By Harish Ahuja

Mr. Aakash is a power generator. His company operates a 500 MW thermal and renewable hybrid plant in central India. About 80% of his output is tied up under long-term power purchase agreements (PPAs) with various state distribution companies. The remaining 20% is sold on merchant markets, often through spot exchanges or bilateral short-term deals.

Every year, he faces the same challenge: the 20% merchant power gives him the chance to earn extra — but it also exposes him to risk. Spot prices swing. Grid congestion delays delivery. Buyers back out. Banks ask questions about revenue variability. There is no visibility beyond next week. Every budgeting exercise feels like guesswork.

In Mumbai, a power trading company that supplies commercial and industrial customers under open access arrangements, faces another challenge. Its retail model depends on margin visibility. When day-ahead market prices spike, power cost overshoots fixed contract terms. Hedging tools don’t exist. Customers expect fixed bills; regulators limit passthroughs. The company manages volatility without control.

Meanwhile, a major aluminum component exporter in eastern India, supplying to European EV markets, consumes over 300 MWh daily. Power is over 35% of their production cost. Every Re 1 fluctuation affects international pricing. Without price certainty, they cannot bid confidently for multi-quarter export contracts.

And in Delhi, a proprietary trader, already active in equities and commodities, watches the volatility in real-time electricity markets. He sees patterns, but no product to express them. Electricity is the last untapped data-rich commodity — but inaccessible, because derivatives don’t exist.

These aren’t abstract inefficiencies. These are barriers to scale, stability, and investment. They all share one thing: they operate in a market without electricity futures.

