The COVID-19 pandemic continues to challenge central banks. When the pandemic struck and economies nosedived, the pressure was on central banks to rescue and sustain the economy. This led to a quick opening of liquidity floodgates to keep the economy humming. A year later fortunes have changed. And now a rise in inflation has put pressure on central banks to tighten the hosepipes they opened last year. How do central banks cope with this sudden change of events?

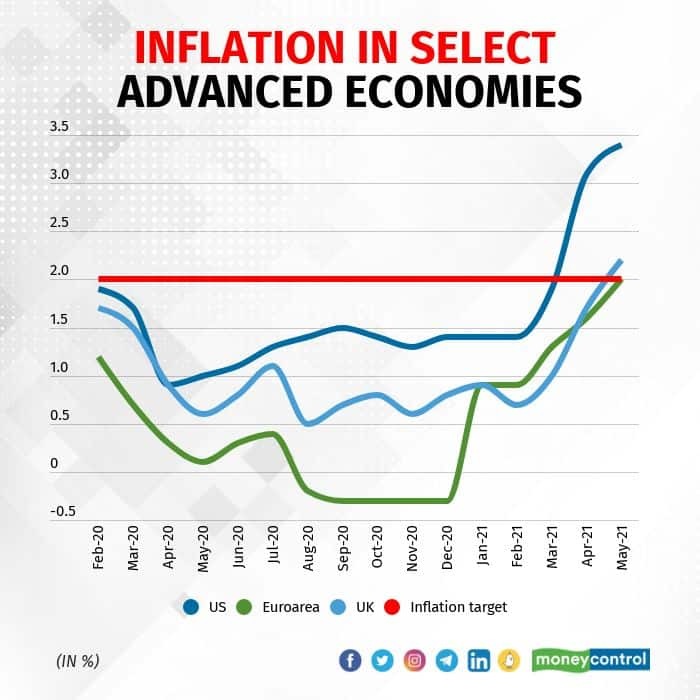

The accompanying graph pictures this turnaround of fortunes in a few selected advanced economies. We see that since the pandemic in February 2020, inflation in these economies which was already lower than the target of 2 percent, started drifting even lower. The low inflation indicated low demand which was because of global a slowdown as policymakers imposed lockdowns that curtailed economic activity.

From Jan 2021 onwards, we see rise in inflation because of stronger recoveries in economies and partly because of the base effect. In its June 2020 outlook, the International Monetary Fund had projected the world economy and advanced economies to shrink 4.9 percent and 8 percent respectively in 2020. Since then, IMF has upgraded its forecast in subsequent outlooks. In the recent July 2021 outlook, it said the world economy and advanced economies contracted 3.2 percent and 4.6 percent in 2020.

Central banks have come under pressure due to this sudden rise in inflation. However, so far they have stayed away from tightening monetary policy. The catchword for central banks regarding inflation is ‘transitory’ as seen in recent monetary policy statements of Federal Reserve, European Central Bank and Bank of England. IMF’s July outlook also used the same word.

Why aren’t central banks worried? There are multifold reasons.

First, central banks actually will be happy with inflation being higher than target. For nearly a decade now, the inflation in developed countries has been lower than targeted leading to criticism. This was obviously ironical as central banks are often criticized for higher inflation. The Federal Reserve even tweaked its framework from inflation targeting to average inflation targeting (AIT). Under AIT, if inflation has been lower for a certain period, the Federal Reserve will allow inflation to be higher so that average inflation over the entire period to be 2 percent.

Second, there is still slack in the economy and growth and unemployment are still not at pre-pandemic levels. This requires continued support from central banks.

Third, inflation has risen due to supply chain disruptions which are gradually easing with rising vaccinations and normalcy.

Fourth, commodity prices have also played a role in the recent rise in inflation. Core inflation, which excludes fuel and food prices, is high only in the case of the US.

Fifth, high inflation is also on account of the base effect. The chart shows that inflation ebbed in Feb 20 and then begins to rise in Feb 21 (For the Euroarea, in December). So, even if the inflation index has increased marginally from Feb 2021, the change from last year will be magnified as index had dipped last year. This is the base effect. As a result, IMF in the July 21 outlook notes “the current spikes in annual inflation in part are the result of mechanical base effects from last year’s low commodity price”.

Last but not least, is the important factor of inflation expectations. If inflation expectations also go up, then central banks poise themselves for action. In the US, while survey-based inflation expectations have edged up, those tracked by financial markets have remained close to the inflation target. In Europe and UK, inflation expectations are broadly anchored.

Having said that, if current inflation remains elevated, inflation expectations will also inch up creating concerns for central banks.

Coming to Emerging and Developing countries (EDCs), inflation has risen there too. Unlike developed countries, EDCs are never in a comfortable position on the inflation front as food prices have both higher weightage in the inflation basket and influence inflation expectations.

On the top of it, EDCs will also be watching inflation trends in developed countries. If inflation continues to go up in developed world, pushing central banks to tighten monetary policy before expectations, one could see capital outflows from the EDCs. This is what we saw in 2013 when Fed chair Ben Bernanke just announced the possibility of tapering policy leading to tantrums and chaos in EDC markets.

To sum up, inflation seems to be back after being in the wilderness for more than a decade. Ever since the 2008 crisis, economists have been divided on inflation in two camps. The pessimists have constantly warned that inflation is around the corner. On the other hand, the optimists have suggested that central banks need not worry about inflation and should instead focus on growth.

When inflation had remained muted, the policy weight was towards the second camp. The virus shock has brought inflation back to the discussion. Developed country central banks may not be worried over inflation now, but for how long is yet to be seen.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.