F&O Manual: Initiate bearish put spread on Bank Nifty as setup remains weak, say analysts

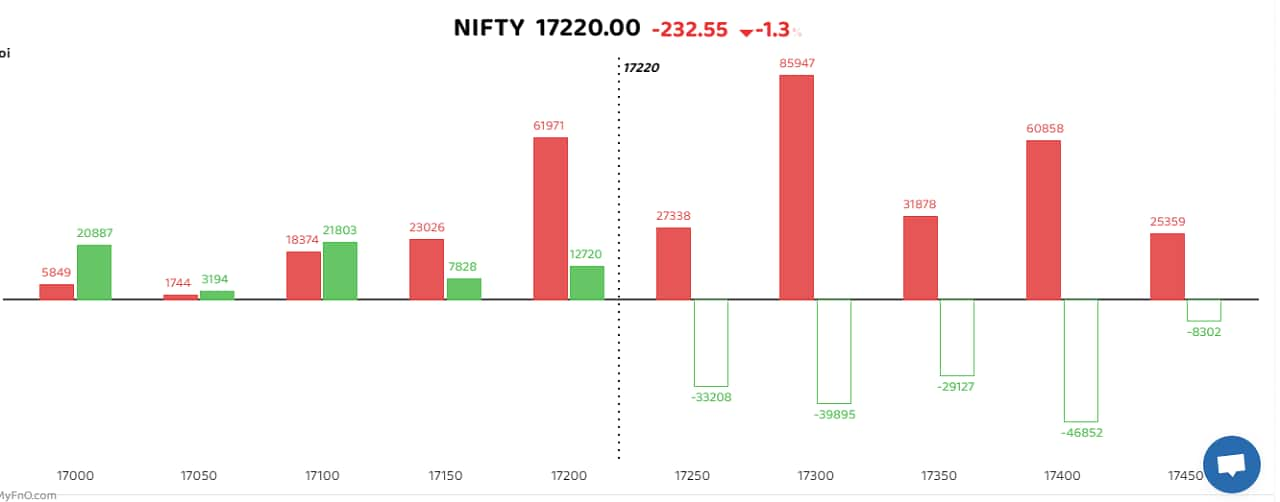

The Nifty witnessed strong selling pressure as it broke below the Budget day low of around 17,250 points and accordingly, analysts predict more weakness hereon.

1/5

The market resumed its sell-off from last week and ended below the Budget day low, extending losses to the third straight session on March 13. Sentiment weakened amid weak global cues as the sudden collapse of three US banks - Silicon Valley Bank, Silver Gate and Signature - sparked concerns over the health of the US banking system. The Nifty ended the day 258.60 points, or 1.49 percent, lower, at 17,154.30. The 'fear-gauge' India VIX also posted its biggest gain in the year so far as it shot up 20.88 percent to settle at 16.21 points, which reflects growing uneasiness among investors. (Blue bars show volume and golden bars open interest (OI)).

2/5

On the options front, 17,300 saw the largest accumulation of call writers followed by 17,200 and 17,400 as the headline index slipped below those levels through the day. Among put options, 17,000 witnessed the maximum buying. "The Nifty has continued with forming lower highs and lower lows in today's session. This time around, the index has even broken its previous swing low of around 17,250 points and is now headed further downhill. Support is likely to come around 17,000 points, however, it is unlikely that the index will manage to defend that level much longer. Traders should use the sell-on-rise strategy in the current setup," said Viraj Vyas, Technical and Derivatives Analyst at Ashika Stock Broking. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

3/5

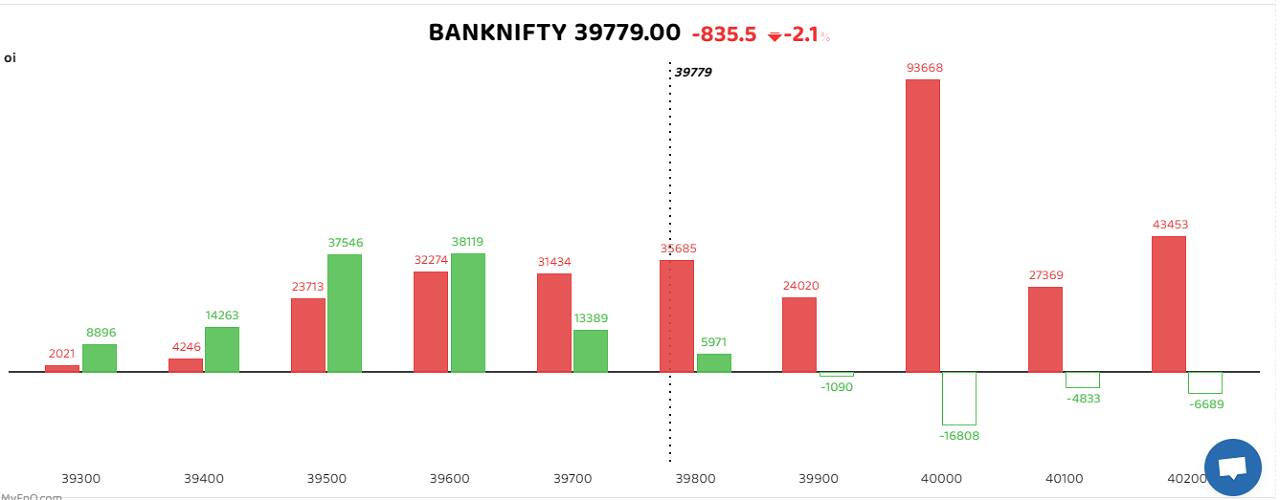

The Nifty Bank index witnessed strong selling pressure from higher levels as it broke its previous swing lows which triggered a bearish momentum for the sectoral index. "Support for the index stands at 38,800 which witnessed a significant addition of open interest on the put side. On the upside, maximum open interest buildup was seen at 40,000 call options. The index is likely to remain weak in the coming sessions and investors should initiate a bearish put spread strategy by selling put options of 39,000 and buying those of 39,500," said Rupak De, Senior Technical Analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

