The great and the good of the central banking world gather on August 25 for the annual Federal Reserve Symposium at Jackson Hole, Wyoming. The snappily-titled theme is ‘Reassessing Constraints on the Economy and Policy’. There needs to be an honest reflection on the causes of the rampant inflation most of the world finds itself battling. The track record of central bank economic forecasting is in tatters, as is confidence that our monetary overlords know what they are doing. Missteps this week risk triggering market dislocations.

It doesn't help that the concept of forward guidance on interest-rate policy is being discarded in favour of meeting-by-meeting data dependency. Something needs to fill this vacuum, so US Fed Chair Jerome Powell's keynote address on August 26 needs to clarify how much risk the US central bank is prepared to take with the economy to slay the inflation beast. It’s simplistic to say there’s a trade-off between growth and rising consumer prices, but any response to the current situation that doesn't at least attempt to square that circle won't hold.

At the European Central Bank’s forum in Sintra, Portugal in June, Powell admitted that "we now understand better how little we understand about inflation.” More candour is needed now on how the inflationary monster was so underestimated, and how far policy makers are willing to go in sacrificing growth — and jobs — to tame it.

The global central bank reaction to the pandemic prevented a major recession, but the stimulus was left in place for far too long. Super-relaxed financial conditions, roaring stock markets and asset prices ought to have given enough clues. To put it in military terms, mission creep combined with a lack of post-invasion withdrawal planning has led us here.

Powell was adamant in Sintra that failing to control inflation expectations posed a bigger threat than recession. In other words, interest-rate beatings will continue until consumer-price morale improves. But what does that mean for future policy? Where is the Fed’s pain threshold for choking off economic growth and causing unemployment?

