Want to buy an ETF? Check out these most liquid Equity ETFs

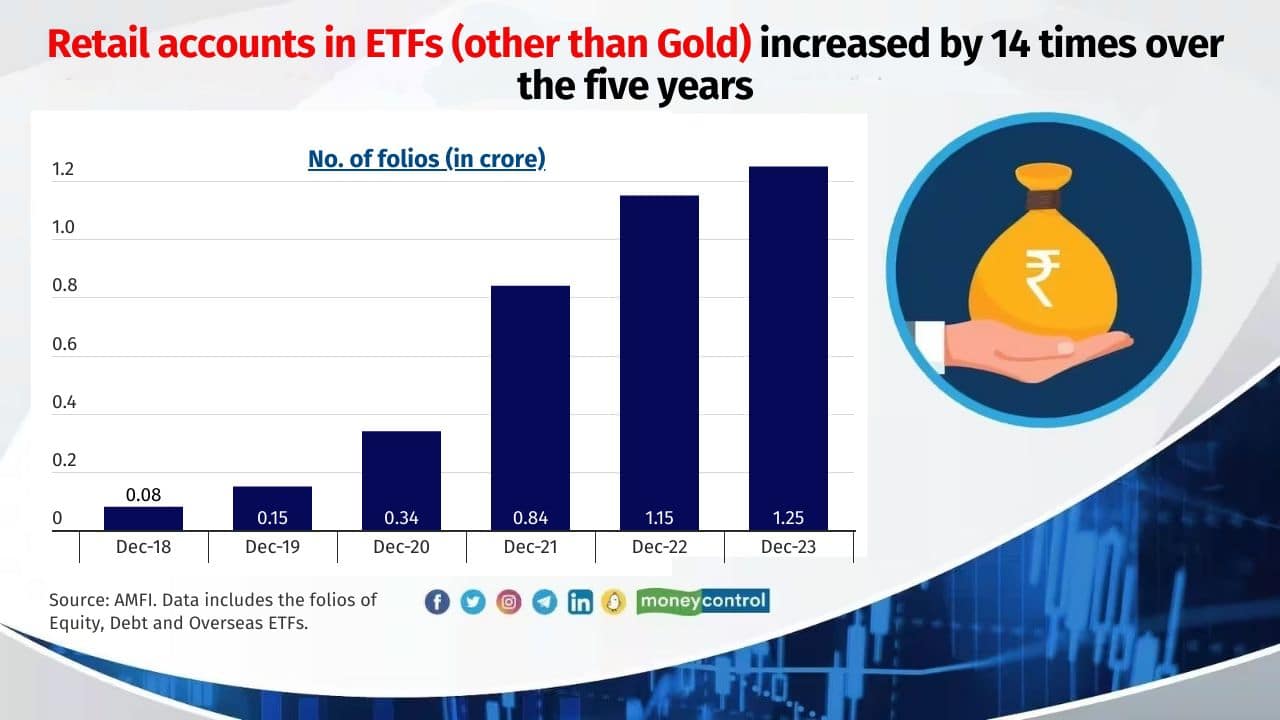

Although exchange-traded funds are superior to index funds in structure and tracking error, they lag behind on liquidity. Not all ETFs are liquid. Liquidity or the trading volume plays an important part in ETF selection. Choose ETFs with high liquidity, lower tracking error, expense ratio, and impact cost

1/14

The big benefit of an ETF over an index fund is its superior structure. An ETF can much closely mimic its benchmark index than an index fund because of the way an ETF is ‘created’. As passive investing gains traction among retail investors, an index funds’ underperformance - in the past - has put the spotlight on an ETF’s superior structure. But lack of liquidity can dampen an ETF, which might result in the rise of its impact cost.

2/14

One of the main parameters that one should look at while choosing ETFs is liquidity. Liquidity, or the trading volume plays an important part in your ETF selection. Since you can buy and sell units only on the stock exchange, it is imperative that there should be ample sellers and buyers available when you want to buy and offload your units and you are able to get a good price.

It is better to choose ETFs that are traded every day with decent volumes. You should strictly avoid the ETFs that are thinly traded.

Here are the top actively traded equity ETFs on NSE. Source: NSEIndia and ACEMF. Returns are as of February 23, 2024. Portfolio data as of January 2024.

It is better to choose ETFs that are traded every day with decent volumes. You should strictly avoid the ETFs that are thinly traded.

Here are the top actively traded equity ETFs on NSE. Source: NSEIndia and ACEMF. Returns are as of February 23, 2024. Portfolio data as of January 2024.