4/5

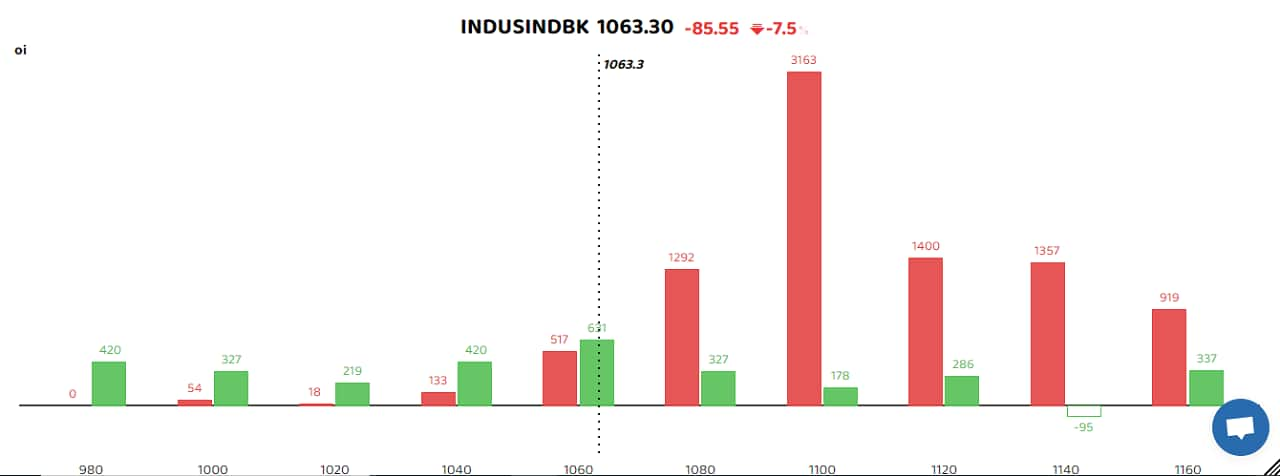

IndusInd Bank witnessed a short buildup with open interest rising 26.2 percent as concerns over the lower tenure extension of the lender's managing director and chief executive officer coupled with the weak market sentiment weighed on the stock. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. AU Small Finance Bank, RBL Bank, and Indiabulls Housing Finance were others that witnessed a heavy buildup of short positions. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

5/5

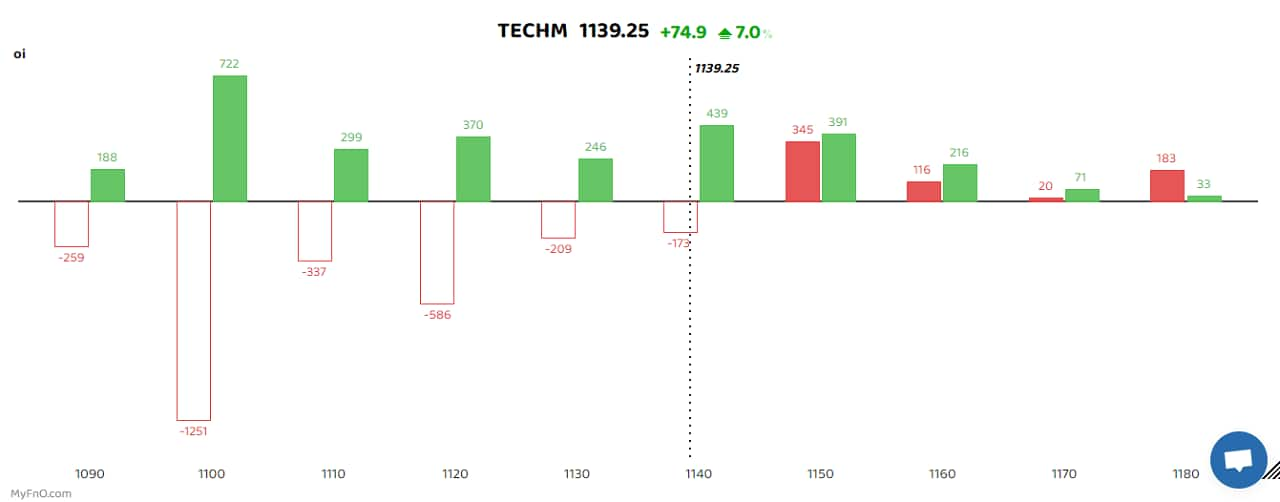

Tech Mahindra saw the maximum addition of long positions as the announcement of Mohit Joshi as the company's new managing director and chief executive officer bode well with investors. Open interest in the counter jumped 20.6 percent while the stock gained 6.84 percent in the cash market. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Apollo Hospitals, Dr Lal Pathlabs and Mahanagar Gas were among the few others that saw some buildup of long positions. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!