MF stress test, round 2: How did the 10 largest midcap funds do?

As per the second-round results, mid-cap funds would need 6.5 days on an average, to liquidate 50 percent of their portfolios, almost similar the category average of 6.6 days that was disclosed a month ago

1/11

The second round of mutual fund (MF) stress test results are out. Fund houses are meant to disclose the results on the 15th of every month, as per instructions by the capital market regulator Securities and Exchange Board of India (SEBI).

The stress test results give investors an idea of how many days it would take a mid-cap and a small-cap scheme to liquidate its portfolio in case of adverse scenarios. As per the second-round results, mid-cap funds would need 6.5 days on an average, to liquidate 50 percent of their portfolios, which is lower than the category average of 6.6 days that was disclosed a month ago.

Here is the comparison in the days to liquidate the 25 percent and 50 percent of their portfolio of the top 10 mid-cap funds over the last one month. Source: AMFI and ACEMF.

The stress test results give investors an idea of how many days it would take a mid-cap and a small-cap scheme to liquidate its portfolio in case of adverse scenarios. As per the second-round results, mid-cap funds would need 6.5 days on an average, to liquidate 50 percent of their portfolios, which is lower than the category average of 6.6 days that was disclosed a month ago.

Here is the comparison in the days to liquidate the 25 percent and 50 percent of their portfolio of the top 10 mid-cap funds over the last one month. Source: AMFI and ACEMF.

2/11

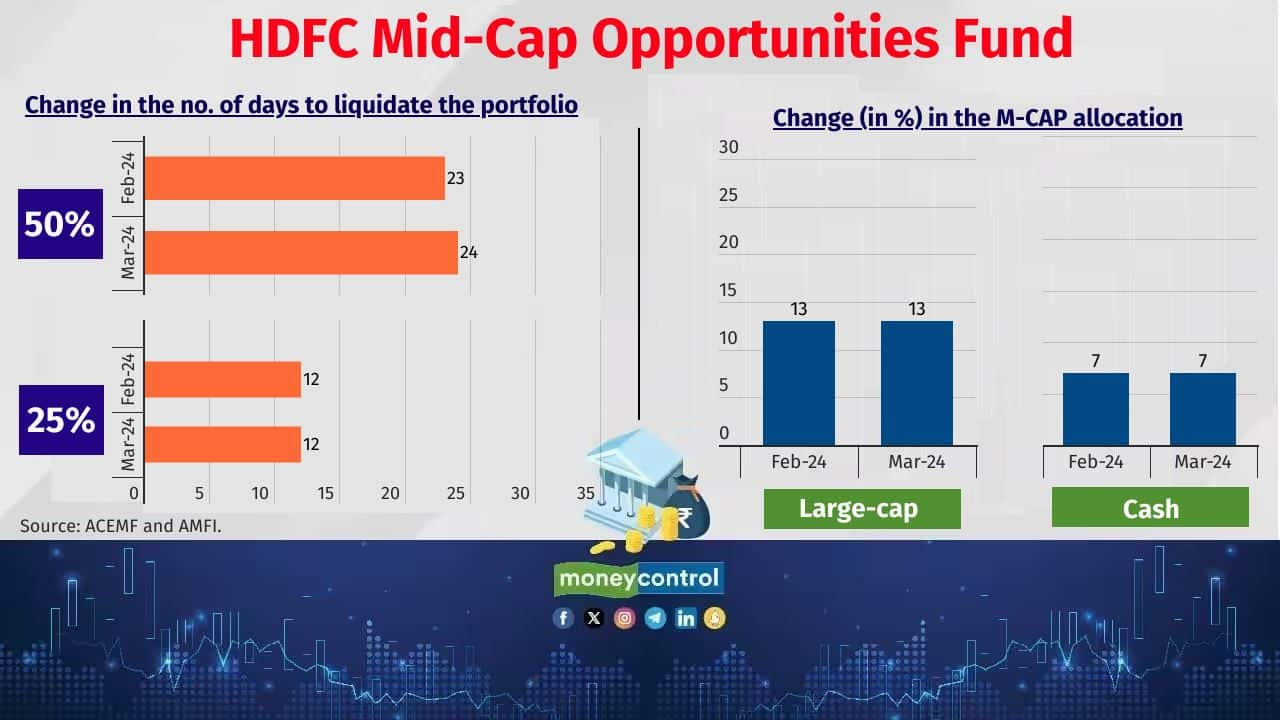

HDFC Mid-Cap Opportunities Fund

Corpus as of March 31, 2024: Rs 60,418 crore (Previous month: Rs 60,187 crore)

No. of stocks newly added in the portfolio in March: Nil

No. of stocks exited the portfolio in March: Nil

Also see: MF Stress Test Round 2: Has top small-cap funds improved their liquidity positions?

