The RBI’s Monetary Policy Committee (MPC), in the June 2024 meeting voted to keep the policy repo rate unchanged at 6.5 percent. The MPC voted to keep rates unchanged for eighth straight meet as the last time RBI changed policy rates was in February 2023. Of the six MPC members, J R Varma continued to vote to cut repo rate by 25 bps.

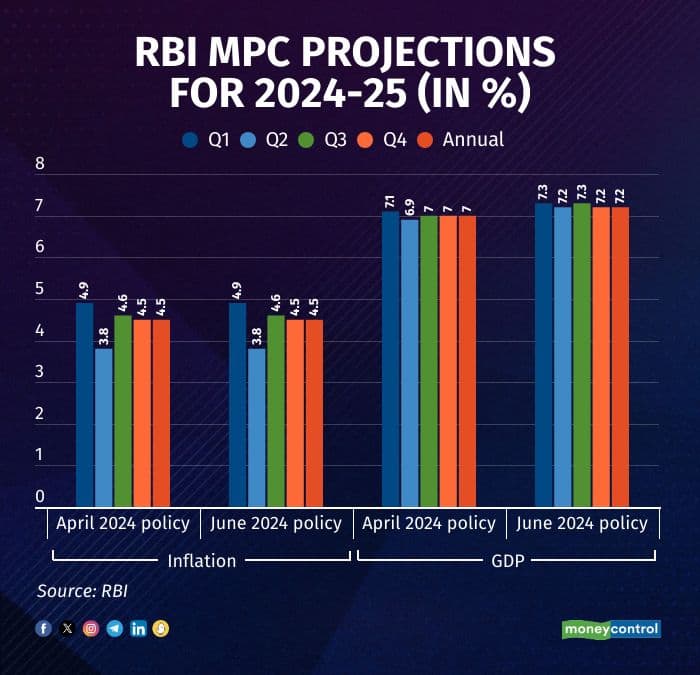

In April, the MPC projected CPI inflation and GDP growth for 2024-25 at 4.5 percent and 7 percent, respectively. In this meet, while RBI kept inflation projections unchanged, it revised GDP projections upwards from 7 percent to 7.2 percent. It is also interesting to note that the central bank revised higher than projected GDP in all the four quarters. Though, the growth rate for 2024-25 is expected to be lower than growth rate of 2023-24 at 8.2 percent.

On inflation front, the headline inflation continued to moderate and touched 4.8 percent in April 2024. The core inflation was noted at 3.2 percent, lowest in the CPI series. While inflation declined on other accounts, food inflation was at 7.9 percent in April. The food inflation is highly dependent on the monsoon. Further, the exceptionally hot summer season and low reservoir levels may add to the stress of the summer crop of vegetables and fruits.

On the growth front, economic activity remains resilient. The eight core industries posted healthy growth in April 2024. The Purchasing Managers’ Index (PMI) in manufacturing exhibited strength in May and is the highest globally. Services sector maintained buoyancy as evident from available high frequency indicators.

Improvement in Growth Dynamics

Overall, MPC noted that the growth-inflation dynamics have improved since its last meeting in April-2024. The economic activity remains resilient due to strong domestic demand and growth in Investment demand. The headline inflation has started easing but risks from volatile and elevated food inflation could play spoilsport in near months.

RBI Governor’s statement also discussed issues pertaining to financial stability. The statement pointed out that the banking system continued to strengthen due to “improvement in asset quality, enhanced provisioning for bad loans, sustained capital adequacy and rise in profitability”. The commercial banks Gross Non Performing Assets ratio for both banks and Non-Banking Finance Companies (NBFC) was lower than 3 percent. The central bank had taken measures to curb high growth in the unsecured retail loans and over-reliance of NBFCs on bank funding. The recent data shows that the measures have started taking shape. The credit growth in unsecured personal loans such as ‘credit card outstanding’ declined from 34.2 percent in November 2023 to 23.0 percent in April 2024, while bank credit growth to NBFCs declined from 18.5 per cent in November 2023 to 14.4 per cent in April 2024. The RBI also noted that few microfinance institutions and NBFCs are charging usurious interest rates on small value loans. They should ensure fairer interest rates.

The Governor’s statement also laid aspirational goals for RBI@100 in a Multi-Year Time Frame. Apart from the usual goals of monetary and eternal stability, the central bank aims to make Reserve Bank’s Supervision a Global Model. It also wishes to focus more on climate change and its impact on financial system. The central bank has also proposed to adopt Artificial Intelligence/Machine Learning (AI/ML) in the central bank.

RBI’s Announcement for Financial Markets

Apart from maintaining a status quo on monetary policy, RBI also announced policies for development and regulation of financial markets.

1. The RBI specifies limits for banks raising bulk deposits. This limit has been increased from Rs 2 crore to Rs 3 crore for commercial banks and small finance banks. The RBI has also allowed Local Area Banks to raise bulk deposits of Rs 1 crore.

2. The central bank will establish Digital Payments Intelligence Platform which will harness advanced technologies to mitigate payment fraud risks. Accordingly, it has constituted a committee to examine various aspects of setting up Digital Payments Intelligence Platform. The committee will submit report in two months.

3. RBI issued an e-mandate framework which allowed recurring payments. The e-mandate framework is being expanded to include recurring payments for Fastag, National Common Mobility Card (NCMC) and UPI Lite Wallet with auto-replenishment facility.

4. RBI has announced third edition of its global hackathon, “HaRBInger 2024 – Innovation for Transformation”. This time the two overarching themes are, ‘Zero Financial Frauds’ and ‘Being Divyang Friendly’.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!