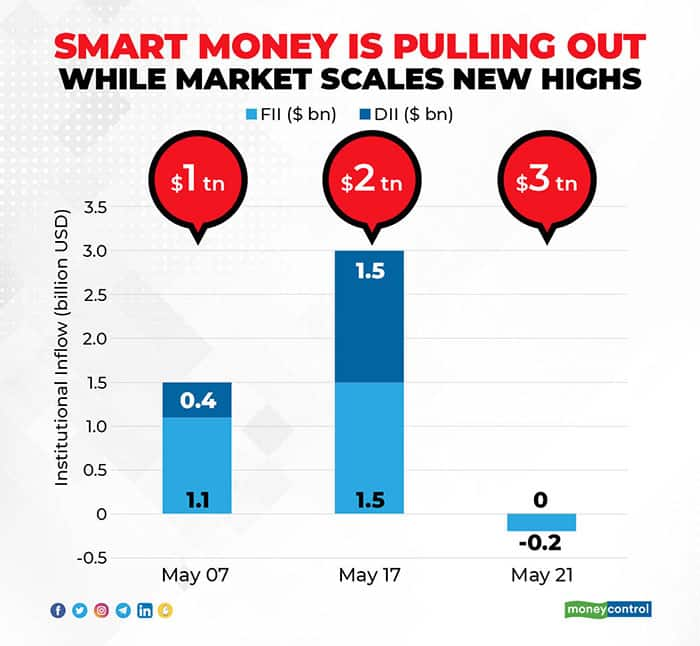

‘Sell in May and go away’? Indian equity markets seem bent on proving this age-old adage wrong. They had reached two key milestones in the month of May — total market-capitalisation had reached the $1 trillion mark in May 2007, and then, the $2 trillion mark in May 2017.

Now, again in May 2021, stocks listed on BSE scaled a new height — their combined market-capitalisation reached $3 trillion. This made India the right most-valued equity market in the world, close on the heels of Canada, France, and the United Kingdom.

At the risk of being a killjoy, I would have to say that this time around, the milestone is more of a red flag than a cause for celebration. This is for two interrelated reasons.

First, unlike the first two milestones, this time, ‘smart money’ is pulling out. Institutional funds, including foreign (FII) and domestic (DII) investors have been net sellers for the month.

This, along with the fact that the recent rally has been primarily driven by mid and small cap stocks, indicates that retail and corporate investors have been driving up the markets. Such investors have been empirically known to be less ‘sticky’ and relatively more prone to panic-selling.

Second, our economy is not doing too well. India has been the hardest hit by the COVID-19 second wave. Several states in India re-imposed lockdowns. Meanwhile, the United States is pumped up by federal funds and the European economy is set to open up as its vaccination drive picks up pace. What this means for investors is that unlike the first wave, this time, the global economy is not as battered and thus, bond-yields have stood their ground. In other words, equities are no longer the only viable investment avenue.

Moreover, with recent lacklustre high-frequency indicators, the Indian economy has been attracting the wrong kind of attention lately. Liquidity-pumped FIIs who had flocked into Indian equities in FY21 have been pulling out since April.

At the same time, the global commodity rally, which has pumped up metal stocks in India, poses the risk of inflation. The possibility of a hike in US yields heightens this risk. Given these growth and inflation concerns, quite understandably, several agencies have recently downgraded India’s growth forecasts.

So, we see a clear dichotomy here — the markets are in a celebratory mood while the economy is struggling. In fact, if we look at the Buffett Indicator for country-level valuation, the market-cap to GDP ratio is at a 10-year high of more than 100 percent. Such valuations have been historically seen to precede sharp corrections in the market.

Eventually, the dichotomy is going to fix itself. Either equity markets will correct to levels commensurate with the economy, or the economy will recover in time to justify the current valuations.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!