The reciprocal tariffs imposed by the US on all the countries have already brought gloom in the countries depending on it for substantial export of goods. The uncertainty about the future rate of tariffs for different countries will further dampen any appetite for investment in export-oriented sectors in India. For example, the General Secretary of the Communist Party of Vietnam, has already offered to reduce the tariff for import from US to zero. It means that the advantage Indian textiles and garment exporters were looking for may not materialise at all.

Shrimp

Among the agriculture and allied products, shrimp is a major item of concern for India.

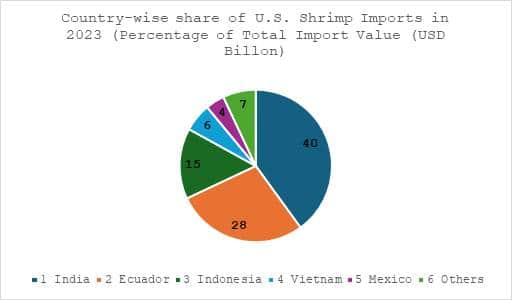

In 2023, US imported shrimps worth $ 6.6 billion. India’s export was $2.4 billion while Ecuador and Vietnam’s exports were $1.4 billion and $0.66 billion respectively. As a response to local marine industry demand, US had imposed anti-dumping duty of 2.49 percent and countervailing duty of 5.77 percent on imports from India. The reciprocal tariff of 26 percent for India will result in total duty of tariff of 34.26 percent.

For Ecuador, the reciprocal tariff is 10 percent, and countervailing duty is 3.78 percent. Thus, overall duty on import of shrimp from Ecuador will be only 13.78 percent.

At present, export of shrimp from Vietnam to US attracts highest duties. Anti-dumping duty is 25.76 percent while countervailing duty is 2.84 percent. With reciprocal tariff of 46 percent, the total duty comes to 74.6 percent. It will make Vietnam’s exports to US totally unviable. It is therefore no surprise that Vietnam has taken lead in offering zero tariff on imports from the US.

Source: FAO Globefish (as on 17/10/2024)

Source: FAO Globefish (as on 17/10/2024)

While exporters of shrimp would be having sleepless nights due to impending loss of business, there is a possibility that the consignments on the way may have to be offered at a lower price. The farmers and labour employed in the industry face an immediate threat to livelihood as the exports to US dwindle. It is possible that it will result in lower domestic prices. But the additional domestic demand may hardly compensate for reduction of export to US.

Rice

The US is not a rice eating nation, but it is still the 4th largest importer of rice in the world, with about 1.3 million tonnes of annual import.

At the same time, the United States exports 40–45 percent of its rice crop each year.

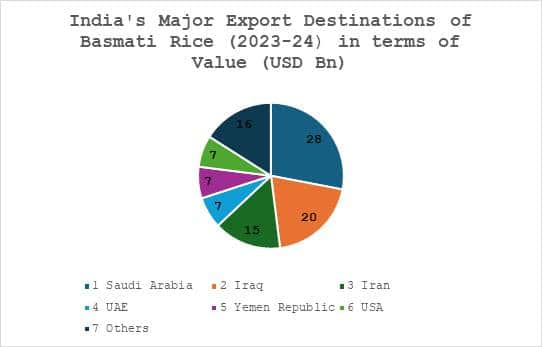

Import of rice into the US has been rising over the years and in 2022-23, about 25 percent of US market was supplied by import. About 60 percent of these imports are of aromatic varieties, jasmine from Thailand and basmati from India and Pakistan. India exports about 3 lakh tonnes of basmati rice to the US.

In 2023, US imported $1.41 billion of rice from all the countries taken together. Leading exporters of rice to the US were Thailand ($730 million), India ($376 million), Pakistan ($60.3 million), China ($44.9 million) and Vietnam ($30.8 million).

Due to high reciprocal tariff on these countries, it is possible that the US consumers may switch to domestically produced rice rather than basmati rice.

Major importers of Indian basmati rice are Iran, Saudi Arabia, Iraq and Yemen. With the threat of US war on Iran, there is a possibility that export to Iran may also go down.

Source: A Brief Report on Export of Rice by India, DGCIS, Kolkata, August 2024

Source: A Brief Report on Export of Rice by India, DGCIS, Kolkata, August 2024

Basmati paddy is grown in Punjab, Haryana, Uttarakhand and western Uttar Pradesh. In this scenario, the farmers may decide to reduce area under basmati paddy and go for non-basmati variety.

Agrochemicals

India has emerged as a significant exporter of agro-chemicals. In 2022-24, $1.47 billion of these were exported to US alone. With 26 percent reciprocal tariff, this export will become uncompetitive.

China is the largest exporter of agro-chemicals. Due to high tariff wall of US, Indian exports may have a new opening.

Summing up

The negotiations for a trade agreement with the US are not going to be easy. In India, there is great concern that opening of agriculture sector for import from US will adversely impact the livelihood of a vast majority of farmers and those who depend on the agricultural operations. The lobbies of US producers of several crops, like wheat, soybean and maize, see India as an export market of future. Minimum Support Price (MSP) operations have been questioned by members of US Congress several times in the past. So, our policy makers will do well not to downplay the threat posed by the tariff of 26 percent tariff on Indian goods.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.