Indonesia’s decision to ban the export of palm oil from April 28 could not have come at a worse time. Even before this ban, edible oil prices were trading at record prices, about 45 percent more than their previous highs in 2008 and 2011.

The hit is severe for India, the world’s largest importer of edible oil—specifically, palm oil and soya oil. Consumer price index (CPI) data show that the prices of edible oil and fat rose 19 percent year-on-year (YoY) in March, and 27.4 percent for the whole fiscal year 2021-22. The Indonesian palm oil ban may result in an immediate further 10 percent jump in prices, said Atul Chaturvedi, president of the Solvent Extractors association

Also Read | Government may cut effective import duties on crude edible oil further

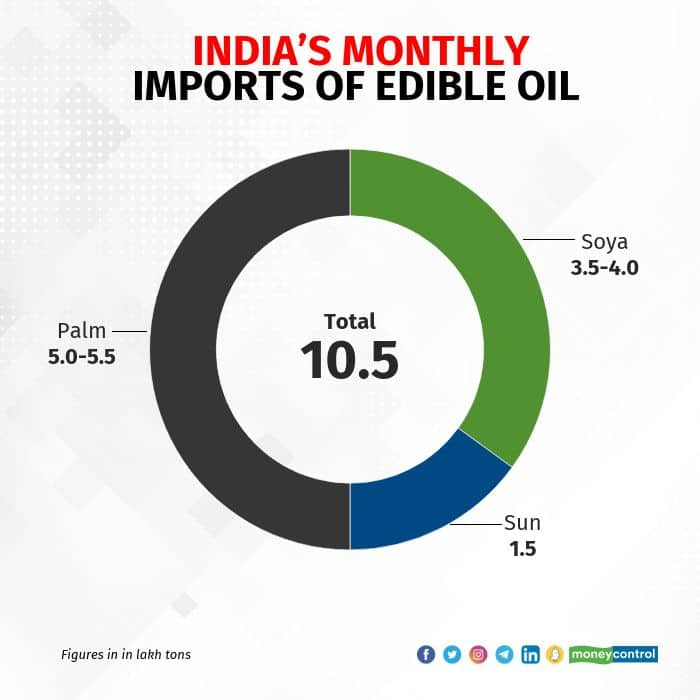

India imports about a million tons of edible oil a month and finished FY22 with an import of 1.3 million tons down from 1.5 million tons the previous year. Yet, India’s import bill for edible oil in FY22 jumped to Rs 1.4 lakh crore, up 72 percent from Rs 82,123 crore a year ago.

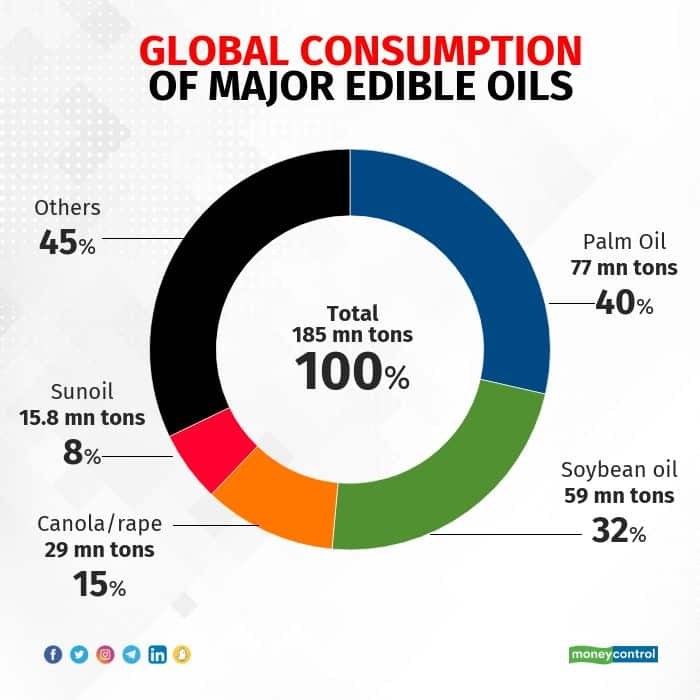

The Indonesian news has landed the global edible oil market in a perfect storm. Palm is the most consumed cooking oil in the world, accounting for 40 percent of global consumption, followed by soya oil at 32 percent and rape-mustard (or Canola) at 15 percent.

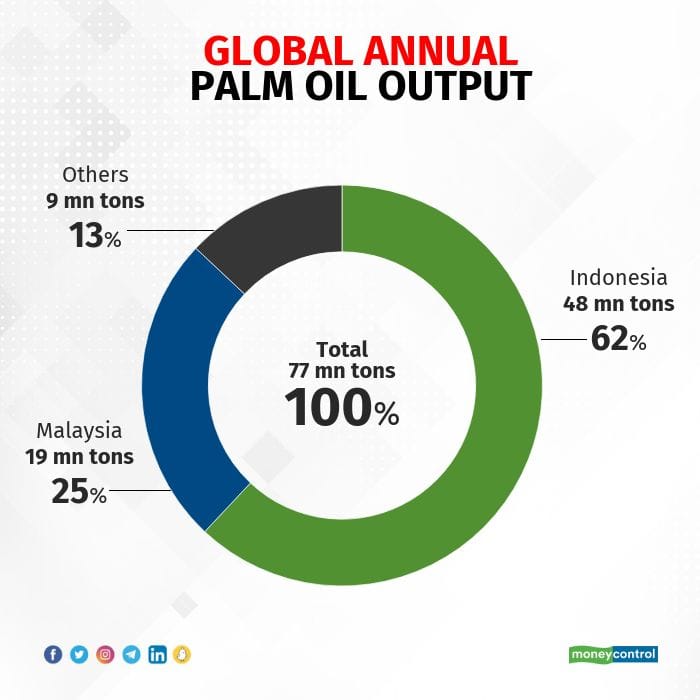

In the past 12 months, everything that can conceivably go wrong for edible oil crops has gone wrong. Palm oil output was hit for the better part of 2020 and 2021 in its largest growing areas of Indonesia and Malaysia due to unavailability of migrant labour thanks to Covid.

Argentina, the largest exporter of soya oil, reported a poor crop in 2021. It halted exports briefly, and then resumed after hiking its export tax to 33 percent from 31 percent. Canada and Europe, the largest producers of canola, reported crop damage. Thus, in February when Russia went to war with Ukraine - stopping sunflower oil exports, cooking oil prices were already at historic highs. The war and the sanctions made it worse.

Also Read | Listed consumer firms may face earnings risk after Indonesia ban on palm oil exports

The tragedy is that cooking oil inflation is coinciding with a general spike in the prices of crude oil and gas, as well as other commodities such as wheat, nickel, copper, palladium where Russia is the chief exporter. India’s CPI hit a 17-month high of 6.95 percent in March.

Hopes that the March CPI of 6.95 percent may be a peak were already dashed by the stickiness in crude oil prices. The latest spurt in edible oil due to the Indonesian ban may well mean that the worst is yet to come.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.