The Reality of India’s Electricity Market

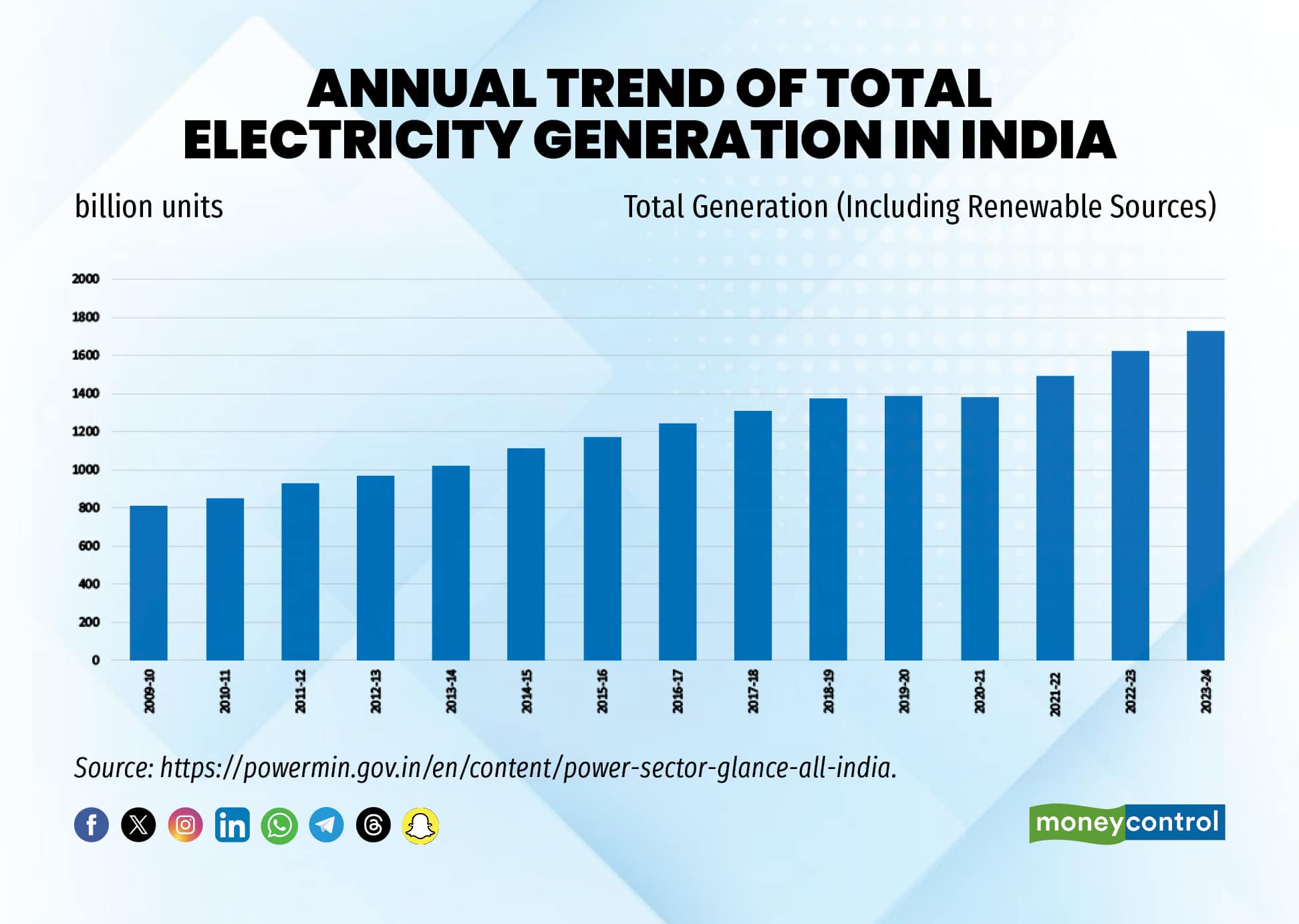

India’s electricity generation crossed 1,730 billion units (BU) in FY 2024 (as shown in the graph). Around 1550 BU of this is covered through long-term arrangements. The remaining 180 BU moves through the short-term market: day-ahead, term-ahead, real-time, and bilateral OTC trades. Spot exchanges like IEX, PXIL, and HPX capture around 5% of total volume.

This 5% carries disproportionate volatility. It is the slice where prices are not fixed. Where demand forecasting, grid balancing, and weather risk meet pricing decisions. For generators, this is revenue uncertainty. For discoms, it is cost volatility. For financiers, it is risk with no hedge.

India’s physical electricity market is wide. But its financial risk management layer is still missing.

Why Electricity Futures market is needed

In global electricity markets (as shown in the figure below), financial derivatives play a central role. In the EU, EEX and other exchanges trade over 12,000 BU of electricity futures annually — more than four times the actual generation. In the United States, electricity derivatives markets total over 3,000 BU, helping hedge risks across generation portfolios, transmission bottlenecks, and consumer obligations.

India took its first formal step in 2016, when electricity was notified as a tradable commodity under the Securities Contracts (Regulation) Act (SCRA). But regulatory jurisdiction quickly became contested. While CERC claimed all electricity contracts should be under its control, SEBI argued that financial instruments belonged within the securities market.

A decisive shift came in October 2021, when the Supreme Court of India ruled that:

This cleared the way for structured derivatives to enter India’s power market.

Why Electricity Derivatives are needed

The core utility of financial derivative is to hedge against the business risk emanating from frequent price changes. Ideally speaking all active players in physical markets, i.e., generators, retailers, traders, large C & I (Commercial and Industrial) buyers should hedge their physical position in financial derivatives to safeguard themselves from frequent price changes.

To make a net zero energy transition where distributed and intermittent sources of power generation like solar and wind will contribute more than 50% of installed power capacity by 2030, it has become imperative to launch electricity derivatives to give more depth and avenues to the power market participants to hedge their capex risk.

Though initiated in 2003, power sector reforms are not complete till the retail side of business is made fully elastic and responsive to everyday price change owing to various socio economics, geopolitics, and technical factors. Giving asymmetric power to only suppliers to influence the prices and isolating the last mile of customers due to poorly designed market forces cannot last long. Content and carriage separation in the distribution side of business will allow entry of more retailers (pure service companies) and encourage demand side elasticity. But till the time it happens, fully cash settled future markets (electricity derivatives) would allow all important players to participate and contribute their skills towards discovering future electricity prices.

