Elara Capital

The bull market in midcaps started after 2014 . Since then, we saw massive inflows into local mutual fund (MF) portfolios. Most funds were diverted into mid and smallcaps due to lack of largecap options.

MF built a big tail inside markets in the past few years, which accelerated after the note ban. We have seen evidence to suggest that the big crowd got sucked into the markets post demonetisation

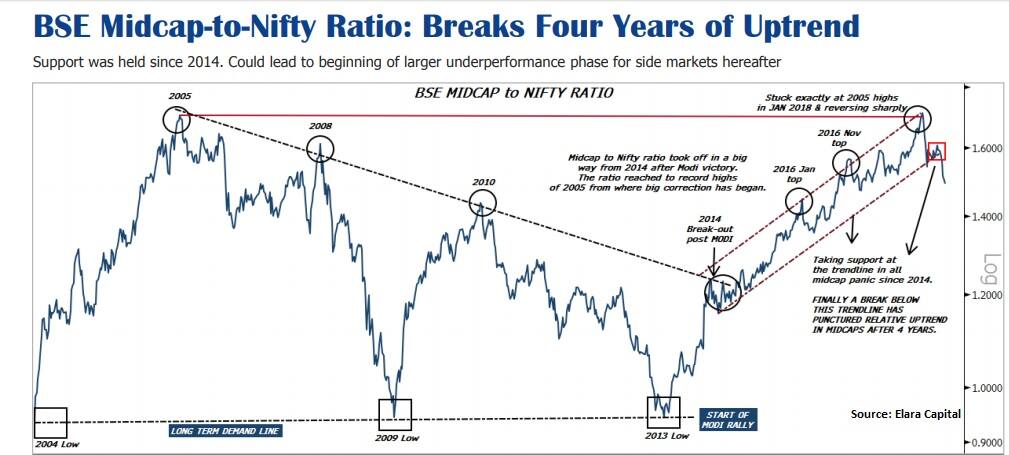

One key trend here is the midcaps relative pattern. Post-2014, midcap-to-Nifty ratio broke out of a decade cycle downtrend on the back of midcap chasing.

The ratio has been following this uptrend for the past four years. We saw two large setbacks in midcaps over 2016-17, but this trendline has held well.

In this leg, we have seen a big reversal in the trend emerging after four years. In this round of market correction, relative performance of side market has already reached a two-year low.

Since 2014, midcaps have seen three large round of corrections during January 2016, November 2016 and May 2017). In all three rounds, the retracement in the Midcap-to-Nifty ratio from the highs in the range of 6-8 percent.

However, in this round, midcaps have already retraced 14 percent from the top, puncturing the Bull cycle. Although, we may see a bottom fishing rally in the short term (as few indicators have reached oversold zone), the larger trend in midcaps outperformance has broken down.

The macro, which was favourable for midcaps since 2014, also is getting challenged. This shows there could be a gradual contraction in the side market valuations.

2014-15 was a largecap market, 2015-16 was midcap market and 2016-17 was a smallcap market. One full cycle of shift into smaller names seems to have been played by the markets for now.

These ratio breakdowns have a lot of relevance. In the past, we had seen such breakdowns in the Metals-to-Nifty ratio in 2014, Pharma-to-Nifty ratio in 2016 and breakouts in the Auto-to-Nifty ratio in 2014 & now IT-to-Nifty ratio in 2018.

All of these have transformed into medium-term trends. The breakdown holds importance as we have seen big crowding in the side markets in 2017 post demonetisation. The market volume in the midcaps remains a cause for concern for most big participants.

Hereafter, it would be advisable to move the focus towards largecaps from mid and small caps for some time. Bottom fishing interest remains strong; hence, it could see strong counter-rallies.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.