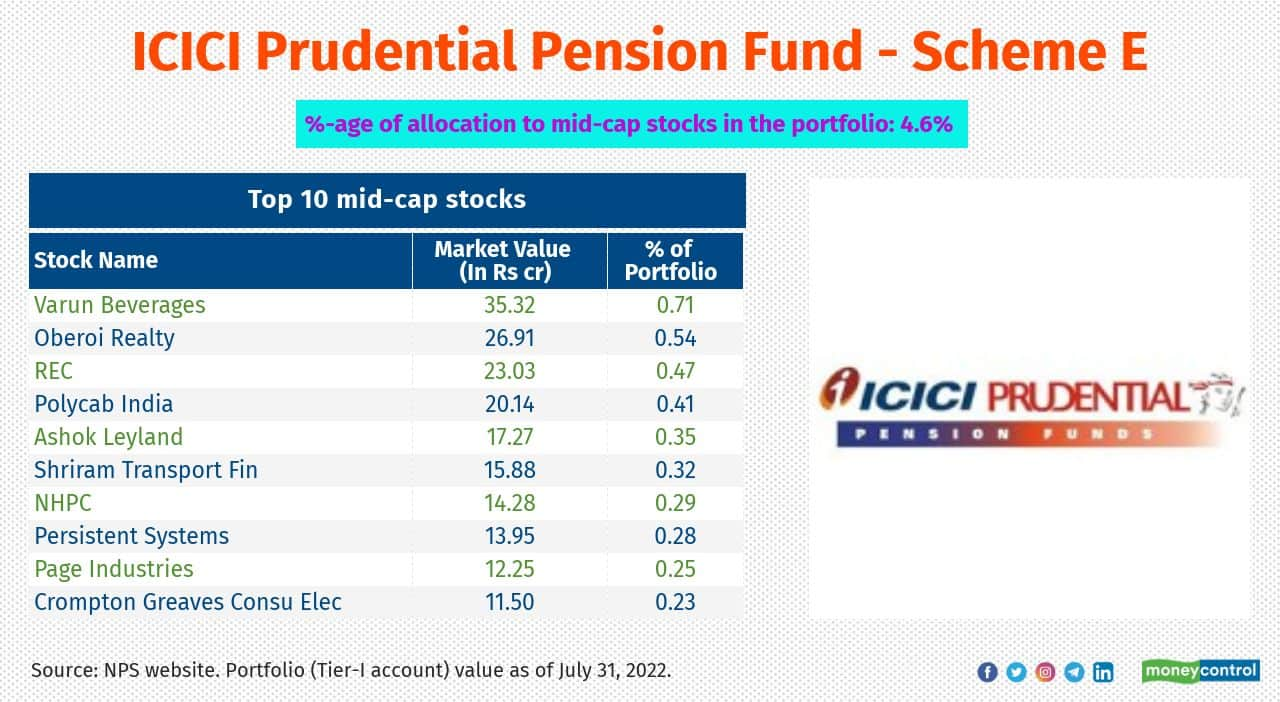

ICICI Prudential Pension Fund - Scheme E

Corpus as of July 31, 2022: Rs 4,952 crore

Allocation to large-cap stocks: Rs 4,460 crore

Allocation to mid-cap stocks: Rs 229 crore

5-year return (CAGR): 12.8%

Corpus as of July 31, 2022: Rs 4,952 crore

Allocation to large-cap stocks: Rs 4,460 crore

Allocation to mid-cap stocks: Rs 229 crore

5-year return (CAGR): 12.8%

6/9

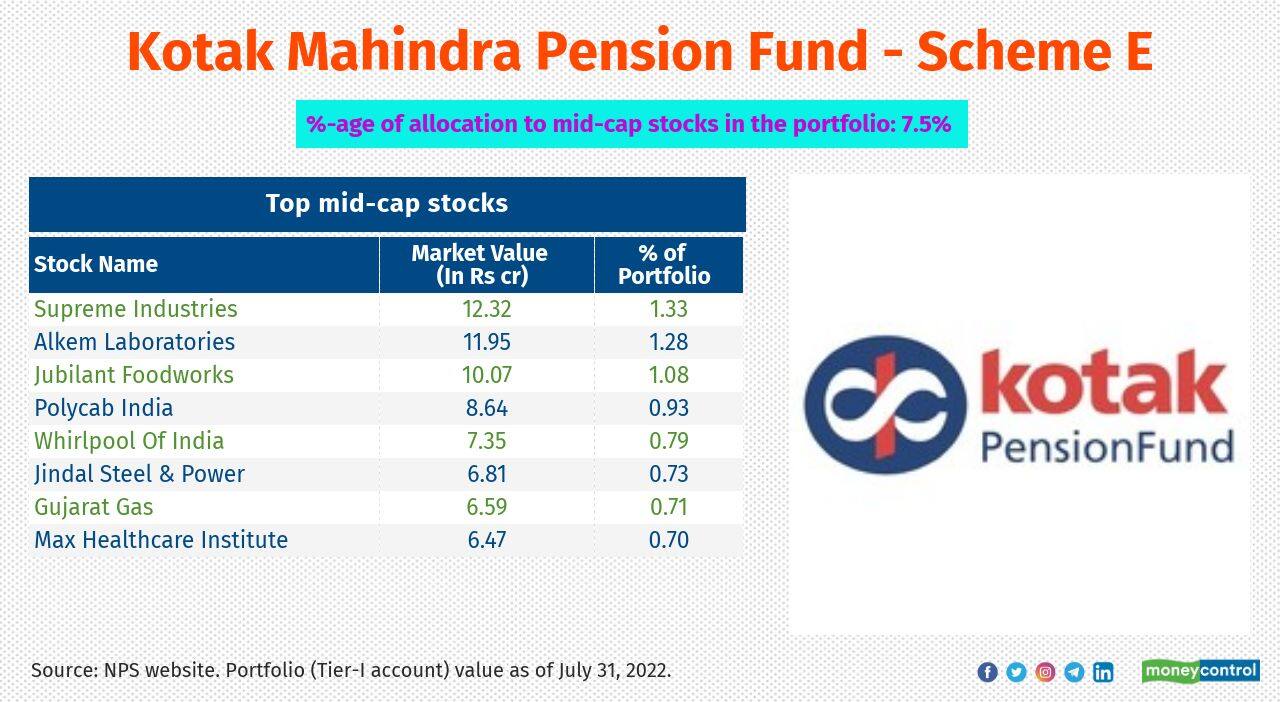

Kotak Pension Fund - Scheme E

Corpus as of July 31, 2022: Rs 930 crore

Allocation to large-cap stocks: Rs 825 crore

Allocation to mid-cap stocks: Rs 70 crore

5-year return (CAGR): 12.1%

Corpus as of July 31, 2022: Rs 930 crore