3/14

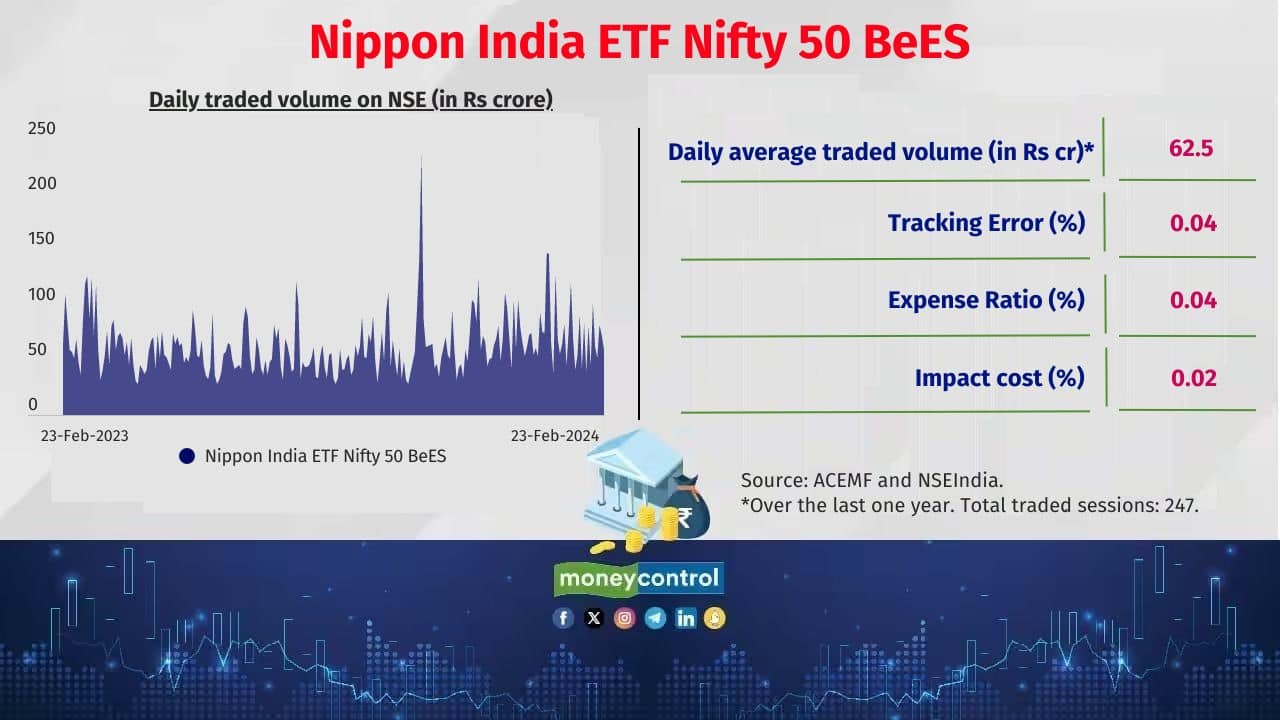

Nippon India ETF Nifty 50 BeES

5 year return (CAGR): 16.8%

Corpus: Rs 20,317 crore

Also see: Top 12 ELSS Funds To Look For

5 year return (CAGR): 16.8%

Corpus: Rs 20,317 crore

Also see: Top 12 ELSS Funds To Look For

4/14

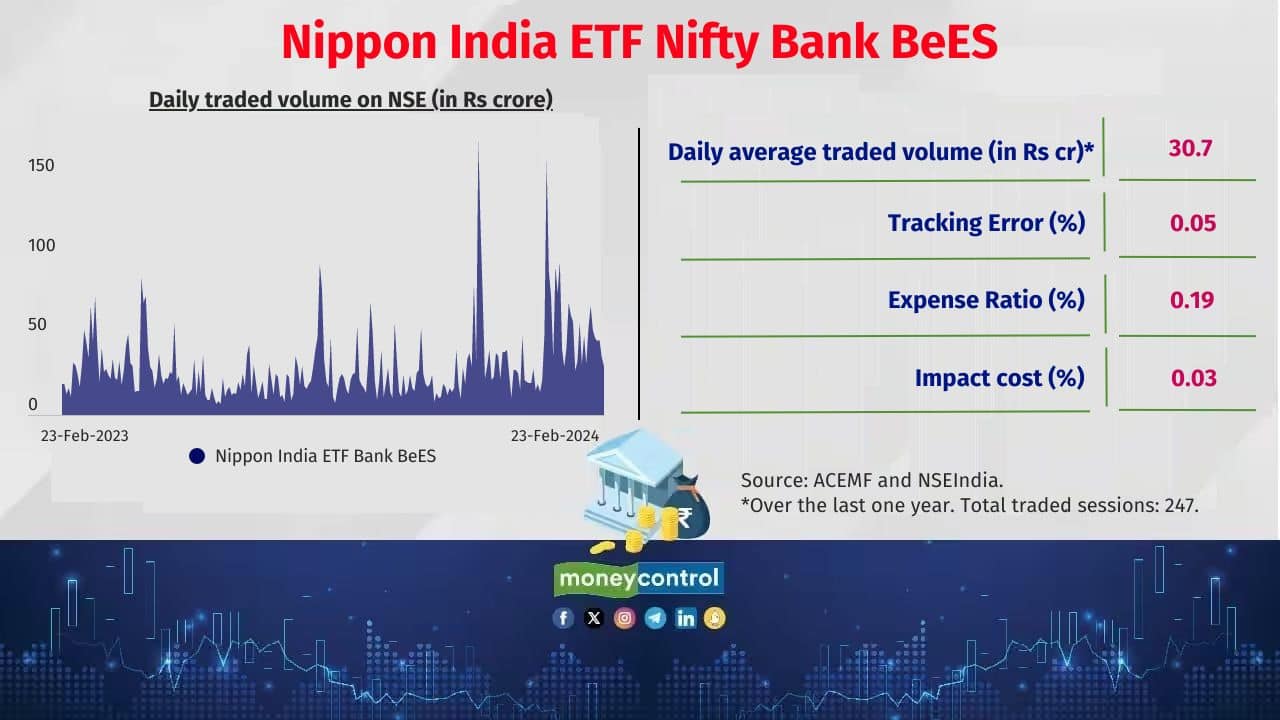

Nippon India ETF Nifty Bank BeES

5 year return (CAGR): 11.8%

Corpus: Rs 6,248 crore

5 year return (CAGR): 11.8%

Corpus: Rs 6,248 crore

5/14

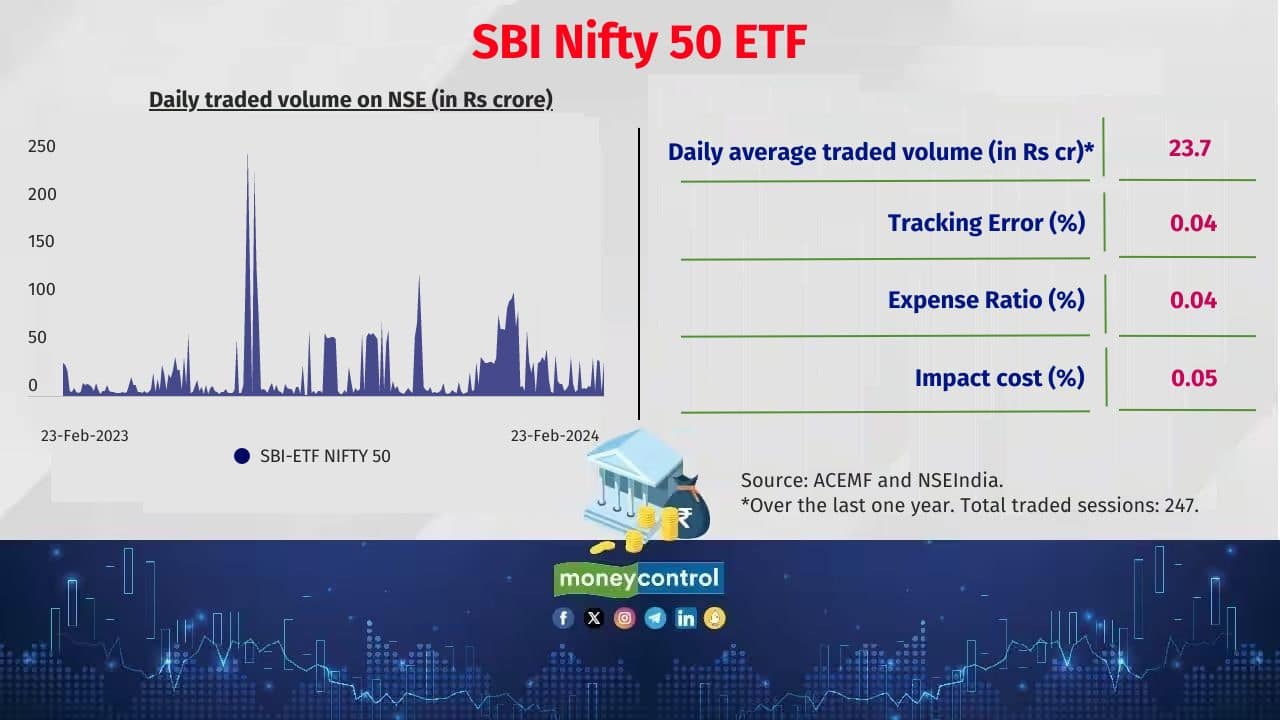

