CNBC Awaaz

November’s sharp rally in stock prices of debt-laden Vodafone Idea Ltd and Bharti Airtel Ltd may have gone beyond fundamentals, analysts say, given the fact that the much-anticipated government-backed move to pull up rock-bottom call rates is no longer on the horizon. Vodafone Idea surged 78 percent this month to Rs 6.93 and Bharti Airtel gained 18.9 percent to a fresh 52-week high in November.

The government and the Telecom Regulatory Authority of India are no longer batting for raising the world’s lowest call and data rates, concluded a meeting between the regulator and the four players in the beleaguered sector. It was left to Vodafone Idea, Bharti, Reliance Jio and Bharat Sanchar Nigam Ltd to thrash out their pricing among themselves. Mumbai-based Jio and state-run BSNL aren’t keen to raise tariffs unless there is a government fiat, analysts say.

“We will not intervene,” an official from the Telecom Ministry told CNBC Awaaz. “Companies have already decided to raise call rates and they will do it themselves.” TRAI, too, concurred. The regulator can only move ahead on tariffs if there is a written request from service providers and that has not happened. The move to put a floor on prices would be “anti-competitive,” said the official. As a consequence, the government put in cold storage its plan to set up a committee of secretaries to suggest price hikes for the sector. This is bad news for both Bharti and Vodafone Idea as the markets were hopeful that tariffs would rise after a decade of hyper competition, one Mumbai-based telecom analyst told Awaaz.

New Delhi-based Bharti Airtel’s second-quarter loss surged to Rs 23,045 crore after it made a provision of Rs 28,450 crore – dues that the mobile operator has to pay to the government in pending revenue share, fines and interest. Bharti and Vodafone lost a 15-year battle with the government in the Supreme Court in October. The top court directed both companies to pay a whopping Rs 88,000 crore to the government within three months consisting of licence fees, penalties and interest. Vodafone and Bharti had not provided for this contingent liability in their balance sheets. As a consequence they approached the government and the Supreme Court to provide relief.

First you, then me!

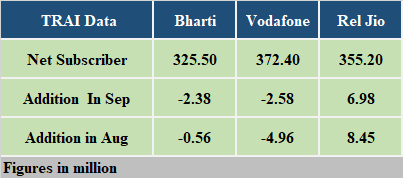

All four players – Bharti, Vodafone, Reliance Jio and BSNL – may actually look at each other to take the lead in raising prices. It is unlikely that anyone will make the first move as that may prove to be a costly mistake. Already, users are migrating to Reliance Jio’s top-end network, available at lower prices, from Bharti and Vodafone, industry data from TRAI show. Jio launched its services in mid-2016 and has since then gained nearly a third of the market share in a sector having more than 110 crore users.

Airtel’s outstanding dues to the government stand at Rs 35,600 crore and Vodafone has to pay a total of Rs 53,000 crore.

“For Vodafone Idea to be a going concern – with its balance sheet most stressed – our analysis suggests tariff hike needs to be steep enough to raise Vodafone’s ARPU (average revenue per user) by about 70 percent just to make operations sustainable,” Axis Capital said in a recent report. “Cash generation for debt repayment would require further improvement in ARPU. Price hike of this magnitude is likely to be spread over 12-24 months.”

Vodafone Idea’s existing subscriber base stands at 37.24 crore users and the company collects an ARPU of Rs 107 a month, according to Axis Capital. A 70 percent rise in call rates is not feasible as stronger players such as Bharti and Reliance Jio will not raise rates in a bid to attract top paying users from Vodafone. Therefore, the likely scenario is that Vodafone Idea will get into a downward debt spiral and approach the National Company Law Tribunal to have its debt restructured, said an analyst.

Bharti Airtel may actually be salivating at this prospect as Vodafone’s technological backend and product offerings are similar to Bharti. There may be a chance that users may shift en masse to Bharti.

Analyst Chris Hoare of Newstreet Research believes the government is unlikely to provide major relief to Vodafone and Bharti as it is likely “to be accused of transferring value to foreign shareholders and Indian billionaires by such a move”.

Hoare goes on further to state that Vodafone’s “market share drops rapidly over the next 12 months as the company enters bankruptcy. We assume 60 percent of VIL’s customers migrate to Bharti and 40 percent to Jio.”

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.