F&O Manual: Bearish sentiment to continue as setup remains weak

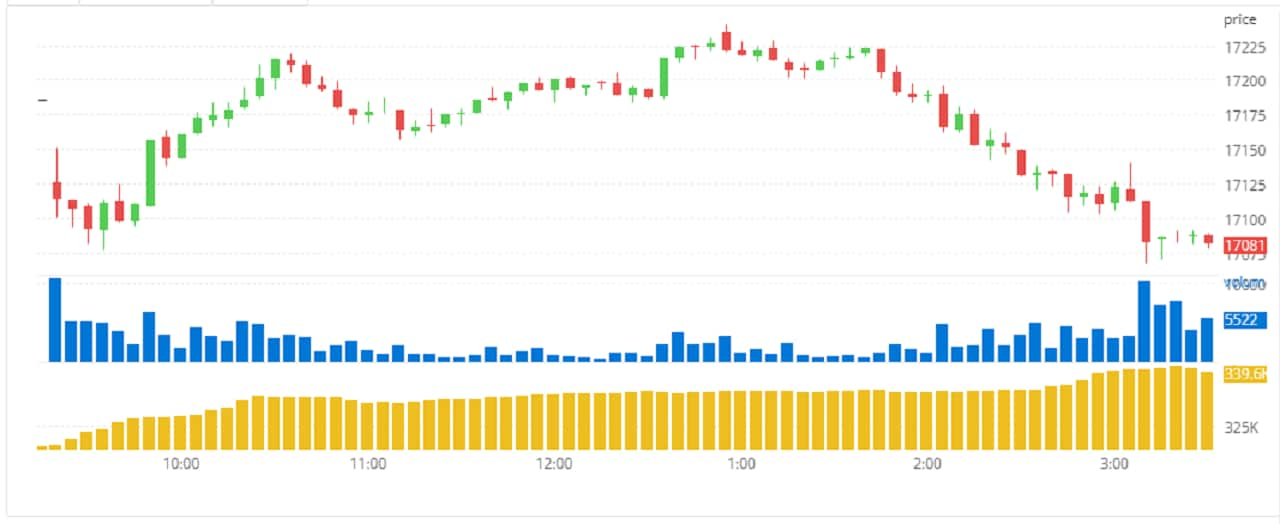

After a weak start, the market saw high volatility. Mid-afternoon gains were squandered in selling in the final hours with the benchmarks indices ending the day on a losing note

1/5

The Indian market snapped a two-day recovery on March 23 as weak global cues dented sentiment, a day after the Federal Reserve raised interest rates by another 25 basis points, sticking to its fight against inflation while ignoring pressures from the banking crisis in the US. The Nifty settled 75 points, or 0.44 percent, down at 17,076.90. (The blue bars show volume and the golden open interest).