SBI Nifty 50 ETF

5 year return (CAGR): 16.8%

Corpus: Rs 1,72,064 crore

5 year return (CAGR): 16.8%

Corpus: Rs 1,72,064 crore

6/14

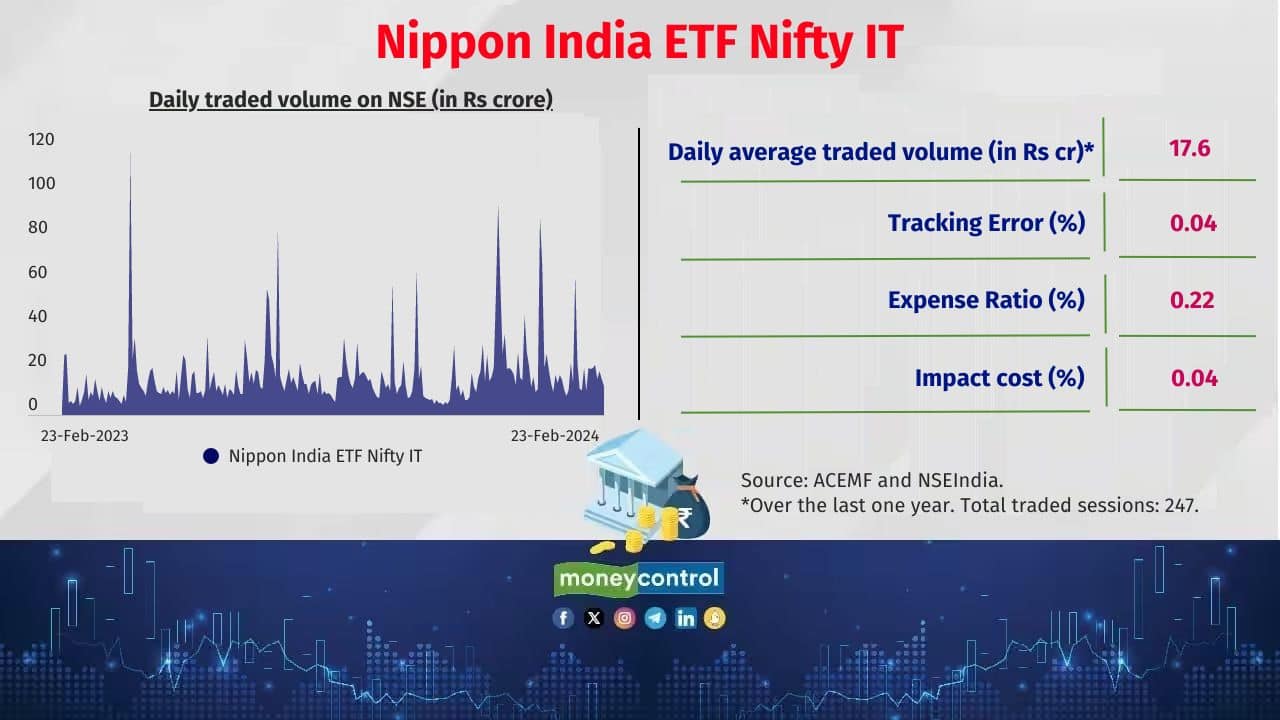

Nippon India ETF Nifty IT

3 year return (CAGR): 17.3%

Corpus: Rs 1,972 crore

Also see: Switching between equity and debt: These ULIP BAF funds return up to 12.2% over 10 years

3 year return (CAGR): 17.3%

Corpus: Rs 1,972 crore

Also see: Switching between equity and debt: These ULIP BAF funds return up to 12.2% over 10 years