Corpus as of March 31, 2024: Rs 60,418 crore (Previous month: Rs 60,187 crore)

No. of stocks newly added in the portfolio in March: Nil

No. of stocks exited the portfolio in March: Nil

Also see: MF Stress Test Round 2: Has top small-cap funds improved their liquidity positions?

3/11

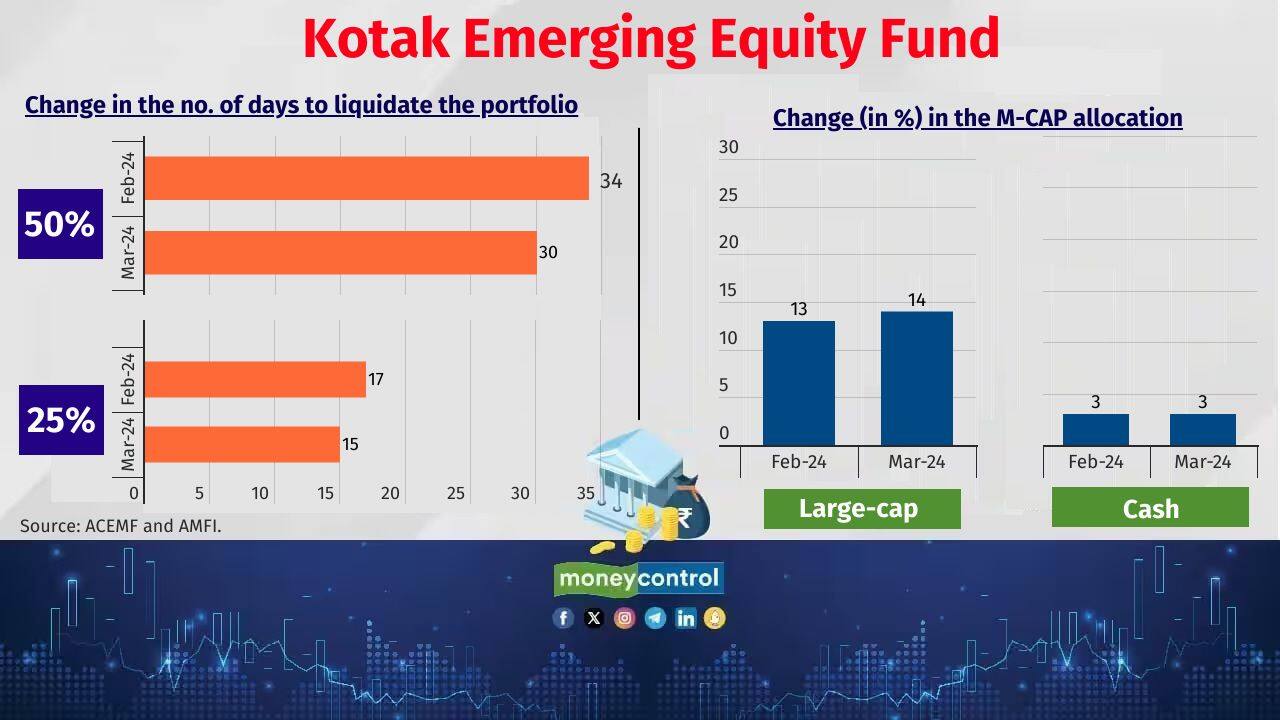

Kotak Emerging Equity Fund

Corpus as of March 31, 2024: Rs 39,685 crore (Previous month: Rs 39,738 crore)

No. of stocks newly added in the portfolio in March: 4

No. of stocks exited the portfolio in March: 3

Corpus as of March 31, 2024: Rs 39,685 crore (Previous month: Rs 39,738 crore)

