India’s economic activity witnessed an expected acceleration in the first quarter (Q1) of FY2024, with the GDP expansion in constant terms rising to 7.8 percent from 6.1 percent in Q4 FY2023, partly on account of a supportive base. While the headline print was in line with consensus expectations, it trailed our own estimates. Moreover, the internals for the expenditure side were not very convincing.

For instance, as per the data released by the National Statistical Office (NSO), India’s net exports (goods and services) deteriorated to -2.3 percent of GDP (at current prices) from -1.6 percent in Q4 FY2023, but were lower than the -3.8 percent in the year-ago quarter. We believe that this figure is likely underestimated and the drag on GDP on account of net exports is likely to have been larger.

We understand that the NSO uses the merchandise trade data provided by the Ministry of Commerce and Industry and the provisional monthly services trade data provided by the Reserve Bank of India (RBI) to compute the aggregate trade numbers for the latest quarter, as the Balance of Payments (BoP) data is typically released around a month after the GDP data for that quarter. Consequently, the aggregate export and import numbers used in the quarterly GDP dataset are revised later to incorporate the BoP numbers. This is reflected in similarities in the historical trends in net exports as per the revised NSO and the BoP data; as a proportion of GDP at current prices, the difference in net exports from these two datasets has largely remained mild, at below 0.1 percentage points.

Deviation in trade data

Exports and imports are typically higher on a BoP basis than the corresponding initial prints released by the Ministry of Commerce and Industry, with the deviation in imports being much larger, on average, vis-à-vis that seen in exports, which typically warrants the revisions in the net exports print for the latest quarter. ICRA estimates the drag from net exports at -2.8 percent of GDP at current prices in BoP terms in Q1 FY2024, ~0.5 percentage points larger than the NSO’s estimate for that quarter. Consequently, we expect the net exports data for Q1 FY2024 at current prices to subsequently be revised downwards by the NSO. This would result in a likely revision in the net exports figures in constant price terms as well.

Interestingly, after displaying a similar trajectory in the recent past, there was a material variation in the trend seen in the share of net exports in GDP, in constant vs current price terms in Q1 FY2024. The former fell quite sharply to -6.4 percent in Q1 FY2024 (the lowest level since Q3 FY2013) from -0.1 percent in Q4 FY2023, even as the latter witnessed a relatively modest dip to -2.3 percent from -1.6 percent in Q4 FY2023. This divergence was driven by the unusually large gap between the deflators used for deriving values for aggregate exports and imports at constant prices.

While the deflator for exports was +7.2 percent year-on-year (YoY) in Q1 FY2024, that for imports was -15.2 percent in the quarter. The latter pushed up the YoY growth in imports at constant prices to 10.1 percent in Q1 FY2024 (vs a contraction of 7.7 percent in exports at constant prices) as against the contraction of 5.1 percent in imports at current prices, leading to a sharp widening in net exports (at constant prices).

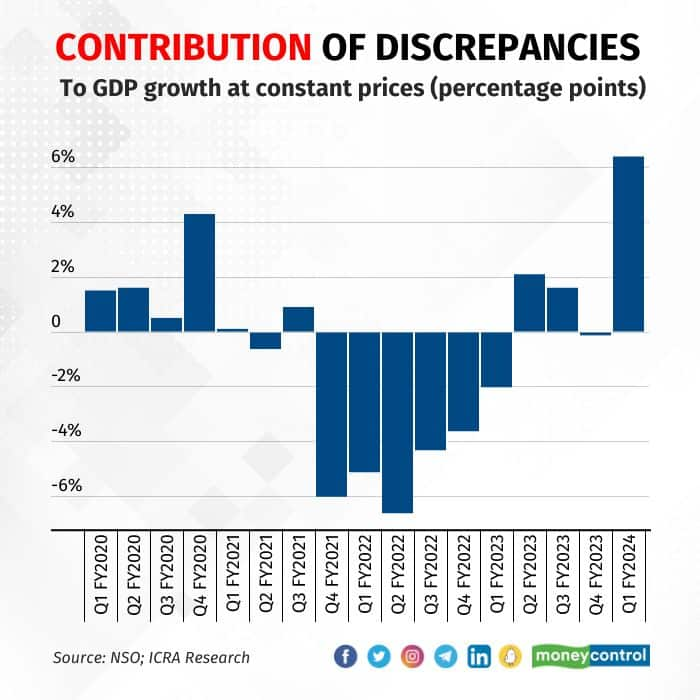

Explaining the discrepancies print in the GDP data has been a persistent conundrum. This item, which refers to the residual that remains after disaggregating GDP into its expenditure components such as private final consumption expenditure (PFCE), government final consumption expenditure (GFCE), gross fixed capital formation (GFCF) and net exports, widened quite sharply to +2.8 percent of GDP (at 2011-12 prices) from -2.9 percent of GDP in Q4 FY2023. This contributed as much as 6.4 percentage points to GDP growth (at constant prices) in Q1 FY2024 after exerting a marginal drag of 0.1 percentage points in the previous quarter, as the print turned positive after remaining in the negative territory for the last eight quarters.

The high discrepancies print suggests that the absolute values for the expenditure side components for Q1 FY2024 are likely to undergo an upward revision in the future. This may manifest in a higher or lower growth in such components, depending on the extent of revision in the year-ago data. The quarterly growth rates of the GDP components such as PFCE and GFCF have typically undergone revisions for the past quarters. For instance, the growth of PFCE has been revised upwards in five of the last eight quarters, while that of GFCF has been raised in three quarters for the same period, with respect to their initial estimates.

Overall, based on an expected larger drag from net exports and high discrepancies in the Q1 FY2024 GDP data, we believe that PFCE and/or GFCF may report an upward revision, assuming the GDP growth is kept unchanged at 7.8 percent. Accordingly, these components are likely to have fared better than what is suggested by their moderately healthy initial YoY growth estimates of 6.0 percent and 8.0 percent, respectively, for the quarter.

Aditi Nayar is Chief Economist and Head - Research & Outreach, ICRA. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.