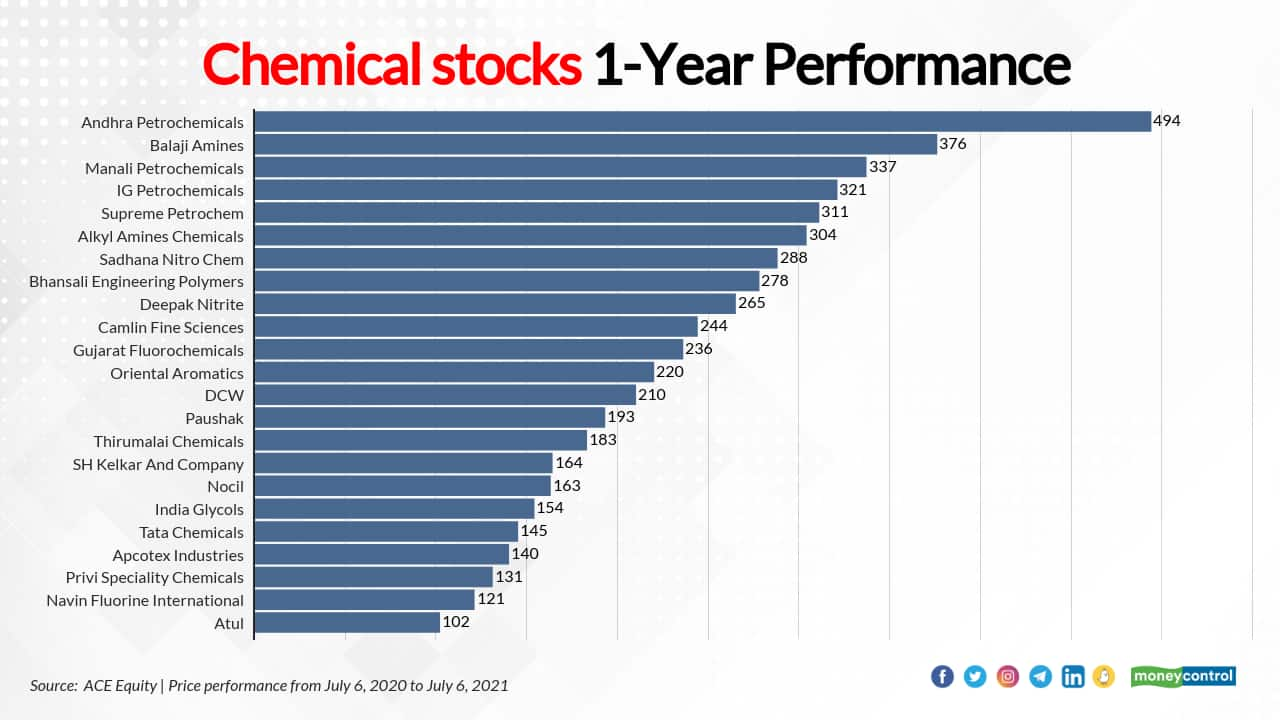

23 stocks from the chemicals sector turn multibaggers in a year. Take a look

Meanwhile, in the niche specialty chemicals sector, seven stocks have gained over 40 percent. The research firm JM Financial is bullish on 4 out of these 7 stocks

1/7

Chemical stocks have had a phenomenal run in the last one-year period. There are 23 stocks on the BSE from the sector that have doubled investors' wealth in last one year. In fact, six stocks from the list have gained between 300 percent and 500 percent each, according to ACE Equity data. We considered only stock with a market-cap of Rs 1,000 crore.

2/7

These 23 stocks from the chemicals sector have doubled the investors' wealth in just one year.