No. of stocks newly added in the portfolio in March: 4

No. of stocks exited the portfolio in March: 3

4/11

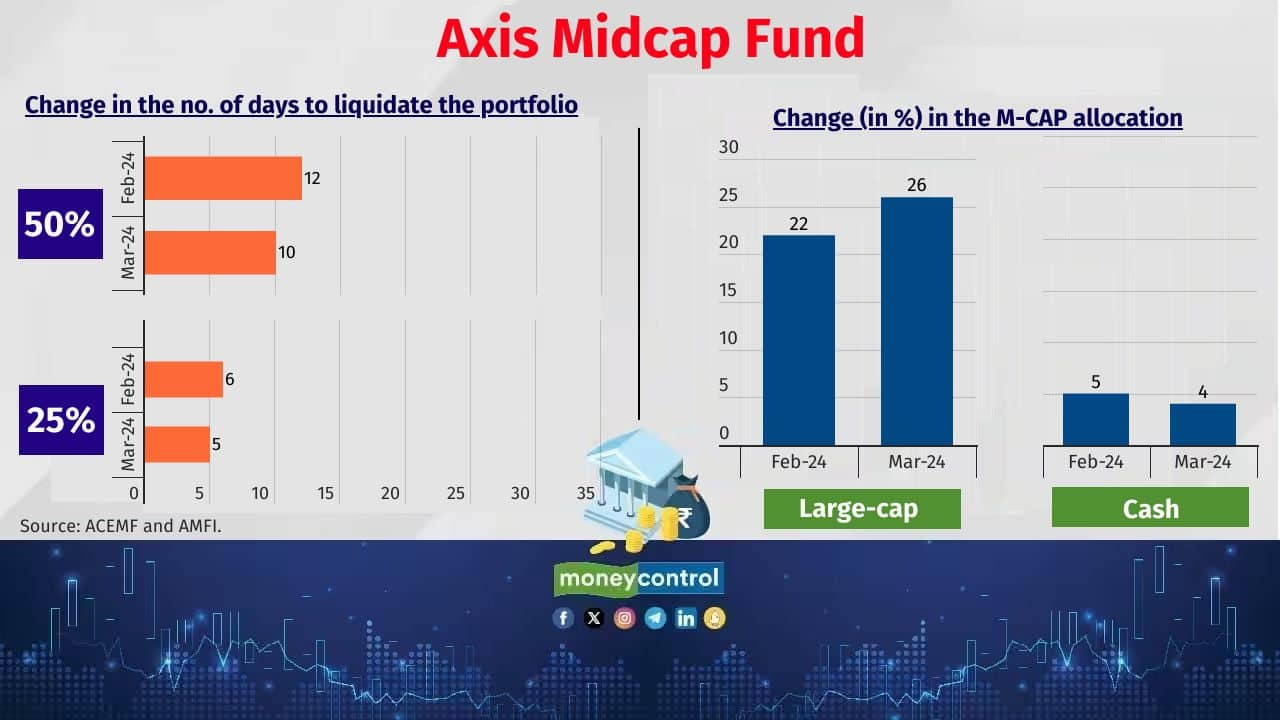

Axis Midcap Fund

Corpus as of March 31, 2024: Rs 25,537 crore (Previous month: Rs 25,264 crore)

No. of stocks newly added in the portfolio in March: 5

No. of stocks exited the portfolio in March: 5

Corpus as of March 31, 2024: Rs 25,537 crore (Previous month: Rs 25,264 crore)

