Stocks and bonds rallied at the end of last year on the hope of a seemingly improbable combination of dynamics playing out to support financial assets in 2024 — cooling inflation, solid economic growth, a resilient labour market, and as much as 150 basis points of interest-rate cuts. That may not have been exactly what Austan Goolsbee, president of the Federal Reserve Bank of Chicago, meant when he said the economy appeared to be on a “golden path,” but it was the rosy scenario investors focused on.

Economic growth remains robust to start the year, but some recent data and comments from Fed Chair Jerome Powell have made that nirvana-like set of conditions less probable. A couple of key business sentiment measures have raised the possibility that a pickup in production could fuel a pickup in inflation. At the same time, Powell has said that the Fed wants further evidence of a sustainable easing in price pressures before cutting rates.

Such reluctance signals a central bank that’s waiting for the year-over-year level of its preferred inflation gauge to return to 2 percent and, in waiting, increasing the risk of an unwelcome economic surprise. That measure has climbed at a 1.9 percent annualized rate, below the Fed’s target, over the past seven months already. With a continued fall in shelter inflation nearly assured (read this) and overall wage growth cooling to pre-pandemic levels, there’s little reason to believe inflation can pick up in a meaningful and sustainable way.

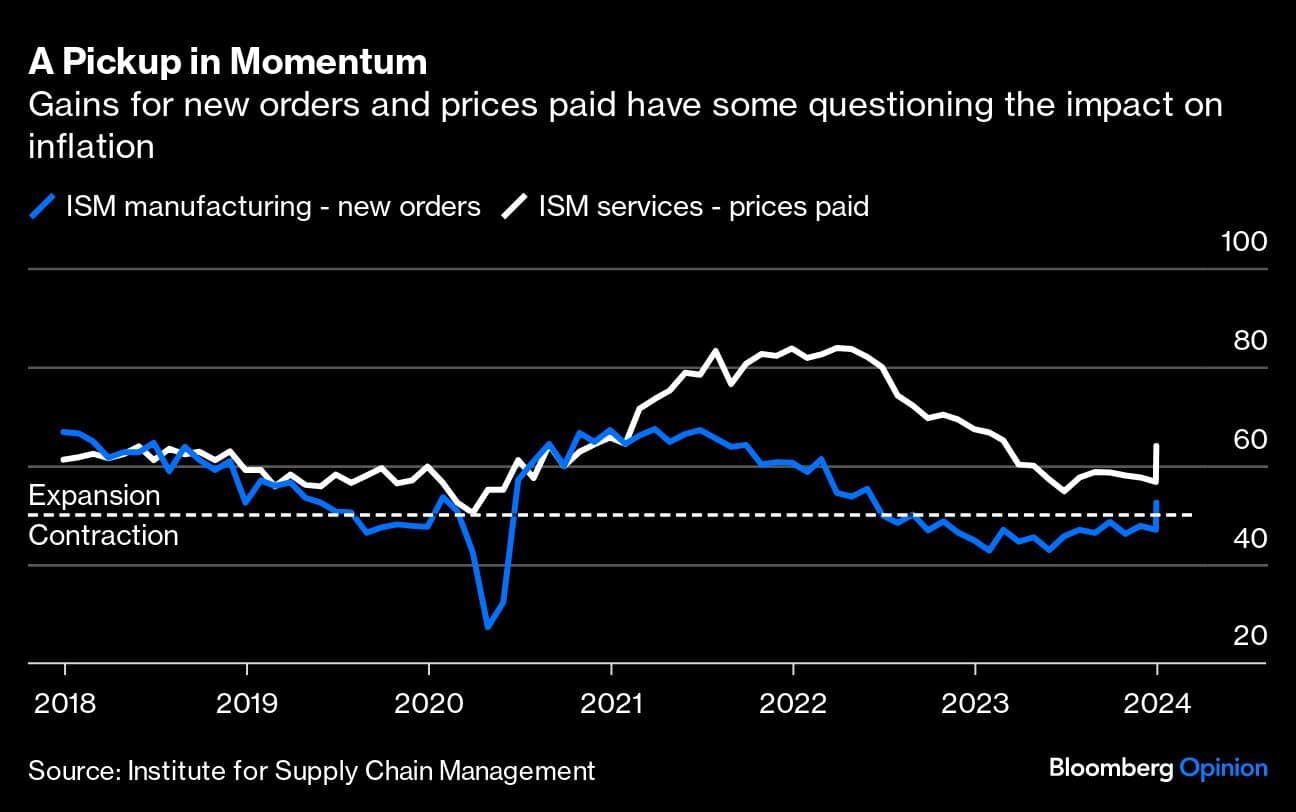

Yet recent data has muddied the waters. On business sentiment, the big news last week came from the Institute for Supply Management’s closely followed manufacturing report, which showed new orders expanding again for the first time since August 2022. This has been a long time coming. I first wrote about the possibility in December 2022 — at the time, inventory levels were too high because of all the orders that had poured in in late 2021 and early 2022. While sales remained resilient, companies weren’t yet in a position to place new orders. I thought inventory levels might take until the spring of 2023 to be worked down, but it ended up taking much longer. The report showed prices paid increased as well, though to a level that on its own shouldn’t signify an inflation concern.

More worrying on the inflation front was the ISM’s services report, which came out Monday, showing the biggest one-month increase in a decade for its prices-paid component. The data casts some doubt over whether overall inflation will remain at the low levels we’ve witnessed since the middle of last year.

Meanwhile, the Fed looks content to wait a little longer to see how things shape up. Powell used two opportunities in the past week to push back on market pricing for an early start to policy easing. Traders have gone from seeing reasonable prospects for a 25-basis-point cut in March and the certainty of a reduction in May to now wagering on an 80 percent chance of a move in May.

The risk is that this recovery in factory orders and perhaps quicker inflation is akin to a "dead cat bounce," but the Fed uses the improvement in cyclical economic activity to postpone rate cuts for too long.

After a miserable 2023, a modest recovery in factory orders and housing activity makes sense, with or without rate cuts. An uptick in prices for some parts of the goods economy that have been weak, such as trucking freight rates, would make sense, too.

But there’s little doubt that monetary policy continues to restrain growth. With financing costs where they are, it seems unlikely that companies will rush to expand capacity or break ground on new apartments. Despite the strong addition to January payrolls, the average workweek showed another concerning drop, suggesting labour market risks remain.

Rather than drawing out the timing of the first rate cut, creating anxiety among businesses and consumers needing to borrow or refinance debt, it would be better to start sooner and cut slowly, communicating that there’s no guarantee the easing cycle will be long and deep if the economy shows signs of a meaningful reacceleration. Instead, a potential uptick in cyclical economic activity and inflation after an unsustainable period of weakness threaten to confuse the Fed and keep rates overly restrictive until something breaks.

Conor Sen is a Bloomberg Opinion columnist. Views do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.