3/7

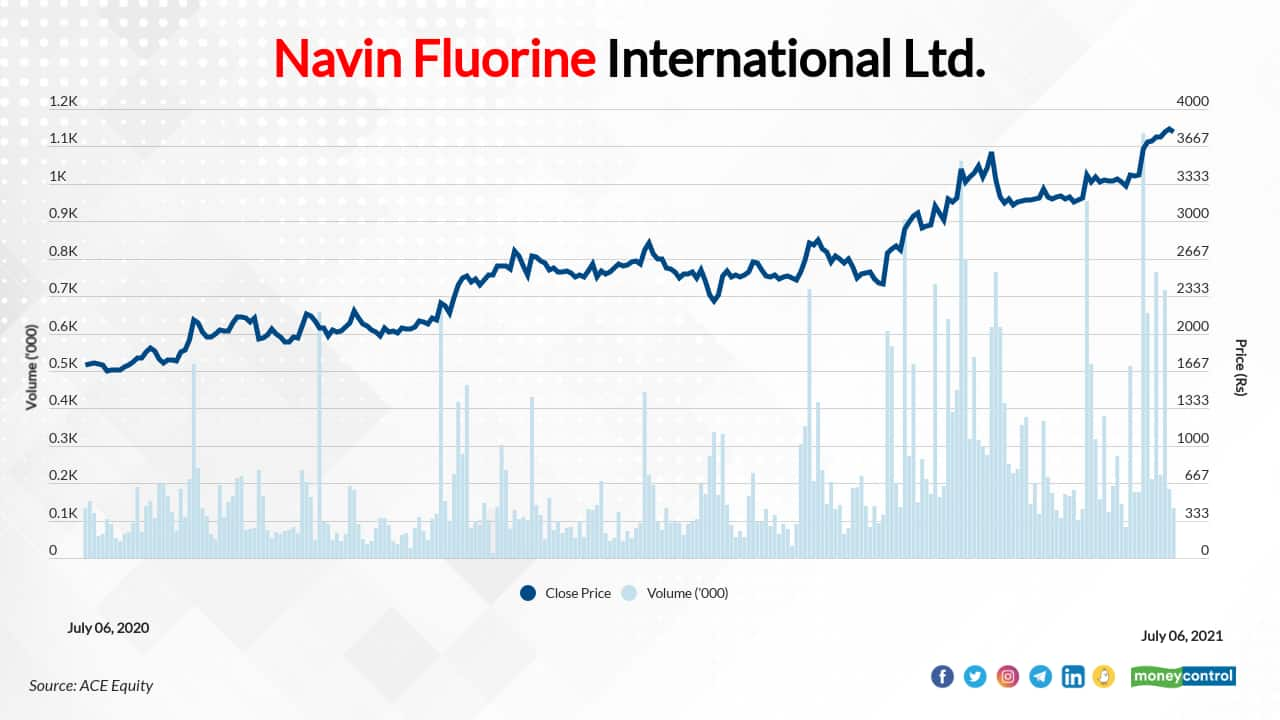

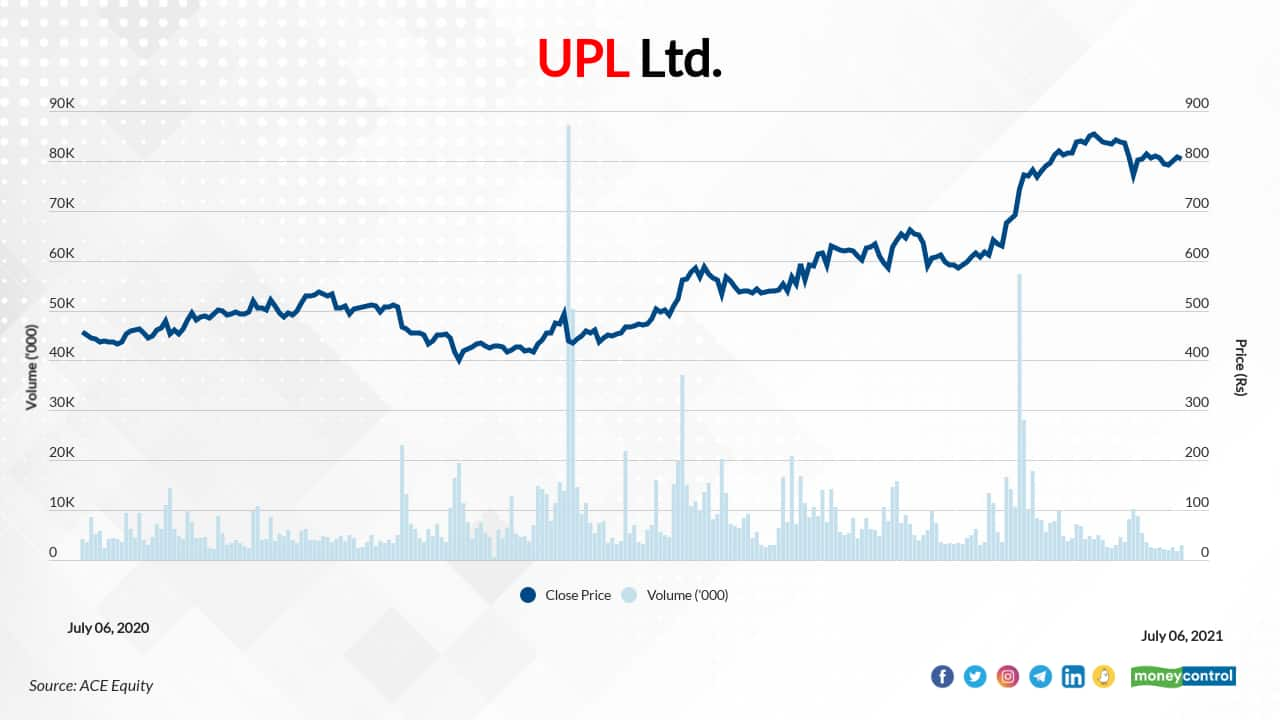

Meanwhile, in the niche specialty chemicals sector, seven stocks have gained over 40 percent. The list of 23 chemicals stocks does not fully include the 7 specialty chemicals companies. The research firm JM Financial is bullish on 4 out of these 7 stocks. "India’s specialty chemicals industry is a decadal growth opportunity and it is still not too late to participate in the value creation process. We prefer CRAMS/CSM players Navin Fluorine and PI Industries as they provide long-term earnings visibility. We also like UPL due to robust growth outlook and reducing debt concerns and SRF due to rising contribution from the chemicals business," JM Financial research report.

4/7

Navin Fluorine International | In last one year, the stock has risen 121 percent to Rs 3,791 as on July 06, 2021. JM Financial is bullish and has recommended a "Buy" rating on the stock with a target price of Rs 4,240.

5/7

SRF | In last one year, the stock has risen 96 percent to Rs 7544 as on July 06, 2021. JM Financial is bullish and has recommended a "Buy" rating on the stock with a target price of Rs 8,375.

6/7

PI Industries | In last one year, the stock has risen 82 percent to Rs 2978 as on July 06, 2021. JM Financial is bullish and has recommended a "Buy" rating on the stock with a target price of Rs 3380.

7/7

UPL | In last one year, the stock has risen 76 percent to Rs 804 as on July 06, 2021. JM Financial is bullish and has recommended a "Buy" rating on the stock with a target price of Rs 1020.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!