No. of stocks newly added in the portfolio in March: 5

No. of stocks exited the portfolio in March: 5

5/11

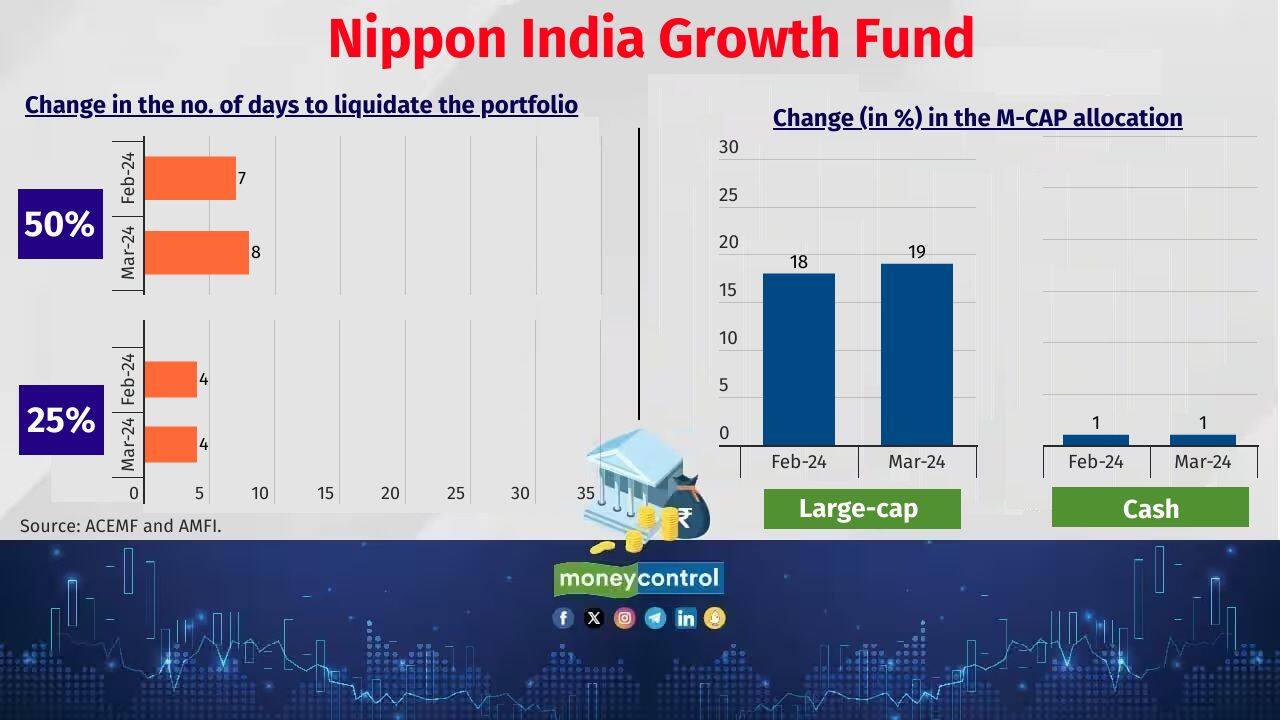

Nippon India Growth Fund

Corpus as of March 31, 2024: Rs 24,796 crore (Previous month: Rs 24,481 crore)

No. of stocks newly added in the portfolio in March: Nil

No. of stocks exited the portfolio in March: Nil

Also read: 10 years of Modi regime: How mutual funds turned into a must-have investment

Corpus as of March 31, 2024: Rs 24,796 crore (Previous month: Rs 24,481 crore)

No. of stocks newly added in the portfolio in March: Nil

No. of stocks exited the portfolio in March: Nil

Also read: 10 years of Modi regime: How mutual funds turned into a must-have investment

