Just as confidence in the economic recovery began growing in March, the pandemic took over India again, with cases rushing past the September peak. Straddling the lives vs livelihoods balance, the central government chose to avoid a national lockdown.

As local authorities begin imposing restrictions to curb the spread, migrant workers are again on the move homeward. The Markit Manufacturing PMI index fell to a seven-month low in March, with factories recording their highest rate of layoffs in six months. To make matters worse, fresh compliances are being imposed, raising costs; for instance, mandatory fortnightly COVID-19-testing of all employees in Maharashtra. As always, the Micro, Small, and Medium Enterprises (MSMEs), in particular the smaller units, are the ones that will bleed out.

The government estimates peg the MSME sector to comprise 63.3 million units, providing employment to 110 million in 2015-16, contributing around a third of India’s national output. But there is a wide divergence in sizes within this, and we must keep the spotlight on the smallest firms, the micro units that make up 99 percent of the number and 97 percent of the total employment within the MSME sector.

Sharp Disparity

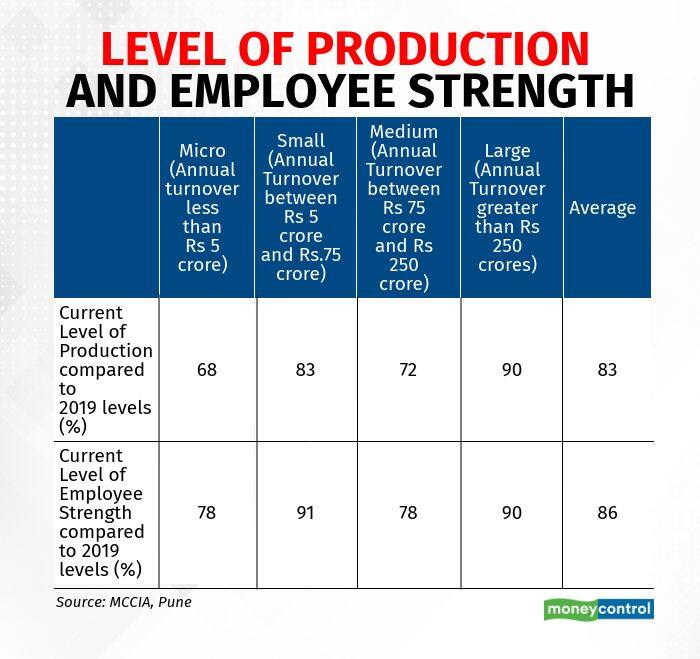

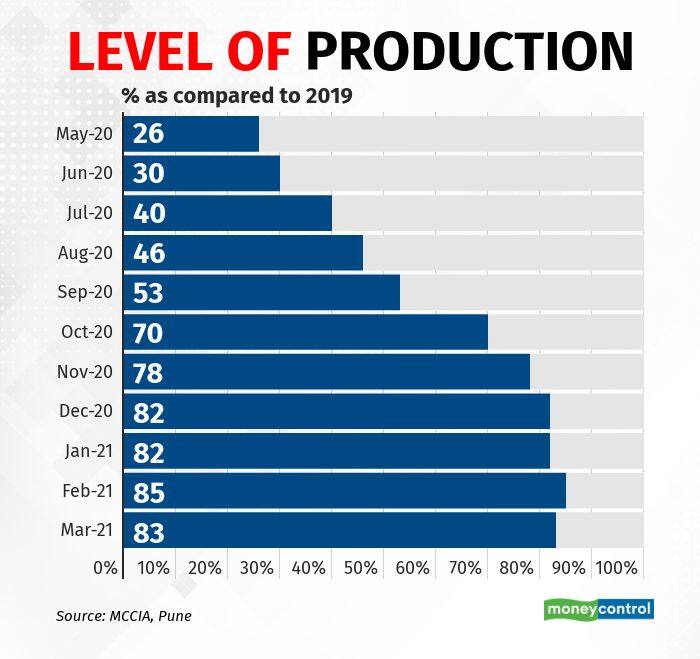

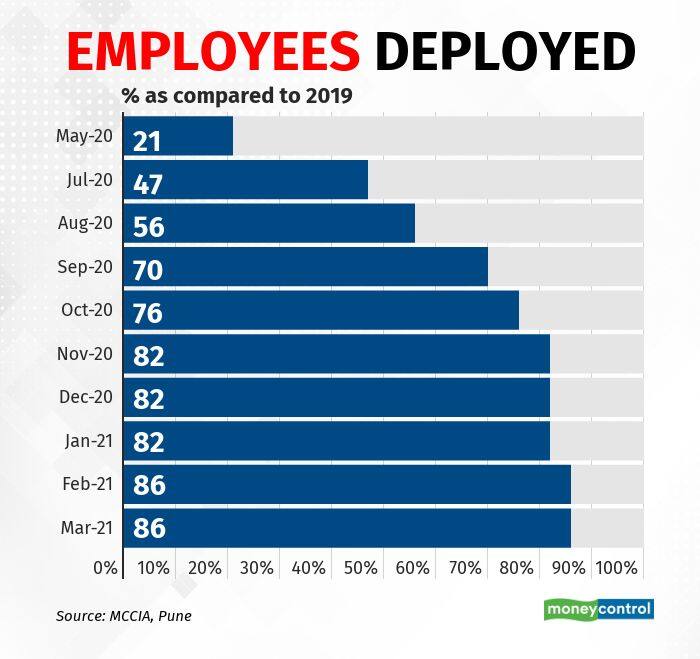

The pandemic has sharpened inequalities — larger businesses managed to hold their own, smaller firms were worse hit and are recovering at a slower rate. The evidence is quite stark. Mahratta Chamber of Commerce, Industries and Agriculture (MCCIA), Pune, has been conducting a longitudinal survey of 150-200 industries, including the MSMEs, over the past year. The monthly survey started in April 2020 when overall production levels had dropped to about 37 percent of the 2019 level; by March 2021, production levels had grown back to 83 percent of the 2019 level. However, there was a sharp disparity in the performance of firms across size — by March, large companies were clocking production levels at 90 percent on an average, while the smallest in the pack, micro-companies reported recovery to only 68 percent of the pre-COVID-19 level.

Several measures were rolled out to alleviate the fiscal stress, however, most MSMEs have not taken advantage of these government schemes. For instance, a key relief measure, the Emergency Credit Line Guarantee Scheme (ECLGS) witnessed uptake of about two-thirds of the limit set Rs 3 trillion, till the end of March 2021, giving timely support towards the working capital liquidity needs of about a 10 million MSME accounts. As the recovery is yet to reach pre-COVID-19 levels, this scheme has now been extended both in terms of ‘time’ and ‘sectors covered’.

