Madhuchanda DeyMoneycontrol Research

AU Small Finance Bank had a dream listing. The stock scaled a high of Rs 724 (up 102 percent from its issue price) before correcting by 25 percent. The stock, nevertheless, is still at a 51 percent premium to its issue price.

The first quarterly update was eagerly awaited. While the business looks to be in fine fettle, it is going to be a slow and careful journey to convert into a full-fledged retail bank. The market appears to have priced in the “most optimistic” scenario in the current valuation. Hence, AU becomes one more candidate where investors have to monitor results closely, as the stock is priced to perfection.

It is not a high ROA NBFC any more

The transition pangs of an NBFC (non-banking finance company) to the bank was evident. The result of AU has to be seen in light of the low-yielding liquidity that the bank is maintaining to comply with the statutory requirements and up-fronting of costs as it expands its network. Consequently, the return on assets has moderated to a level of 1.7 percent. While gradual diversification of lending on the asset side and building of a low cost retail based liability should push up the return on assets, it would be amateurish to assume that AU would ever revert even closer to the days of high ROAs that it enjoyed in its NBFC avatar. Hence, we are circumspect about the sustainability of the steep valuation multiple.

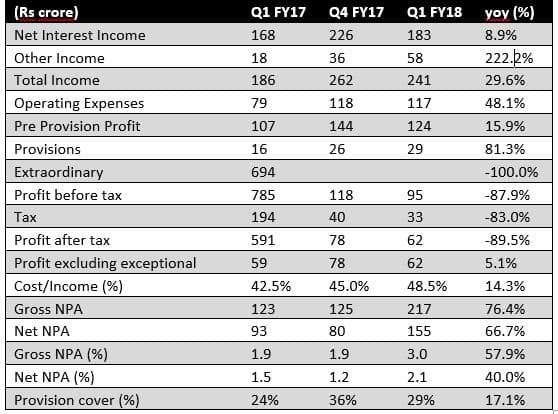

Result at a glance

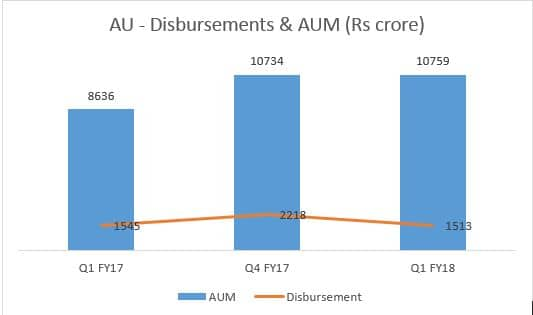

It would be premature to infer much from the result as the bank commenced commercial operations from April 19, 2017 and had barely 55 working days in the quarter. Growth numbers were expectedly muted. Disbursements de-grew by 2 percent and margins declined by 240 basis points to 5.1 percent. Consequently, the net interest income (difference between interest earning and expenses) posted a modest growth of 9 percent.

Other income that showed a steep uptick in the quarter got Rs 22 crore boost from liquid mutual funds (thanks to the surplus liquidity it is carrying) and Rs 11 crore from bad debt recovery.

Operating and employee expenses had a predictable uptick. However, it is reassuring to hear from the management that the cost-to-income ratio will be more or less stable at the current level.

Provisioning saw 81 percent increase that led to a muted 5 percent growth in after-tax-profit.

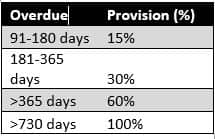

Asset quality

To comply with the asset quality recognition norms of a bank, AU has moved to recognising bad assets on a 90-day past due basis. Consequently, there was a sequential addition of Rs 92 crore to gross NPA (non performing assets). The bank also decided to adopt a slightly aggressive provisioning policy. The management mentioned that in addition to the regulatory diktat, there was a bit of seasonality in the slippages (normal phenomenon in the first half), that should improve in the second half on the back of good monsoon. The annualised credit cost stands at 1.8 percent.

What are the positive takeaways?

The bank has a decent distribution network with 284 branches, 119 asset centres, 23 offices and 251 ATMs in 11 states and 1 Union Territory. It understands its core markets well which should benefit the asset as well as the liability book, going forward.

The ramp-up has already kicked off. The bank has garnered Rs 815 crore of deposits (with 61 percent low-cost CASA) in the first quarter itself. With most large banks now cutting deposit rates on savings deposits, it makes life simpler for AU as it offers 6 percent on its savings bank balance. Hence, garnering CASA (current account & savings account) may be a lot easier, without much pressure on margin as long as it continues to deploy the money in high-yielding assets.

The bank is well capitalised, with capital adequacy ratio of 19.9 percent (Tier I 18.9 percent) that can take care of medium term growth objectives.

What should we be monitoring closely?

First and foremost, the growth in disbursements. The premium valuation the bank enjoys is on account of a superior track record of growth with high margin and decent asset quality. The journey from Rs 10,000 crore to Rs 20,000 crore of assets under management (AUM) will have to be evaluated on all the three parameters -- at what pace, with what profitability and at what quality.

The bank is planning to diversify into newer areas from its traditional forte of automobile, SME and MSME into gold loans, business banking and housing finance (by the end of the year). The risk adjusted profitability of these new businesses should be monitored closely.

Costs are likely to be elevated as the bank ramps up and roll-out happens at a brisk pace.

Outlook

While early days, we still like the growth strategy chalked out by the dynamic management of AU Small Finance Bank. But as it grows, the macro headwinds are more and the retail landscape is highly competitive. Hence, investors got to temper expectations on profitability and give the tiny efficient entity enough time to build a solid franchise.

Seen in this context, the current valuation at 7.5X FY18 adjusted book, leaves little by way of short-term upside. However, equity markets provide ample opportunity to accumulate quality businesses at lows. Investors should wait for such opportunities for AU Small Finance Bank as well.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!