6/11

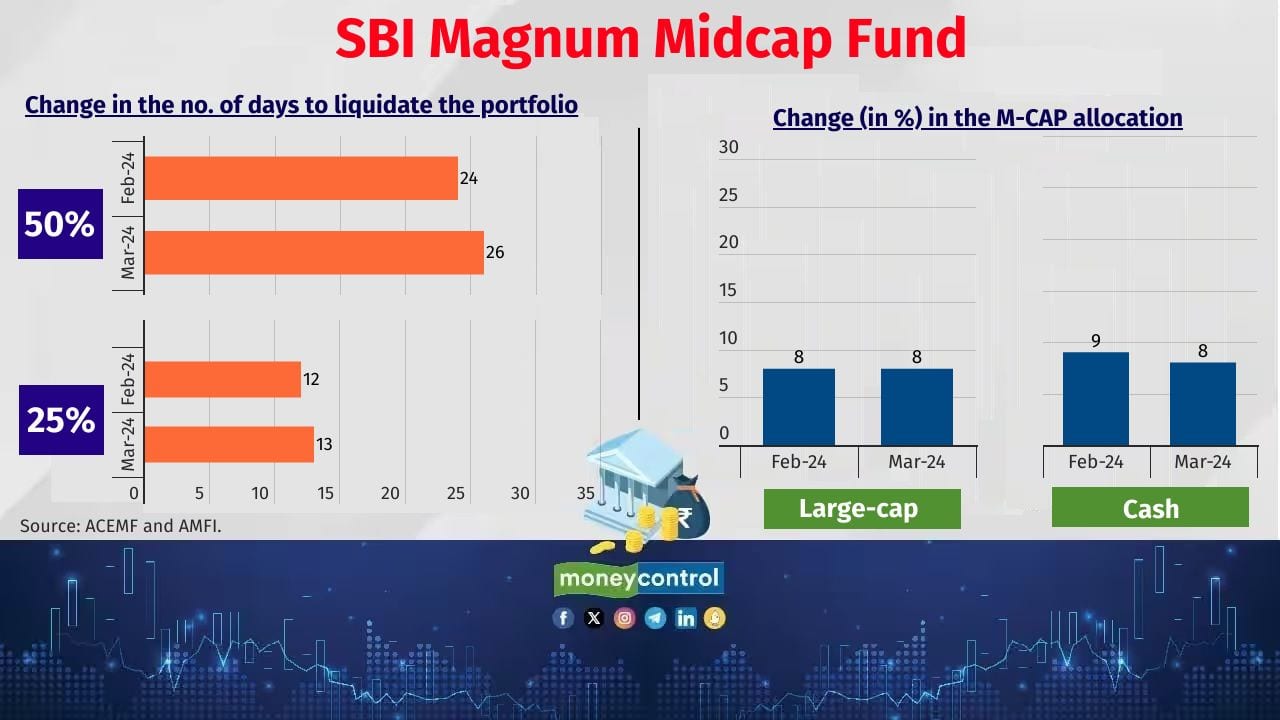

SBI Magnum Midcap Fund

Corpus as of March 31, 2024: Rs 16,856 crore (Previous month: Rs 16,459 crore)

No. of stocks newly added in the portfolio in March: Nil

No. of stocks exited the portfolio in March: 1

Corpus as of March 31, 2024: Rs 16,856 crore (Previous month: Rs 16,459 crore)

No. of stocks newly added in the portfolio in March: Nil

No. of stocks exited the portfolio in March: 1

7/11

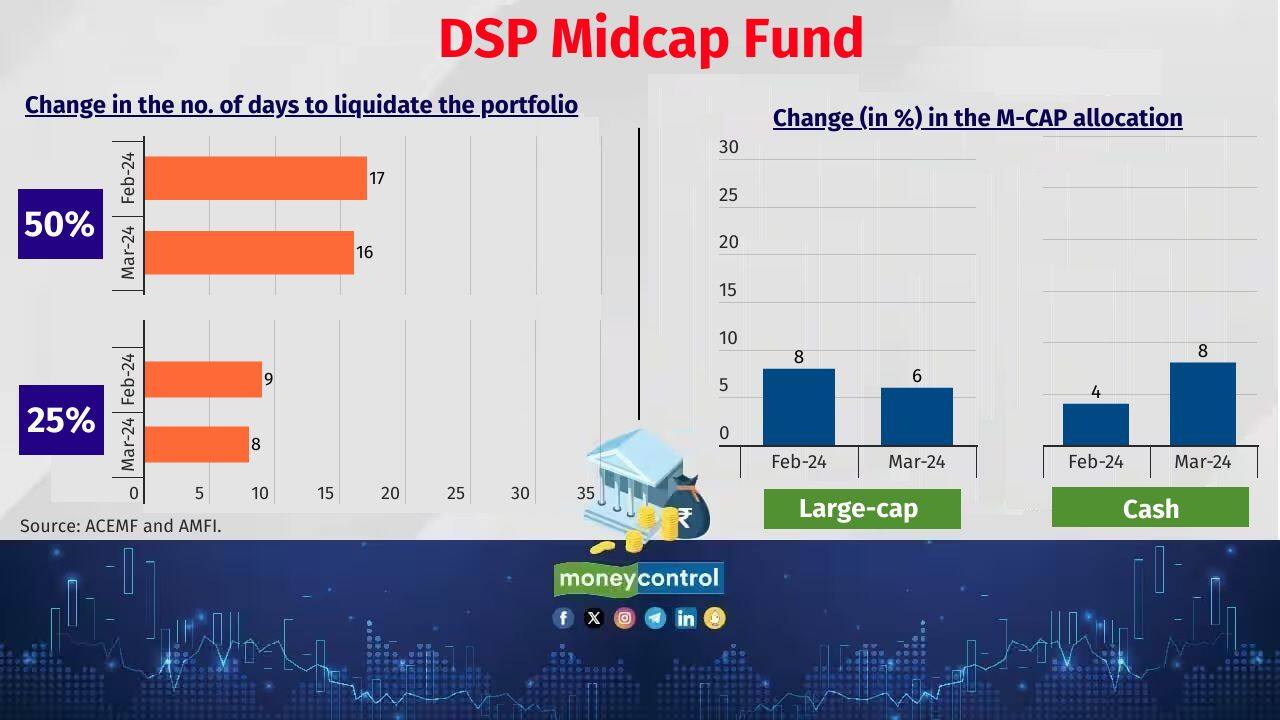

DSP Midcap Fund

Corpus as of March 31, 2024: Rs 15,969 crore (Previous month: Rs 16,312 crore)