7/14

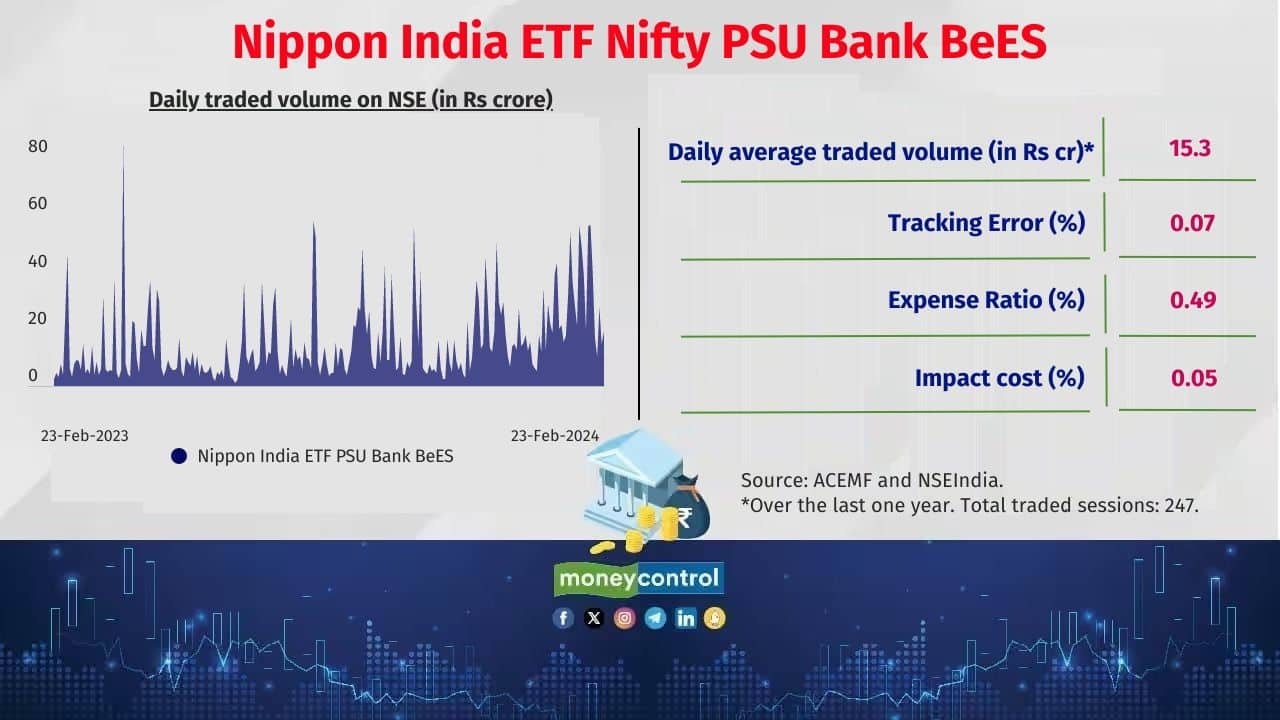

Nippon India ETF Nifty PSU Bank BeES

5 year return (CAGR): 20.6%

Corpus: Rs 2,189 crore

5 year return (CAGR): 20.6%

Corpus: Rs 2,189 crore

8/14

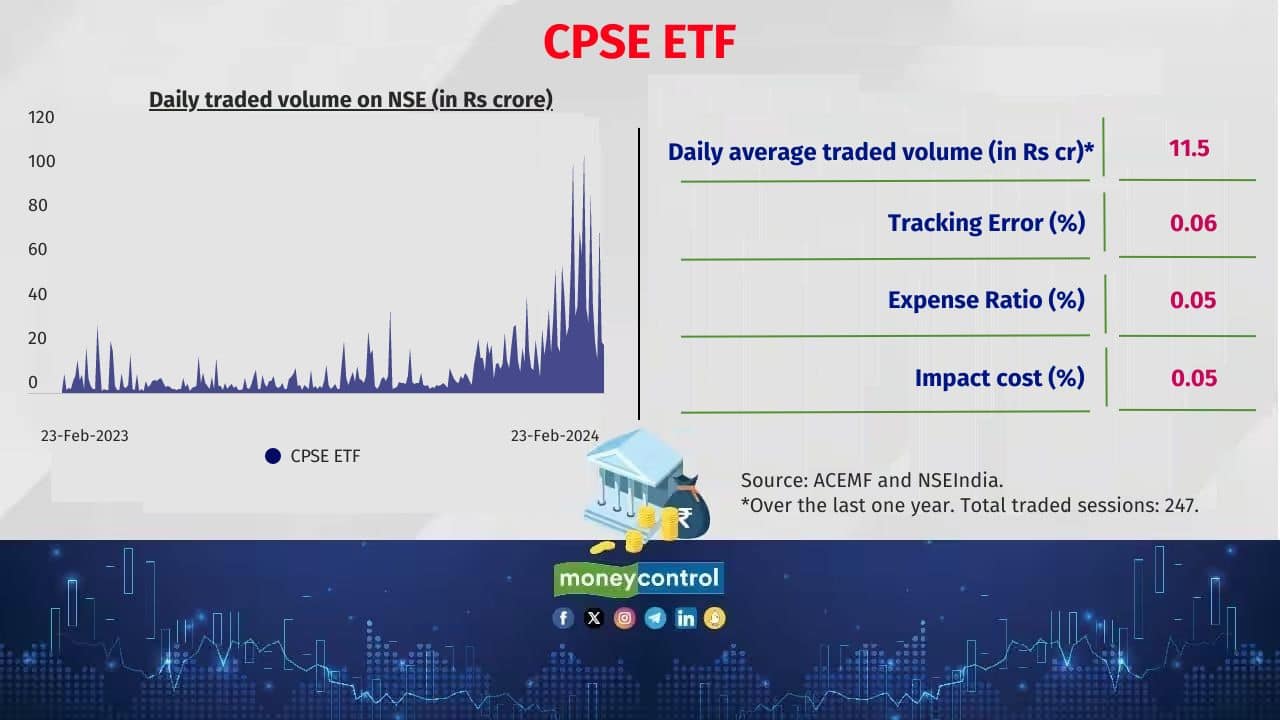

CPSE ETF

5 year return (CAGR): 28%

Corpus: Rs 33,635 crore

5 year return (CAGR): 28%

Corpus: Rs 33,635 crore

9/14

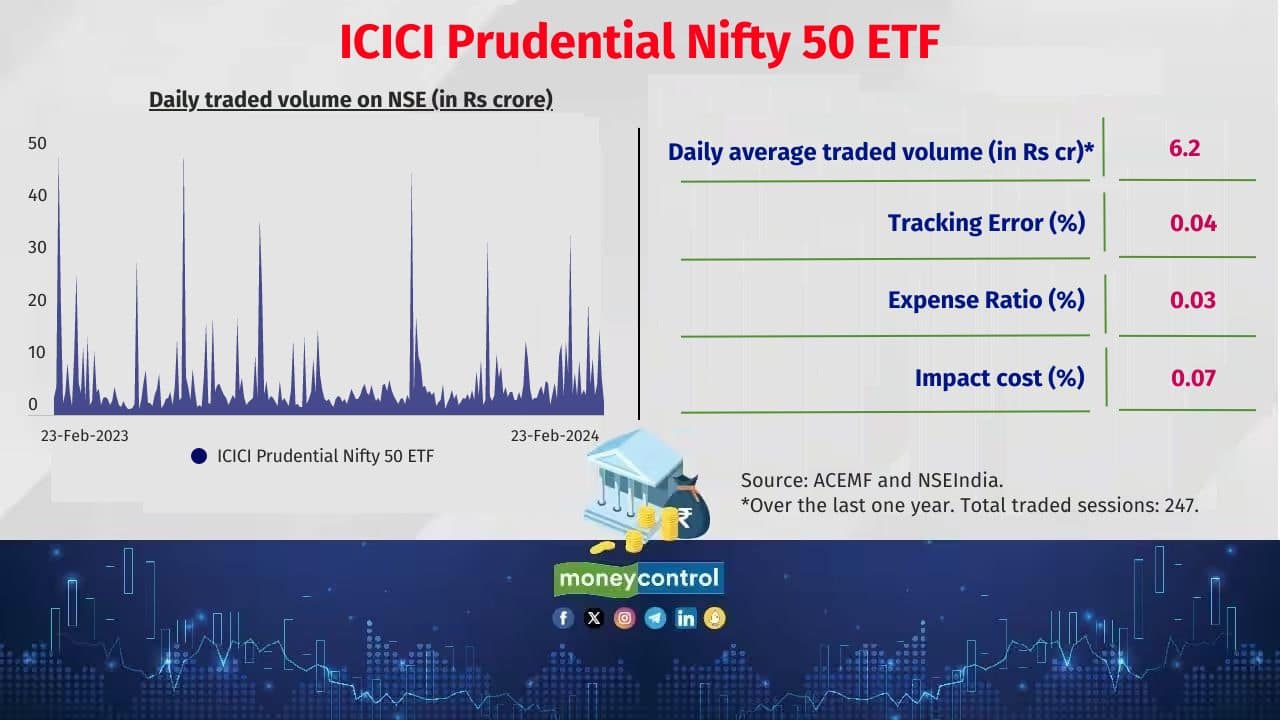

