Investing in equity is generally considered the best way to generate returns that beat inflation. It has been practically drilled into our minds that if you need to earn more returns, then invest in equity, stay invested for the long term and you would be handsomely rewarded. To validate some of these claims, we have analysed both debt and equity indices returns since January 2000.

Here are five myths related to investing in equity for inflation-beating returns:

Equity can and has given negative/lower-than-inflation returns. This happened continuously over a period of three years – from January 2000 to January 2003 and for about seven years from December 2013 to May 2020.

Even over the past 18-odd months, equity returns have not beaten inflation and if the market declines from current levels, the returns would be negative.

From January 2000 to date, equity returns have been 11.3 percent. This when the markets are at a peak now and there is talk of a likely 20-25 percent drop. From January 2000 to November 2011, the returns were 10 percent. From November 2011 to date, the returns have been 12 percent.

The point is, equity is similar to other asset classes and has its own cycles. With regard to beating inflation, debt also has outperformed during different periods.

Over the past 15 years, the equity markets had a very good run over two periods – January 2009 to November 2013 and June 2020 to date. Between these two periods (December 2013 to May 2020), the Nifty generated 6 percent annual compounded returns.

However, despite these good times, as per a recent S&P report, most the actively managed MF schemes have not been able to beat the underlying the benchmark index. The below table is the snapshot of their findings.

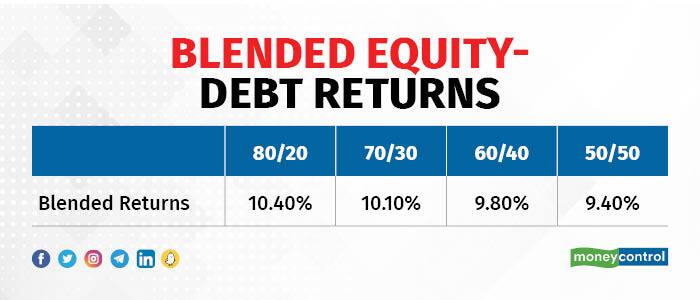

Like equity, debt has also provided lower returns over different periods. Over the past 22 years, it has been 7.8 percent. In the 12-year period from January 2000 to November 2011, it was 8.5 percent. From November 2011 to date, the 10-year gilt index has given 7 percent returns. So a blended return during all the periods has been about 10 percent or less.

Remember, the equity markets are currently close to all-time highs and a decline from these levels will only lower these returns.

There was a report in November 2021 (peak equity markets) about a professional investor’s portfolio and its performance since March 2019 (~2.5 years). It had 15 stocks accounting for 2/3rd of the portfolio. The professional investor garnered a 100 percent return.

If one had invested in gilt funds for 15 months till June 2020 (after the markets rallied 20 percent from the bottom) and invested in a Nifty index fund (post 30 percent tax on the gilt fund), the returns would have been similar till November 2021.

For details, refer to https://www.moneycontrol.com/news/opinion/want-to-mimic-rakesh-jhunjhunwalas-portfolio-returns-use-this-simple-investment-logic-7937961.html

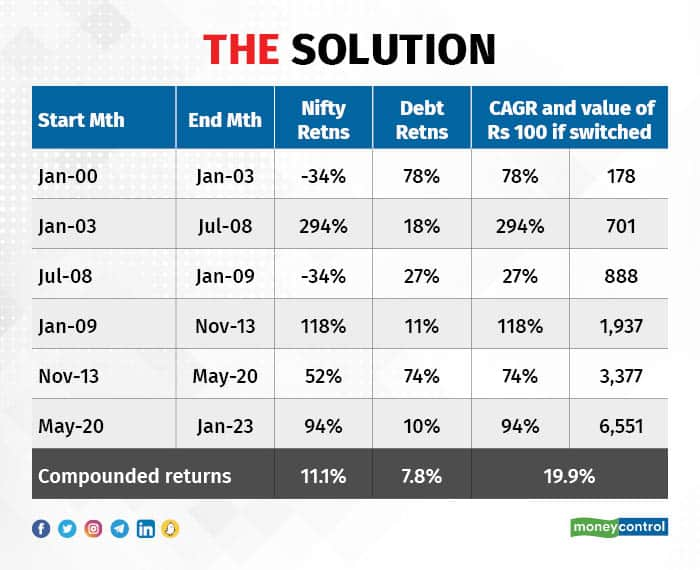

Invest based on the interest rate cycle and that too, only in an equity index fund like the Nifty 50 or the Sensex 30 fund (for equity exposure) and a gilt fund or 10-year target maturity fund (for debt exposure).

In the Indian context, whenever the 10-year G-Sec yield moves from 6 percent to 9 percent, buy a gilt fund, and whenever it moves from 9 percent to 6 percent, buy an equity index fund. Shift between these two only when the thresholds are breached.

Remember, this movement (between 6 percent and 9 percent) is not swift and does not happen overnight. Hence, one would have ample time to make the move.

Also, there have been only six such movements over the past 22 years. In each of these movements, the underlying asset class yielded returns exceeding inflation meaningfully.

To know more about this, refer to

https://www.moneycontrol.com/news/opinion/secrets-about-mutual-fund-investing-which-experts-do-not-tell-you-6865901.htmlK Shankar and Amitabh Tiwari are co-founders of Finanza Personale. Views are personal and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.