Rashmi Das

On April 22, Reliance Industries Ltd (RIL), its subsidiary Jio Platforms Ltd (JPL) and Facebook Inc (FB) signed binding agreements for an investment of Rs 43,574 crore by FB for a 9.99 percent stake in JPL. Concurrently, JPL, Reliance Retail Ltd (RRL) and FB’s WhatsApp have also entered into a commercial partnership agreement. Under this agreement, WhatsApp will further accelerate RRL’s new commerce business on the JioMart platform while JPL/RRL will support small businesses on WhatsApp. It benefits both the groups.

The deal values JPL at Rs 4.62 lakh-crore, pre-money. JPL is a new company and was incorporated on November 15, and Reliance Jio Infocomm Ltd that provides telecommunication services has been brought under it. The creation of a new company may have been triggered due to Supreme Court’s October 24 judgment on AGR (adjusted gross revenue) in 2019, following which it has become imperative for companies to segregate revenues flowing in from non-licensed telecom services and put such operations under a separate company.

Reliance Jio has nearly 400 million mobile users, at par with FB’s numbers of about 400 million on WhatsApp, Facebook and Instagram. Most of these subscribers are overlapping. Many FB users are subscribers of Jio’s rivals (Bharti Airtel and Vodafone Idea) to whom Jio’s other services can be extended. This way, Jio gets another channel to promote its other digital services to the customers of its competitors.

The entire deal appears to be focussed on e-commerce business and e-payment services in the near term. RRL already has over 10,900 retail stores in more than 6,700 cities and clocked a turnover of Rs 1,30,566 crore and EBITDA (earnings before interest, taxes, depreciation, and amortisation) of Rs 6,201 crore in FY19. It employs over 1,25,000 people. It has 100 million loyalty members and serves more than 5 million people every week.

The group is in the process of launching its marketplace, JioMart. It will allow millions of local retailers and kirana merchants to list their products on the portal and sell them to customers. It is currently under trial in select areas of Maharashtra — Navi Mumbai, Thane and Kalyan.

WhatsApp is already active in connecting small businesses in India. Many small businesses are already using WhatsApp Business to promote their offerings, take orders from clients and get their feedback etc.

Both Facebook and Jio will work closely to ensure consumers are able to access the nearest kirana stores that can provide products and services to their homes by transacting seamlessly with JioMart using WhatsApp.

Both have their own payment apps. WhatsApp has WhatsApp Pay, which was launched in February 2018 in India on a trial basis. Payments through WhatsApp were introduced to about 1 million users under a partnership with ICICI Bank. On February 7, 2020, WhatsApp received the National Payments Corporation of India’s (NPCI’s) approval to roll out its digital payment service in a phased manner. The NPCI approval follows the Reserve Bank of India’s (RBI’s) go-ahead on the condition that it will comply with the data localisation norms.

Reliance already has its own payment app, JioMoney.

The deal gives enough leverage to JioMart to effectively compete with well-established and equally deep-pocketed Amazon and Walmart (Flipkart) in India. However, the duo have been accused of often violating existing FDI (foreign direct investment) norms, which prohibit interference in pricing of the products and services for marketplace players. It is said that they enter into secret deals with the suppliers/traders and offer deep discounts of high-moving products, thus killing the business of brick-and-mortar shops, who cannot match or better the prices offered on marketplaces.

It will be interesting to see how JioMart deals with such ‘illegal’ competition. However, it appears that a swadeshi model of e-commerce is before the nation, where more than 90 percent is with the Indian group. Going by the Reliance group’s philosophy, it will compete on price with efficiency and volumes, yet make sufficient profits to run the show. It is not likely to interfere in the pricing of products and leave it entirely to the market forces.

Millions of kirana stores are likely to become part of this marketplace model and reap benefits of scale and convenience for their customers of home delivery. They can be the actual beneficiaries, and not companies with alleged doubtful credentials as were found with Amazon and Walmart. This will set an example of how, with clean practices, both physical and digital retail can co-exist and flourish.

About 75 percent of the $1.2 trillion retail market in India is still in traditional mode while 18 percent is organised retail, and the balance 7 per cent is e-commerce. A large part of the traditional retail is for groceries, estimated at about $700 billion. This is likely to grow 10 percent annually. Even if a 20 percent of this is targeted in the next two years, it is a huge opportunity.

With this monetisation of digital assets, RIL can also deleverage its balance sheet and can aim to be a net debt-free group by March 2021. As on December 31, the group’s debt stood at Rs 1,53,100 crore.

Jio is progressing well on its mission: Carriage, Content and Commerce. The deal will also enhance the valuation of its partnership with FB in case it decides to go public. At a time when COVID-19 has brought about worldwide business gloom, this is a feel-good tiding.

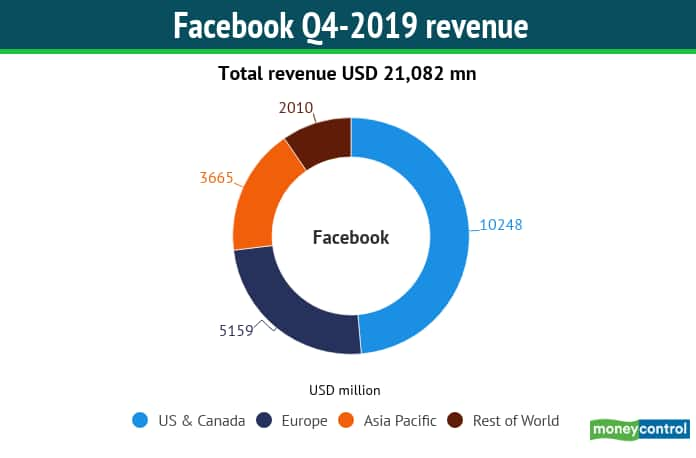

In the process, FB can also recover its investments. Currently, though more than half of its subscribers are in the Asia-Pacific region, its revenue is only 17.38 percent from the region (see table).

The deal can trigger consolidation and better regulatory behaviour in the marketplace. We can also expect both Amazon and Walmart to come under tighter scrutiny over the issue of FDI violations. On the other hand, cleaner practices will mean sustainability of retail. Young educated professionals will be prompted to engage in this field and become entrepreneurs — thus creating more jobs.

Rashmi Das is Editor, Telecom Live. Views are personal.

Disclaimer: Reliance Industries Ltd., which also owns Jio, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!