ICICI Prudential Nifty 50 ETF

5 year return (CAGR): 16.8%

Corpus: Rs 11,526 crore

5 year return (CAGR): 16.8%

Corpus: Rs 11,526 crore

10/14

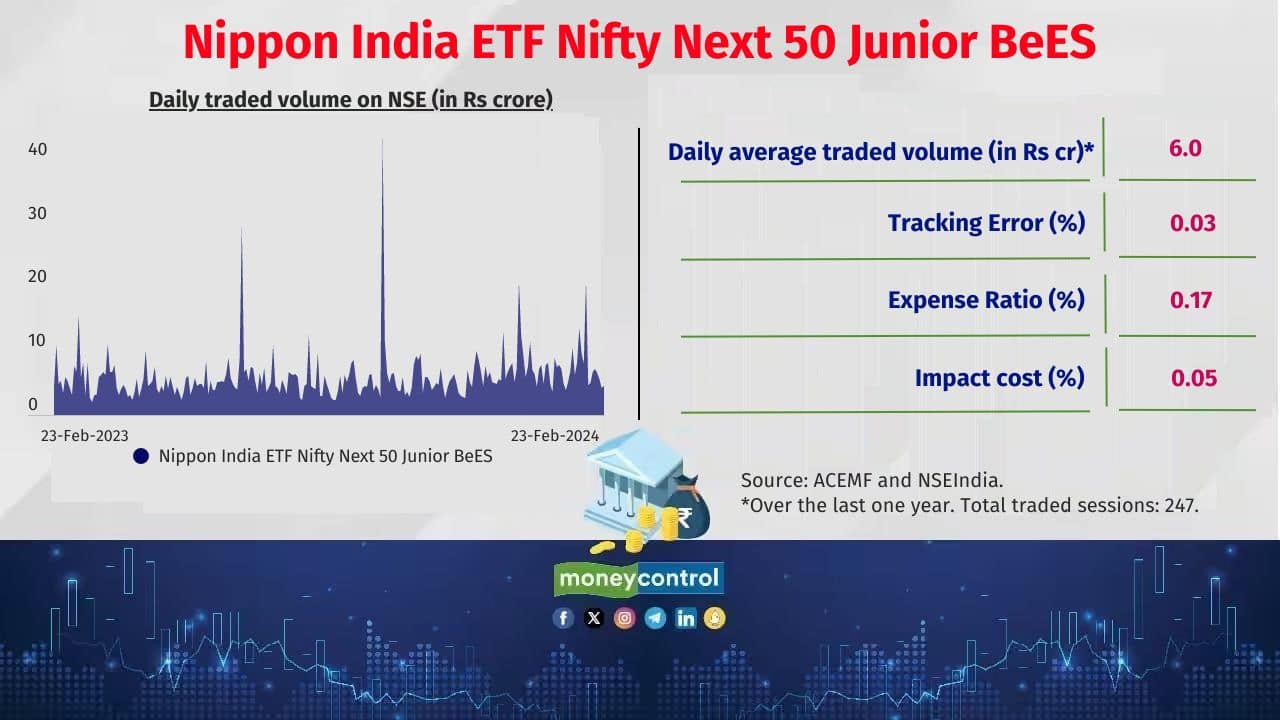

Nippon India ETF Nifty Next 50 Junior BeES

5 year return (CAGR): 18.5%

Corpus: Rs 4,216 crore

Also see: Microcap stocks that fund houses have sold in 3 months

5 year return (CAGR): 18.5%

