By paying an insurance premium of Rs. 1,50,000, your tax savings could be Rs. 53,820, if you fall in the highest tax bracket. But is that the only basis to decide your investment? Certainly not!

Every year, taxpayers tend to postpone their investment decision to tomorrow until it’s March. With hardly any time left for taking the decision, people are more prone to choosing an unsuitable plan or paying higher premium.

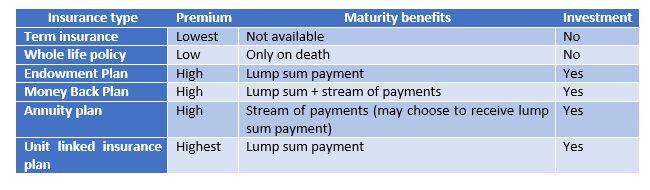

To facilitate better decision making this year, let us first understand the types of life insurance policies available in the market:

Common mistakes that people make are that of not aligning their insurance policies with their long-term goals, purchasing without comparing various policies, not assessing risk appetite or capacity to pay premium year-on- year, etc.

Even though a unit-linked insurance plan (ULIP), money back plan (MBP) or endowment plan are primarily perceived as investment plans, one has to understand the allocation of premium towards life cover and investments. One can purchase a term insurance policy to suit his requirement either as a plain vanilla policy or opt for additional benefits that come at an extra cost.

Ability to pay premium in future plays a significant role in deciding the type of policy. Discontinuance of whole-life or endowment policy may result in a huge financial loss. On the other hand, a term policy can be discontinued at any time without a financial loss as one would have paid the premium for a year. If need arises, one may obtain a loan by pledging the ULIP, endowment, MBP or annuity plan but such cannot be the case with term insurance . In general, risk appetite, income level, health, life expectancy, purpose and return are some factors that a policy investor cannot ignore.

Tax saving is perceived as the most important criteria for investments in a life insurance policy. A taxpayer can claim deduction up to Rs 1,50,000 under section 80C of the Income Tax Act in respect of insurance premium paid on his own life or life of his spouse or children. Also, maturity proceeds from a life insurance policy either on death or on maturity is exempt from tax upon fulfilment of certain conditions.

Deduction/exemption is available under the Act only if the premium paid does not exceed 15 percent of the sum assured in case of people having specified disability or ailment and 10 percent of the sum assured in other cases where policy is taken after April 1, 2013. Above deduction will not be available if the taxpayer fails to pay premium or terminates policy within five years in case of ULIP and two year in other cases.

Life insurance policies being long-term in nature impacts not only your today but also the future. Term insurance may help to secure life at low cost whereas an endowment plan guarantees some amount on maturity. Besides insurance there are other products - equity linked savings schemes and fixed deposits - which provide returns on investment as well as a tax break. But insurance comes into play when you intend to cover risk.

Hence you should study your financial state and long-term goals to begin with. If you cannot do it yourself, then you should involve an advisor, before buying a policy that suits your need. For this you need to avoid the last minute rush.

(The writer is Partner from N.A. Shah Associates LLP)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.