2/5

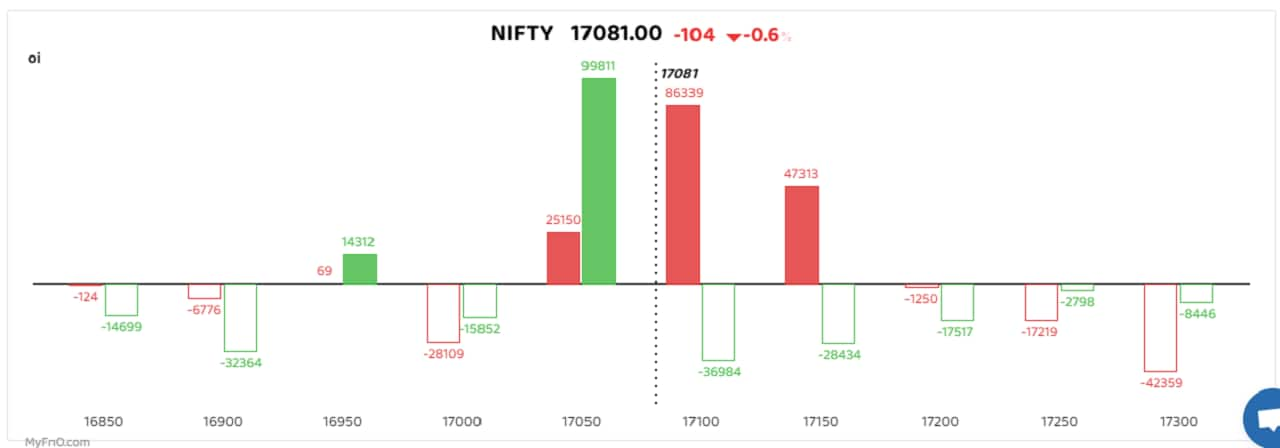

On the options front, heavy put writing was seen at 17,050 as the bulls fought to limit losses. The maximum accumulation of call writers was at 17,100, as the bears tried to take control. Raj Deepak Singh, Derivatives Analyst at ICICI Securities, said the market gave a glimpse of the direction in the last hours of the trade when it slipped into losses. "Positions formed through the week suggest that sentiment will remain bearish and I will go short if the Nifty falls below 17,000," Singh said. (the bars reflect changes in OI during the day. The red show call option OI and the green put option OI.)

3/5

Vedanta witnessed a heavy buildup of short positions as open interest in the counter surged 30.9 percent, the highest in a quarter. The jump was also accompanied by the prices in the cash market hitting their lowest level in a quarter after sliding below the 20-day exponential moving average. A short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. Other stocks that saw short buildup included Hindustan Aeronautics, Bank of Baroda and Vodafone Idea. (The bars reflect the change in OI during the day. The red show call option OI and the green put option OI.)

4/5

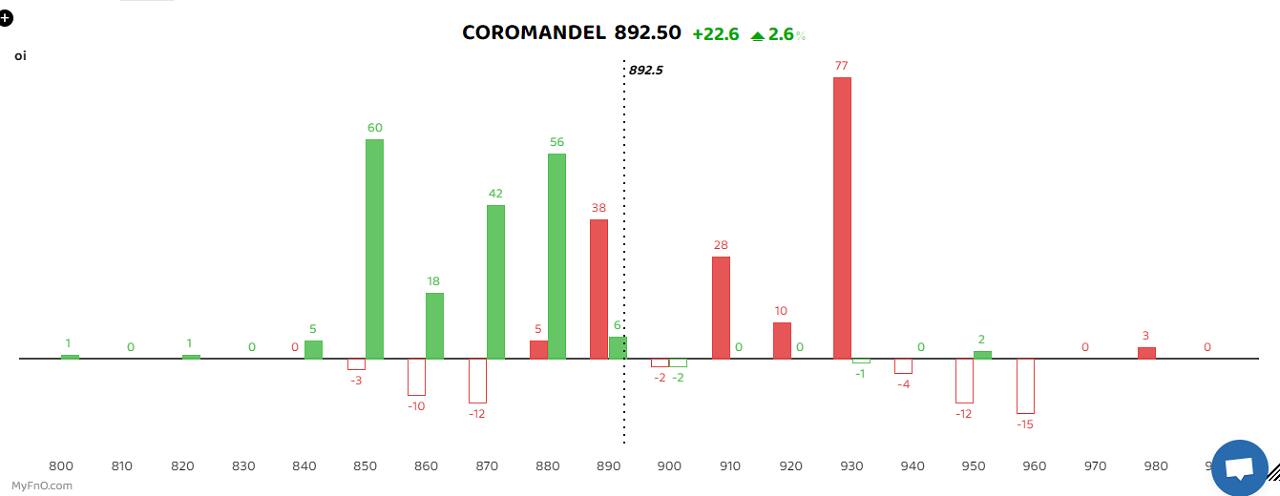

Corromandel International saw a long buildup as the company's decision to foray into speciality and industrial chemicals was cheered by investors. Open interest in the counter rose to a month's high of 5.1 percent, as the stock price climbed above the 50-day simple moving average. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Balrampur Chini Mills, ABB India and Hindalco Industries also saw the addition of long positions. (The bars reflect a change in OI during the day. The red bars show call option OI and green put option OI.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

5/5

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!