Corpus: Rs 4,216 crore

Also see: Microcap stocks that fund houses have sold in 3 months

11/14

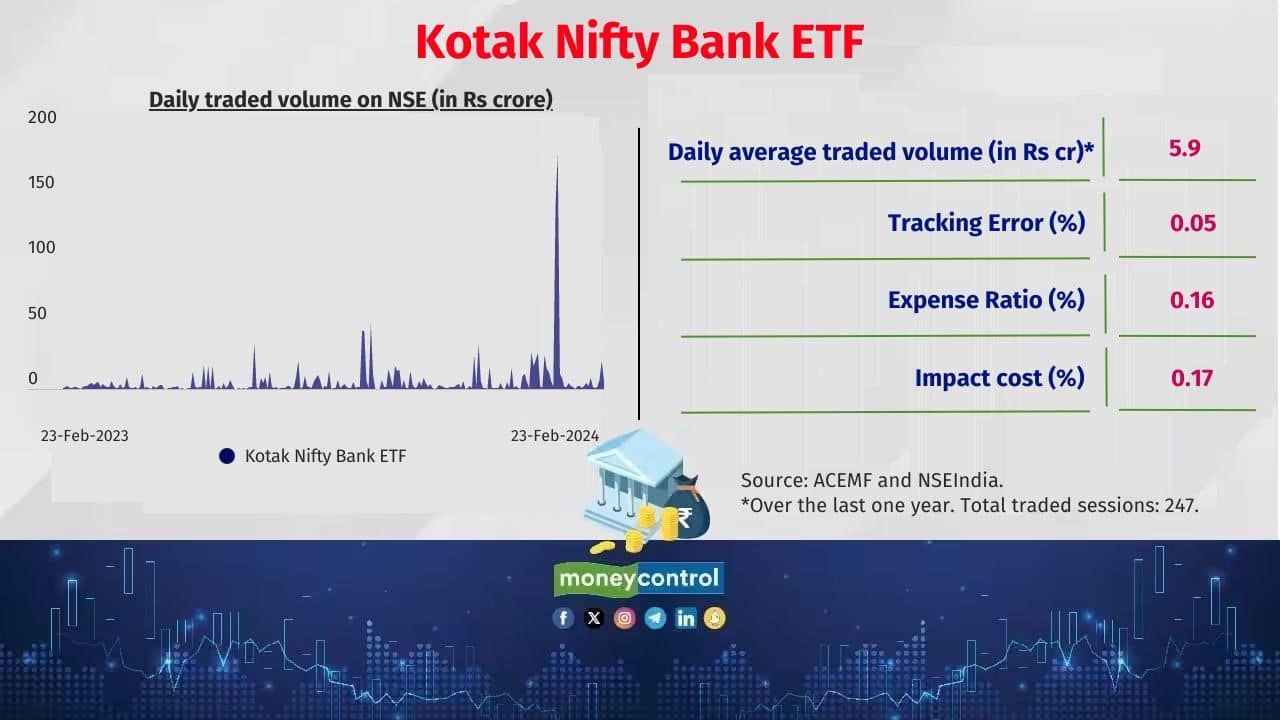

Kotak Nifty Bank ETF

5 year return (CAGR): 11.7%

Corpus: Rs 4,704 crore

5 year return (CAGR): 11.7%

Corpus: Rs 4,704 crore

12/14

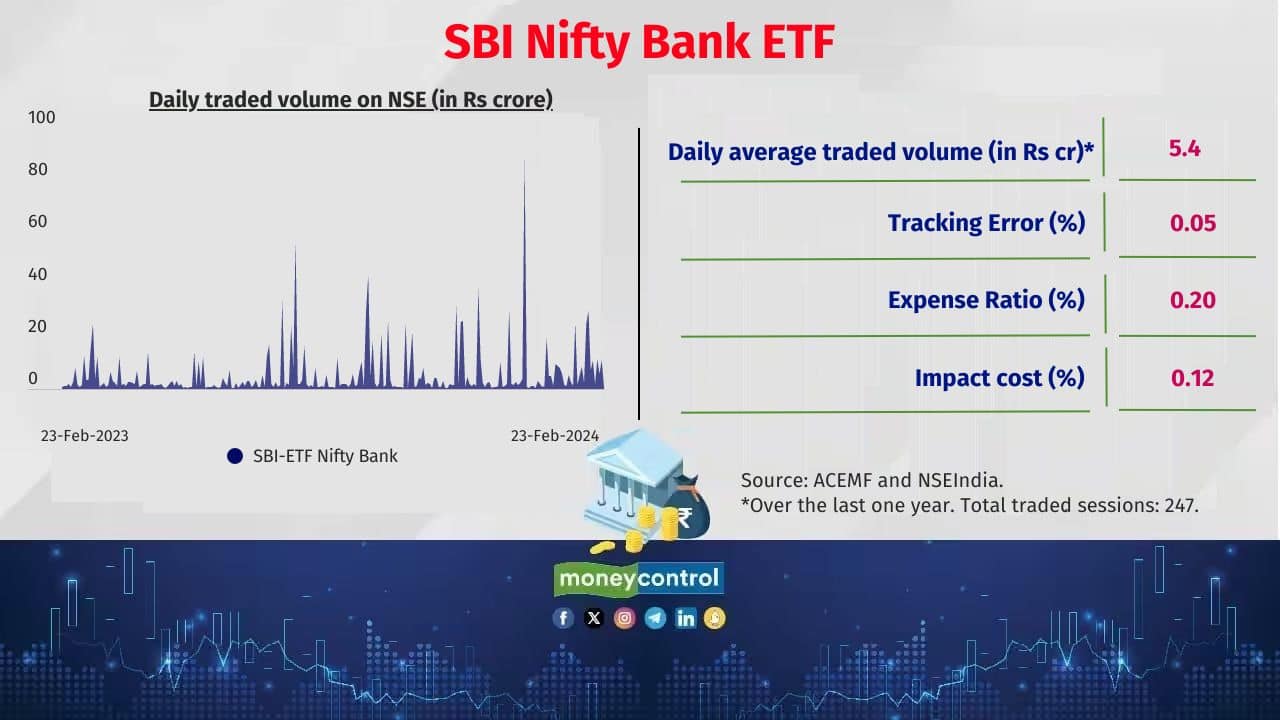

SBI Nifty Bank ETF

5 year return (CAGR): 11.8%

Corpus: Rs 4,531 crore

