Smallcap funds bet on these largecaps to manage liquidity risk

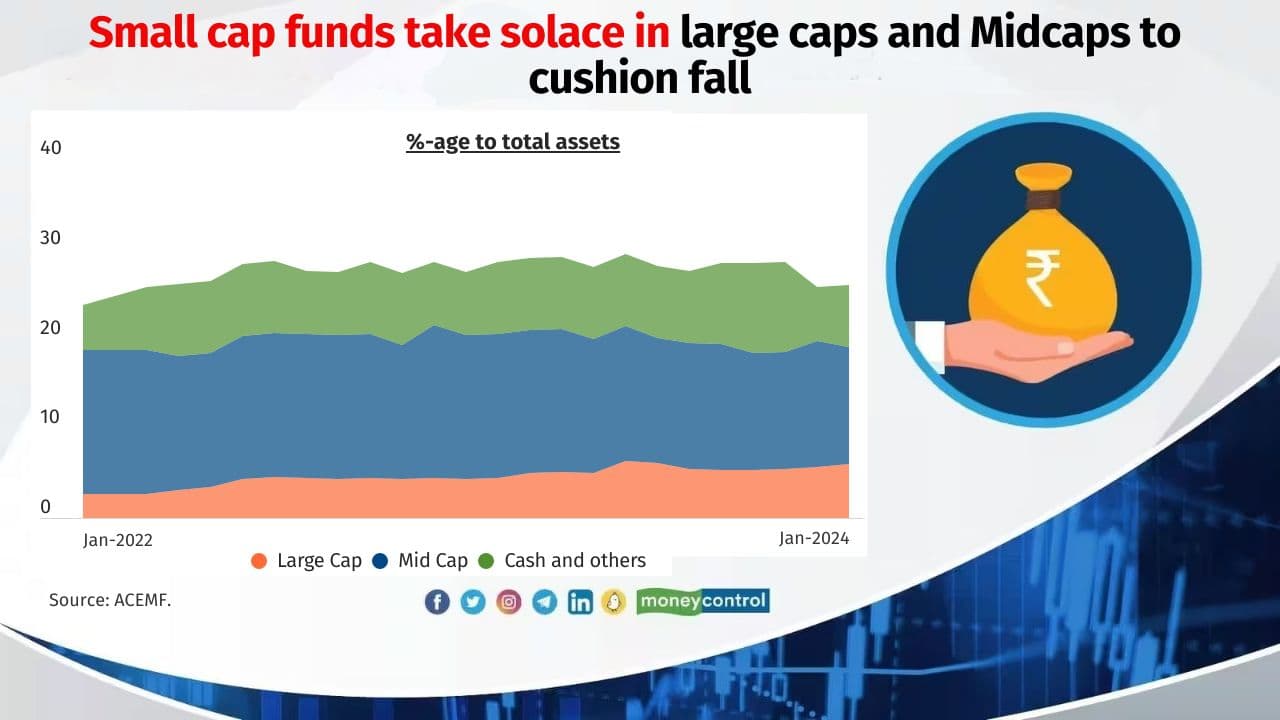

Small-cap funds have been under the spotlight due to rising market valuations. SEBI has asked fund houses to take measures to de-risk their portfolios. One such method that fund houses use is to add large-cap stocks. Data shows that allocation to largecap stocks by smallcap funds has more than doubled over the last two years

1/16

The capital market regulator, Securities and Exchange Board of India (SEBI), recently instructed mutual funds to dig deep into their small-cap and midcap funds’ portfolios to gauge how liquid they are and how volatile they are compared to their benchmarks, among many other such indicators. One of the ways that smallcap funds manage the liquidity risk is by holding large-cap stocks in their portfolio, (up to 35 percent of their corpus; a combination of cash, large-cap, and mid-cap stocks). If cash holding is a temporary strategy pending deployment, a higher allocation towards large-cap stocks mitigates risk at a time when equity markets appear over-valued.