Allocation to large-cap stocks: Rs 825 crore

Allocation to mid-cap stocks: Rs 70 crore

5-year return (CAGR): 12.1%

7/9

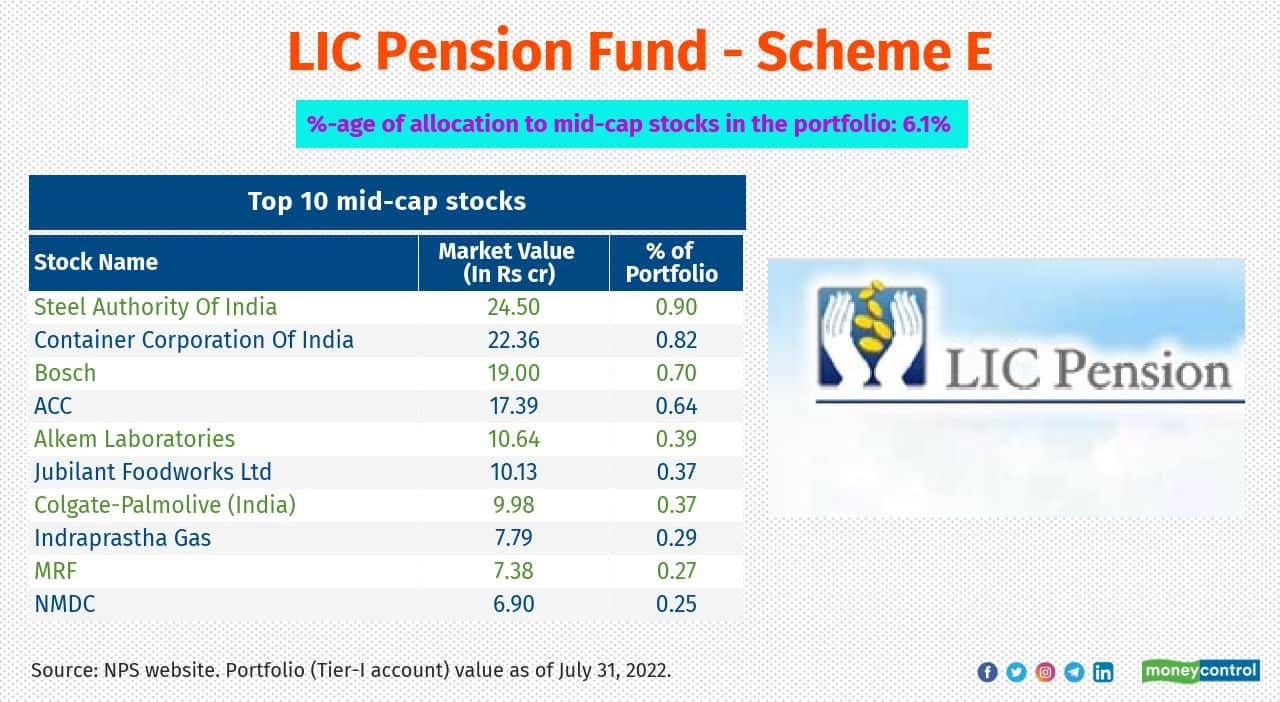

LIC Pension Fund - Scheme E

Corpus as of July 31, 2022: Rs 2,717 crore

Allocation to large-cap stocks: Rs 2,426 crore

Allocation to mid-cap stocks: Rs 166 crore

5-year return (CAGR): 12%

Corpus as of July 31, 2022: Rs 2,717 crore

Allocation to large-cap stocks: Rs 2,426 crore

Allocation to mid-cap stocks: Rs 166 crore

5-year return (CAGR): 12%

8/9

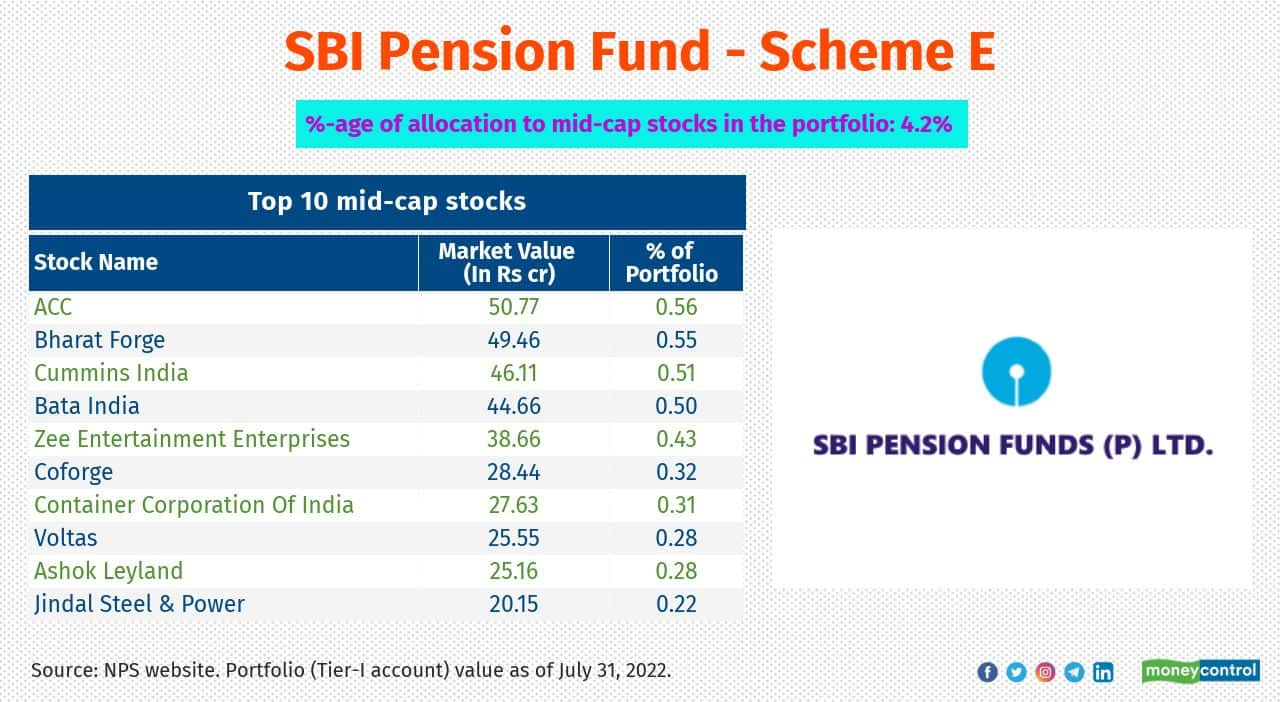

SBI Pension Fund - Scheme E

Corpus as of July 31, 2022: Rs 9,022 crore

Allocation to large-cap stocks: Rs 8,369 crore

Allocation to mid-cap stocks: Rs 377 crore

5-year return (CAGR): 12.2%

Corpus as of July 31, 2022: Rs 9,022 crore

Allocation to large-cap stocks: Rs 8,369 crore

Allocation to mid-cap stocks: Rs 377 crore

5-year return (CAGR): 12.2%

9/9

UTI Retirement Solutions Pension Fund - Scheme E

Corpus as of July 31, 2022: Rs 1,312 crore

Allocation to large-cap stocks: Rs 1,151 crore

Allocation to mid-cap stocks: Rs 109 crore

5-year return (CAGR): 12.6%

Corpus as of July 31, 2022: Rs 1,312 crore

Allocation to large-cap stocks: Rs 1,151 crore

Allocation to mid-cap stocks: Rs 109 crore

5-year return (CAGR): 12.6%

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!