The availability of the electricity derivative market is a must-have feature for these pure retailers and also C & I customers to have some impact on determining the electricity prices without having ownership of physical generating or transmission assets. The balance among buyers and sellers must be restored to bring market equilibrium in a fast-changing prosumers world.

Launch of electricity derivatives products in a gradual, well calibrated and a coordinated manner

Learning from other countries’ experiences, it is imperative that India should also follow a calibrated approach while launching of electricity derivatives. Further, being the early phase the spot and future markets has to move in coordinated fashion to avert any early crisis. In the beginning, the deepening of the derivatives markets will require enough players, extra liquidity and enabling ecosystem for trading. This shall require some premeditated action on policy & regulatory front both by CERC in the spot market and in the financial markets by SEBI.

The real depth of power markets across the globe and best practices being followed by different countries to deepen the markets ultimately reflect in the liquidity and size of trading volumes of respective country’s electricity derivatives contacts.

In the Indian context, for volume to increase in the days ahead, a financially settled future market is must to give buyers/sellers the option to hedge their exposures and similarly for a financially settled market to thrive, a large volume of power needs to go through the day ahead spot market. Typically, in European markets the volume of the financially settled transaction is 3-4 times the volume of actual physical power consumed in the country (market churn).

The journey of a thousand miles begins with one step

In February 2025, SEBI invited proposals from exchanges to launch electricity futures. Like other asset classes but even more so, the infrastructure for this market needs to be operationally resilient for minimal disruption, an active presence across assets for collateral fungibility, strong surveillance systems and importantly, a robust, well-capitalised clearing corporation for counterparty risk protection and guaranteed settlement.

What Futures Actually Offer

Electricity futures are standardised, cash-settled contracts that let participants agree on a price today for a unit of electricity delivered or settled in the future. They do not require physical delivery. They do not need transmission scheduling. They sit beside the physical market, not inside it.

The value is simple à price visibility in advance.

A Market that Plans, Not Reacts

At present, India’s power market operated in silos — one part delivering electrons, another part reacting to their price. With futures, the financial and physical markets finally speak to each other.

Generators can split their portfolios. Buyers can forecast energy budgets. Banks can model returns. And the market moves from firefighting to forward planning.

In the financially settled power derivatives market, the following next steps are proposed:

Each player now participates differently — but each does so with visibility, protection, and planning. The market has evolved from firefighting to forecasting.

Challenges during the initial phase of Electricity Futures

Liquidity is likely to be thin at the start; markets need volume to attract volume. Early adoption will require patient ecosystem building, supported by committed players and price transparency.

The Electricity Market India badly needs

Futures are not a luxury for advanced markets. They are the missing piece in any system that wants to be efficient, fair, and stable. Electricity is too important, too volatile, and too exposed to operate without financial risk tools.

In conclusion, it has become imperative to launch electricity derivatives to give more depth & meaning to the power market reforms initiated in 2003 while implementing the electricity act 2003. The reforms are not complete till the retail side of business is made fully elastic & responsive to everyday price change owing to various socio economics, geopolitics and technical factors. Giving asymmetric power to only suppliers to influence the wholesale markets prices and insulating the last mile of customers due to poorly designed market forces cannot long last.

The power balance between buyers and sellers must be restored to bring market equilibrium in a fast-changing prosumers world.

With the launching of electricity futures, India doesn’t just catch up with global best practices. It lays the foundation for a new layer of planning — one that doesn’t change how electricity is generated or consumed, but transforms how it is managed, financed and trusted.

(Harish Ahuja is the Head- Sustainability, Product & Strategy Development (Power & Carbon Markets), Primary Market relationship, and Social Stock Exchange at National Stock Exchange.)

Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.