The COVID-19 pandemic has sharpened existing inequalities, and one of the divides that has grown is the gender-gap. Data from the World Bank last year revealed that women-owned businesses were 5.9 percentage points more likely to have closed than male-owned businesses. Results from small-sample surveys conducted in India are indicative of the higher stress faced by women entrepreneurs. For instance, a report published in 2020 showed that almost three-quarters of women-led businesses reported cash shortages, compared to half of male-led businesses.

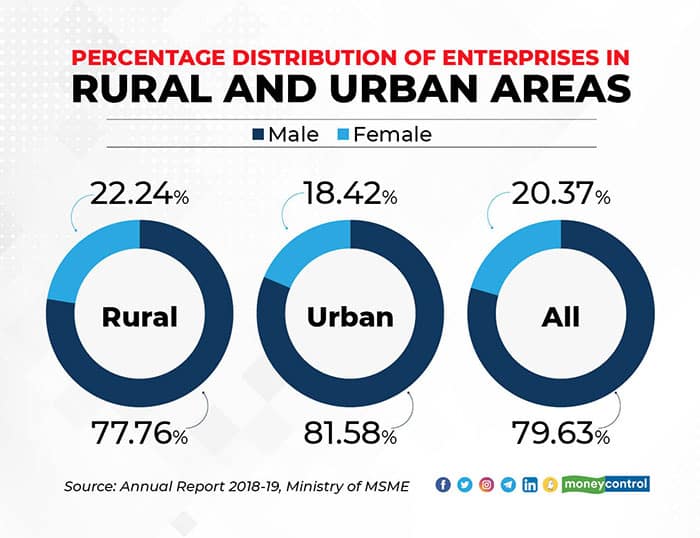

The pandemic has only exacerbated the challenges that women face in India. The female labour participation rate has been dropping for decades, and in 2015, we were ranked 70 out of the 77 countries measured by the Global Entrepreneurship Development Institute’s Female Entrepreneurship Index. In a male-dominated society as ours, women find it even more difficult to start and operate a business. Around 20 percent (See Table 1) of Indian MSMEs are owned fully or partially by women, as per the NSS 73rd round in 2015-16; this is lower than the global average of 33 percent share. In India, women entrepreneurs face a rejection rate of 19 percent by lending institutions, this is more than twice the rate of 8 percent for men.

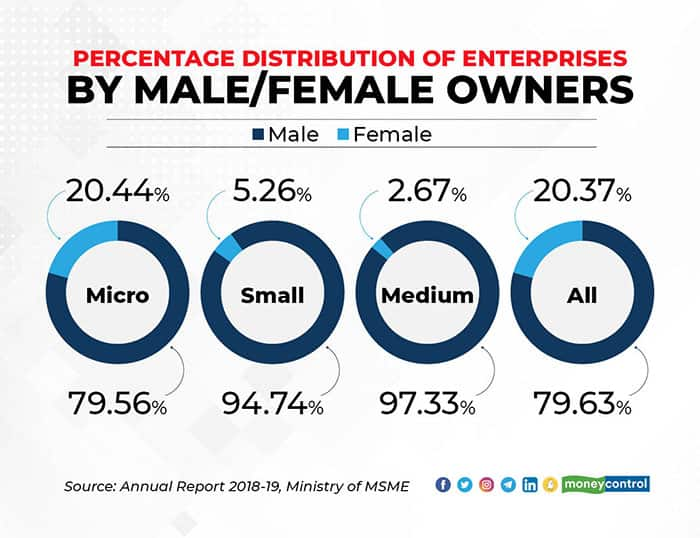

The problems are well-known for Indian women with low social mobility and high burden of family and home care being the main barriers that impact all aspects of work. Women are more likely to be setting up micro-units (see Table 2 below) and while small businesses find it difficult to scale up, it is much more challenging for a woman to grow the business. No wonder then, that the 2020 report mentioned earlier year showed women entrepreneurs reporting higher stress of increased household conflicts and managing household expenses, compared to male entrepreneurs. Interestingly, and this is crucial for policymakers, despite the higher stress, women entrepreneurs were more optimistic of their business recovery than men, with half reporting a shift in business by adding different products and services.

Source: Annual Report 2018-19, Ministry of MSME

Support from the government has been coming through in many ways for easy access to working capital and training for women entrepreneurs. The Mudra loan scheme, for example, has been effective for women — in its first five years since 2015, 68 percent of the loan accounts were for women beneficiaries. Then there are other schemes such as the Trade Related Entrepreneurship Assistance and Development (TREAD) scheme for women from the Ministry of MSME, the Women Entrepreneurship Platform of NITI Aayog and SIDBI, the Mahila Udyam Nidhi Scheme from SIDBI, etc.

However, one of the key findings from the LEAD-IWWAGE survey last year was that while almost 90 percent of the women reported awareness of government schemes, almost 60 percent of them had not applied for any scheme. In fact, schemes with the highest offtake were the ones with direct transfers, like cash transfers to the Jan Dhan accounts and PM Kisan, which did not need applications.

The biggest barrier to applying for the schemes was the complicated processes, including the paperwork, documentation and not understanding the eligibility conditions. This corroborates with the fact that the highest share of women beneficiaries in the Mudra scheme are in the Shishu, the smallest category, which have been disbursed through the MFIs, indicating that trusted channels such as self-help groups (SHGs) give effective support.

What is needed is a gender-lens in all schemes and processes. For instance, greater use of SHGs will help connect rural women entrepreneurs to the banking system and offering collateral-free loans will help women who typically lack assets in their name. In some states such as Chhattisgarh, the State Rural Livelihood Missions are engaged in digitising SHGs to empower women with access to digital banking.

Industry associations can complement the Ministry of MSME and SIBDI’s efforts by providing outreach and giving assistance with government schemes and processes. Reservation of space in industrial areas is another good step. Maharashtra was the first state to bring in an Industrial Policy in 2017, blocking 5 percent in all MIDC area for women entrepreneurs. This must be taken forward systematically to carve out an area within the industrial zones, to provide a safe space with all facilities and services such as crèche and help desks for women entrepreneurs and employees.

Such a move will help women entrepreneurs scale up and think beyond the typical household based, micro units they are usually involved in. For a country that aspires to climb up two-three ranks to become the third-largest economy by nominal GDP, increased participation of women in enterprise ownership is an imperative.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.