5 year return (CAGR): 11.8%

Corpus: Rs 4,531 crore

13/14

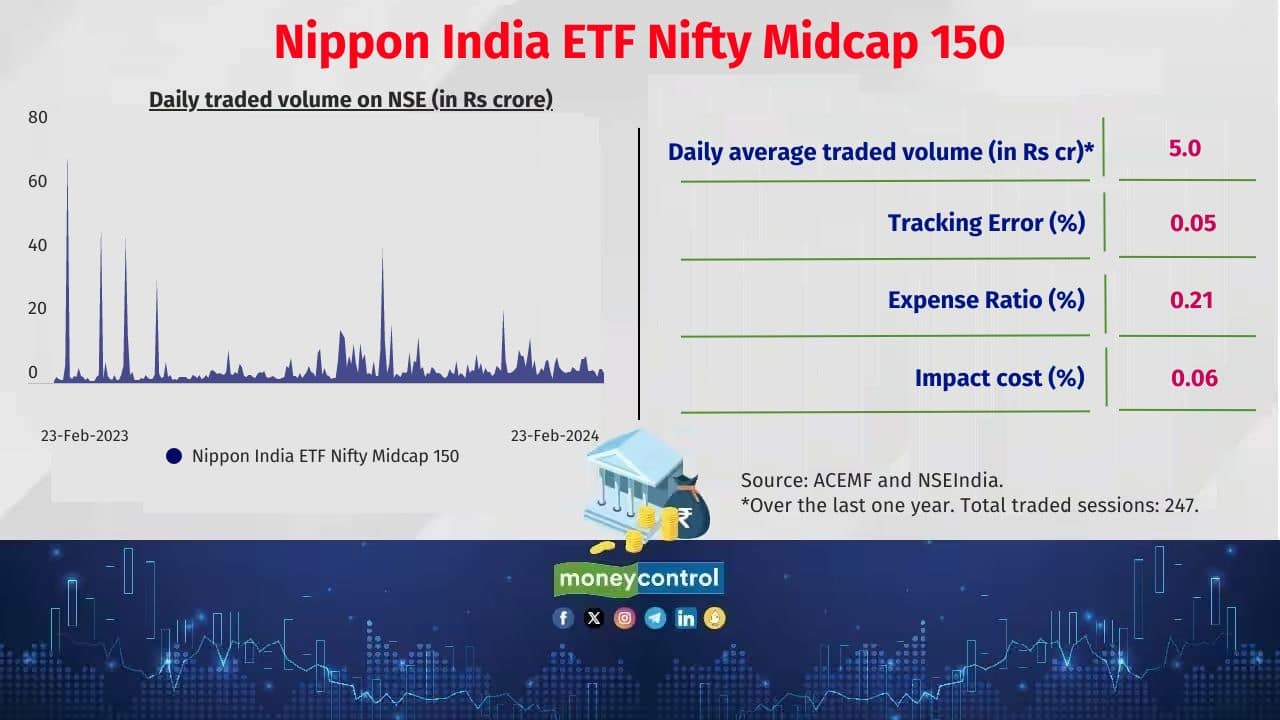

Nippon India ETF Nifty Midcap 150

5 year return (CAGR): 25.7%

Corpus: Rs 1,187 crore

Also see: Mid-Cap Multibaggers that retirement goal Mutual Fund schemes chase

5 year return (CAGR): 25.7%

Corpus: Rs 1,187 crore

Also see: Mid-Cap Multibaggers that retirement goal Mutual Fund schemes chase