No. of stocks newly added in the portfolio in March: Nil

No. of stocks exited the portfolio in March: 2

Corpus as of March 31, 2024: Rs 15,969 crore (Previous month: Rs 16,312 crore)

No. of stocks newly added in the portfolio in March: Nil

No. of stocks exited the portfolio in March: 2

8/11

Mirae Asset Midcap Fund

Corpus as of March 31, 2024: Rs 14,252 crore (Previous month: Rs 14,536 crore)

No. of stocks newly added in the portfolio in March: 2

No. of stocks exited the portfolio in March: Nil

Also read: The winners’ club: Here’s the list of the top performing equity mutual funds across categories in 2023-24

Corpus as of March 31, 2024: Rs 14,252 crore (Previous month: Rs 14,536 crore)

No. of stocks newly added in the portfolio in March: 2

No. of stocks exited the portfolio in March: Nil

Also read: The winners’ club: Here’s the list of the top performing equity mutual funds across categories in 2023-24

9/11

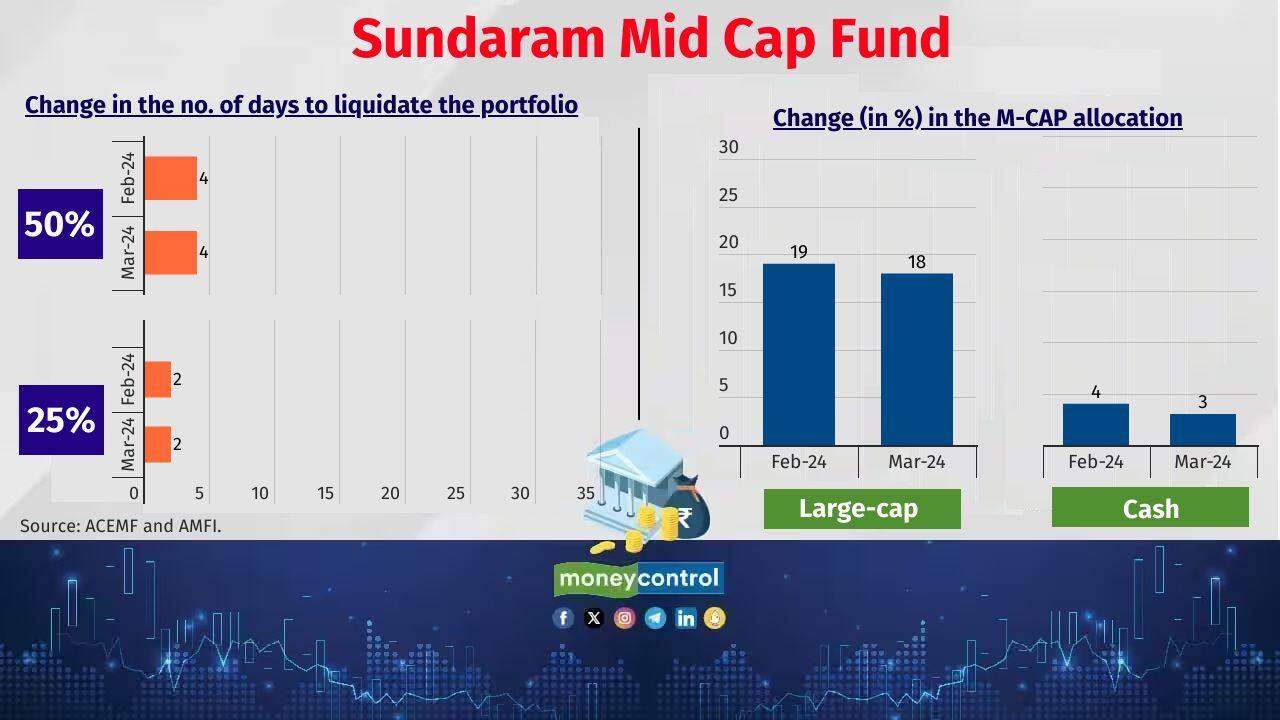

Sundaram Mid Cap Fund

Corpus as of March 31, 2024: Rs 10,269 crore (Previous month: Rs 10,262 crore)

