The tax system of a country is the art of the possible and not the optimal. India's Goods and Services Tax (GST) system that turns five on July 1, was the outcome of a difficult negotiation between the Centre and the states.

Has it been worth the transition pains for businesses and the political capital spent on Centre-state tussles?

A tax system is judged by its efficiency in collecting higher revenues without hurting economic activity. The GST collections have been higher than Rs 1 trillion for the past 11 months. The latest GST revenue figure (for May 2022) came in at Rs 1.41 trillion, lower than the April figure of Rs 1.68 trillion, but it was nevertheless a jump of 44 percent over May 2021.

The average monthly GST collection in FY22 has been Rs 1.23 trillion, a 30 percent jump over the FY21 monthly average of Rs 0.94 trillion. While a part of this robust performance of GST revenue could be explained by factors other than tax efficiency, like a low base (FY21 being the pandemic-affected year), and high inflation (higher prices allow the value of tax revenues to be high, thanks to an inflated nominal income base), an analysis of a longer time period of tax collections provides more clarity.

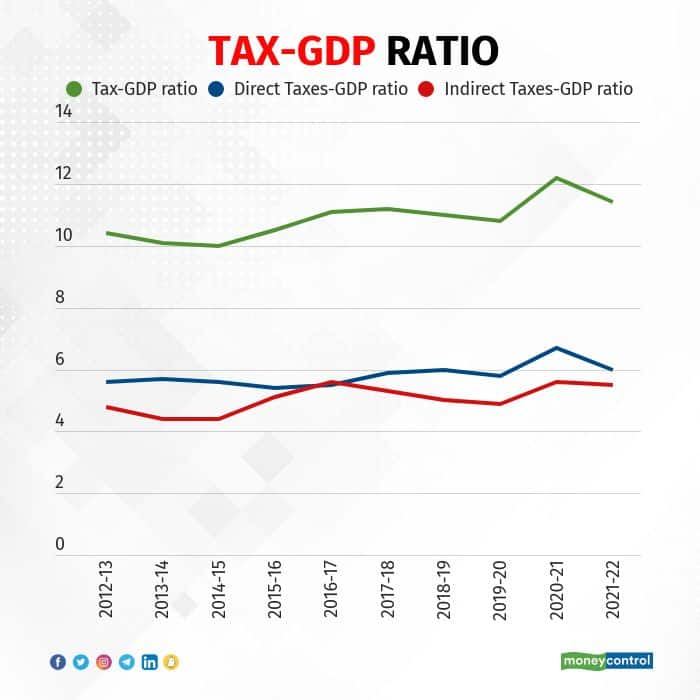

Tax-GDP Ratio

The efficiency of a tax system can be measured by the tax-GDP ratio i.e. tax revenues as a share of the GDP. Comparing the five-year average tax-GDP ratio before and after the GST's introduction, we find it increased from 10.4 percent to 11.3 percent (considering gross revenues of the Centre). Excluding the turbulent years of demonetisation (FY17) and COVID-19 (FY21) — both were years of high tax revenues — there was still an increase in the tax-GDP ratio from 10.2 percent to 11.1 percent after GST.

The tax-GDP ratio of 11.4 percent in FY22 is the highest since FY08 (excluding the pandemic year of FY21 when it crossed 12 percent). This shows that a higher amount of taxes are being collected out of the economy's income since the GST's launch. When we look at direct and indirect taxes separately, it turns out that the tax-GDP ratio for both have improved.

The five-year average of direct tax-GDP ratio rose to 6.1 percent after 2017 compared to the previous average of 5.6 percent. The five-year average of indirect tax-GDP ratio is 5.3 percent since 2017, up from 4.9 percent earlier. Clearly, it is not only the GST that has helped revenues but a slew of other measures like digitisation, demonetisation, corporate tax cuts, and higher investments that boosted both direct and indirect tax collections.

Can an increase in the indirect tax-GDP ratio by less than half a percentage point justify the costs incurred by the government and businesses, particularly smaller firms, in adopting the GST?

The benefits of any tax reform should not be seen in terms of government revenues alone, but through wider implications for the economy. There, the GST may have done more than it has delivered for the Department of Revenue. First, as the GST avoids the problem of cascading effect of taxes, any increase in the rates (such as on garments, textiles and footwear in January) would have lower effect on prices than was the case before.

The five-year average inflation rate post-GST is just 4.7 percent compared to 6.9 percent before 2017. The stability of prices in India in the recent years can be partly attributed to the GST apart from the RBI's inflation targeting and the government's fiscal prudence.

Second, there has been increasing formalisation of the economy as seen in the rapid rise in enrolments in the Employees' Provident Fund Organisation (EPFO). Third, there is more transparency in the taxes paid by consumers on their purchases. One look at a printed bill is enough to understand the tax rate, and the split between the Centre and the state.

Some of the above benefits are impossible to quantify, and there is hardly any rigorous research on the effects of the GST on the Indian economy. What makes it difficult to isolate the GST's impact is that this reform has been concomitant with inflation targeting, demonetisation, and digitisation. But it is clear that the GST alone cannot be credited with any of the positive effects as it is one among a package of reforms initiated by the government to improve the productivity of Indian businesses.

Going forward, the government must simplify the GST return filing and refund processes so that smaller businesses do not find it a burden. The calls for reducing the number of rates to bring simplicity need to be weighed against the importance of tax rate progression in a country with high income inequality.

Rudra Sensarma is Professor of Economics, Indian Institute of Management Kozhikode. Twitter: @RudraSensarma. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.