The most foolproof way to attract attention on Wall Street is to make a hyperbolically negative call, and the past year has had no shortage of them.

So far, the crash hasn’t materialised. For all the perceived and real volatility, the S&P 500 Index has essentially ping-ponged around 4,000 for the past 11 months. About 81 percent of trading days have closed within 5 percent of that level in the period despite the continuing bull market in news reports mentioning the words “recession” and “bear market.” The market is going nowhere fast, humbling arch-optimists and pessimists alike. (Even Jamie Dimon has become more evenhanded in his latest letter to investors.) To assess whether the loudmouths were wrong — or just early — I looked at the history of sideways stock markets.

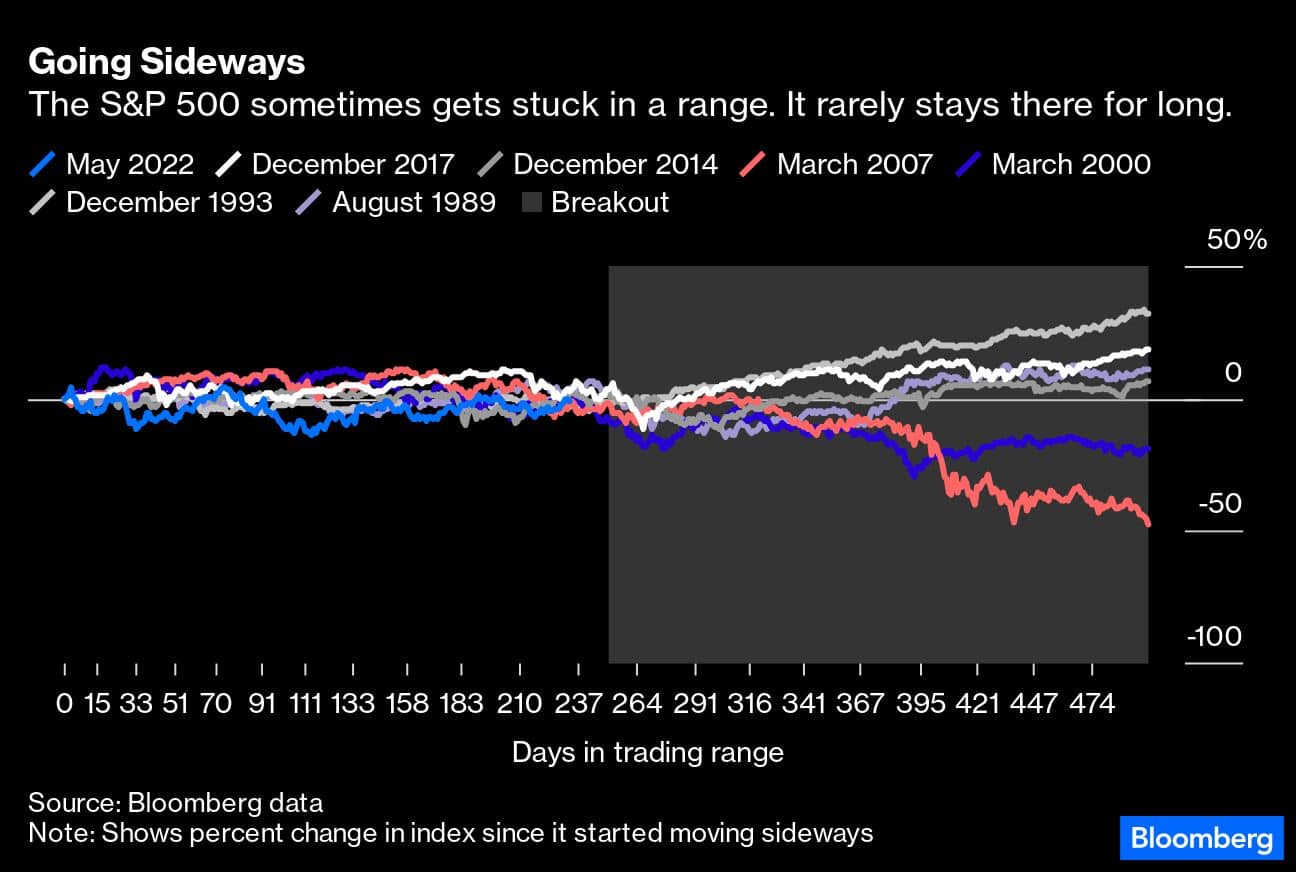

A range-bound market, of course, simply conveys that investors are collectively trying to make up their minds. Sideways trading can presage big turning points at the end of years long bull or bear markets, but it can also mark periods when the prevailing trend takes a breather only to get right back on track. Throughout recent history, longer-term sideways patterns exhibit more upside breakouts than crashes. But that’s to be expected because stocks rise on average more than they fall.

Notably, these narrow ranges rarely last more than 250 trading days or so, and the current market is about 233 trading days old. In the mid-1990s, the upside breakout came around day 300. In the financial crisis, the impasse ended around day 340, and the bottom fell out around day 400.

What do most of these periods have in common? The Federal Reserve, of course. With the exception of 2014, all of them occurred in or around significant sequences of interest-rate increases as the market was waiting on the earnings impact and trying to game out the central bank’s next move.

The Cassandras and Pollyannas alike can take heart in knowing that they’ll probably have the resolution to this story in the coming months or year — US stocks aren’t likely to go sideways forever.

On one hand, the run on Silicon Valley Bank (even if it’s now contained) has added to a string of mini-crises that feel as if they’re wearing on the US economy — a sort of death by a thousand cuts. Corporations and US consumers entered 2022 with extraordinarily strong balance sheets, but the barrage of economic shocks since Russia’s invasion of Ukraine has slowly worn on us. Banks’ willingness to lend is coming under pressure; commercial real estate owners face a looming wall of mortgage maturities; and credit card balances are rising, albeit from very low levels. It’s easy to see how the next blow could finally catch the economy off balance.

On the other hand, isn’t this exactly what Fed Chair Jerome Powell wanted? The economy is growing below potential but not collapsing yet, opening the door for disinflation later this year. The first legitimate whiff of a reduction in the fed funds rates promises to send valuations significantly higher, provided corporate profits aren’t imploding at the same time. In that scenario, the stock market doesn’t need an earnings bonanza for an upside breakout, just signs of durability.

It’s hard to tell who is going to be right here — the doom merchants or the perma-bulls — but one of those groups is likely to get a victory dance sometime soon. And don’t expect too many mea culpas for getting the timing all wrong. Unfortunately, there are no headlines or trophies handed out to the investors and analysts who predict that nothing much is going to happen, and that’s a shame because that’s occasionally what reality gives us.

Jonathan Levin has worked as a Bloomberg journalist in Latin America and the US, covering finance, markets and M&A. Views are personal and do not represent the stand of this publication. Credit: BloombergDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.