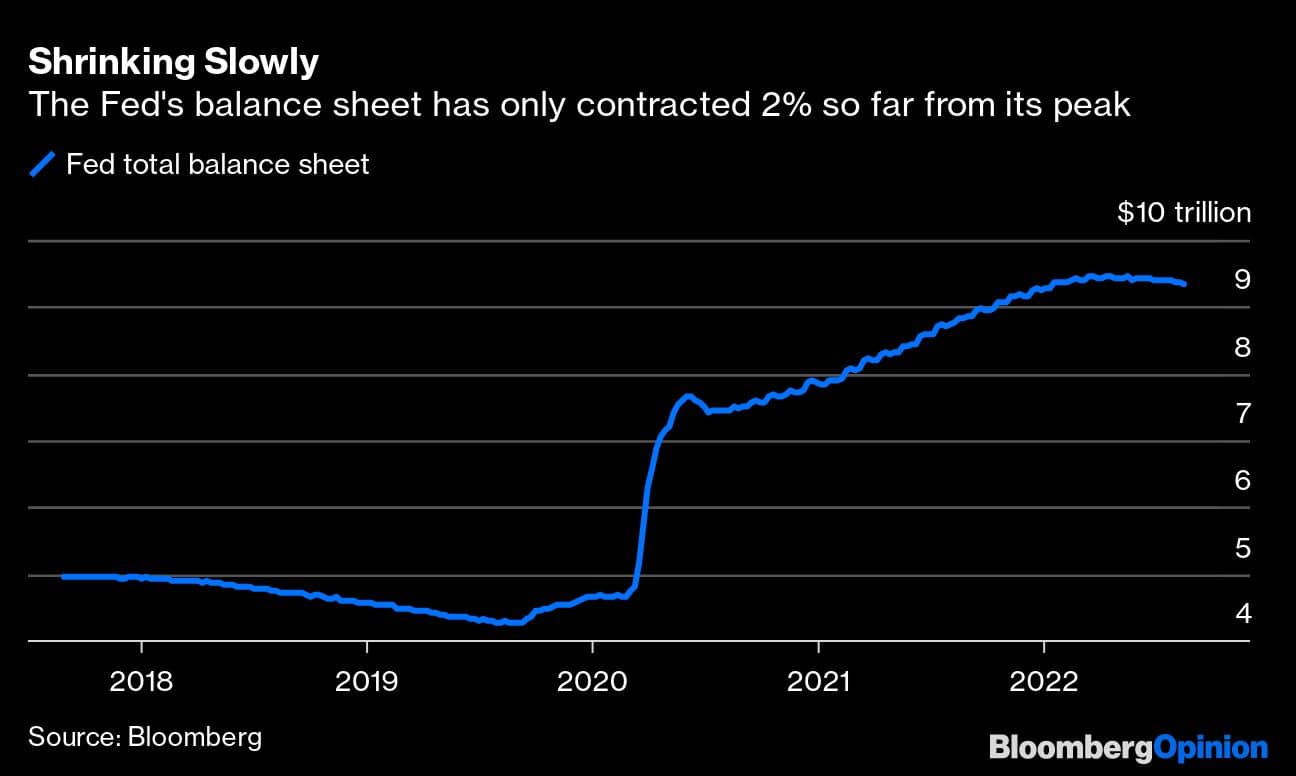

Graph

This is the third time the Fed has tried to scale back its balance sheet, with swift reversals following 2013's ‘taper tantrum’, and another U-turn in 2018 in the early days of Powell's tenure. Understandably, financial markets retain a sneaking feeling, based on every monetary authority reaction since the Global Financial Crisis, that central banks will revert to pumping stimulus back in if the stock market crashes or the economy stumbles.

The world has a too-strong dollar problem, fuelled by US rate hikes, and as the global economy struggles the surging greenback will become a drag on US growth, too. Reducing the amount of dollars in circulation, which the Fed is about to attempt by reducing its balance sheet by $1 trillion annually, comes with potential unintended consequences.

The Fed only stopped adding stimulus in March, when it also started raising official rates from near-zero. We’ve barely started tightening with only 2 percent of the quantitative easing purchases wound down. The risks of making further policy mistakes, by blithely skipping over the past, are high.

Traders and investors are banking on a dovish pivot. Rhetoric from Fed officials, even the supposed doves, has been strikingly hawkish, but it has yet to reset market expectations. The US economy is still in robust shape, bar some worrying signs from the housing market — but a glance across the Atlantic should give pause.

