Krishna KarwaMoneycontrol Research

The Union Cabinet, in a landmark move for Indian retail, announced some noteworthy changes in norms pertaining to single-brand foreign direct investments (FDI) in India, thus making it considerably easier for global retailers to gain access to the highly dynamic and fast-growing Indian markets. Is this initiative truly for the better, or is there more to it than meets the eye?

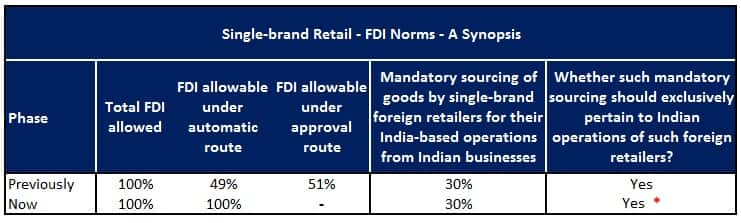

Here’s a summary of the erstwhile regulations and the revised ones:-

* For the first five years (starting April 1 of the financial year in which the first store is opened), products sourced by single-brand foreign retailers from domestic entities and used for their international operations will also be included in the 30 percent limit.

In the aftermath of this development, what can one look forward to?

Process simplification: The action is part of the government’s strategy to liberalise FDI policy with the objective of facilitating ease of doing business and promoting the 'Make in India' campaign. Moreover, it will play a key role in turning India into a global investment hotspot.

Survival of the fittest: With new players entering the highly competitive retail space, the competition will intensify between domestic and foreign brands, thereby leading to an increase in promotional spends. Indian retailers’ margins may be affected.

Consumption boost: India’s discretionary consumption, an aspect that will be largely impacted by the new regulation, is anticipated to grow on the back of increased availability of products and presence of international outlets across geographies.

Organised retail traction: Presently, unorganised units constitute nearly 80-90 percent of India’s retail industry. Apart from the GST transition, arrival of some renowned foreign retail names in the country is expected to further accelerate the growth of organised businesses as a whole.

Which foreign brands benefit and which ones don’t?

Our top stock pick

Shaily Engineering Plastics, a stock under our coverage purview, stands to gain the most. The engineered plastic component maker derives 50-60 percent of its annual revenue from Ikea (a Sweden-based home furnishing multinational company) alone and is fundamentally robust as well. For Shaily, the degree of customer stickiness is high (especially in case of Ikea). This is evident from their 14- year long business relationship, that has only grown with time.

Ikea is bullish on its prospects of succeeding in India. Two of its stores (Mumbai, Hyderabad) are likely to be operational by the end of FY19. The Swedish company intends to add 25 outlets in other parts of the country, apparent from its commitment to invest over Rs 10,000 crore in this regard in the next 10 years.

Over the years, Ikea’s growth in India was largely hindered owing to complexities associated with sourcing-related directives, among numerous other procedural formalities. Revisions to the mandate augur well for it and consequently for Shaily, too.

The stock has rallied pretty sharply in recent months. At 28.5x FY19 projected earnings, investors may consider accumulation on price dips.

Stocks that may face the heat

With disposable incomes on the rise, an average Indian consumer no longer shies away from loosening the purse strings for purchasing high-quality branded products. This is underscored by the pace with which foreign brands have been gaining sales momentum in the past few years.

Clearly, international brands, on an average, are sold at higher price points than Indian brands. Therefore, those Indian companies that manufacture and/or sell in premium brands could have a tough time if foreign brands succeed in upping the ante. For now, multi-brand Indian retailers (D-Mart, V-Mart, Future Retail) can heave a sigh of relief.

Initially, the effect of the rule alteration will be visible predominantly in metros and tier 1 cities of India. In due course, the possibility of extensive network augmentation by the single-brand foreign retailers cannot be ignored, given the immense growth potential for retail in tier 2/3 cities of the country.

The sore points

Firstly, the notification does not include multi-brand foreign retail. The inclusion would’ve not only transformed the landscape of Indian retail noticeably but also garnered significantly higher interest from many more prospective international retailers.

Secondly, some well-known single-brand foreign retailers, who were keen on gaining access to the Indian markets, have already succeeded in done so through licensing agreements/joint ventures (JVs)/partnerships. The arrangements are unlikely to be modified. For example, the likes of Zara and Marks & Spencer entered into JVs with Trent and Reliance Retail, respectively, to expand their footprint in India. On the other hand, Uniqlo, a Japanese clothing brand, sought the desired approvals in late 2017, too.

Thirdly, some industry experts highlighted the fact that compulsions in connection with sourcing will continue to play spoilsport. Furthermore, though there are relief provisions (in relation to sourcing-related compliances) for single-brand retailers who use ‘cutting-edge’ and ‘state-of-the-art’ technologies, there is no clarity whatsoever about the definition of such words and the criteria to be fulfilled for such classification.

Outlook

The move initiated by the Modi-led Government, prima facie, seems promising on paper (and will be, to some extent). However, in reality, barring a marginal tweak, there isn’t anything dramatically groundbreaking. The buzz, that caused some branded garment and retail stocks to rally quite a bit on the day of this announcement, is purely sentimental. Therefore, investors shouldn’t jump the gun and get swayed by the frenzy.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!