No. of stocks newly added in the portfolio in March: 2

No. of stocks exited the portfolio in March: 3

Corpus as of March 31, 2024: Rs 10,269 crore (Previous month: Rs 10,262 crore)

No. of stocks newly added in the portfolio in March: 2

No. of stocks exited the portfolio in March: 3

10/11

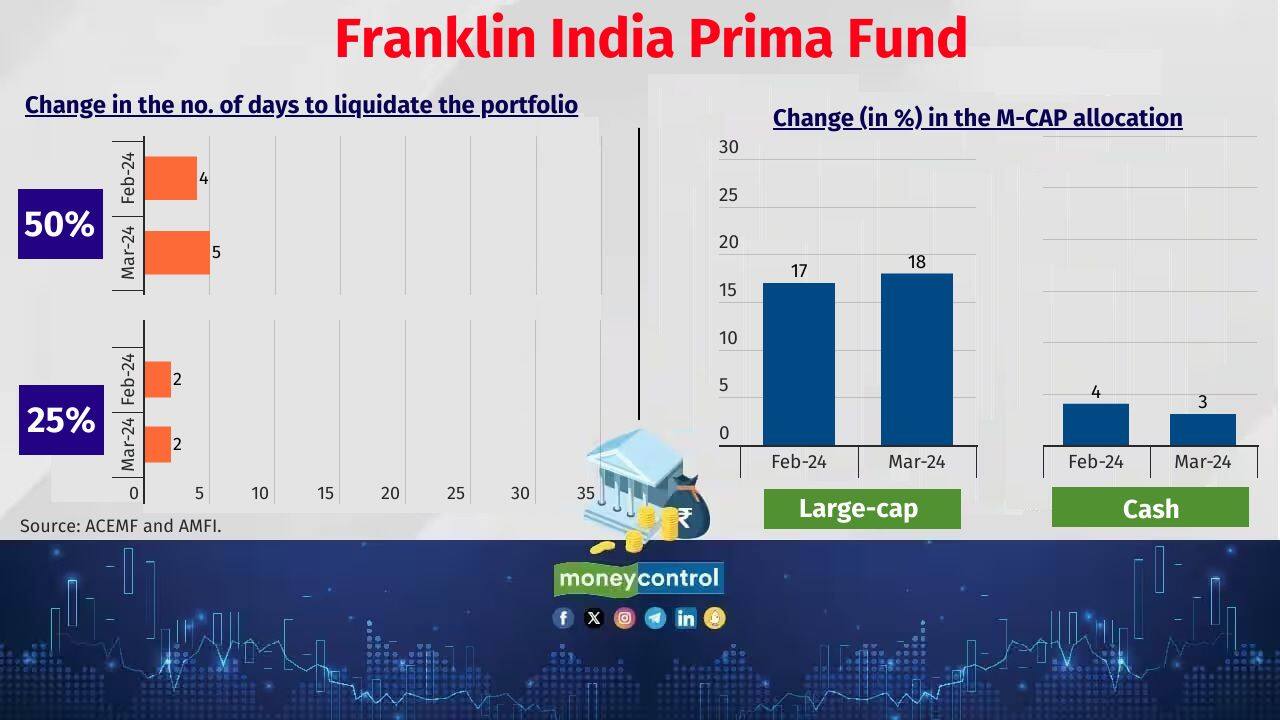

Franklin India Prima Fund

Corpus as of March 31, 2024: Rs 10,108 crore (Previous month: Rs 10,181 crore)

No. of stocks newly added in the portfolio in March: 1

No. of stocks exited the portfolio in March: Nil

Corpus as of March 31, 2024: Rs 10,108 crore (Previous month: Rs 10,181 crore)

No. of stocks newly added in the portfolio in March: 1

No. of stocks exited the portfolio in March: Nil

11/11

UTI Mid Cap Fund

Corpus as of March 31, 2024: Rs 9,944 crore (Previous month: Rs 10,047 crore)

No. of stocks newly added in the portfolio in March: 3

No. of stocks exited the portfolio in March: 2

Also read: MF stress test: Check whether your smallcap fund has these illiquid stocks

Corpus as of March 31, 2024: Rs 9,944 crore (Previous month: Rs 10,047 crore)

No. of stocks newly added in the portfolio in March: 3

No. of stocks exited the portfolio in March: 2

Also read: MF stress test: Check whether your smallcap fund has these illiquid stocks

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!