14/14

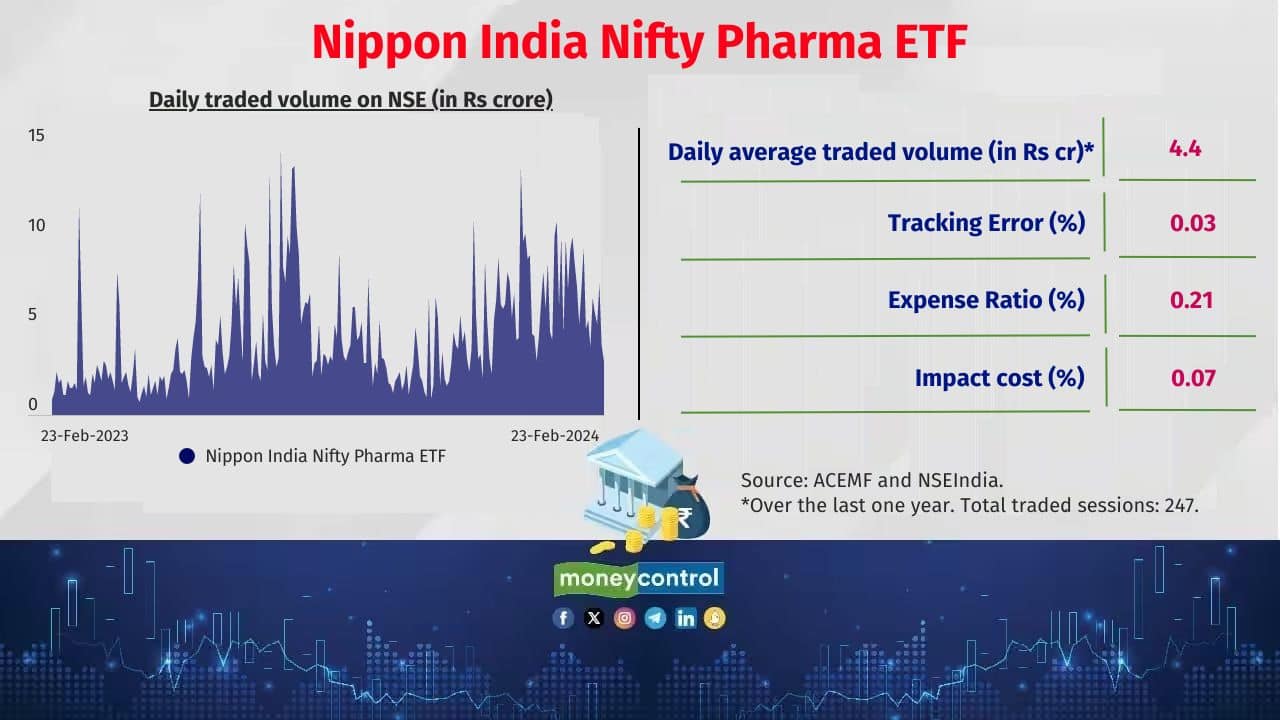

Nippon India Nifty Pharma ETF

2 year return (CAGR): 22%

Corpus: Rs 578 crore

Also see: Chasing multibaggers: Micro-cap stocks that Flexicap MFs added

2 year return (CAGR): 22%

Corpus: Rs 578 crore

Also see: Chasing multibaggers: Micro-cap stocks that Flexicap MFs added

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!