2/16

Over the last two years, the share of large-cap stocks in the overall portfolio of smallcap funds was more than doubled to six percent from 2.7 percent. The other reason is that there are some sectors where there are no advantages of buying small caps due to scale and liquidity reasons. It makes more sense to allocate in these sectors through large caps.

Here are the most popular large-cap stocks among the 27 small-cap funds. Data as of January 2024. Source: ACEMF.

Here are the most popular large-cap stocks among the 27 small-cap funds. Data as of January 2024. Source: ACEMF.

3/16

REC

No. of smallcap funds holding the stock: 5

Sample of smallcap funds holding the stock: Mahindra Manulife Small Cap and Bandhan Small Cap.

Also see: Microcap multibagger pharma stocks that MFs added lately

No. of smallcap funds holding the stock: 5

Sample of smallcap funds holding the stock: Mahindra Manulife Small Cap and Bandhan Small Cap.

Also see: Microcap multibagger pharma stocks that MFs added lately

4/16

Zomato

No. of smallcap funds holding the stock: 5

Sample of smallcap funds holding the stock: Motilal Oswal Small Cap and Invesco India Smallcap

No. of smallcap funds holding the stock: 5

Sample of smallcap funds holding the stock: Motilal Oswal Small Cap and Invesco India Smallcap

5/16

HDFC Bank

No. of smallcap funds holding the stock: 4

Sample of smallcap funds holding the stock: Nippon India Small Cap and Quantum Small Cap.

No. of smallcap funds holding the stock: 4

Sample of smallcap funds holding the stock: Nippon India Small Cap and Quantum Small Cap.

6/16

ICICI Bank

No. of smallcap funds holding the stock: 4

Sample of smallcap funds holding the stock: Sundaram Small Cap and Franklin India Smaller Cos

Also see: Want to buy an ETF? Check out these most liquid Equity ETFs

No. of smallcap funds holding the stock: 4

Sample of smallcap funds holding the stock: Sundaram Small Cap and Franklin India Smaller Cos

Also see: Want to buy an ETF? Check out these most liquid Equity ETFs

7/16

Reliance Industries

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Quant Small Cap and Mahindra Manulife Small Cap

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Quant Small Cap and Mahindra Manulife Small Cap

8/16

Power Finance Corporation

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Sundaram Small Cap and Bandhan Small Cap

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Sundaram Small Cap and Bandhan Small Cap

9/16

Mankind Pharma

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Kotak Small Cap and ITI Small Cap

Also see: Microcap stocks that fund houses have sold in 3 months

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Kotak Small Cap and ITI Small Cap

Also see: Microcap stocks that fund houses have sold in 3 months

10/16

Shriram Finance

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Kotak Small Cap and Nippon India Small Cap

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Kotak Small Cap and Nippon India Small Cap

11/16

Coal India

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Bandhan Small Cap and Nippon India Small Cap

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Bandhan Small Cap and Nippon India Small Cap

12/16

Sun Pharmaceutical Industries

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: ITI Small Cap and Nippon India Small Cap

Also see: Mid-Cap Multibaggers that retirement goal Mutual Fund schemes chase

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: ITI Small Cap and Nippon India Small Cap

Also see: Mid-Cap Multibaggers that retirement goal Mutual Fund schemes chase

13/16

Bajaj Finance

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Canara Rob Small Cap and Nippon India Small Cap

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Canara Rob Small Cap and Nippon India Small Cap

14/16

Bank Of Baroda

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: HDFC Small Cap and Nippon India Small Cap

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: HDFC Small Cap and Nippon India Small Cap

15/16

IndusInd Bank

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Bank of India Small Cap and Quantum Small Cap

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Bank of India Small Cap and Quantum Small Cap

16/16

JIO Financial Services

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Quant Small Cap and Nippon India Small Cap

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Also see: Bracing for Volatility? Bet on these newly added large-cap stocks by PMS

No. of smallcap funds holding the stock: 3

Sample of smallcap funds holding the stock: Quant Small Cap and Nippon India Small Cap

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Also see: Bracing for Volatility? Bet on these newly added large-cap stocks by PMS

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!