Formalisation

However, it would be worth taking a pause to reflect on the fact that out of the estimated 63.3 million units, less than 10 million took recourse to benefits from this one or other consequential schemes for the MSMEs. In effect, five in six MSMEs do not seem to have taken advantage of such schemes. In all probability, the reason is that most of the MSMEs remain informal businesses, out of the formal financial network. While the ECLGS is easy to apply to and has worked well for many, only units who have outstanding loans from banks and select financial institutions are eligible. Unfortunately, the majority of the small businesses have not been able to garner formal credit, and stay out of many government schemes.

Formalisation is an imperative, but only about 10 million MSMEs are registered under any governmental system like GST or Udyog Aadhaar Memorandum. While the new ‘Udyam Registration’ is promising, with simple registration process and backend integration with government systems such as GSTN, just about 2.8 million have registered by end of March 2021.

Awareness Camps

For the five out of every six MSMEs currently not benefitting from the various government schemes like credit guarantee, interest rate subventions, etc., we need a national drive like Aadhaar and the Pradhan Mantri Jan Dhan Yojana (PMJDY). The task at hand here would be ‘relatively’ smaller and simpler, with just around 50 million units to connect through a massive awareness campaign, camps, etc. across India. This will help engineer a bottom-up formalisation drive; the current top-down approach leads to slower rates of recovery for smaller firms.

The bottomline is that every time we talk about the 63 million MSMEs in India, we need to remind ourselves: a) size matters, small firms are more vulnerable in the ongoing stress; b) majority of the small firms are missing out on government benefits as they are out of the formal system; and c) pushing new Udyam registration through a national drive on mission mode can bring 50 million into the formal system.

It is time to use this crisis to make fundamental changes in the way India does business.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.