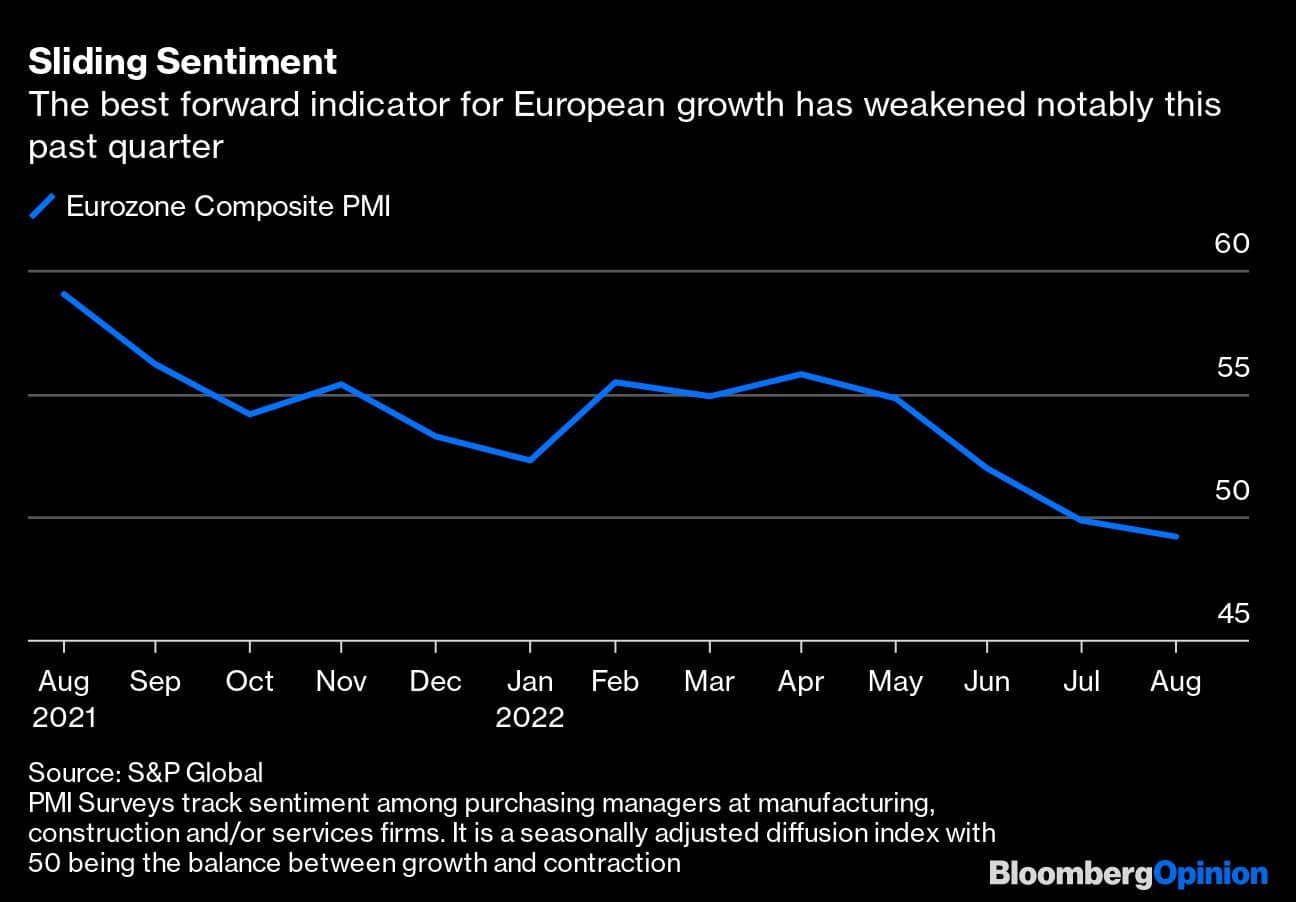

The ECB is in a worse quandary, faced with much lower growth and an inflationary surge driven by its energy dependency on Russia. Its governing council is not in a happy place, with Bundesbank President Joachim Nagel highlighting that German inflation is set to exceed 10 percent, and clearly hankering for faster stimulus withdrawal. The ECB only stopped adding stimulus in July, ending an eight-year era of negative interest rates. Yet the euro has fallen below parity with the dollar, its weakest level for 20 years. Recession warnings are flashing with the euro area composite purchasing managers' index dropping below the 50 level that divides growth from contraction.

Graph

ECB President Christine Lagarde is not attending Jackson Hole again this year, so eyes will be on her fellow executive board member Isabel Schnabel's participation in a panel discussion on August 27. In a hawkish interview with Reuters last week, Schnabel emphasized the risk of de-anchored inflation expectations, even if the euro area enters recession. She also mentioned the possibility of the ECB soon discussing a runoff of its 5 trillion-euro QE programmes. This comes as Italian 10-year yields are again around 3.7 percent, close to the danger zone where its debt burden becomes less sustainable.

The Bank of England is in a similar predicament to the ECB, with inflation already into double digits, and the added complication of fiscal policy having been tightened earlier this year but likely to be far looser in the coming months. Governor Andrew Bailey will be attending Jackson Hole but is not scheduled to speak. As the BOE is about to embark on active sales of its near $1 trillion of QE holdings, hopefully he will use his time to confer with his Fed counterparts on their experiences of raising borrowing costs at the same time as running down the balance sheet.

Taking back stimulus is tricky as money flows like water through the global system. Bond-buying programmes in the major economies had a knock-on stimulatory effect elsewhere, so the opposite must be a big risk as quantitative tightening gets underway in multiple regions. Now that it’s time to take away the punchbowl, let’s hope the unity shown between central banks during the pandemic is mirrored — but that needs to start with clear communication of what has gone wrong, as well as what needs to be done to fix it.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. Views are personal, and do not represent the stand of this publication.Social: Now that it’s time to take away the punchbowl, let’s hope the unity shown between central banks during the pandemic is mirrored:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.